Malaysia Company Tax Return Due Date CIT returns are due nine months after the date of the company s financial year end The final balance being the actual tax liability less any payments made on account is due by the date of filing the return i e nine months after the date of

General submission due date Within seven months from the date following the close of the accounting period which constitutes the basis period for the year of assessment E Filing Within an additional one month from the date following the close of the accounting period which constitutes the basis period for the year of assessment Upcoming Malaysia Tax Filing Deadlines for the Year of Assessment YA 2023 Individuals business owners company directors and employers should take note of the new tax filing deadlines and file the tax return before the due date

Malaysia Company Tax Return Due Date

Malaysia Company Tax Return Due Date

https://i.ytimg.com/vi/YoE_ci66-lY/maxresdefault.jpg

Income Tax Return Due Date Extend Request FM To Extend ITR Due Date

https://i.ytimg.com/vi/rwdmfcWMBuk/maxresdefault.jpg

Income Tax Return Due Date Extension AY 2022 23 II Latest Update On

https://i.ytimg.com/vi/Y3L-yyjp1e8/maxresdefault.jpg

Under the self assessment system companies are required to submit a return of income within seven months from the date of closing of accounts Particulars required to be specified in the return include the amount of chargeable income and tax payable by the company Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja TANGGUNGJAWAB SYARIKAT Hantar anggaran cukai secara e Filing e CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual Mulai Tahun Taksiran 2018 anggaran cukai perlu dihantar secara e Filing e CP204

Sales tax and service tax return payment of tax due Form SST 02 Last day of the month following the end of the taxable period or 30 days from the end of the taxable period where taxable period is varied The 2022 filing programme stipulates the due date for the submission of the RF i e Form BT e BT for resident individuals who are non citizen workers holding key positions

Download Malaysia Company Tax Return Due Date

More picture related to Malaysia Company Tax Return Due Date

Latest Update Income Tax Return Due Date For AY 2022 23 August 24

https://www.filemybooks.in/wp-content/uploads/2022/06/income-tax.jpg

Income Tax Malaysia 2022 Deadline Latest News Update

https://i.pinimg.com/originals/7a/04/b5/7a04b54ac47a10cec5c9840af96dff8b.png

Pin On Personal Finance Today

https://i.pinimg.com/originals/03/41/c9/0341c9dd2f46b9e715008d46ee7dc0a1.jpg

Corporate income tax CIT due dates CIT return due date Within seven months from the date of closing of accounts CIT final payment due date Last day on expiry of seven months from the date upon which the accounts are closed CIT estimated payment due dates Advance tax is paid by 12 monthly instalments For new companies instalment payments will commence in the 6th month of the basis period for the year of assessment i e Payable in the 6th month after the company commences operations All companies required to pay their monthly instalment by the 15th day of each month

The Inland Revenue Board LHDN has extended the deadline for submission of tax return forms for the assessment year 2023 for taxpayers who operate businesses to July 15 Date of online submission may subject to change For further information kindly refer the Return Form RF Program on the IRBM Official Portal

Malaysia Corporate Income Tax Rate Tax In Malaysia

https://www.3ecpa.com.my/wp-content/uploads/2022/03/photo-malaysia-corporate-income-tax-rate-1200x630-1.jpg

Income Tax Return Due Date Last Date 2021 ITR Filing Online Payment

https://static.india.com/wp-content/uploads/2021/12/Income-Tax-Return-ITR-Filing-News.jpg

https://taxsummaries.pwc.com/quick-charts/...

CIT returns are due nine months after the date of the company s financial year end The final balance being the actual tax liability less any payments made on account is due by the date of filing the return i e nine months after the date of

https://www.swingvy.com/blog-my/malaysia-corporate...

General submission due date Within seven months from the date following the close of the accounting period which constitutes the basis period for the year of assessment E Filing Within an additional one month from the date following the close of the accounting period which constitutes the basis period for the year of assessment

Corporate Tax Malaysia All You Need To Know

Malaysia Corporate Income Tax Rate Tax In Malaysia

No Extension For Income Tax Return Due Date 2023

Income Tax Return Due Date Vs Last Date AY 2023 24 Difference Money

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

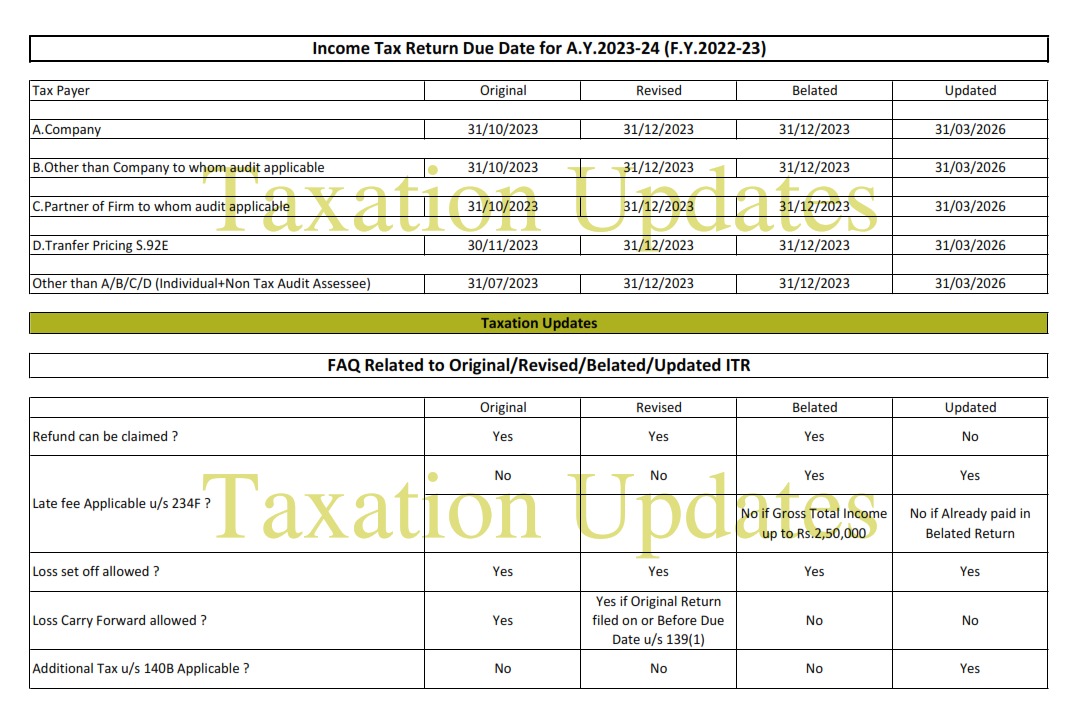

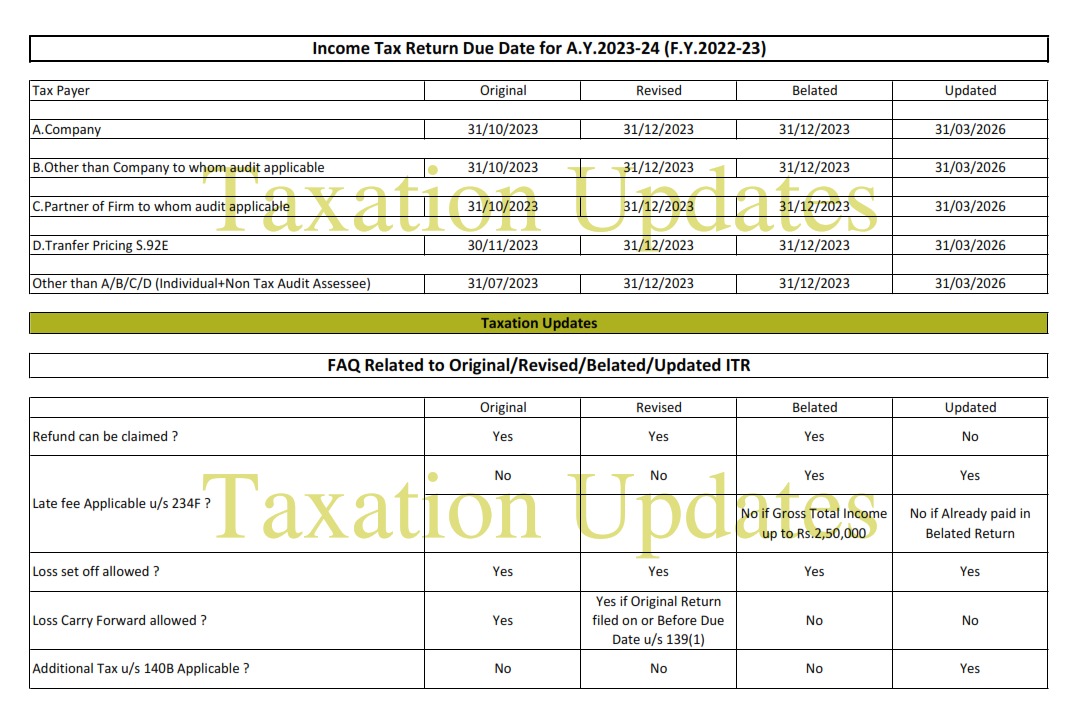

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return Due

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return Due

Coronavirus Last Date To File IT Returns Extended Ummid

NADEEM ACADEMY

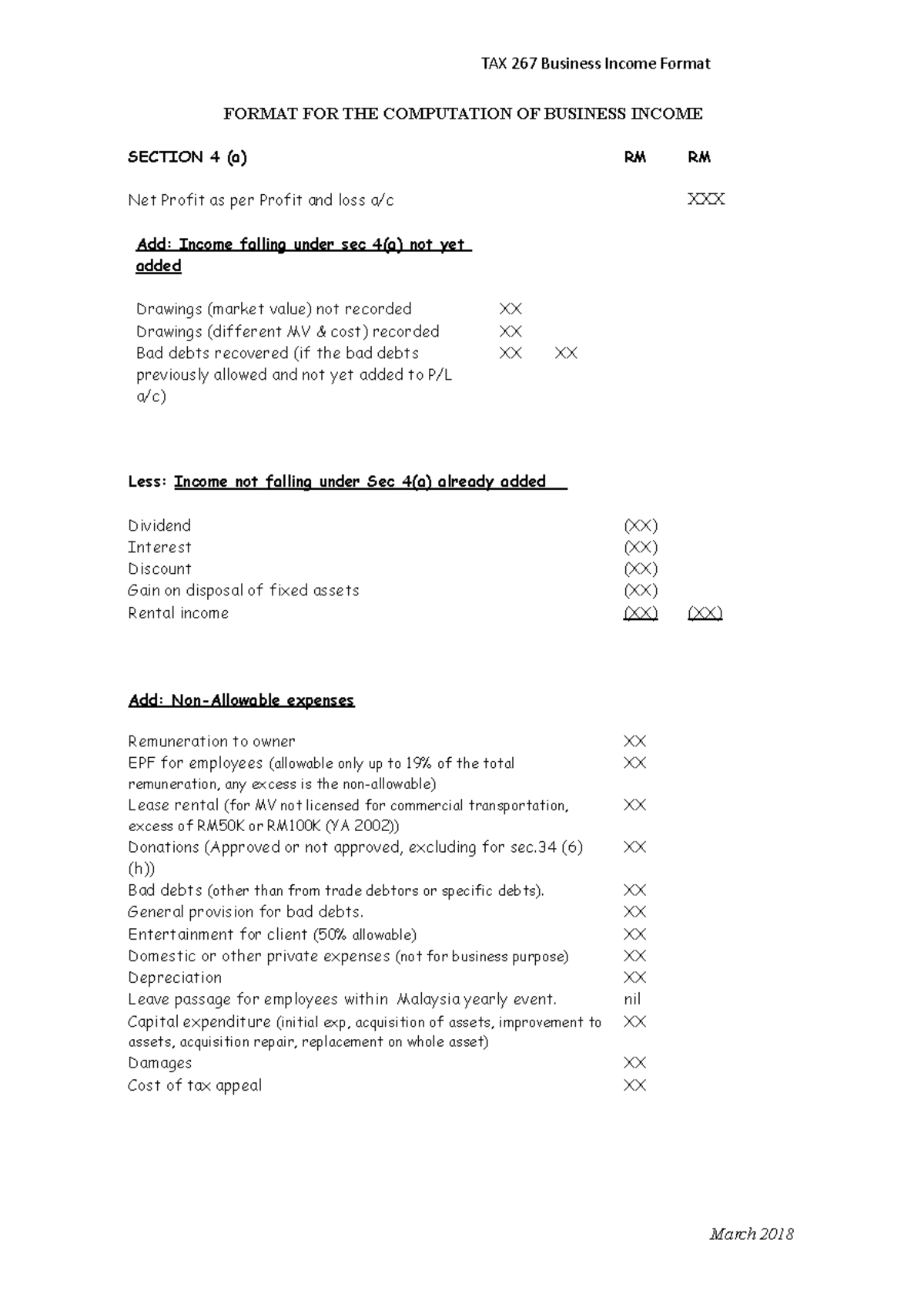

Company Tax Computation Format Malaysia

Malaysia Company Tax Return Due Date - Last reviewed 26 June 2024 For both resident and non resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia Resident companies are also taxed on foreign sourced income received in Malaysia