Marriage Tax Rebate Ireland Web 23 d 233 c 2022 nbsp 0183 32 A list of all foreign marriages and civil partnerships recognised in Ireland is given by the Department of Justice and Equality If we recognise your foreign registered

Web 4 janv 2023 nbsp 0183 32 The standard rate cut off point for married couples civil partners is 49 000 in 2023 This amount is taxed at 20 and the balance is taxed at 40 Where both Web 4 janv 2023 nbsp 0183 32 Tax credits Personal circumstances 2023 Single person 1 775 Married person or civil partner 3 550 Widowed person or surviving civil partner with dependent

Marriage Tax Rebate Ireland

Marriage Tax Rebate Ireland

https://www.taxrebates.co.uk/wp-content/uploads/Marriage_Allowance-768x402.jpeg

Beware Of Irish Tax Scam Ads On Reddit R ireland

https://i.redd.it/87vqf5iu64q81.png

Irish Tax Rebates We Do The Checking You Get The Cheque YouTube

https://i.ytimg.com/vi/kULnmAVqClw/maxresdefault.jpg

Web Marriage amp Family There are so many tax credits available to families in Ireland and yet many fail to claim tax back every year This is because many Irish families are simply Web The following tables show the tax rates rate bands and tax reliefs for the tax year 2023 and the previous tax years Calculating your Income Tax gives more information on how

Web Marital status Marriage and civil partnerships Cohabiting couples Separation divorce dissolution of civil partnership and civil annulment Back to top Assist us Web 20 mars 2022 nbsp 0183 32 With the increased standard rate tax band a married couple can currently earn up to 45 800 before getting hit for the higher tax rate where only one partner is working or up to 73 600

Download Marriage Tax Rebate Ireland

More picture related to Marriage Tax Rebate Ireland

Easy Tax Rebates 4u Just Another WordPress Site

https://easytaxrebates4u.co.uk/wp-content/uploads/2020/10/Marriage-Tax-allowance-5.jpg

Marriage Tax Allowance Rebate My Tax Ltd

https://www.rebatemytax.com/wp-content/uploads/2020/09/Marriage-Allowance.png

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance.jpg

Web 31 mars 2022 nbsp 0183 32 To claim a refund log into PAYE Services within myAccount and select Claim unemployment repayment If you are not e enabled you will need to send the Web Marriage tax refunds are calculated from the date of your marriage But you can avail them only after December 31 the year your marriage was registered So if March 15 2020 was your marriage date then you can

Web The average tax rebate for Irish Tax Rebates customers is 1 092 with some individual rebates issued by Irish Tax Rebates exceeding 20 000 How many years can you claim Web 27 sept 2022 nbsp 0183 32 Taxation Income Tax An increase of 3 200 in the income tax standard rate cut off point for all earners from 36 800 to 40 000 for single individuals worth

Gallery Popup My Tax Rebate

https://www.mytaxrebate.co.uk/wp-content/uploads/2019/05/portfolio-img-5.jpg

The Dividend Allowance Is Being Halved Tax Rebate Services

https://www.taxrebateservices.co.uk/wp-content/uploads/2022/12/ING_52643_02566.jpg

https://www.revenue.ie/.../marriage-and-civil-partnerships/index.aspx

Web 23 d 233 c 2022 nbsp 0183 32 A list of all foreign marriages and civil partnerships recognised in Ireland is given by the Department of Justice and Equality If we recognise your foreign registered

https://www.citizensinformation.ie/en/money-and-tax/tax/income-tax/...

Web 4 janv 2023 nbsp 0183 32 The standard rate cut off point for married couples civil partners is 49 000 in 2023 This amount is taxed at 20 and the balance is taxed at 40 Where both

Why You Should Use A Tax Expert To Claim Tax Back Irish Tax Rebates

Gallery Popup My Tax Rebate

5 Reasons To Use Irish Tax Rebates Irish Tax Rebates

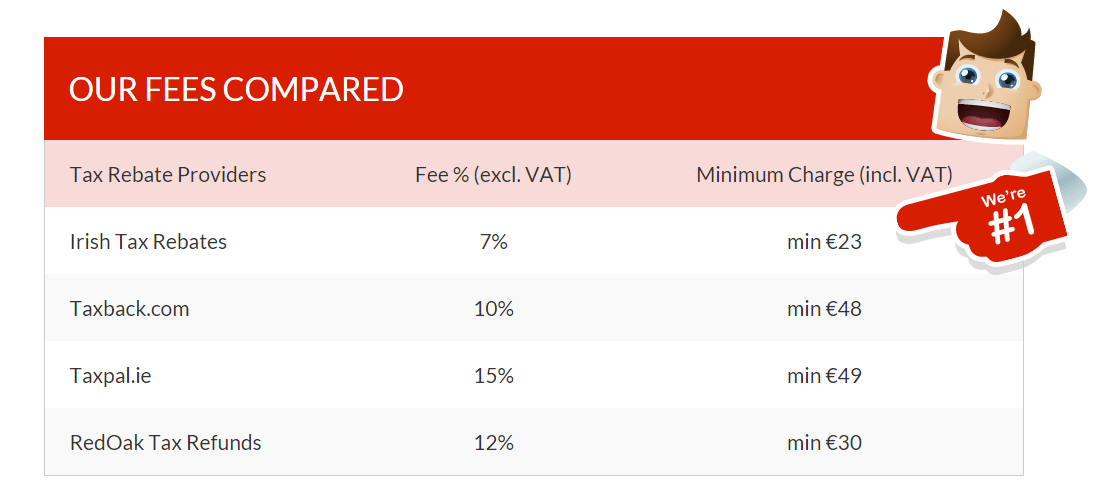

The 101 Marriage Tax Allowance Rebate And Claim Guide

Irish Tax Rebates How It Works YouTube

How To Claim Tax Back Online Revenue Refund Your Tax

How To Claim Tax Back Online Revenue Refund Your Tax

Can A Married Couple File Single They Can Contribute To A Roth Ira As

Dental Nurse Tax Rebate Tax Rebate Online

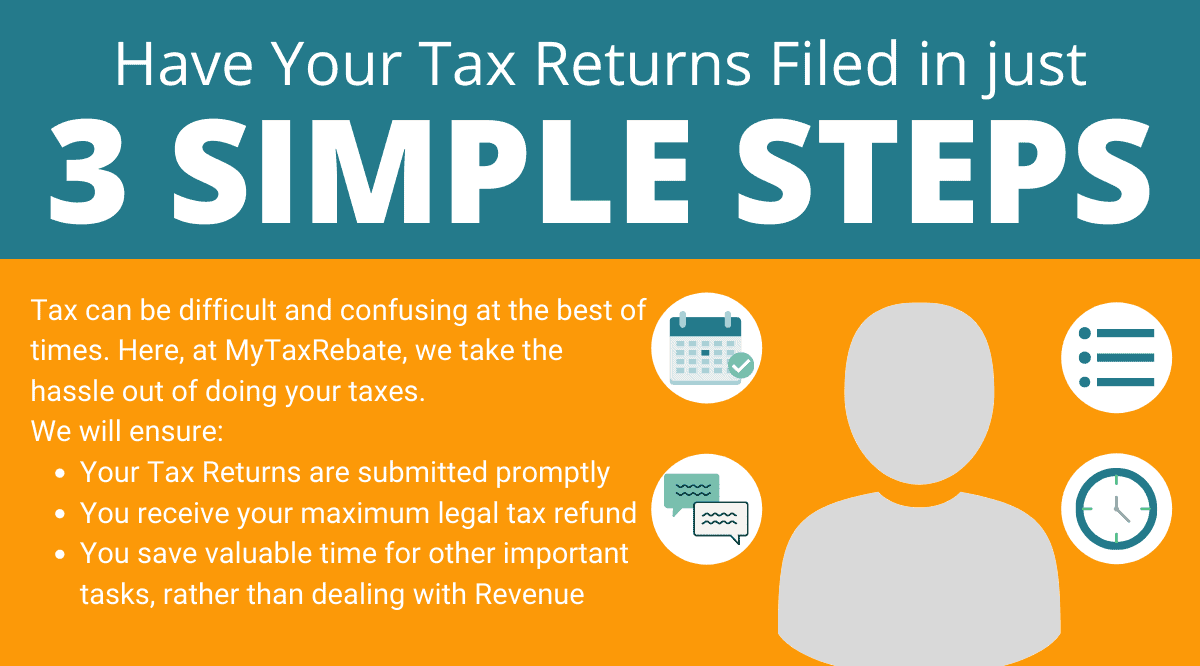

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

Marriage Tax Rebate Ireland - Web 20 mars 2022 nbsp 0183 32 With the increased standard rate tax band a married couple can currently earn up to 45 800 before getting hit for the higher tax rate where only one partner is working or up to 73 600