Maryland Tax Credit You may be eligible to claim some valuable personal income tax credits available on your Maryland tax return The following list contains general information about some of the most commonly used credits You may want to consult with

The State of Maryland has developed a program which allows credits against the homeowner s property tax bill if the property taxes exceed a fixed percentage of the person s gross income In other words it sets a limit on the amount of property taxes The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe Detailed EITC guidance for Tax Year 2023 including annual income thresholds can be found here

Maryland Tax Credit

![]()

Maryland Tax Credit

https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_1200,h_800/https://ecogenamerica.com/wp-content/uploads/Maryland-Tax-Credit-Complete-Guide.jpg

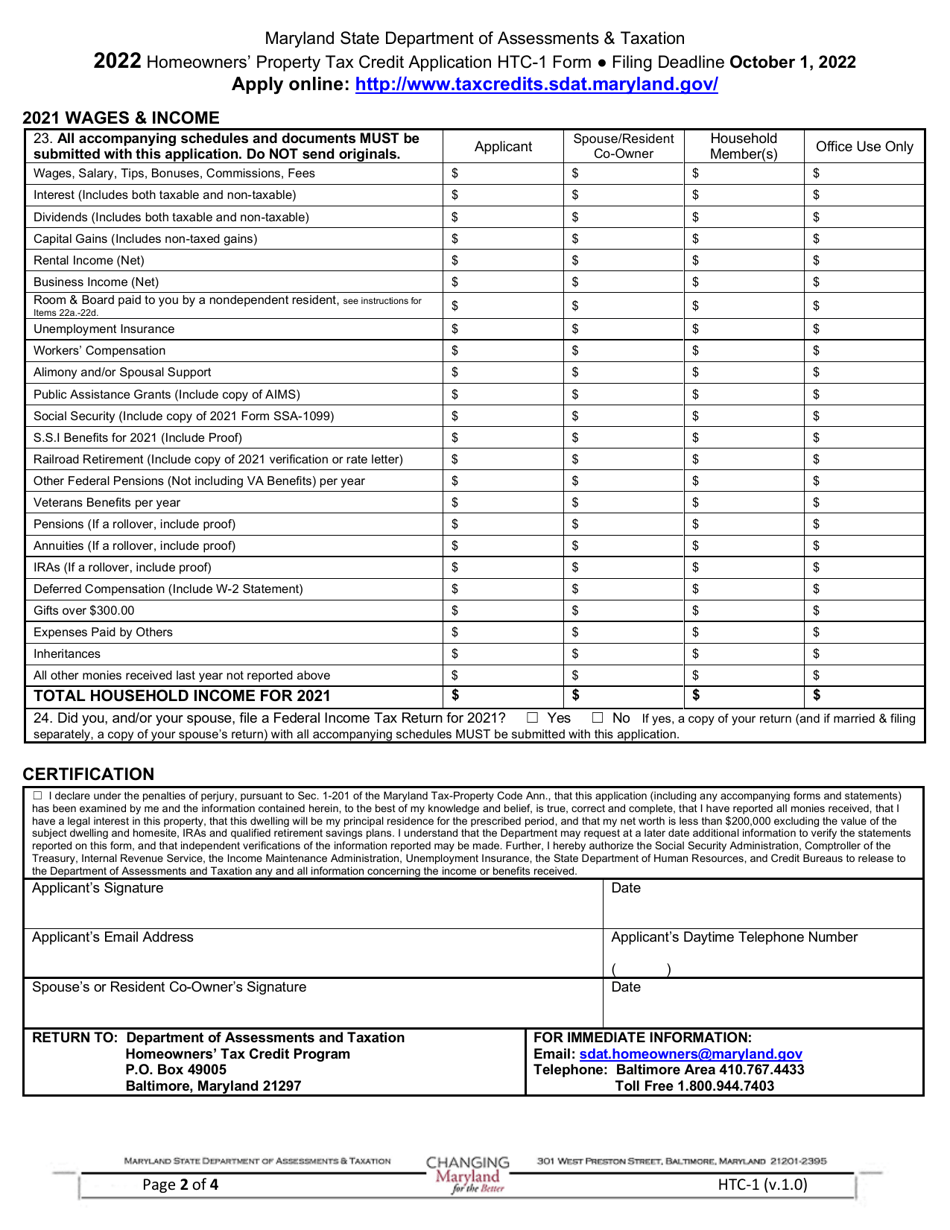

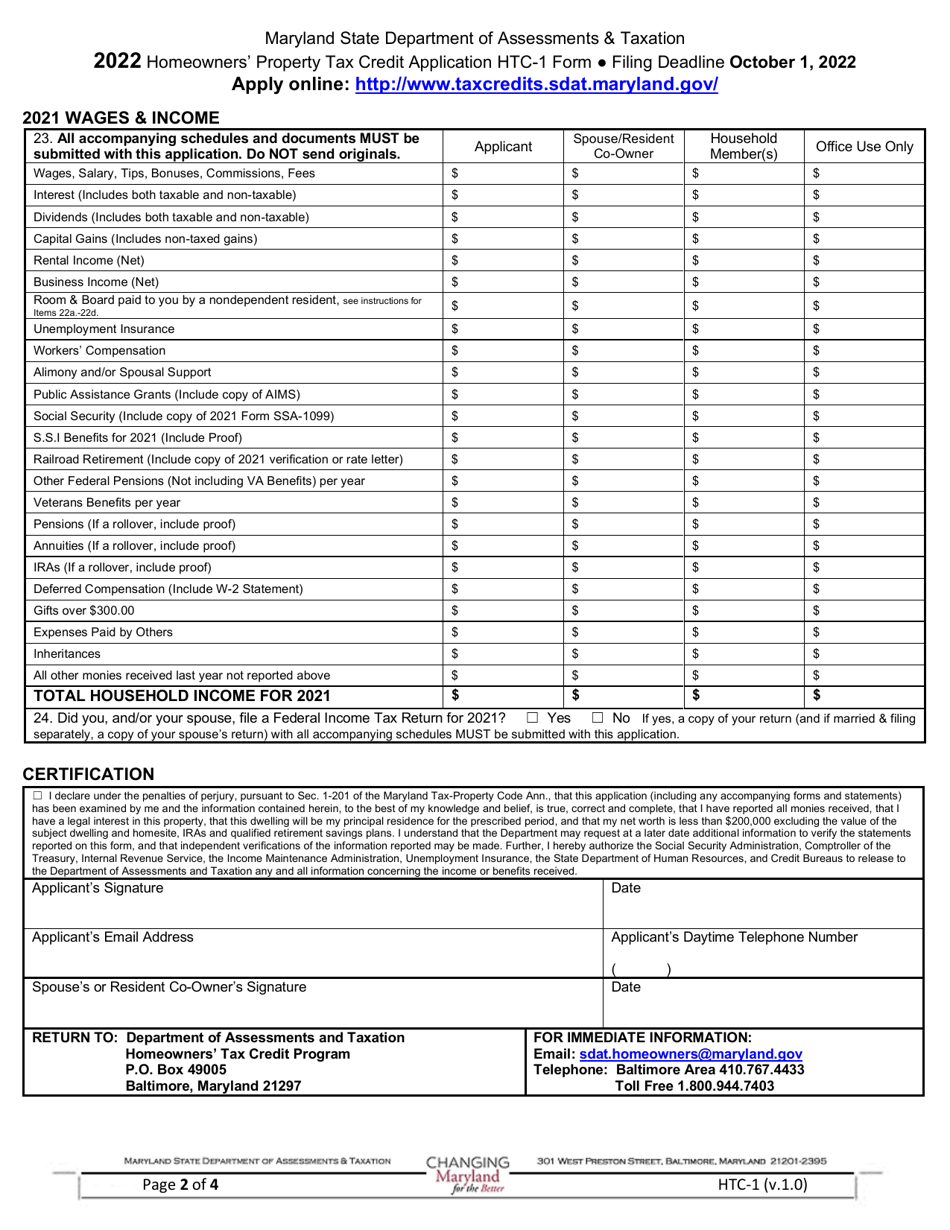

Form HTC 1 Download Printable PDF Or Fill Online Homeowners Property

https://data.templateroller.com/pdf_docs_html/2378/23783/2378304/page_2_thumb_950.png

Maryland Homebuyer s Tax Credit

https://u.realgeeks.media/fortmeadehomes/blog_pictures/Maryland_Homeowners_tax_credit_fort_meade_homes.png

Maryland Homestead Property Tax Credit Program Homestead Tax Credit Please take note of the following for faster and more efficient service Great News As of Monday September 11th 2023 the Homestead Tax Credit Eligibility Application is on Maryland One Stop This means that there is one simple login and no need for an access code All Marylanders who received a Homeowners or Renters Tax Credit in 2021 will be mailed a complimentary 2022 application to their home address To determine whether you are eligible to receive a tax credit please visit SDAT s online tax credit system To receive an application please email sdat taxcreditapp maryland gov or call

BALTIMORE MD The Maryland Department of Assessments and Taxation today announced that applications for the 2024 Homeowners and Renters Tax Credit programs which saved Marylanders more than 58 million in FY23 are available online The 2024 Renters Tax Credit Application is available Sign up to receive important email updates about these tax credits Renters Tax Credit applications can now be filed online The Renters Tax Credit Program provides property tax

Download Maryland Tax Credit

More picture related to Maryland Tax Credit

The Maryland Tax Credit Saving Homeowners An Average Of 1 422 Per Year

https://i.ytimg.com/vi/U9_io6mcVkw/maxresdefault.jpg

Maryland Tax Credit Aims To Spur Investment In Early Stage Biotech

https://www.schgroup.com/wp-content/uploads/2017/03/Tax-Contact-Us-Resource-Center-CTA-1200x386.png

The Tax Credits That Saved Marylanders 63 Million In 2020

https://x-default-stgec.uplynk.com/ausw/slices/721/22f3150cc15946e68b21f11967cfb8d1/721c3f4c08064cdcb692f9ec99de15f4/poster_0dd170aefbbe418aa91699b76b2bb942.jpg

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula 0 of the first 8 000 of the combined household income 4 of the next 4 000 of income 6 5 of the next 4 000 of income and 9 of all income above 16 000 BALTIMORE MD The Maryland Department of Assessments and Taxation SDAT today announced that applications for the 2023 Homeowners and Renters Tax Creditprograms which saved Marylanders more than 58 3 million in FY22 are now availableonline The deadline to file for both tax credits is October 1 2023

The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income View Details Open from Feb 05 2024 at 08 00 am EST to Oct 01 2024 at 11 59 pm EDT 30 90 day approval 0 00 Homestead Tax Credit Eligibility Application HST

Maryland Becomes First State To Offer Tax Credit For Home Batteries

https://blog.pickmysolar.com/hs-fs/hubfs/blog-maryland-tax-credit.jpg?width=2610&name=blog-maryland-tax-credit.jpg

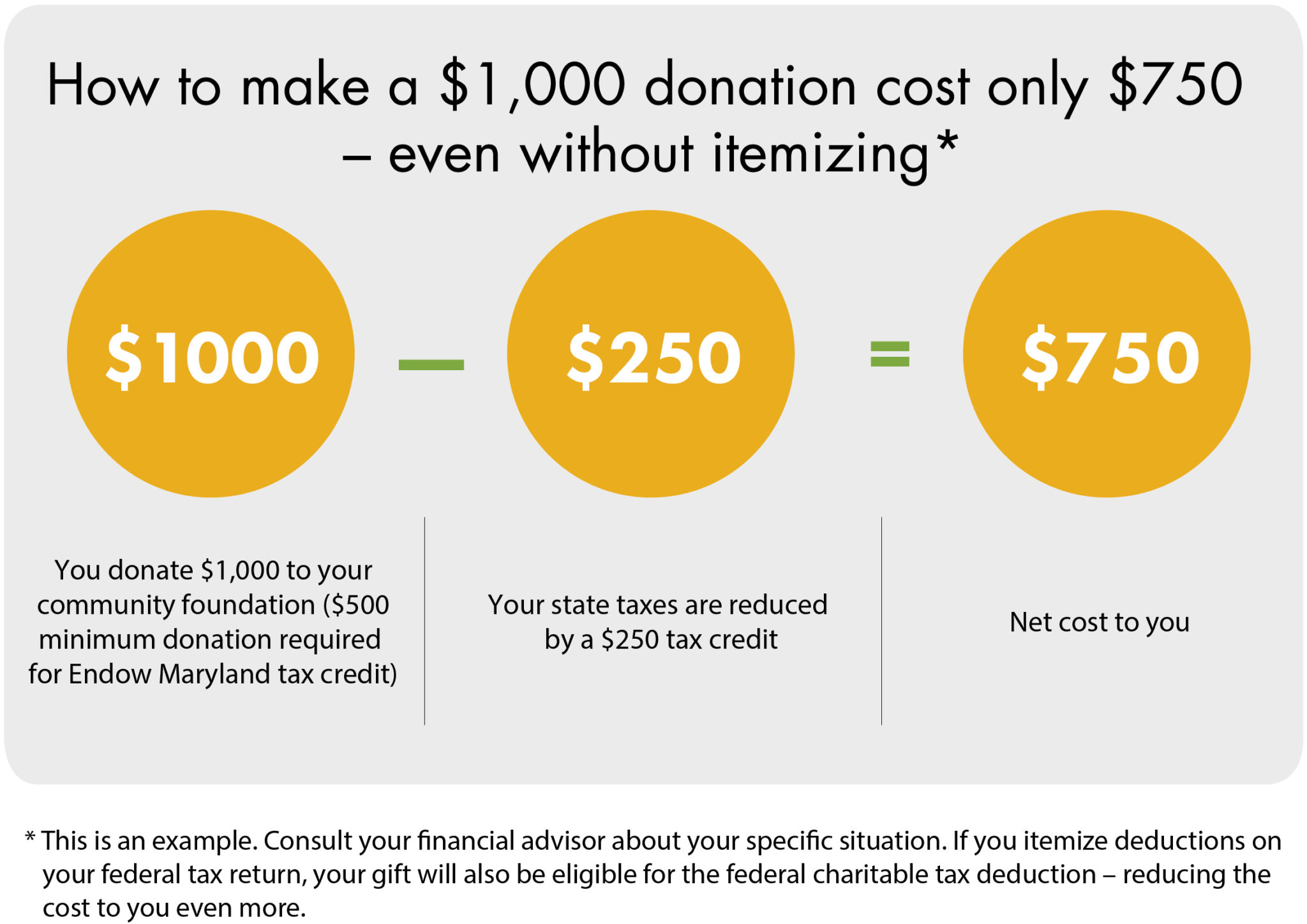

Endow Maryland Tax Credit Program Open For 2022 Community Foundation

https://cfhoco.org/wp-content/uploads/2020/07/endow-md-infographic-2048x1448.jpg

https://www.marylandtaxes.gov/tax-credits.php

You may be eligible to claim some valuable personal income tax credits available on your Maryland tax return The following list contains general information about some of the most commonly used credits You may want to consult with

https://dat.maryland.gov/Pages/Tax-Credit-Programs.aspx

The State of Maryland has developed a program which allows credits against the homeowner s property tax bill if the property taxes exceed a fixed percentage of the person s gross income In other words it sets a limit on the amount of property taxes

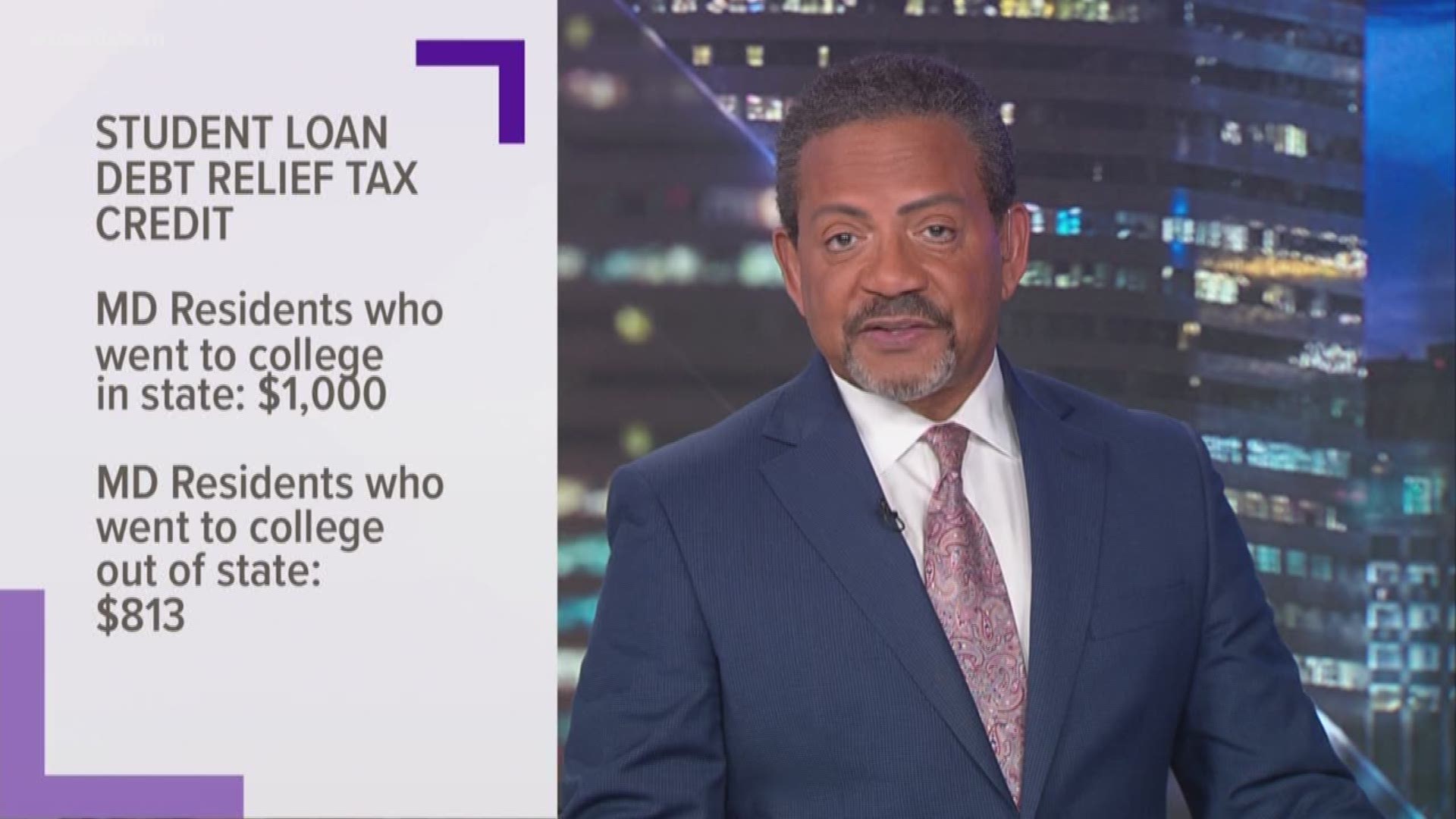

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9

Maryland Becomes First State To Offer Tax Credit For Home Batteries

What Is A Tax Credit Tax Credits Explained

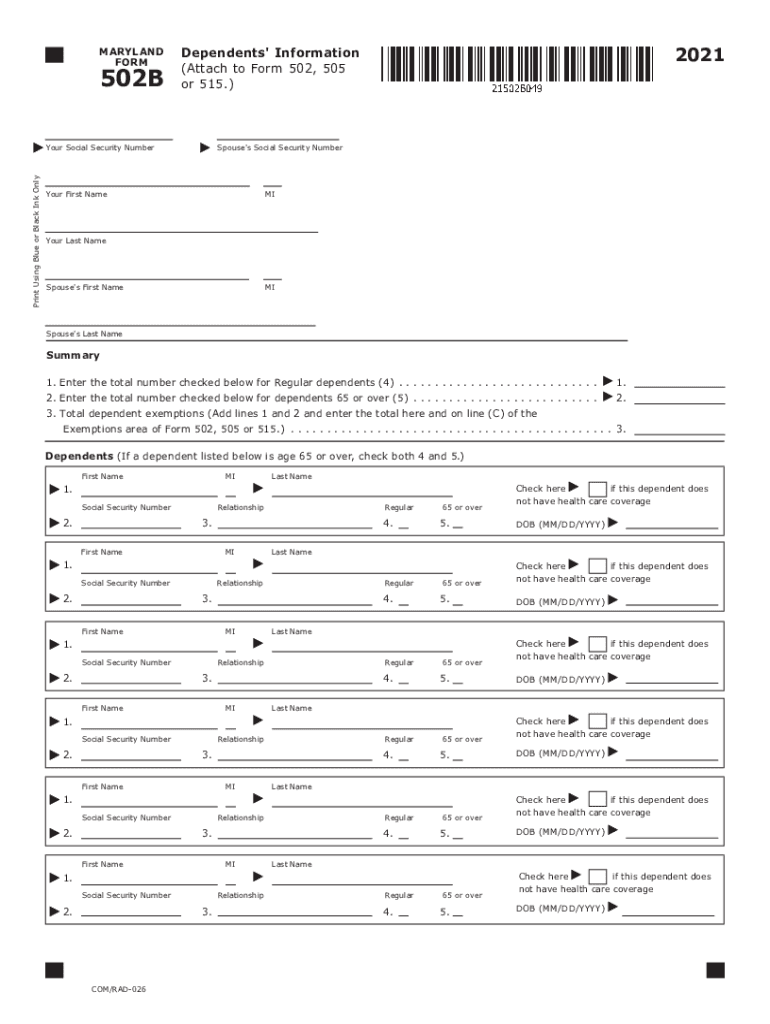

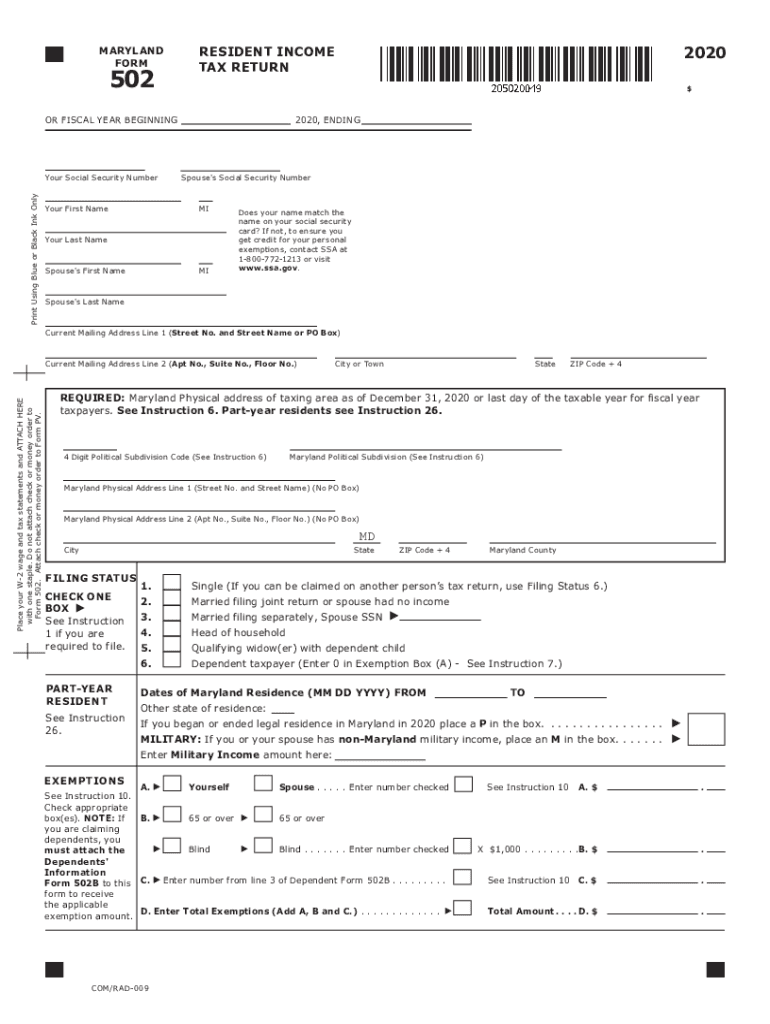

Maryland 502 Booklet 2021 2024 Form Fill Out And Sign Printable PDF

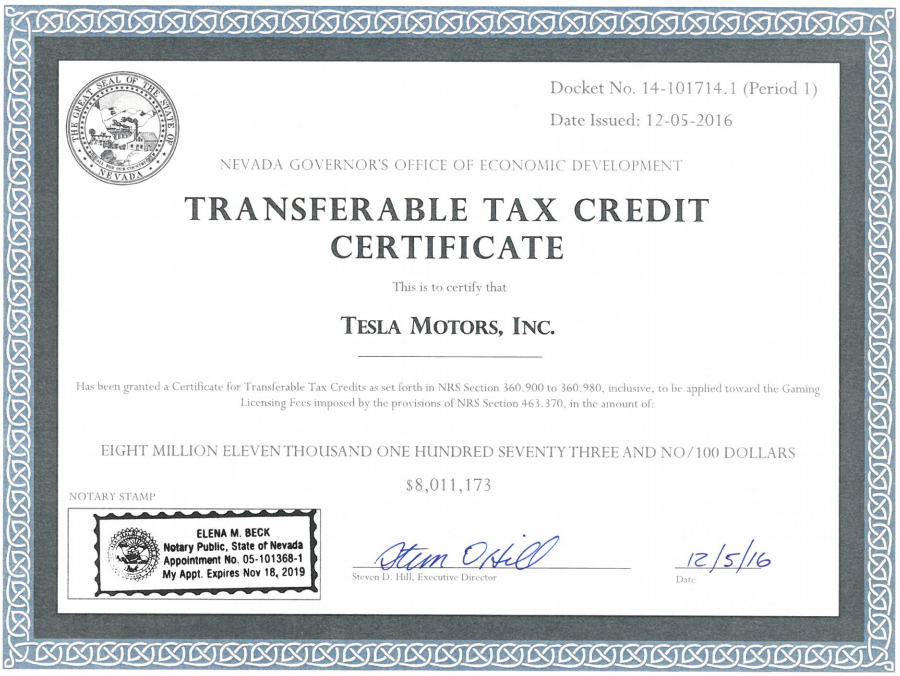

Tesla Receives 8 Million In Tax Credit For The Gigafactory After

Maryland State R D Tax Credit

Maryland State R D Tax Credit

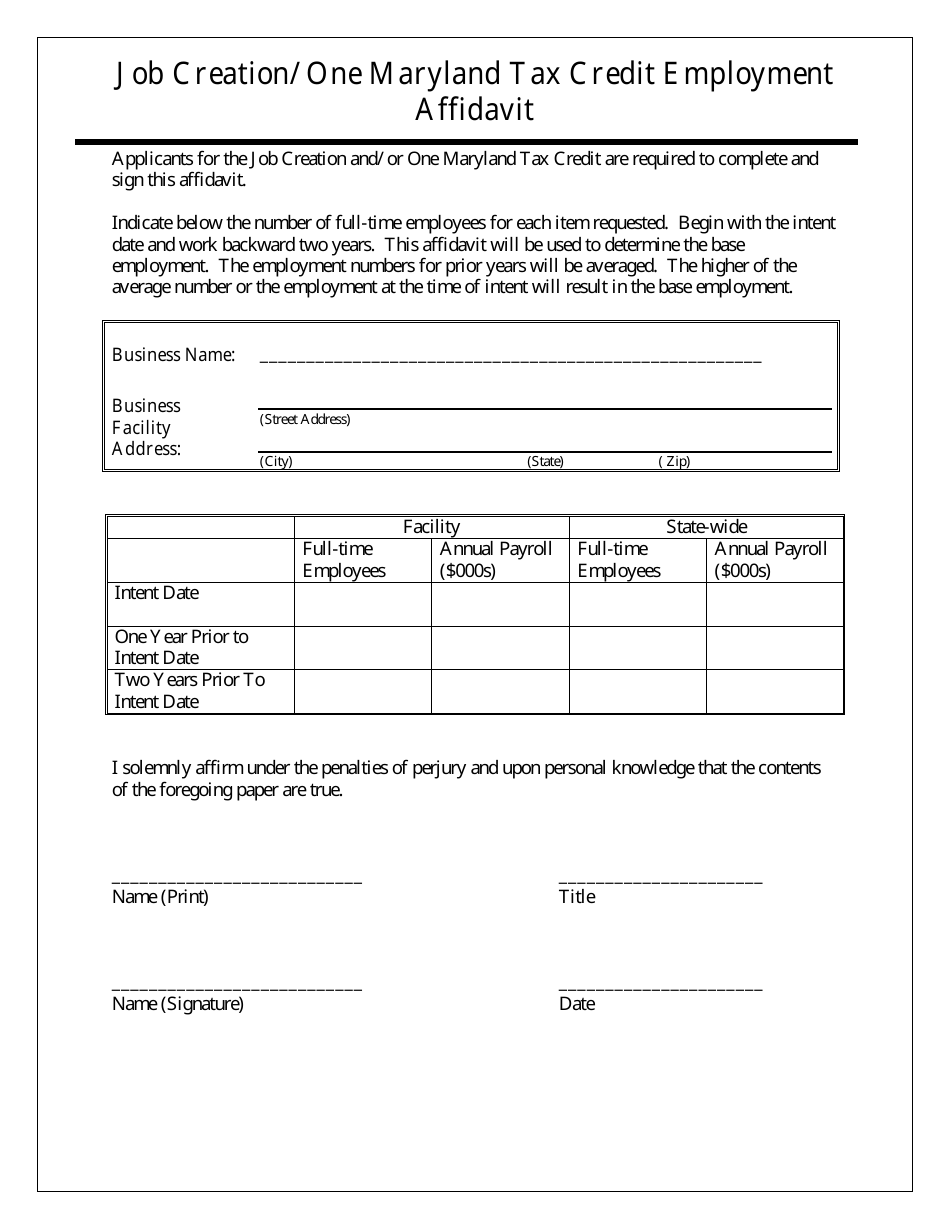

Maryland Job Creation One Maryland Tax Credit Employment Affidavit

Maryland State Tax S 2020 2024 Form Fill Out And Sign Printable PDF

Maryland Tax Credit - The maximum tax credit is 5 000 Other Tips There are not all the tax credits available for individuals and there are also tax credit opportunities for Maryland businesses For the full list