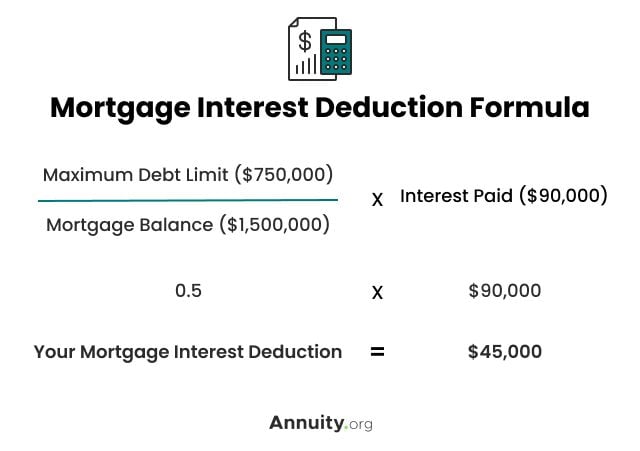

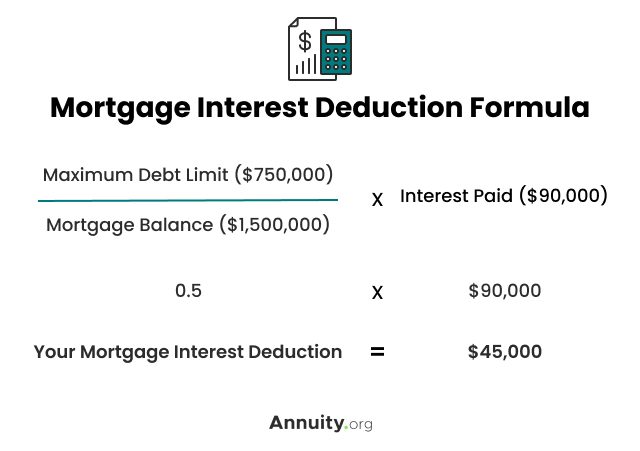

Maximum Deduction For Home Mortgage Interest You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home

Mortgage interest deduction limit 2024 As stated earlier your mortgage interest deduction limit depends on when you purchased your home and your filing status Homeowners can deduct the interest paid on up to 750 000 in mortgage debt The TCJA also nearly doubled the standard tax deduction while eliminating the personal exemption from the tax code

Maximum Deduction For Home Mortgage Interest

Maximum Deduction For Home Mortgage Interest

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

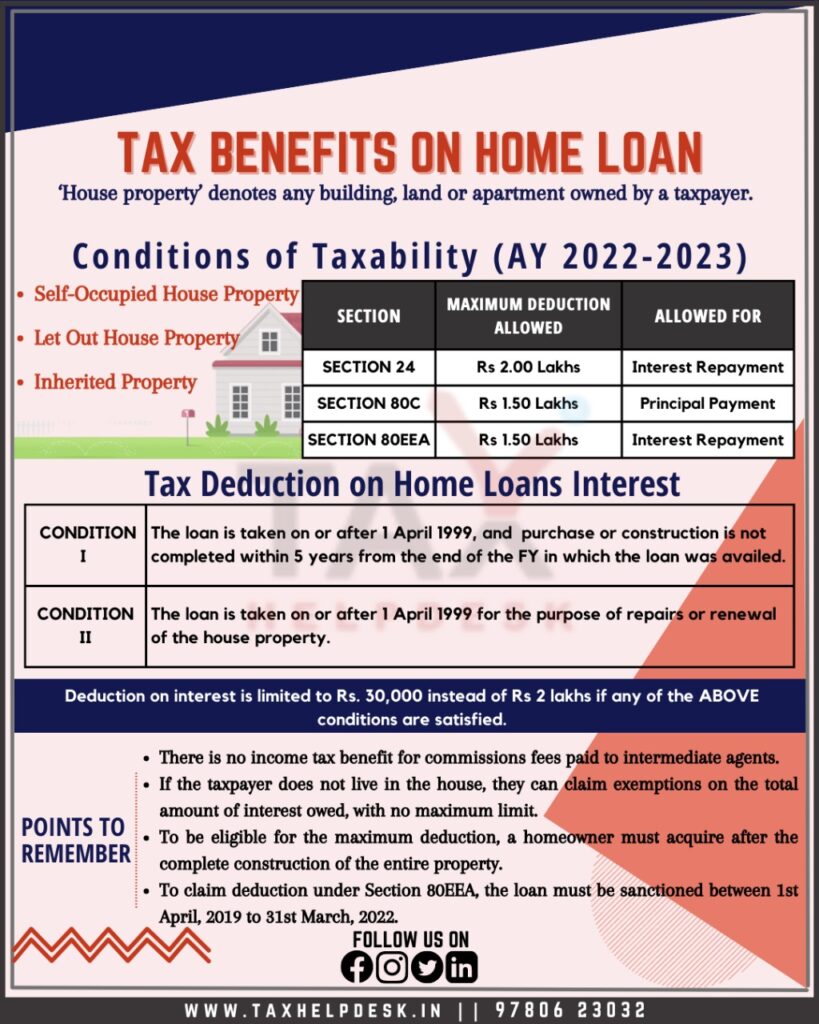

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

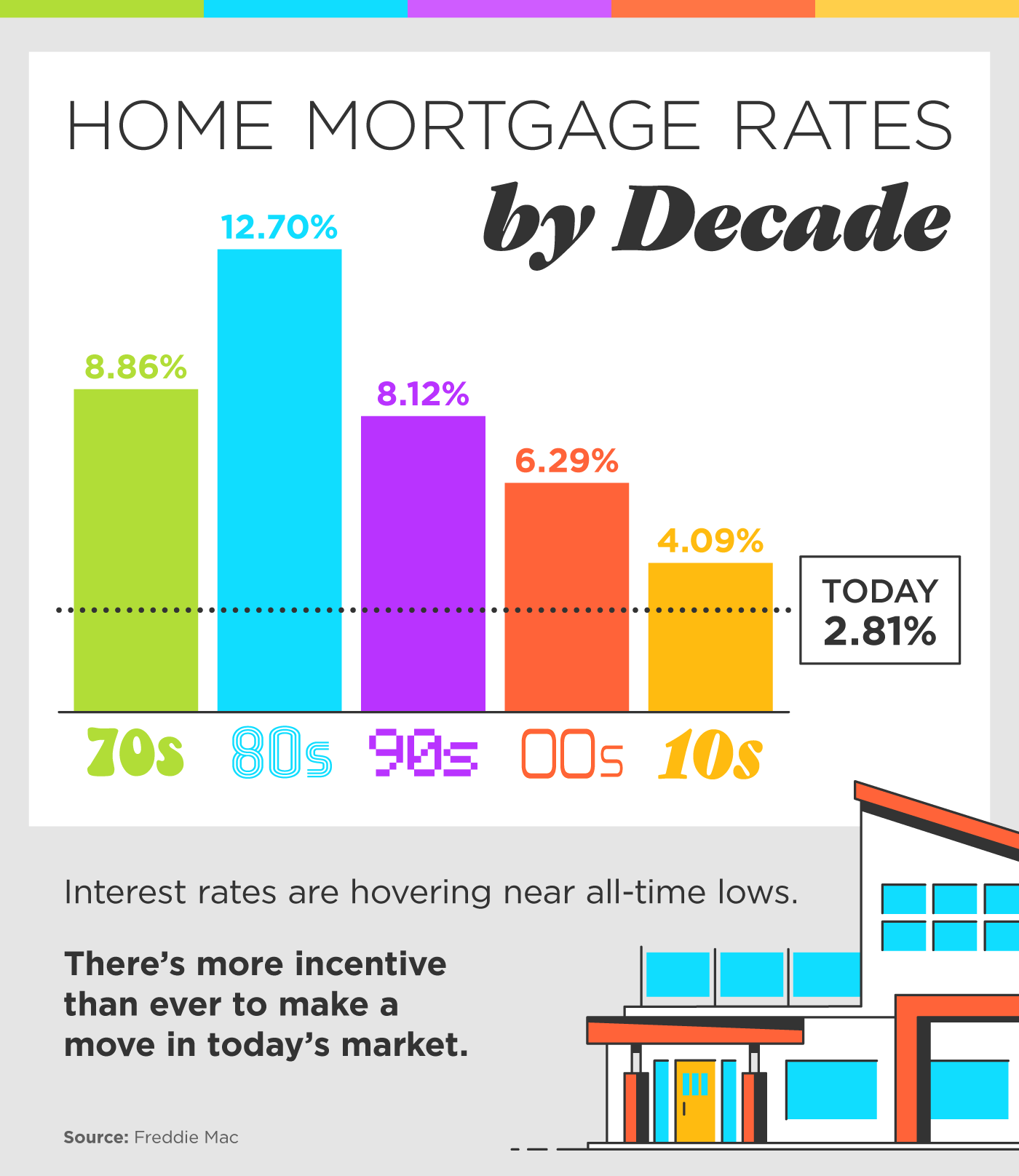

Home Mortgage Rates By Decade INFOGRAPHIC Innovative Mortgage Brokers

https://www.innovativemtgbrokers.com/wp-content/uploads/2021/02/20210219-MEM.png

Are there limits on the mortgage interest deduction Under the Tax Cuts and Jobs Act TCJA of 2017 the mortgage interest deduction is available for up to 750 000 in mortgage debt if you re married and You can usually deduct the interest you pay on a mortgage for your main home or a second home but there are some restrictions The maximum amount of debt eligible for the deduction was 1 million prior

What types of home loans qualify for a mortgage interest deduction How to claim the mortgage interest deduction on your tax return Special circumstances for the mortgage interest Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms Publication 936 explains the general rules for deducting

Download Maximum Deduction For Home Mortgage Interest

More picture related to Maximum Deduction For Home Mortgage Interest

Military Finances 201 Remember All Your Mortgage Interest Might Not

https://static.twentyoverten.com/5a4515738296d37425053dec/n3q5S407R_/Home-Mortgage-Deduction.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

The maximum amount you can deduct is 750 000 for individuals or 375 000 for married couples filing separately If you took out your home loan before Dec 16 2017 the For any home loan taken out on or before October 13 1987 all mortgage interest is fully deductible For home loan taken out after October 13 1987 and before December 16 2017 homeowners can

You can deduct the interest you paid during the tax year on the first 750 000 of your mortgage according to the IRS For married couples filing separately The Tax Cuts and Jobs Act TCJA of 2017 reduced the maximum mortgage principal eligible for the interest deduction to 750 000 from 1 million

How To Use Mortgage Interest Deduction Can It Save You Money Karla

https://www.karladennis.com/wp-content/uploads/2022/08/house-for-blog-scaled.jpg

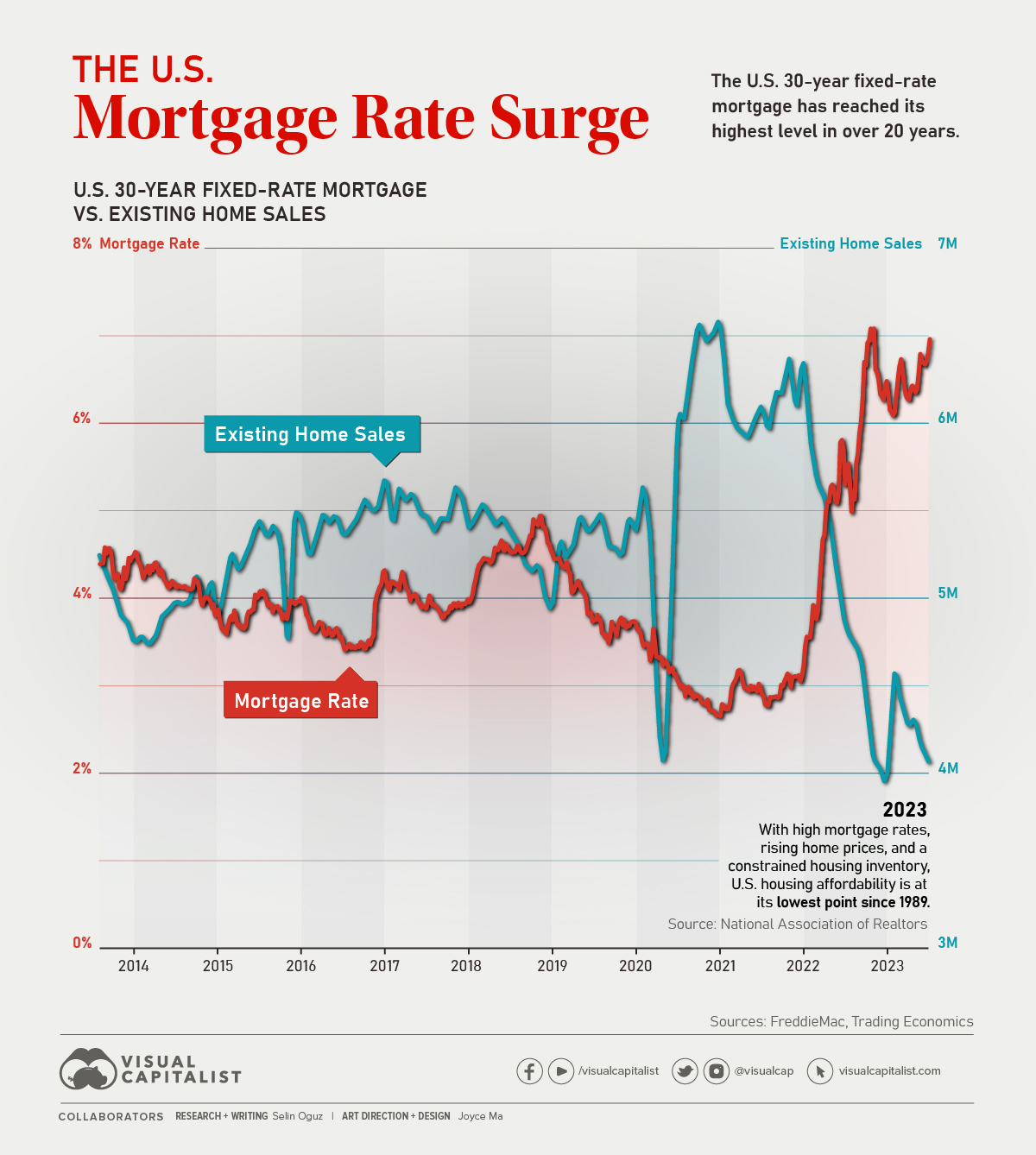

Charted The U S Mortgage Rate Vs Existing Home Sales Telegraph

https://www.visualcapitalist.com/wp-content/uploads/2023/10/US_Mortgage_Rate_Surge-Sept-11-1.jpg

https://www.nerdwallet.com/article/taxes/mortgage...

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home

https://www.kiplinger.com/taxes/mortgag…

Mortgage interest deduction limit 2024 As stated earlier your mortgage interest deduction limit depends on when you purchased your home and your filing status

Mortgage Interest Deduction TaxEDU Glossary

How To Use Mortgage Interest Deduction Can It Save You Money Karla

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Mortgage Interest Deduction 2 The Official Blog Of TaxSlayer

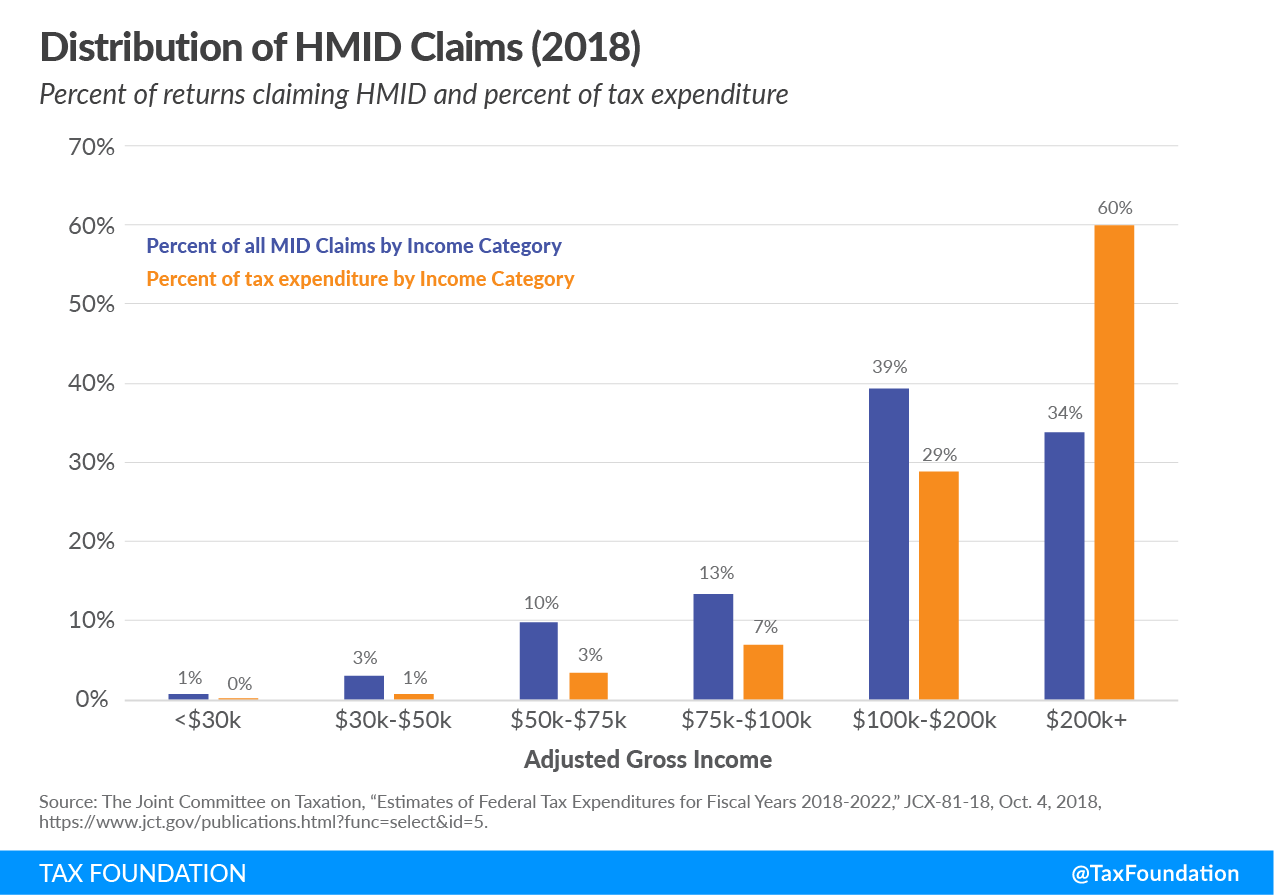

Options To Reform The Deduction For Home Mortgage Interest

Is The Mortgage Interest Deduction In Play B Logics

Is The Mortgage Interest Deduction In Play B Logics

Home Loan Mortgage Interest Tax Deduction For 2015 2016

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Fiscal Cliff Bill Saves Home Mortgage Interest Tax Deduction And PMI

Maximum Deduction For Home Mortgage Interest - Are there limits on the mortgage interest deduction Under the Tax Cuts and Jobs Act TCJA of 2017 the mortgage interest deduction is available for up to 750 000 in mortgage debt if you re married and