Meaning Of Tax Deduction TAX DEDUCTION definition an amount or cost that can be subtracted from someone s income before calculating how much tax they Learn more

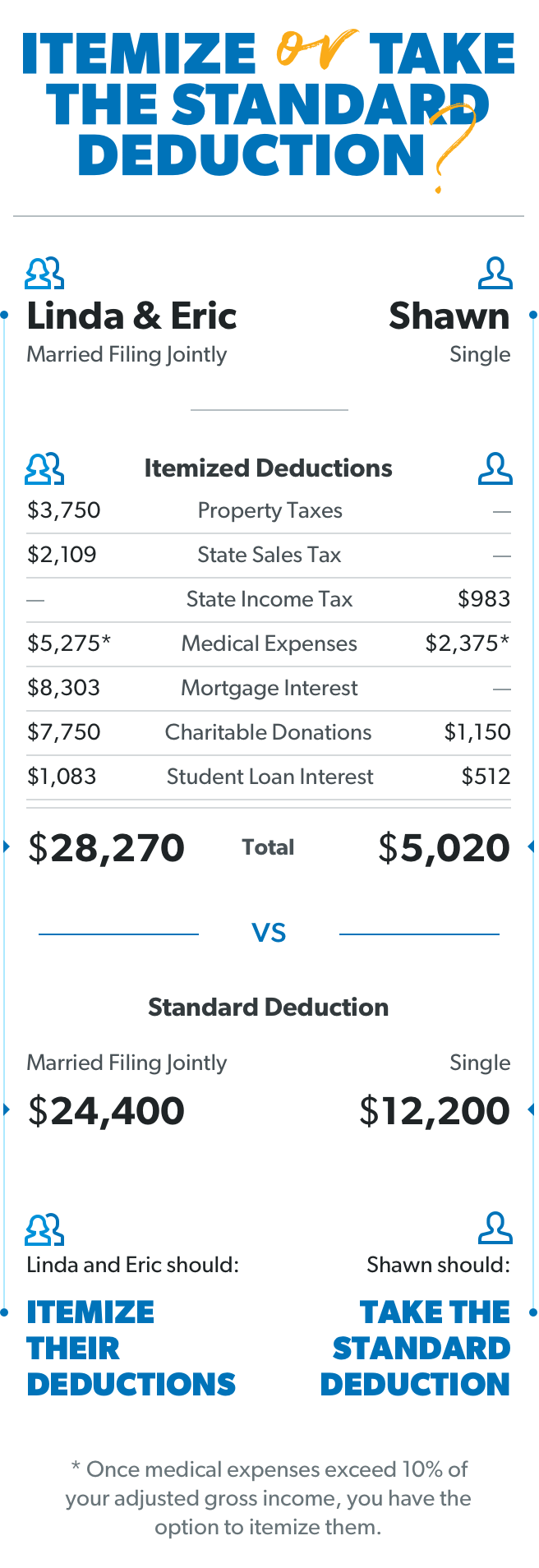

A tax deduction or benefit is an amount deducted from taxable income usually based on expenses such as those incurred to produce additional income Tax deductions are a form of tax incentives along with exemptions and tax credits The difference between deductions exemptions and credits is that deductions and exemptions both reduce taxable A tax deduction is a provision that reduces taxable income as an itemized deduction or a standard deduction that is a single deduction at a fixed amount in some cases tax credits are refundable meaning they can more than offset any tax liability owed Imagine for instance two filers one with taxable income of 30 000 and another with

Meaning Of Tax Deduction

Meaning Of Tax Deduction

https://g.foolcdn.com/editorial/images/437194/tax-deduction_gettyimages-515708887.jpg

PIC Enhanced Tax Deduction Part 2 Tax Made Easy

https://www.taxmadeeasy.sg/wp-content/uploads/2015/10/PIC-Enhanced-dedution-PArt-2.jpg

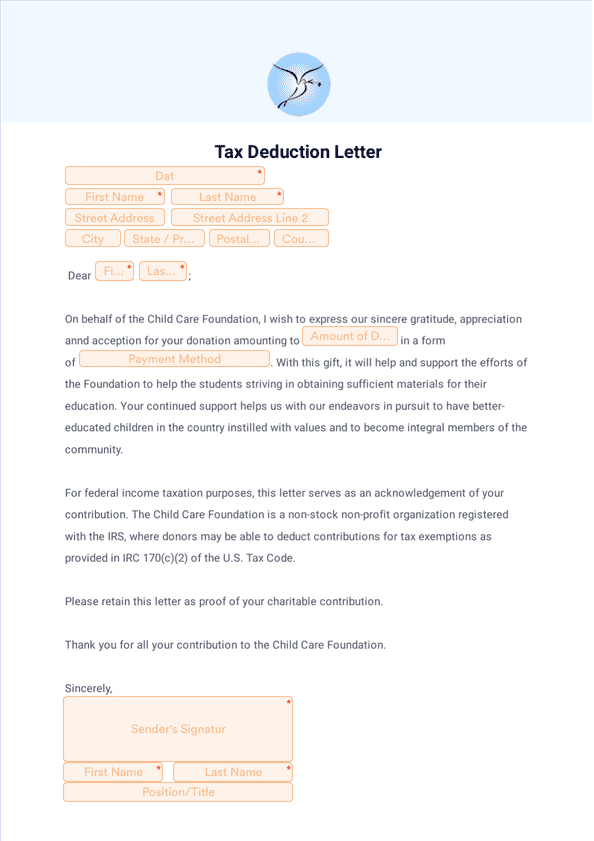

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

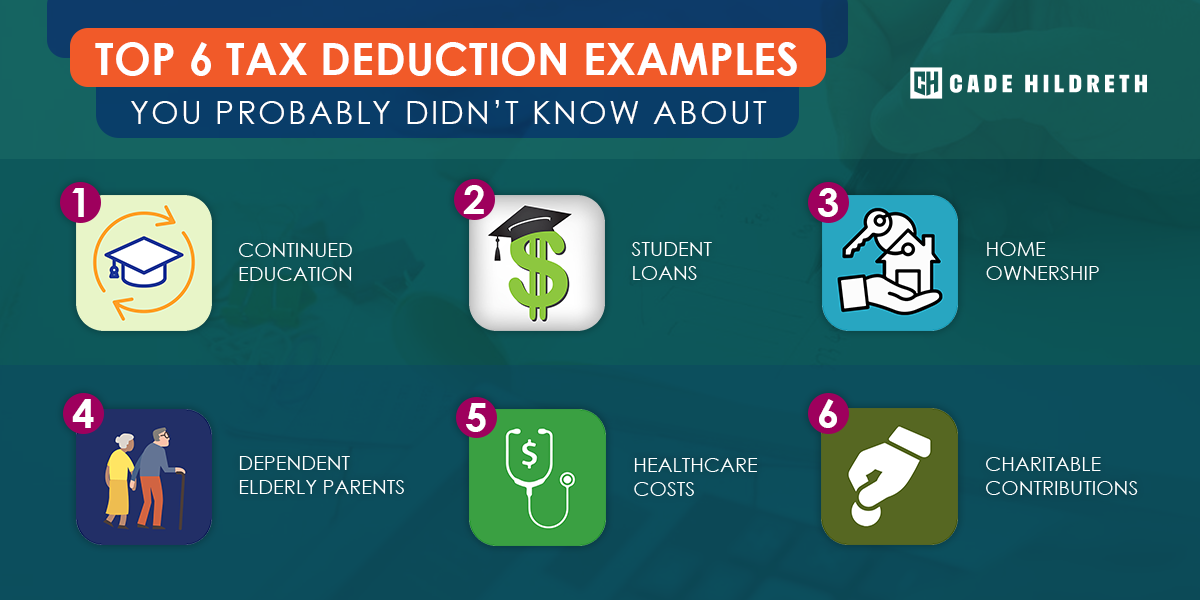

It provides an assessee option to claim an income tax deduction for making contributions to charities Other Deductions Available There are other deductions such as the interest paid to an education loan and purchase of an electric vehicle Also expenditure on disabled dependants is allowed as a deduction to a certain extent Some tax deductions for investments have income limitations which means that high income individuals may not be eligible for certain deductions or may have reduced deduction amounts For example the ability to deduct traditional IRA contributions is phased out for individuals with higher incomes who also participate in an employer sponsored

A deductible for taxes is an expense that a taxpayer or business can subtract from adjusted gross income which reduces their taxable income thereby reducing the amount of taxes owed The standard tax deduction for single filers is 13 850 in 2023 This is the same for married individuals filing separately For those married and filing jointly the deduction is 27 700 in 2023

Download Meaning Of Tax Deduction

More picture related to Meaning Of Tax Deduction

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Top 6 Tax Deduction Examples You Probably Didn t Know About

https://cadehildreth.com/wp-content/uploads/2020/01/tax-deduction-examples.png

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

However under the new tax regime the rebate limit is Rs 25 000 for the taxpayers with an annual income up to Rs 7 lakh for FY 2023 24 and onwards TDS stands for tax deducted at source As per the Income Tax act any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits FS 2023 10 April 2023 A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now qualify for the standard deduction but there are some important details involving itemized deductions that people should keep in mind

[desc-10] [desc-11]

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

What Is Income Tax And How Are Different Types Calculated Basic

https://chatt-r-bug.com/81d4e4f4/https/44f162/www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

https://dictionary.cambridge.org › dictionary › english › tax-deduction

TAX DEDUCTION definition an amount or cost that can be subtracted from someone s income before calculating how much tax they Learn more

https://en.wikipedia.org › wiki › Tax_deduction

A tax deduction or benefit is an amount deducted from taxable income usually based on expenses such as those incurred to produce additional income Tax deductions are a form of tax incentives along with exemptions and tax credits The difference between deductions exemptions and credits is that deductions and exemptions both reduce taxable

What Is Tax Deduction At Source TDS Meaning Definition And Various

Tax Deductions You Can Deduct What Napkin Finance

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

What Is A Tax Deduction DaveRamsey

What Is A Tax Deduction Definition Examples Calculation

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction 2020 Self Employed Standard Deduction 2021

10 2014 Itemized Deductions Worksheet Worksheeto

The 6 Best Tax Deductions For 2020 The Motley Fool

Small Business Tax Deductions Tax Deductible Business Expenses

Meaning Of Tax Deduction - [desc-14]