Medical Checkup Rebate In Income Tax If planned properly claiming your tax reliefs can help you save a significant amount on your taxes Updated list of medical tax reliefs In Budget 2024 income tax

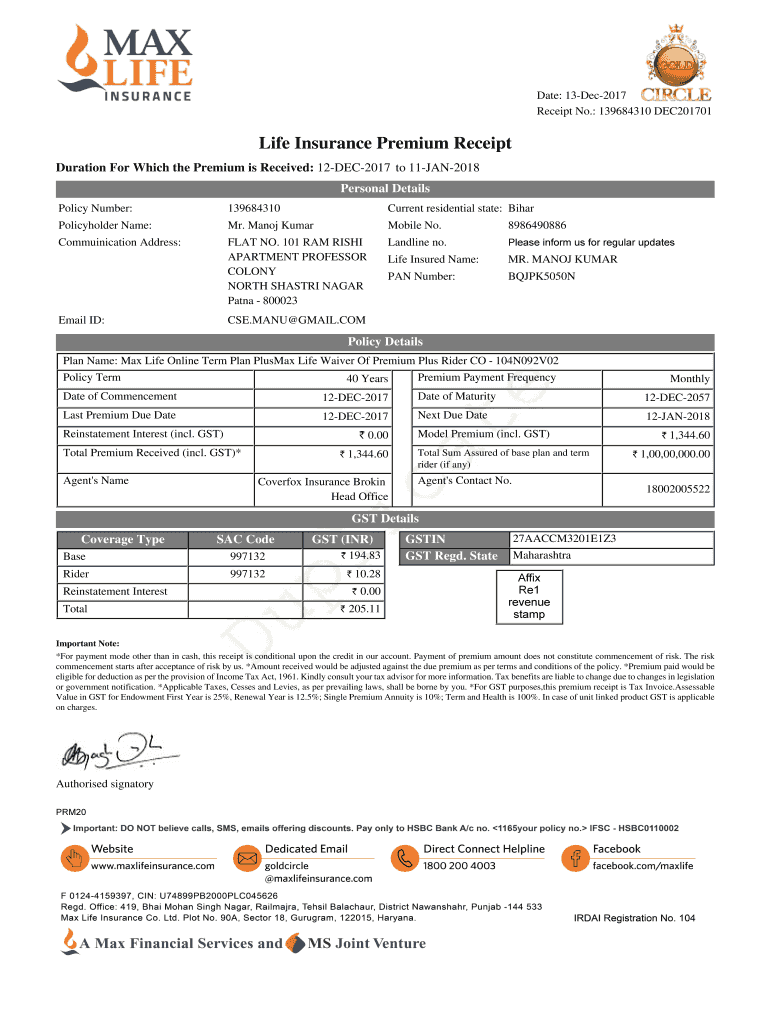

Section 80D of the Income tax Act seeks to provide deduction of INR 15 000 to a taxpayer who has incurred expenditure on health insurance of himself spouse and dependent children A further Deduction Under Section 80D Assessment Year Status Assessee Spouse dependent Children Assesee s parents Payment for medical insurance premium mode other than

Medical Checkup Rebate In Income Tax

Medical Checkup Rebate In Income Tax

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

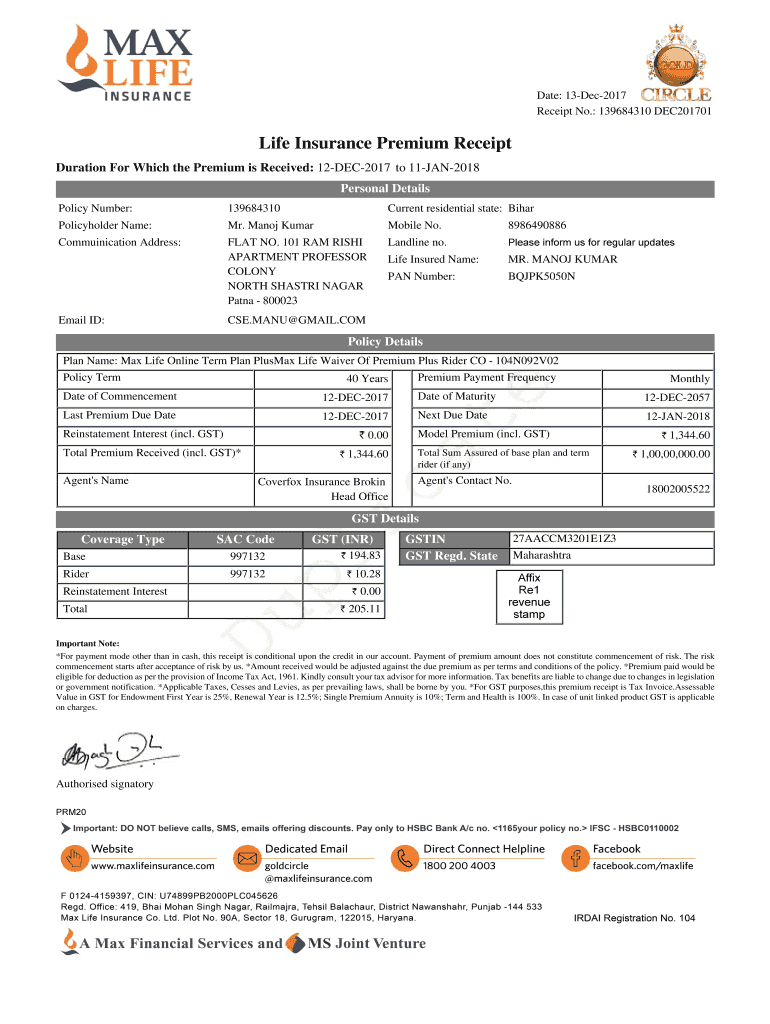

Medical Insurance Premium Receipt PDF Form Fill Out And Sign

https://www.signnow.com/preview/470/590/470590793/large.png

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

In addition to the deduction for health insurance premiums the section allows a deduction for expenses incurred on preventive health check ups Preventive health check ups involve medical tests and Am I Eligible for Tax Deductions on Preventive Health Check up Costs Yes of course Preventive health check up does have a role to play in your income tax returns and tax deductions and it was

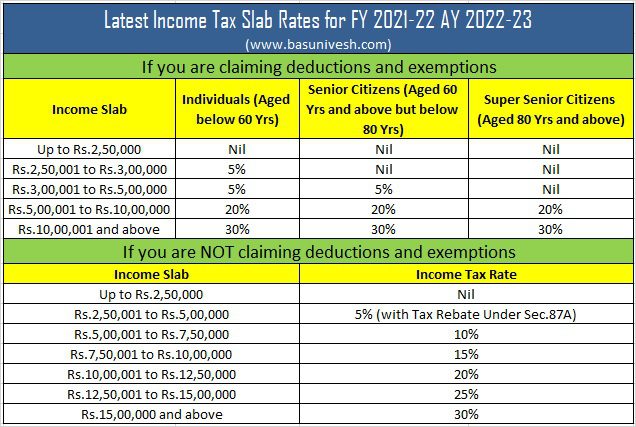

Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit You can avail of a maximum deduction of Rs 5 000 for the amount paid towards preventive health checkups under Section 80D This deduction will be applicable only if your deductions are within the health insurance

Download Medical Checkup Rebate In Income Tax

More picture related to Medical Checkup Rebate In Income Tax

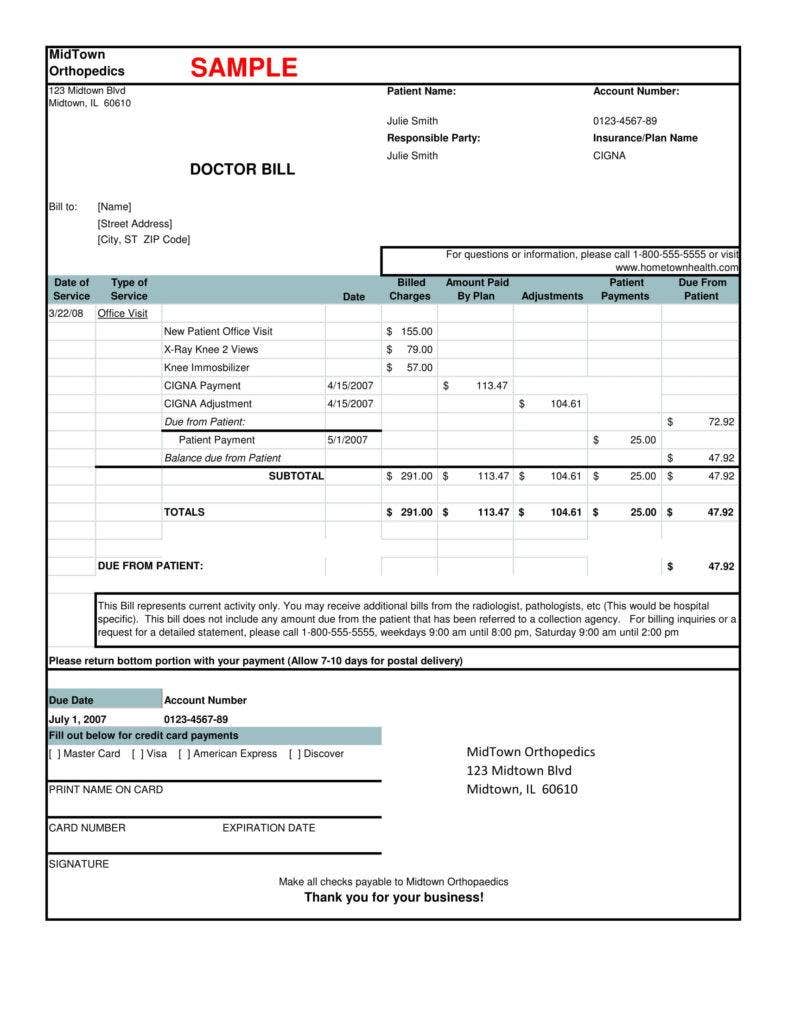

Sample Medical Bill Receipt Invoice Template

https://1.bp.blogspot.com/-MDdgYM0imQY/YH7cixrUfSI/AAAAAAAGqRg/C-kMYr9cjcEAPoeBhia21Vq5puWbhZdWACLcBGAsYHQ/s16000/hospitality-hospitality-hospital-bill-sample.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

How To Get Tax Rebate In Income Tax

https://lh3.googleusercontent.com/-jJ4zZZJpzu4/XkYh5zpW4bI/AAAAAAAALlw/03vDaCyfckIn2RjNTnWAHgi9ClX_V6MrACLcBGAsYHQ/s1600/Image_1.jpeg

Section 80D Deduction for Medical Insurance Health Checkup Section 80D provides for tax deduction from the total taxable income for the payment by any mode other than A deduction of Rs 5000 will be allowed under this section for payment of preventive health check up of either the individual himself or his family members which includes spouse parents and dependent

Section 80D of the Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical Expenditure on preventive health check up can be done via cash and maximum deduction that can be claimed is Rs 5 000 irrespective of the person s age On

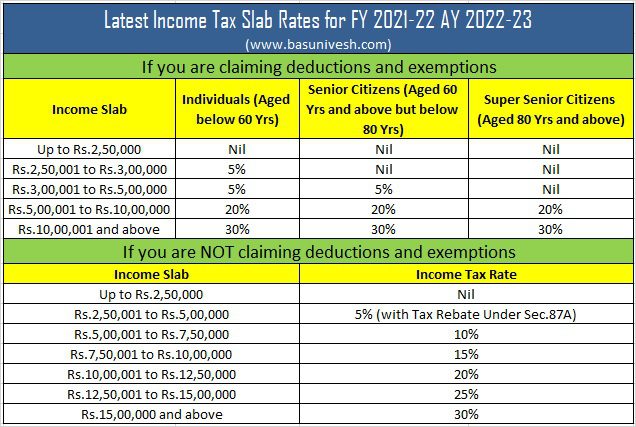

ITR Forms AY 2022 23 FY 2021 22 Which Form To Use BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2021/02/Latest-Income-Tax-Slab-Rates-for-FY-2021-22-AY-2022-23.jpg?lossy=1&strip=1&webp=1

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

https://i.ytimg.com/vi/wqhdYtP4JVc/maxresdefault.jpg

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

If planned properly claiming your tax reliefs can help you save a significant amount on your taxes Updated list of medical tax reliefs In Budget 2024 income tax

https://taxguru.in/income-tax/section-8…

Section 80D of the Income tax Act seeks to provide deduction of INR 15 000 to a taxpayer who has incurred expenditure on health insurance of himself spouse and dependent children A further

Income Tax Appellate Tribunal Recruitment Https www itat gov in

ITR Forms AY 2022 23 FY 2021 22 Which Form To Use BasuNivesh

Province Of Manitoba School Tax Rebate

Cukai Pendapatan How To File Income Tax In Malaysia Jobstreet Malaysia

How To Deal With An Income Tax Notice Wealthzi

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Preventive Health Check Up Benefits Tax Deductions

Income Tax Preparation

Medical Checkup Rebate In Income Tax - Medical Reimbursement is an arrangement under which employers reimburse the portion of the health expenses incurred by the employee The Income Tax Act allows