Medical Expenses Reimbursement Is Taxable Or Not In case of salaried person who is not provided with any medical benefit by his employer and who does not have any medical insurance policy no income tax benefit of medical expenses will be available to them

Health reimbursement arrangement HRA If your employer offers an HRA that qualifies as an accident or health plan your coverage under the HRA and reimbursements of your medical care expenses from the HRA generally aren t included in your income Is the medical allowance taxable Medical Allowance is entirely taxable However Medical reimbursement up to INR 15 000 is not taxable up to FY 2017 18 However from FY 2018 19 onwards medical reimbursement has been discontinued

Medical Expenses Reimbursement Is Taxable Or Not

Medical Expenses Reimbursement Is Taxable Or Not

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

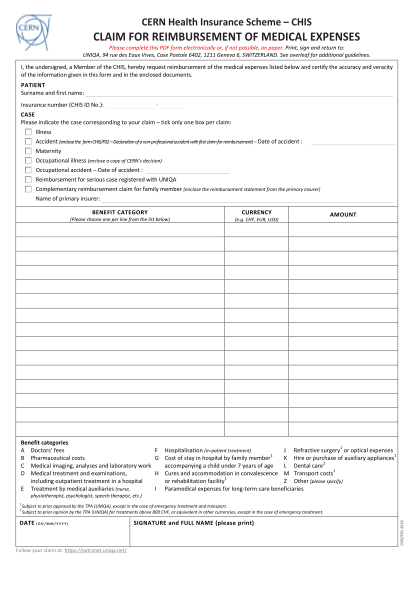

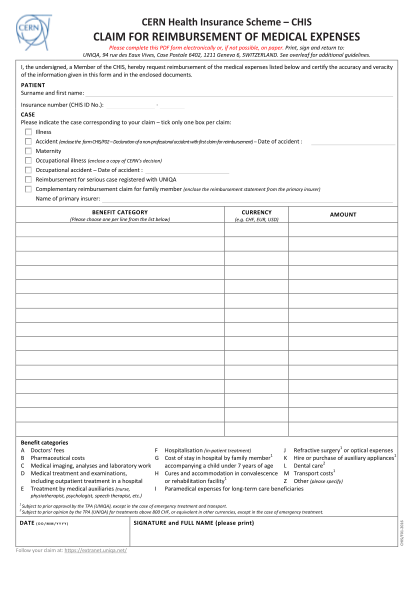

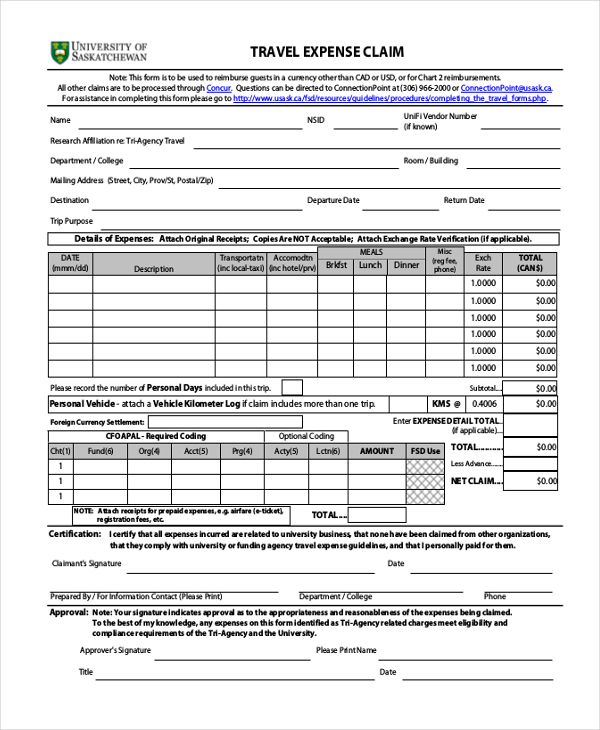

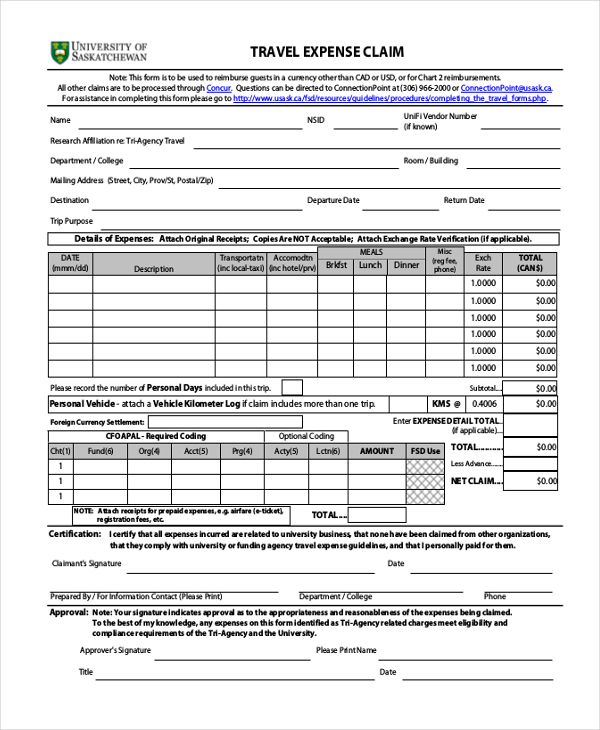

13 Sample Medical Bills Reimbursement Free To Edit Download Print

https://cdn.cocodoc.com/cocodoc-form/png/290536228-CHIS_F01-Claim-for-the-reimbursement-of-medical-expensespdf-CHISF01-Claim-for-reimbursement-of-medical-expenses-CERN-CHIS-UNIQA-Claim-Reimbursement--x-01.png

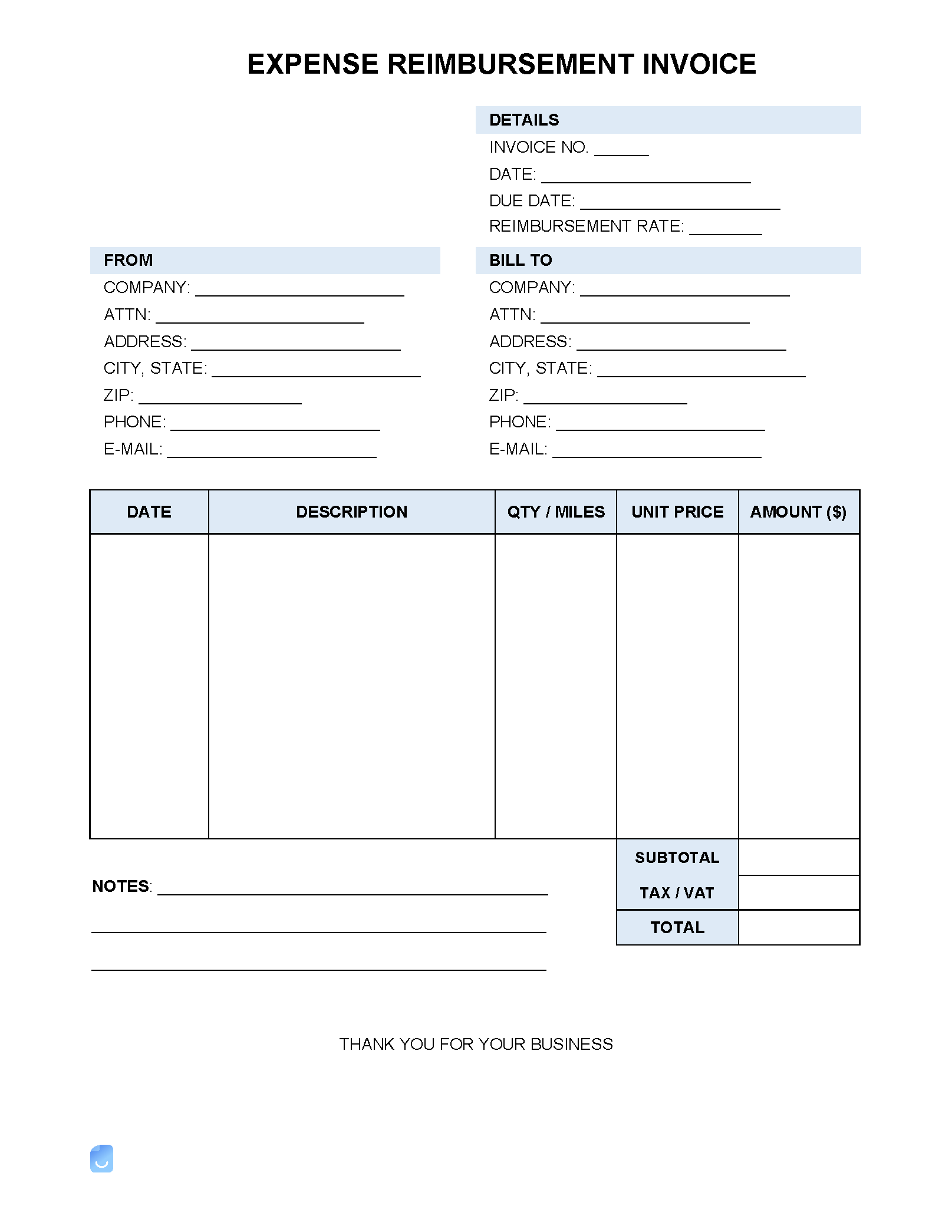

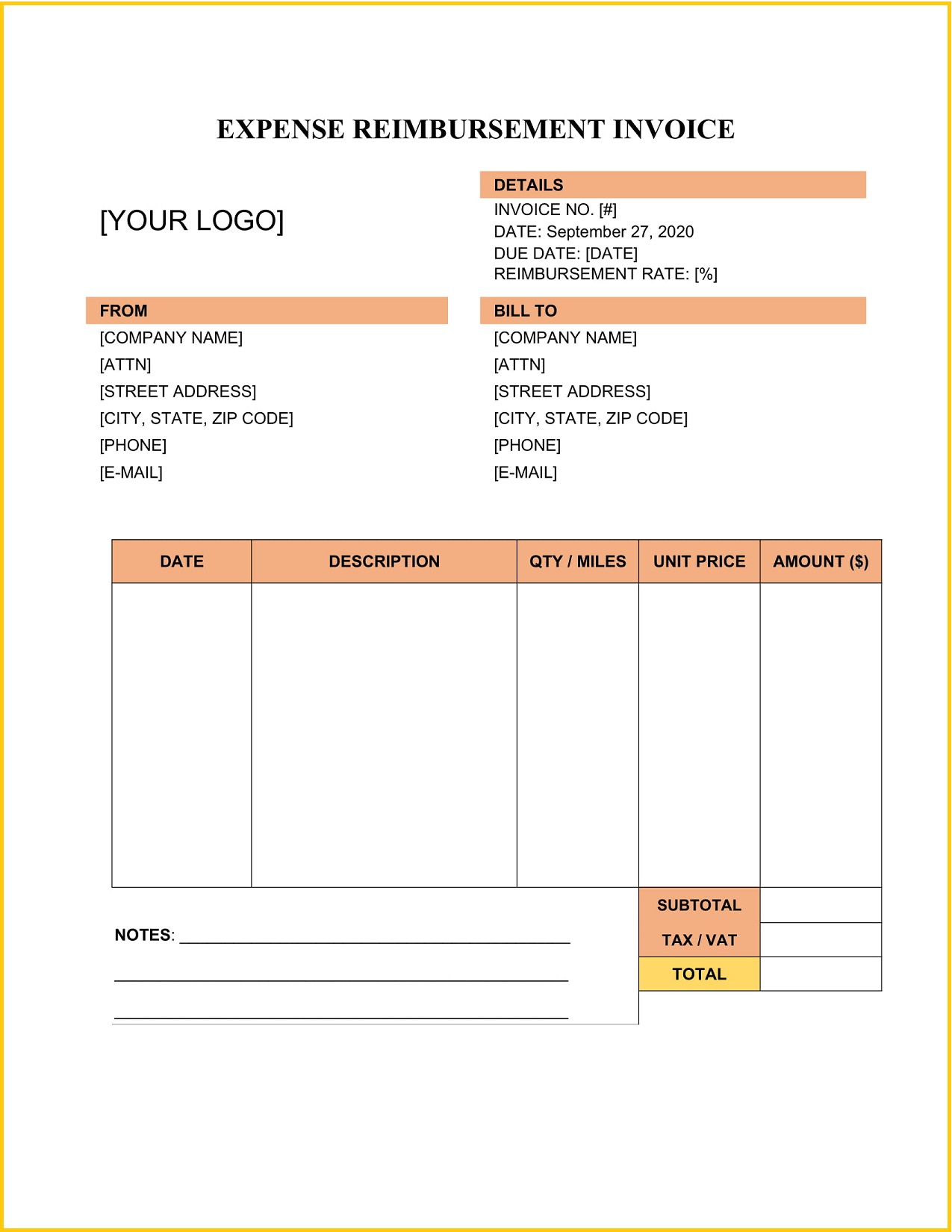

Expense Reimbursement Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Expense-Reimbursement-Invoice-Template.png

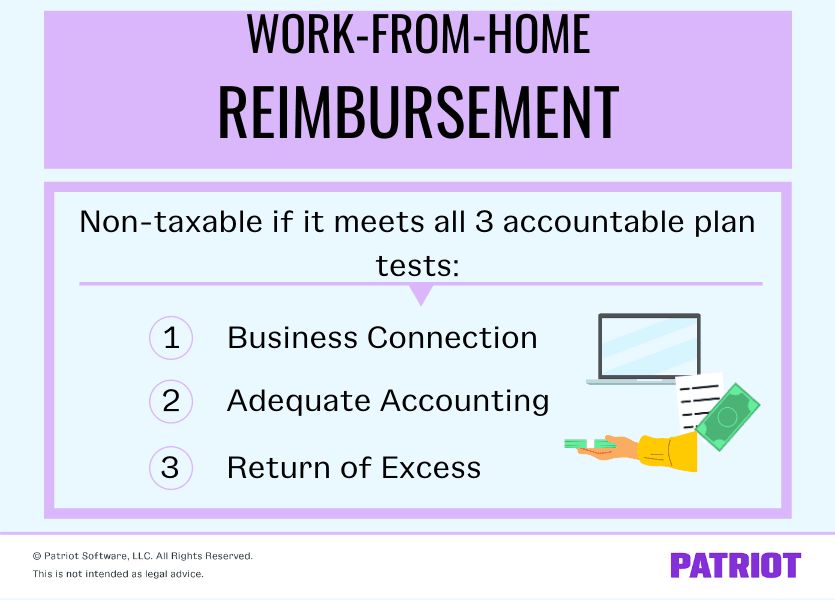

Are employee reimbursement expenses taxable income How do you qualify Learn more about IRS rules and accountable reimbursement plans Before we discuss insurance reimbursement tax treatment the answer is no Health insurance reimbursement through a health reimbursement arrangement or reimbursing employees for health insurance is not taxable

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10 Under medical allowance exemption Section 10 the medical allowance you receive is not included in your taxable income Here are some of the guidelines for medical allowance exemption You need to provide invoices or

Download Medical Expenses Reimbursement Is Taxable Or Not

More picture related to Medical Expenses Reimbursement Is Taxable Or Not

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1-768x552.png

Rural Healthcare Payment And Reimbursement Overview Rural Health

https://www.ruralhealthinfo.org/assets/5014-22505/payment-and-reimbursement-fb.jpg

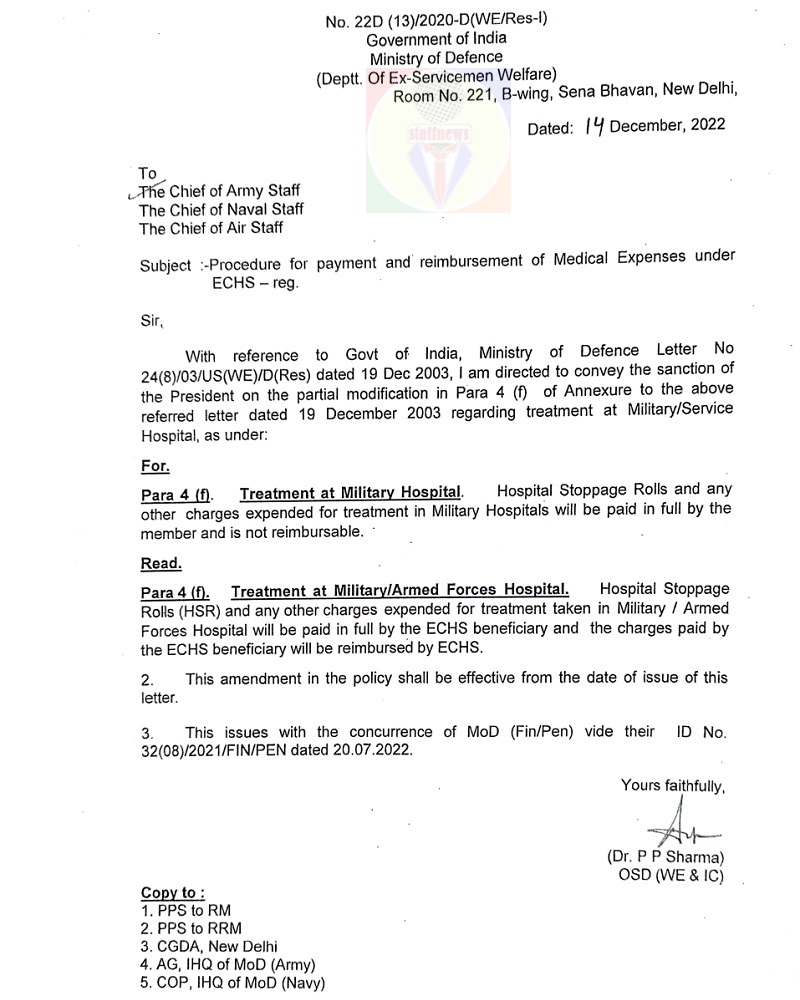

Procedure For Payment And Reimbursement Of Medical Expenses Under ECHS

https://www.staffnews.in/wp-content/uploads/2023/01/reimbursement-of-medical-expenses-under-echs.jpg

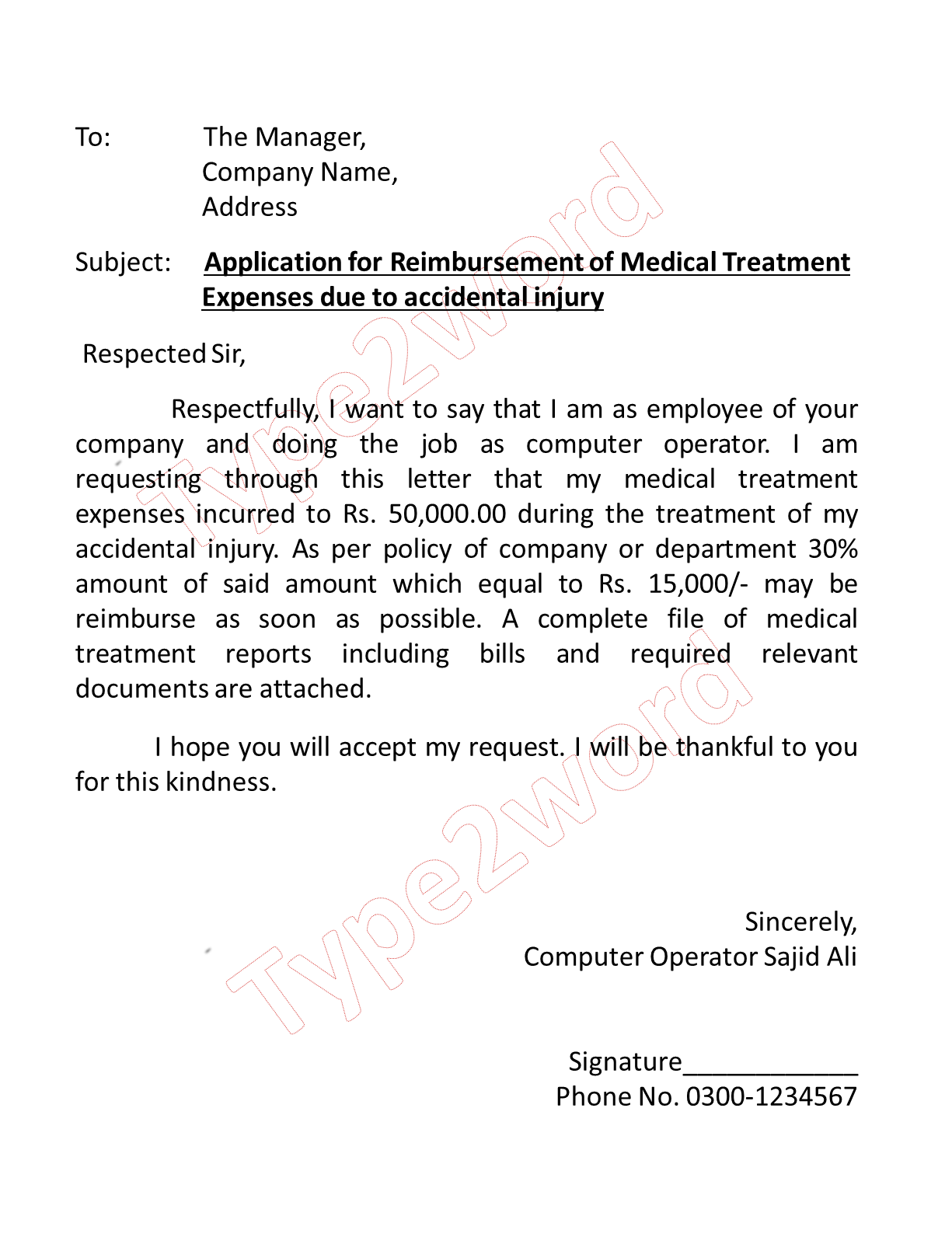

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction No Income Tax on Medical Reimbursement is levied up to Rs 15000 provided all bills for the same are furnished by the employee to the employer

Employers can often deduct the costs of providing medical reimbursement benefits as a business expense Understanding the tax implications helps employers make informed decisions about the structure and generosity of their reimbursement plans A health reimbursement arrangement HRA is a benefit used to pay employees back in tax free money for certain qualified medical expenses and health coverage premiums

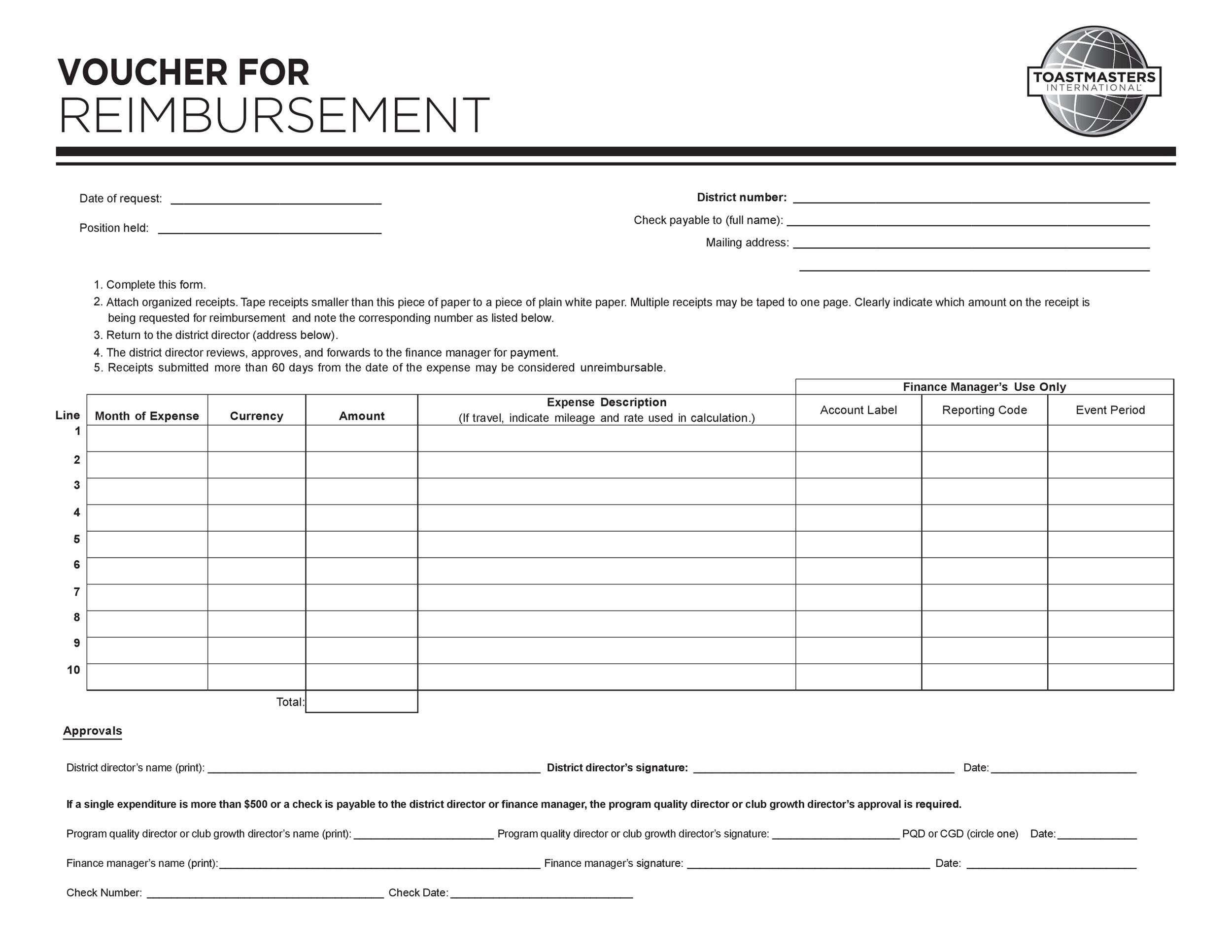

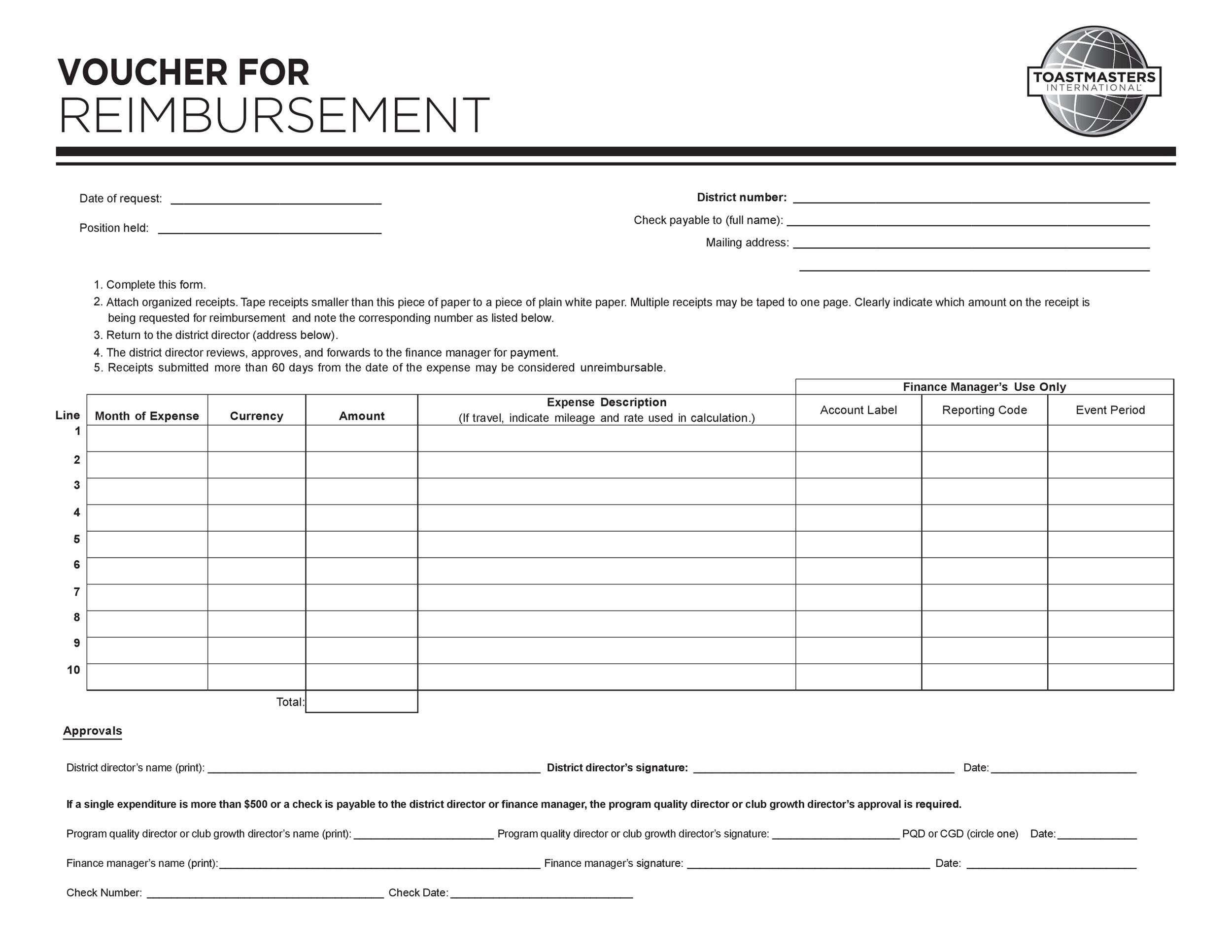

Reimbursement Form Template IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/47-reimbursement-form-templates-mileage-expense-vsp-1.jpg

Payment Or Reimbursement Of Medical Expenses By The Employer Is It

https://i.ytimg.com/vi/ei12uB8pdoE/maxresdefault.jpg

https://taxguru.in/income-tax/taxability-medical...

In case of salaried person who is not provided with any medical benefit by his employer and who does not have any medical insurance policy no income tax benefit of medical expenses will be available to them

https://www.irs.gov/publications/p525

Health reimbursement arrangement HRA If your employer offers an HRA that qualifies as an accident or health plan your coverage under the HRA and reimbursements of your medical care expenses from the HRA generally aren t included in your income

Expense Reimbursement Invoice Template Sample

Reimbursement Form Template IRS Mileage Rate 2021

What Is Pre Tax Commuter Benefit

Reimbursement Letter For Expenses Word Excel Templates

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

9 Expense Claim Form Sample Excel Templates 29283 Hot Sex Picture

9 Expense Claim Form Sample Excel Templates 29283 Hot Sex Picture

Work from home Reimbursement Definition Taxes Policy

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Application For Reimbursement Of Medical Treatment Expenses Due To

Medical Expenses Reimbursement Is Taxable Or Not - Under medical allowance exemption Section 10 the medical allowance you receive is not included in your taxable income Here are some of the guidelines for medical allowance exemption You need to provide invoices or