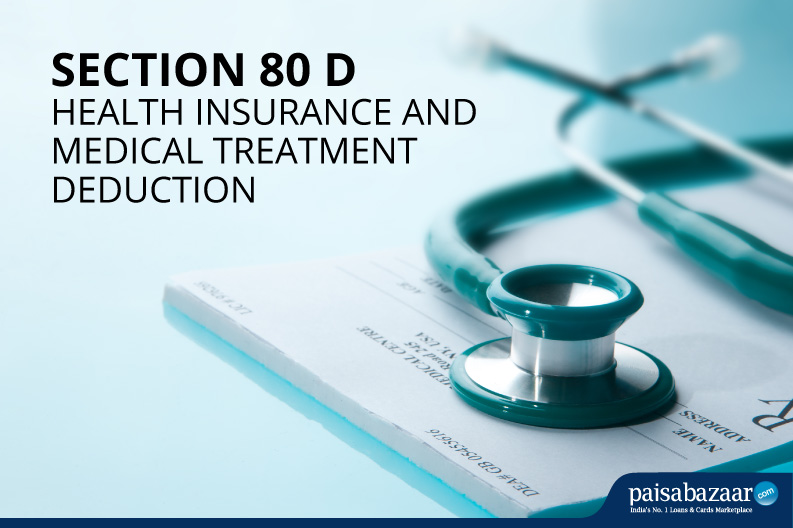

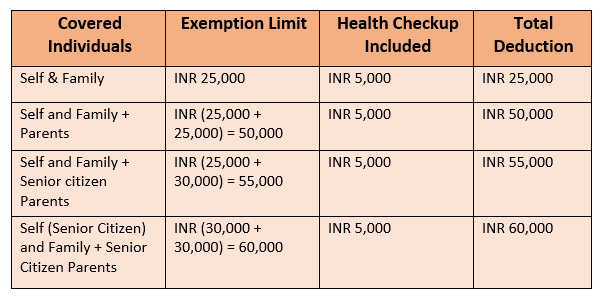

Medical Insurance Income Tax Section Exemption Ans You can avail a tax exemption of up to 25 000 in a financial year on health insurance premiums and preventive health check ups under Section 80D of the Income Tax Act

Explore Section 80D 80D Deduction Understand income tax deductions for medical insurance find out who s eligible and Section 80D of the Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical

Medical Insurance Income Tax Section Exemption

Medical Insurance Income Tax Section Exemption

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

Medical Insurance Income Tax Benefits By Sue Kneeland Medium

https://miro.medium.com/v2/resize:fit:1000/1*lD5c2M9sQnVSQr7REtvLzA.jpeg

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You Under the Income Tax Act medical reimbursements have a tax exemption of up to Rs 15 000 What are Medical Reimbursement Rules The Income Tax Act

Members of HUF below 60 Rs 25 000 Members of HUF above 60 Rs 50 000 Eligible Payments under Section 80D Deduction The mentioned below are the payments on What is Section 80D of the Income Tax Act 80D is a section in the Income Tax Act dedicated to tax benefits for purchasing health insurance policies and preventive

Download Medical Insurance Income Tax Section Exemption

More picture related to Medical Insurance Income Tax Section Exemption

Are Payroll Deductions For Health Insurance Pre Tax Details More

https://www.patriotsoftware.com/wp-content/uploads/2021/06/health-insurance-pre-tax-1.png

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/section-10-under-income-tax-act.jpg

Section 80D Deductions For Medical Health Insurance

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

Section 80D of the Income Tax Act allows for tax deductions for medical expenses incurred Get to know its features eligibility deduction limit etc in detail on Groww Section 80D of the Income tax Act 1961 provides income tax exemption for health insurance premium and select health expenses Health insurance premium can

The Health insurance tax benefits under the section 80D are listed in the table below The table indicates the maximum amount of tax deductions for Self Spouse Dependent Section 80D of the Income Tax Act allows any individual or Hindu Undivided Family HUF to claim a deduction on health insurance premiums paid from their total income

Everything You Need To Know On Section 115 BAB Of Income Tax Act

https://ebizfiling.com/wp-content/uploads/2022/07/Section-115-BAB.jpg

All You Need To Know On Exempted Income In Income Tax Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/income-exempted.png

https://www. policybazaar.com /health-insurance/section80d-deductions

Ans You can avail a tax exemption of up to 25 000 in a financial year on health insurance premiums and preventive health check ups under Section 80D of the Income Tax Act

https:// tax2win.in /guide/section-80d-deductio…

Explore Section 80D 80D Deduction Understand income tax deductions for medical insurance find out who s eligible and

Section 80D Deduction For Medical Insurance Health Checkups 2019

Everything You Need To Know On Section 115 BAB Of Income Tax Act

Tax Compliance Certificate Sample Hq Printable Documents CLOUD HOT GIRL

What Is Income Tax Limit For Property Tax And Insurance

Tax Exemption On Life Insurance Policy Under Section 10 10D Plan

You Can Save Tax On Medical Insurance Joblagao

You Can Save Tax On Medical Insurance Joblagao

Section 80G Of Income Tax Act Income Tax Deductions For Donations

Section 10 Of Income Tax Act Deductions And Allowances

Section 115BAC Of Income Tax Act IndiaFilings

Medical Insurance Income Tax Section Exemption - Members of HUF below 60 Rs 25 000 Members of HUF above 60 Rs 50 000 Eligible Payments under Section 80D Deduction The mentioned below are the payments on