Medical Insurance Tax Relief 2022 Imposition Of Penalties And Increases Of Tax Cancellation Of Disposal Sales Transaction Pegangan Dan Remitan Wang Oleh Pemeroleh Available in Malay Language Only

Your employer might pay medical insurance to an authorised insurer for you or your dependents as a Benefit in Kind If so you can claim tax relief from Medical insurance premiums If you pay medical insurance directly to an approved insurer tax relief is available Qualifying medical insurance policies can be for

Medical Insurance Tax Relief 2022

Medical Insurance Tax Relief 2022

https://landco.my/wp-content/uploads/2022/11/Personal-Tax-Relief-2022-1-830x1162.png

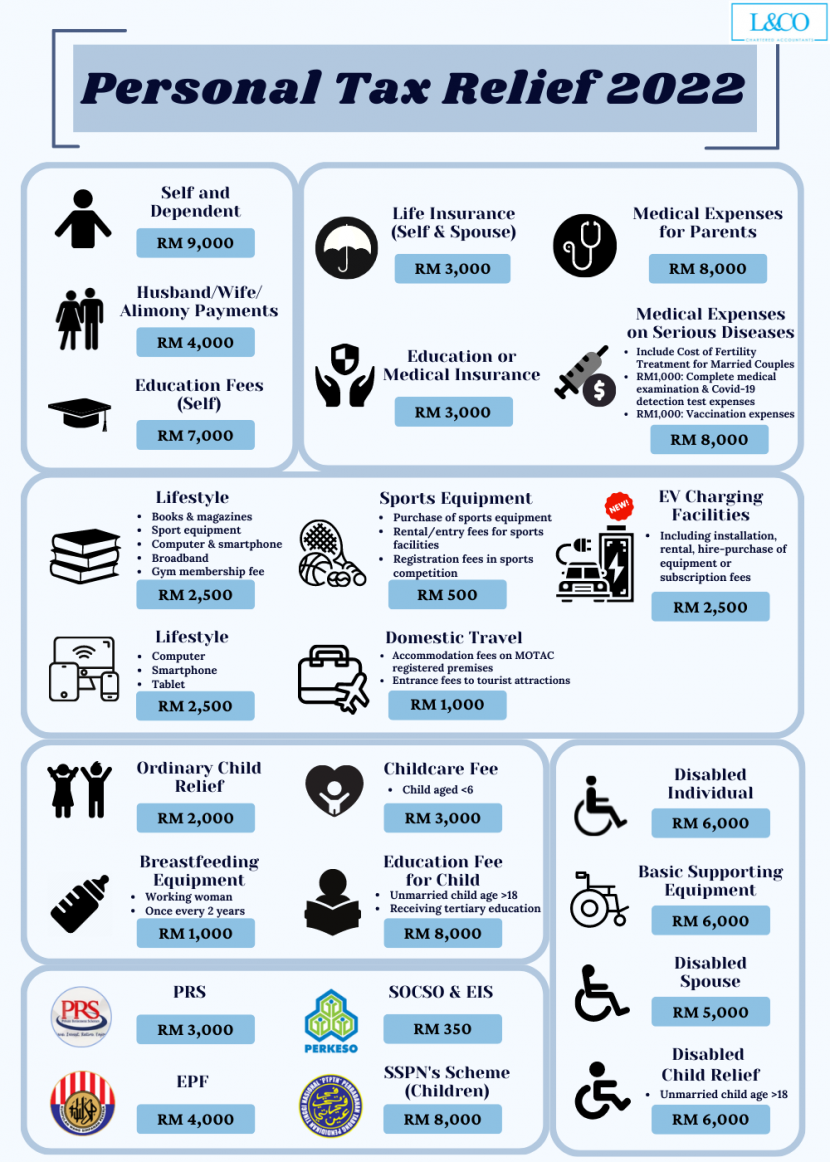

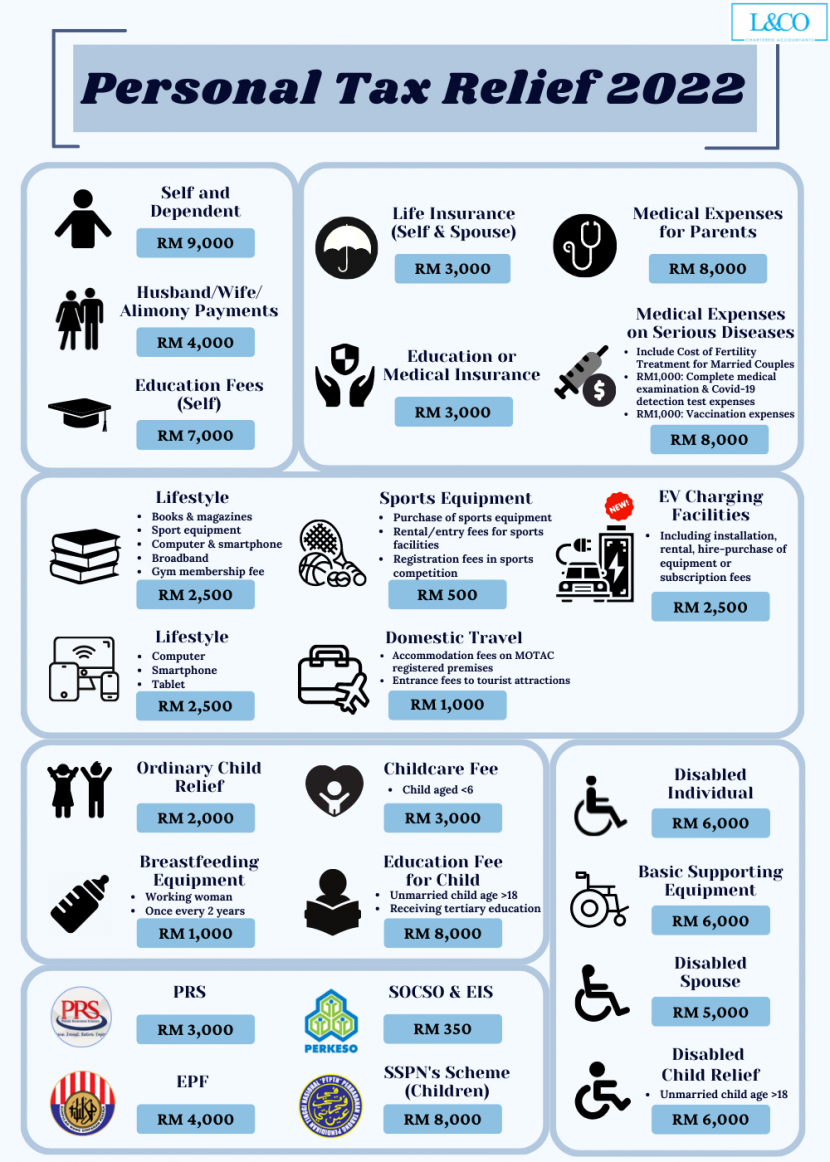

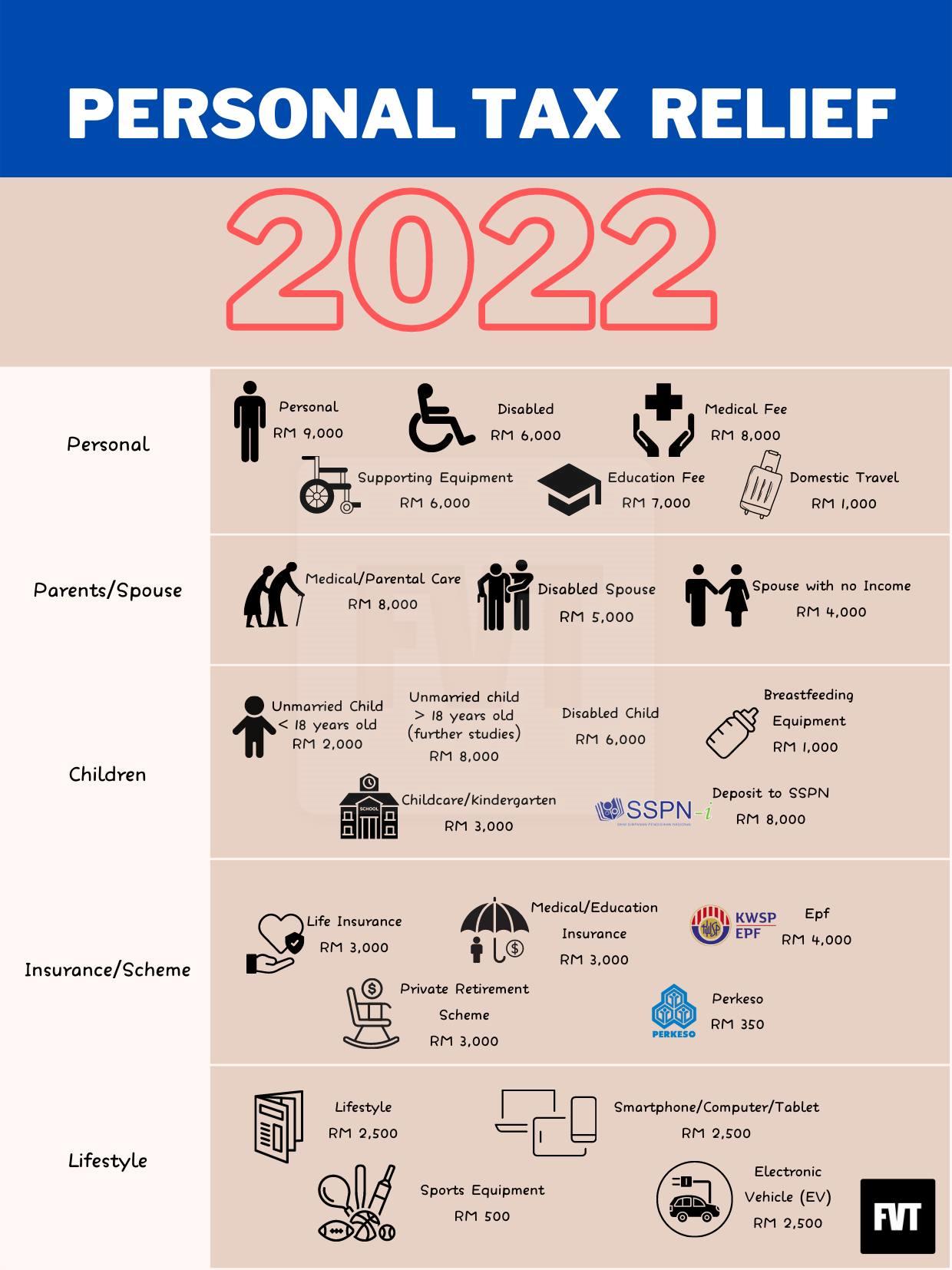

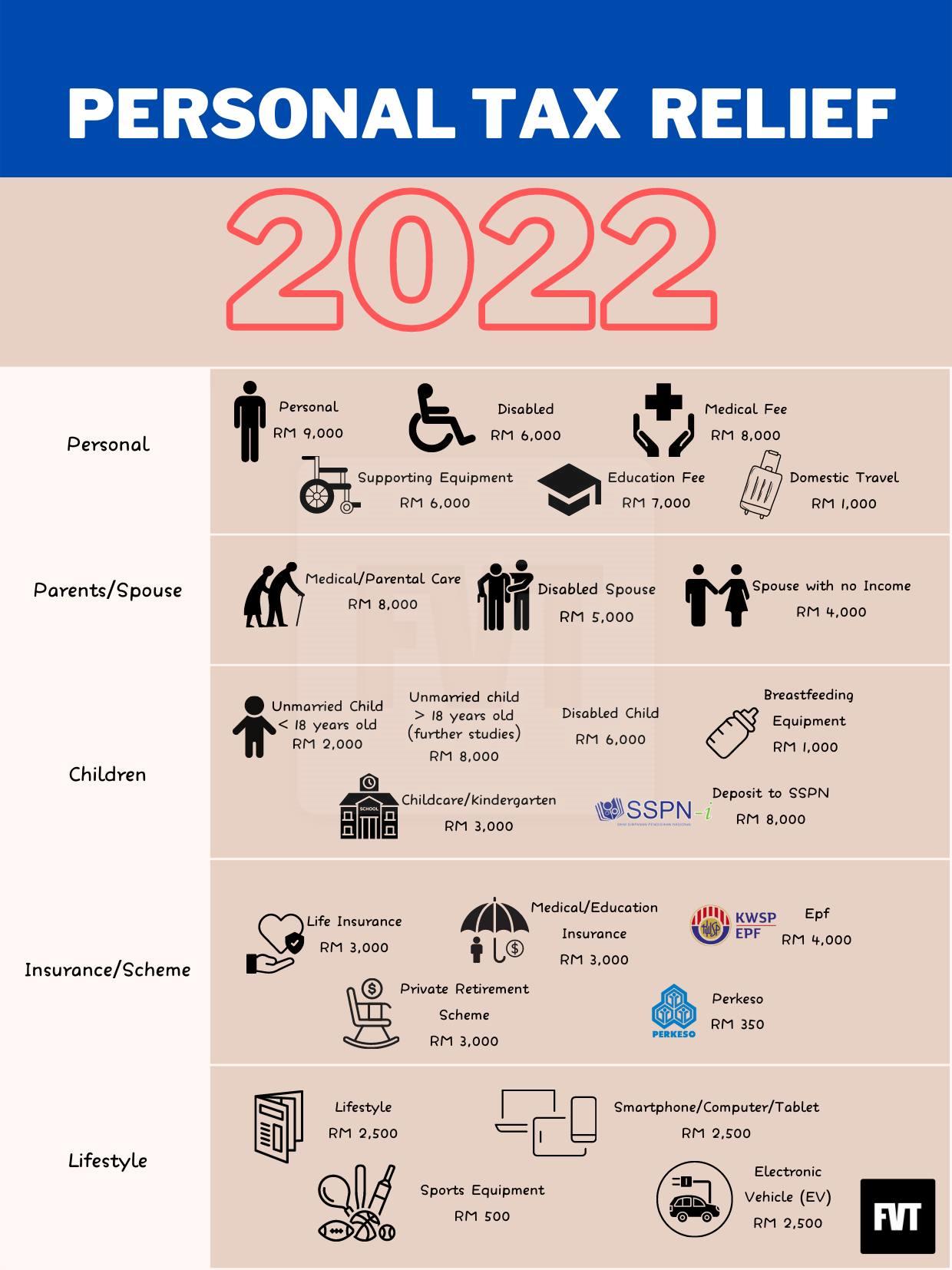

Personal Income Tax Relief Malaysia 2023 YA 2022 The Updated List Of

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2023/03/Personal-Income-Tax-Relief-Malaysia-2023-YA-2022.png?fit=1200%2C628&ssl=1

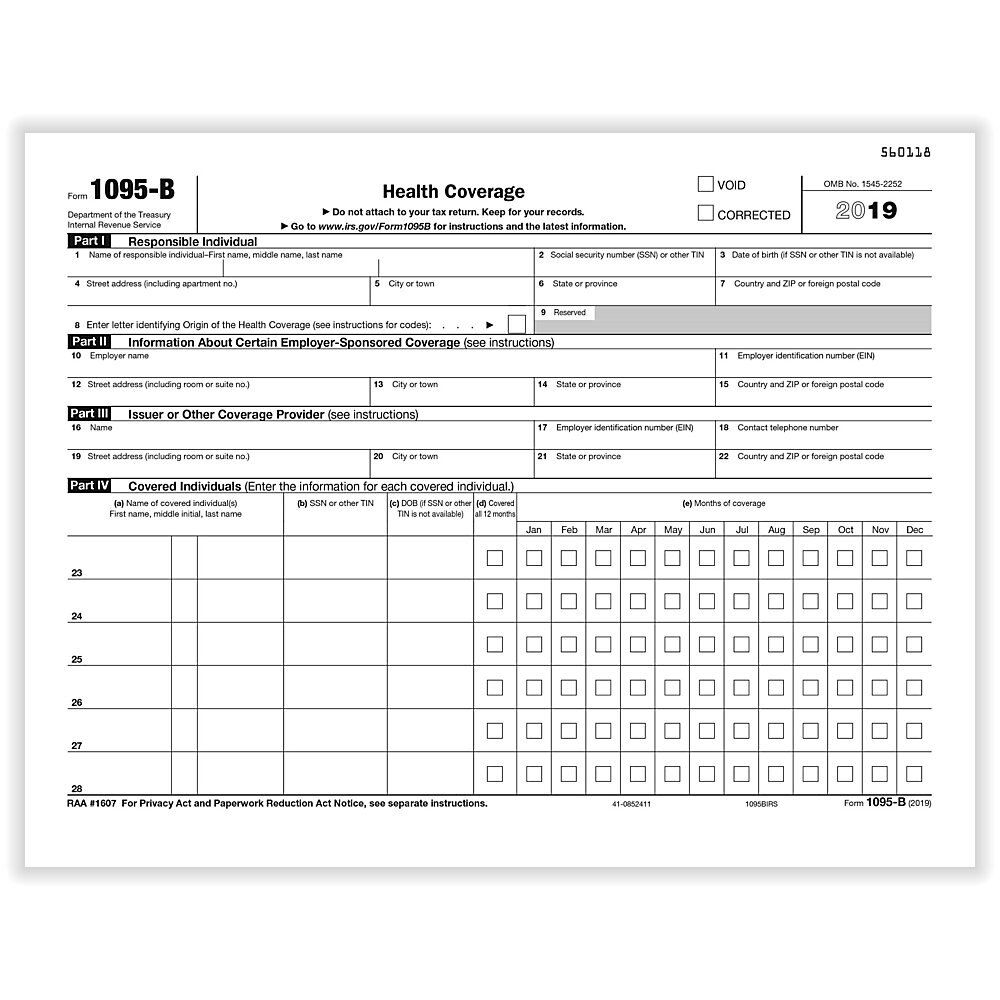

Medical Insurance Premium Receipt 2019 20 PDF Deductible Insurance

https://imgv2-2-f.scribdassets.com/img/document/442594448/original/090873fdc7/1704447541?v=1

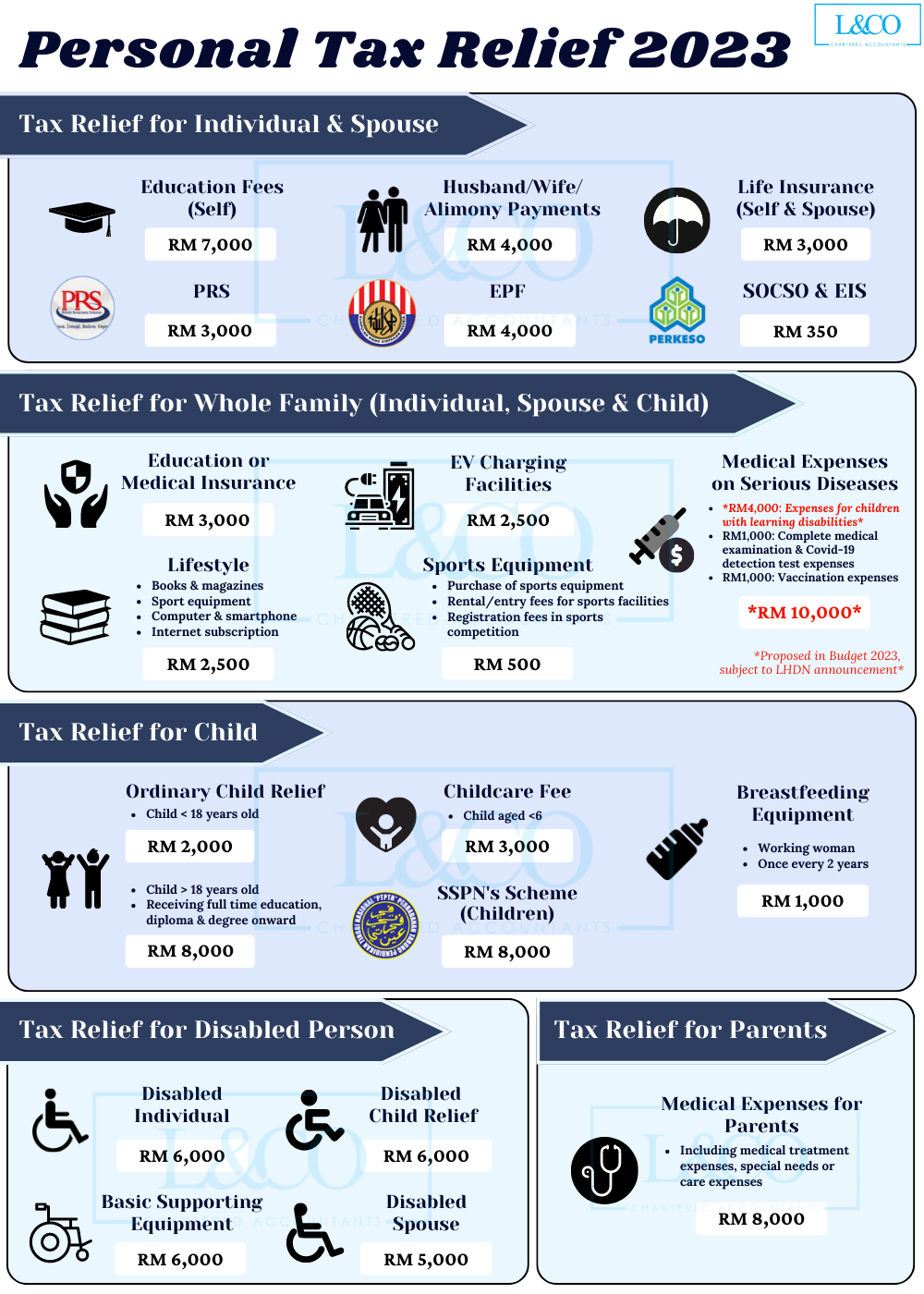

In Budget 2024 income tax relief limit for medical expenses has been increased from RM8 000 to RM10 000 This is effective from the year of assessment The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased

Here are the insurance related tax reliefs you can claim for Source Hasil gov my What insurance policies are eligible for tax relief You can claim for your life education and medical insurance as well as Enhanced premium tax credits in 2021 and 2022 for people who were already subsidy eligible also extended through 2025 by the Inflation Reduction Act

Download Medical Insurance Tax Relief 2022

More picture related to Medical Insurance Tax Relief 2022

15 Medical Insurance Tax Relief References Funaya Park

https://i2.wp.com/carajput.com/blog/wp-content/uploads/2021/01/Inkedsection-80d_LI-1024x612.jpg

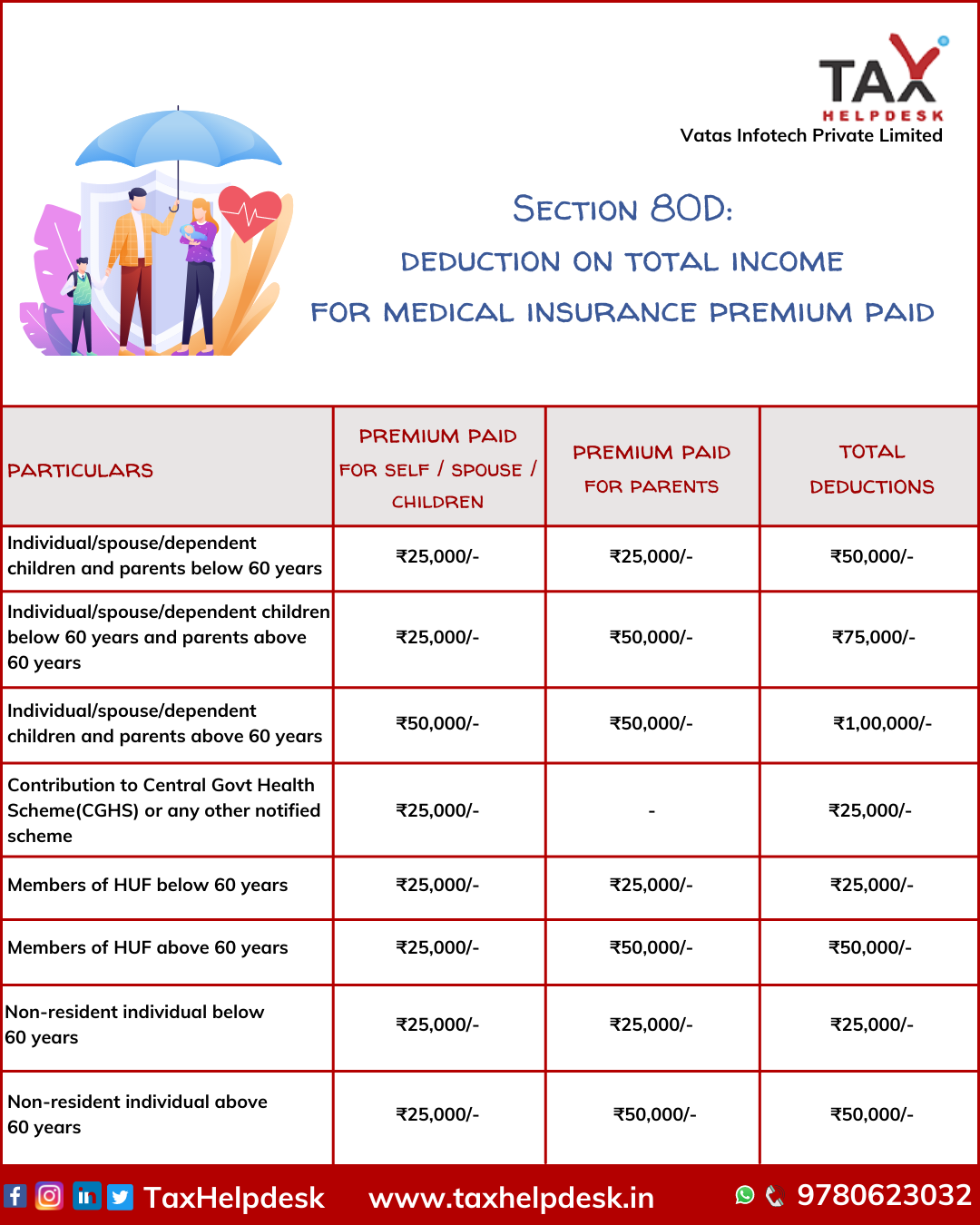

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/tax-benefits-on-medical-insurance.png

What Can You Claim For Tax Relief Under Medical Expenses

https://static.imoney.my/articles/wp-content/uploads/2022/03/26220201/medical-check-up.jpg

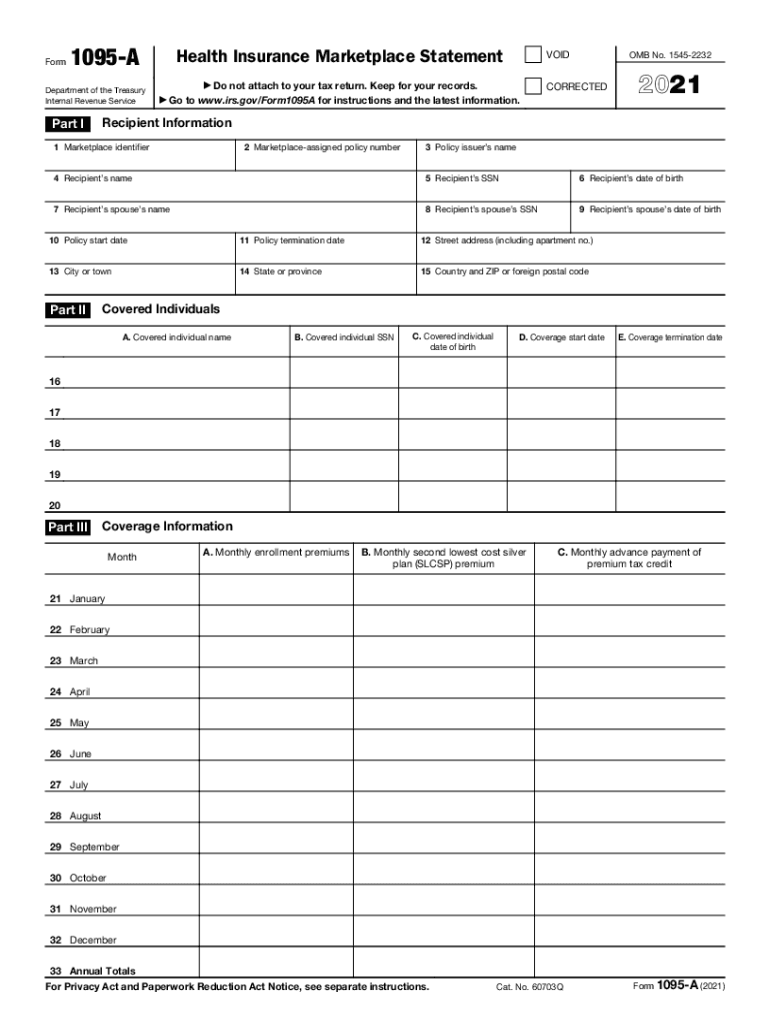

WASHINGTON The Internal Revenue Service today provided guidance on tax breaks under the American Rescue Plan Act of 2021 for continuation health The basics Q1 What is the Premium Tax Credit updated Feb 24 2022 Q2 What is the Health Insurance Marketplace Q3 How do I get advance payments of the Premium

Medical 4 Medical expenses for parents RM8 000 You can claim up to RM8 000 if your parents have a medical condition requiring specific treatment proven by Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on

Income Tax Monthly Deduction Table 2017 Malaysia Two Birds Home

https://www.homage.com.my/wp-content/uploads/sites/2/2021/03/Year-of-Assesement-844x1194.jpg

Personal Tax Relief 2022 Latest CN Advisory

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

https://www.hasil.gov.my/.../tax-reliefs

Imposition Of Penalties And Increases Of Tax Cancellation Of Disposal Sales Transaction Pegangan Dan Remitan Wang Oleh Pemeroleh Available in Malay Language Only

https://www.revenue.ie/.../illness-and-injury/medical-insurance.aspx

Your employer might pay medical insurance to an authorised insurer for you or your dependents as a Benefit in Kind If so you can claim tax relief from

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Income Tax Monthly Deduction Table 2017 Malaysia Two Birds Home

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

Personal Tax Relief Y A 2023 L Co Accountants

What Tax Forms Do I Need For Employee Health Insurance 2023

FVT Accounting Service Johor Bahru JB Mount Austin Bookkeeping

FVT Accounting Service Johor Bahru JB Mount Austin Bookkeeping

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Personal Tax Relief 2021 L Co Accountants

IRS 1095 A 2021 2022 Fill And Sign Printable Template Online US

Medical Insurance Tax Relief 2022 - Here are the insurance related tax reliefs you can claim for Source Hasil gov my What insurance policies are eligible for tax relief You can claim for your life education and medical insurance as well as