Medical Treatment Rebate In Income Tax Taxpayers can claim a deduction under section 80DDB for medical treatment of dependents with specified diseases The certificate can be obtained from

In Budget 2024 income tax relief limit for medical expenses has been increased from RM8 000 to RM10 000 This is effective from the year of assessment Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while

Medical Treatment Rebate In Income Tax

Medical Treatment Rebate In Income Tax

https://i.ytimg.com/vi/UlG2OZkak_k/maxresdefault.jpg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

Rebate Allowable Under Section 87A Of Income Tax Act

https://taxguru.in/wp-content/uploads/2020/08/Tax-Rebate.jpg

The Income Tax Act allows tax exemption of up to Rs 15 000 on medical reimbursements paid by the employer What is the Eligibility to Claim Medical What is Section 80D Every individual or HUF can claim a deduction for medical insurance premiums paid in the financial year under Section 80D This

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can Learn about the income tax act of 1961 and its amendments rules and regulations from the official website of the Central Board of Direct Taxes

Download Medical Treatment Rebate In Income Tax

More picture related to Medical Treatment Rebate In Income Tax

Income Tax Rebate Under Section 87A Legalraasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

What Is The Tax Treatment For The Income Received By Medical

https://cdn1.npcdn.net/image/164981424173531e46613b1dfea515665bf14ccba9.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

The deduction under this section is available only for expenditures incurred for medical treatment of specified diseases All specified diseases for which this Section 80DDB of the Income Tax Act of 1961 allows tax deductions to taxpayers on the treatment of certain specified diseases According to Section 80DDB these taxpayers are individuals and Hindu

Further Section 80DDB of the Income Tax Act allows tax deduction on expenses incurred by an individual on himself or a dependent towards the treatment of specific diseases Deduction in respect of expenses towards medical treatment Section 80DDB allows tax deduction on expenses incurred by an individual on himself or a

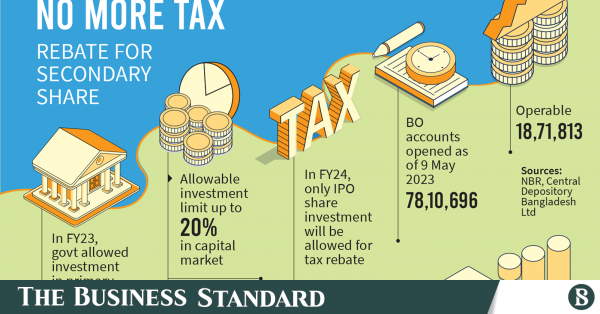

Where To Invest For Tax Rebate In Income Tax Of Bangladesh Calculate

https://sms.wtf/24b8fb83/http/b437e6/www.jasimrasel.com/wp-content/uploads/2017/08/Invest-for-Tax-Rebate.jpg

What Is A Rebate In Income Tax

https://www.mudranidhi.com/wp-content/uploads/2023/12/What-is-a-Rebate-in-Income-Tax-1024x576.jpg

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Taxpayers can claim a deduction under section 80DDB for medical treatment of dependents with specified diseases The certificate can be obtained from

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

In Budget 2024 income tax relief limit for medical expenses has been increased from RM8 000 to RM10 000 This is effective from the year of assessment

How To Get Tax Rebate In Income Tax

Where To Invest For Tax Rebate In Income Tax Of Bangladesh Calculate

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Document In This Notes About Undisclosed Source Of Income In Income

Document In This Notes About Undisclosed Source Of Income In Income

Income Tax Appellate Tribunal Recruitment Https www itat gov in

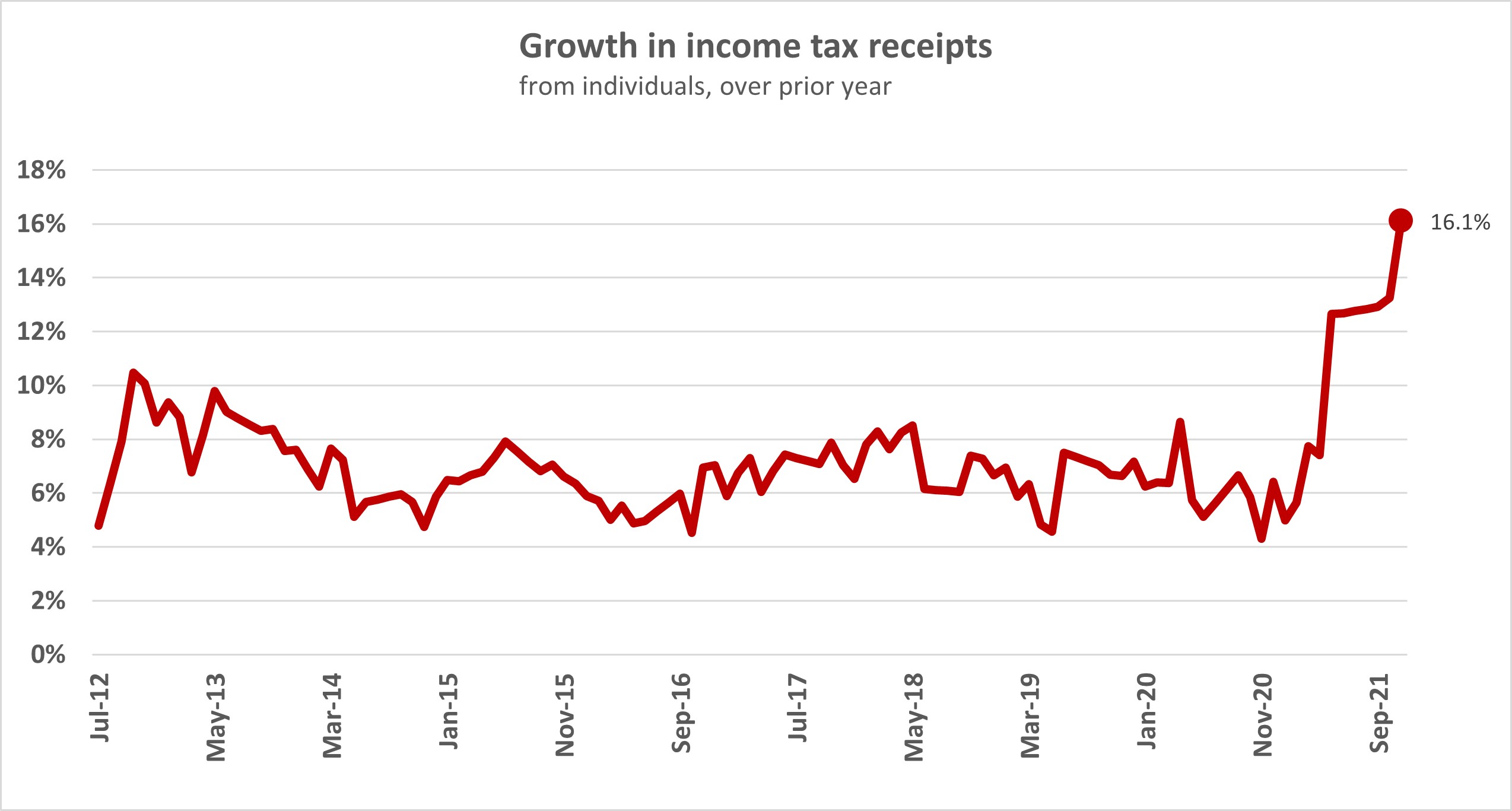

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Income Tax Rebate Is A Bait Video Dailymotion

Medical Treatment Rebate In Income Tax - The Income Tax Act allows tax exemption of up to Rs 15 000 on medical reimbursements paid by the employer What is the Eligibility to Claim Medical