Mileage Reimbursement Calculator For Work Web Step 1 Select your tax year Step 2 Enter your miles driven for business purposes Step 3 Optionally enter your miles driven for moving charitable or medical purposes Mileage Reimbursement Calculator Tax Year How many miles did you drive during the year Business mi Medical mi Moving mi Charitable mi Total Estimated Mileage Deduction

Web 26 Dez 2023 nbsp 0183 32 How Do You Calculate Mileage Reimbursement Calculating the correct amount for a mileage reimbursement is quite simple when using the IRS standard rate Employers only need to multiply the current rate 67 cents or 0 67 dollars by the total number of miles an employee drove for business purposes Web 9 Jan 2023 nbsp 0183 32 How To Calculate Mileage Reimbursement In 2023 In this article we ll cover how to calculate mileage reimbursement in 2023 and go over the best tools for tracking mileage to reduce admin burden whilst remaining compliant with IRS regulations 8 min read Tamara Siklosi January 9 2023 Employee Time Tracking Time Tracking

Mileage Reimbursement Calculator For Work

Mileage Reimbursement Calculator For Work

https://www.workingdata.co.uk/wp-content/uploads/2013/08/simple-excel-mileage-claim-tool-01-1024x577.png

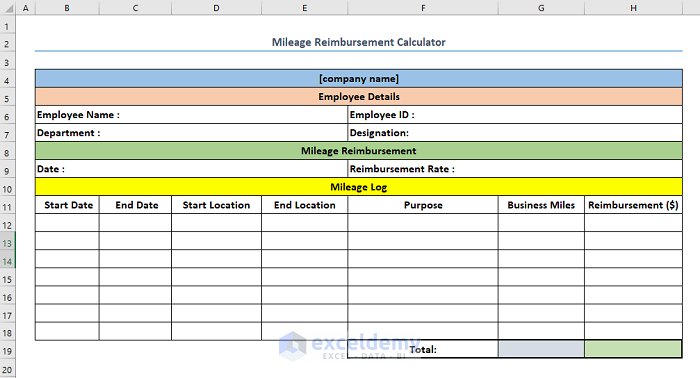

How To Calculate Mileage Reimbursement In Excel Step by Step Guide

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-mileage-reimbursement-in-excel-1.png

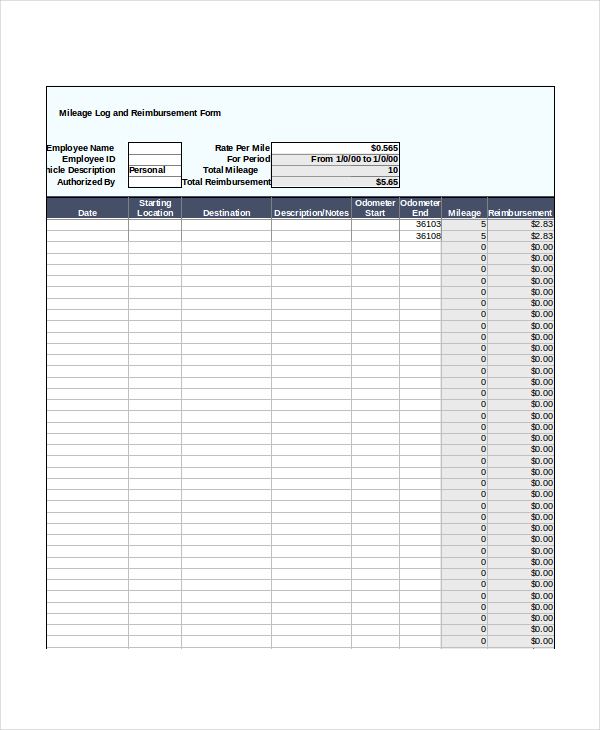

Mileage Reimbursement Form Template For Excel Excel Templates

https://www.xltemplates.org/wp-content/uploads/2019/10/Mileage-Reimbursement-Form-820x536.png

Web Instructions This calculator can help you track you mileage and can accommodate 2 different rates Enter your data and then look for the Total Reimbursement amount at the bottom Calculators like this are handy but they don t store employee mileage and expenses at all let alone for the 2 years of historical data that the government Web To find your reimbursement multiply the number of business miles driven by the IRS reimbursement rate So if you drove 1 000 miles and got reimbursed 585 cents per mile your reimbursement would be 585 1 000 miles X 0 585 585

Web Our online calculator works out exactly how much you re entitled to spend when you travel for work Calculate your allowance Mileage Reimbursement Calculator Calculate how much money you get back for using your personal vehicle with our easy to use mileage reimbursement calculator Check out our country specific calculators United States Web The following table summarizes the optional standard mileage rates for employees self employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes Period Rates in cents per mile Source Business

Download Mileage Reimbursement Calculator For Work

More picture related to Mileage Reimbursement Calculator For Work

FREE 9 Sample Mileage Reimbursement Forms In PDF Word Excel

https://images.sampleforms.com/wp-content/uploads/2016/08/mileage-log-reimbursement-form.jpg

2023 Mileage Reimbursement Calculator With HMRC Rates

https://www.travelperk.com/wp-content/uploads/calculators-mileage-reimbursement-header.png

Mileage Reimbursement Form In Word And Pdf Formats

https://static.dexform.com/media/docs/5994/mileage-reimbursement-form-3_1.png

Web 9 Jan 2023 nbsp 0183 32 Here s the formula for how to calculate mileage reimbursement Mileage Reimbursement Miles driven x Mileage Rate For example if an employee traveled 200 miles for work in a week and you are using the standard IRS mileage rate of 62 5 cents per mile the mileage reimbursement calculation would be as follows Mileage Web 10 Jan 2023 nbsp 0183 32 Urgently hiring jobs View more jobs on Indeed What is mileage reimbursement Mileage reimbursement is what an employer pays an employee for business related use of their personal vehicle Companies typically use a

Web You can calculate the percentage of how many business miles you ve driven by dividing the business miles by the total miles 100 400 0 25 In this example business mileage accounts for 25 of your total mileage To calculate your mileage reimbursement you can take your total business miles and multiply them by the standard IRS mileage rate Web Your mileage reimbursement would be 122 08 224 X 58 5 cents 131 04 The same principles apply if you are self employed Download MileIQ to start tracking your drives Automatic accurate mileage reports Get Started Does My Company Have To Provide A Mileage Expense There is no federal law requiring a mileage reimbursement

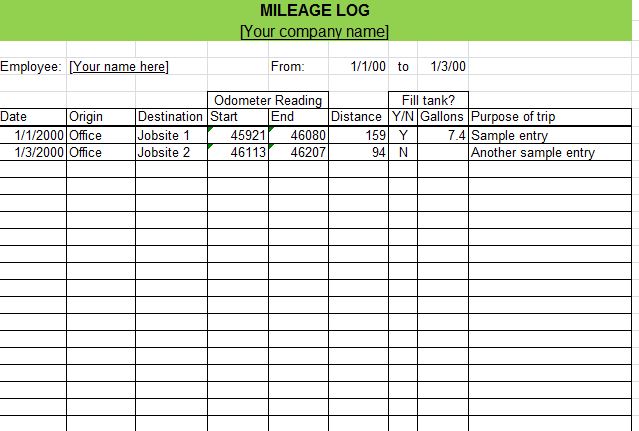

13 Sample Mileage Log Templates To Download Sample Templates

https://images.sampletemplates.com/wp-content/uploads/2015/04/22115542/Mileage-Log-Employee-Reimbursement.jpeg

Mileage Reimbursement Form 1

https://source.cocosign.com/images/employee/mileage-reimbursement-form/mileage-reimbursement-form_1.jpg

https://blog.taxact.com/mileage-reimbursement-calculator

Web Step 1 Select your tax year Step 2 Enter your miles driven for business purposes Step 3 Optionally enter your miles driven for moving charitable or medical purposes Mileage Reimbursement Calculator Tax Year How many miles did you drive during the year Business mi Medical mi Moving mi Charitable mi Total Estimated Mileage Deduction

https://www.paylocity.com/.../blog-post/employee-mileage-reimburs…

Web 26 Dez 2023 nbsp 0183 32 How Do You Calculate Mileage Reimbursement Calculating the correct amount for a mileage reimbursement is quite simple when using the IRS standard rate Employers only need to multiply the current rate 67 cents or 0 67 dollars by the total number of miles an employee drove for business purposes

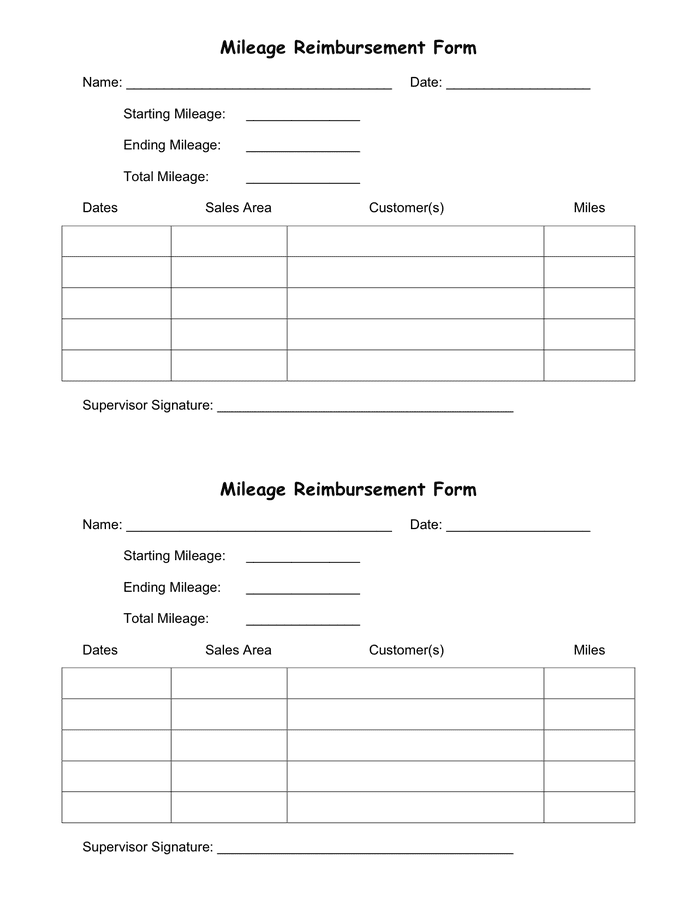

Mileage Reimbursement Form Download Free Documents For PDF Word And

13 Sample Mileage Log Templates To Download Sample Templates

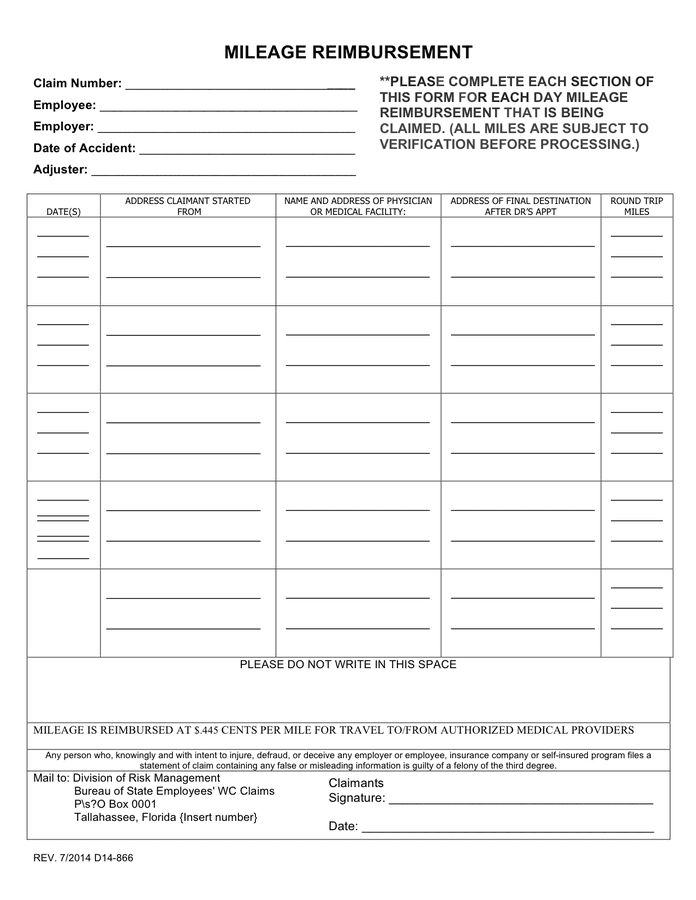

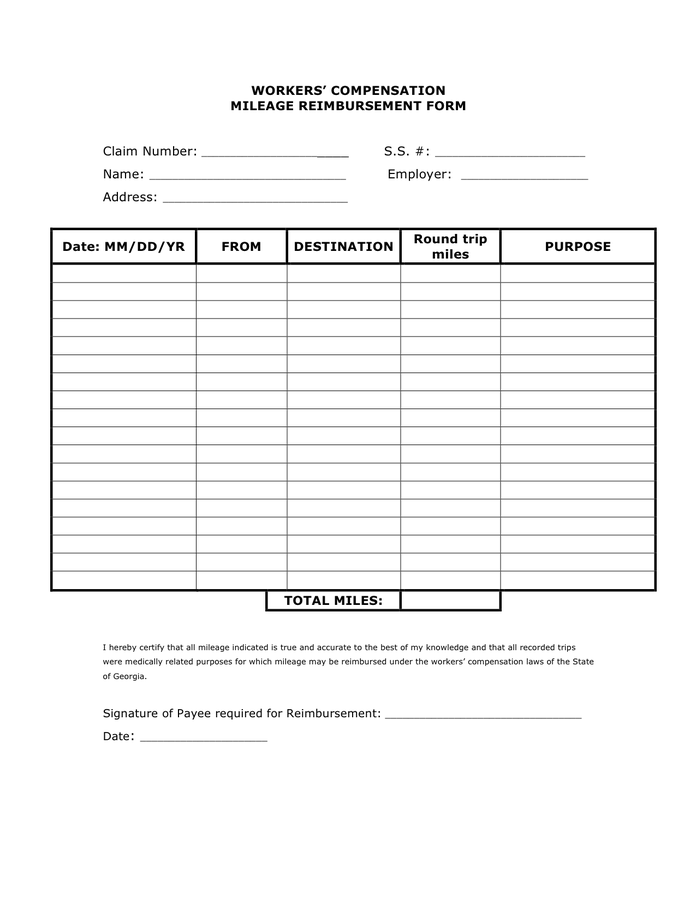

Workers Comp Mileage Reimbursement Form IRS Mileage Rate 2021

Free Mileage Log Templates Smartsheet 2022

Mileage Reimbursement A Complete Guide TravelPerk

Mileage Claim Form Template

Mileage Claim Form Template

Example Mileage Reimbursement Form Printable Form Templates And Letter

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Mileage Template For Excel Mileage Log Excel Template

Mileage Reimbursement Calculator For Work - Web Instructions This calculator can help you track you mileage and can accommodate 2 different rates Enter your data and then look for the Total Reimbursement amount at the bottom Calculators like this are handy but they don t store employee mileage and expenses at all let alone for the 2 years of historical data that the government