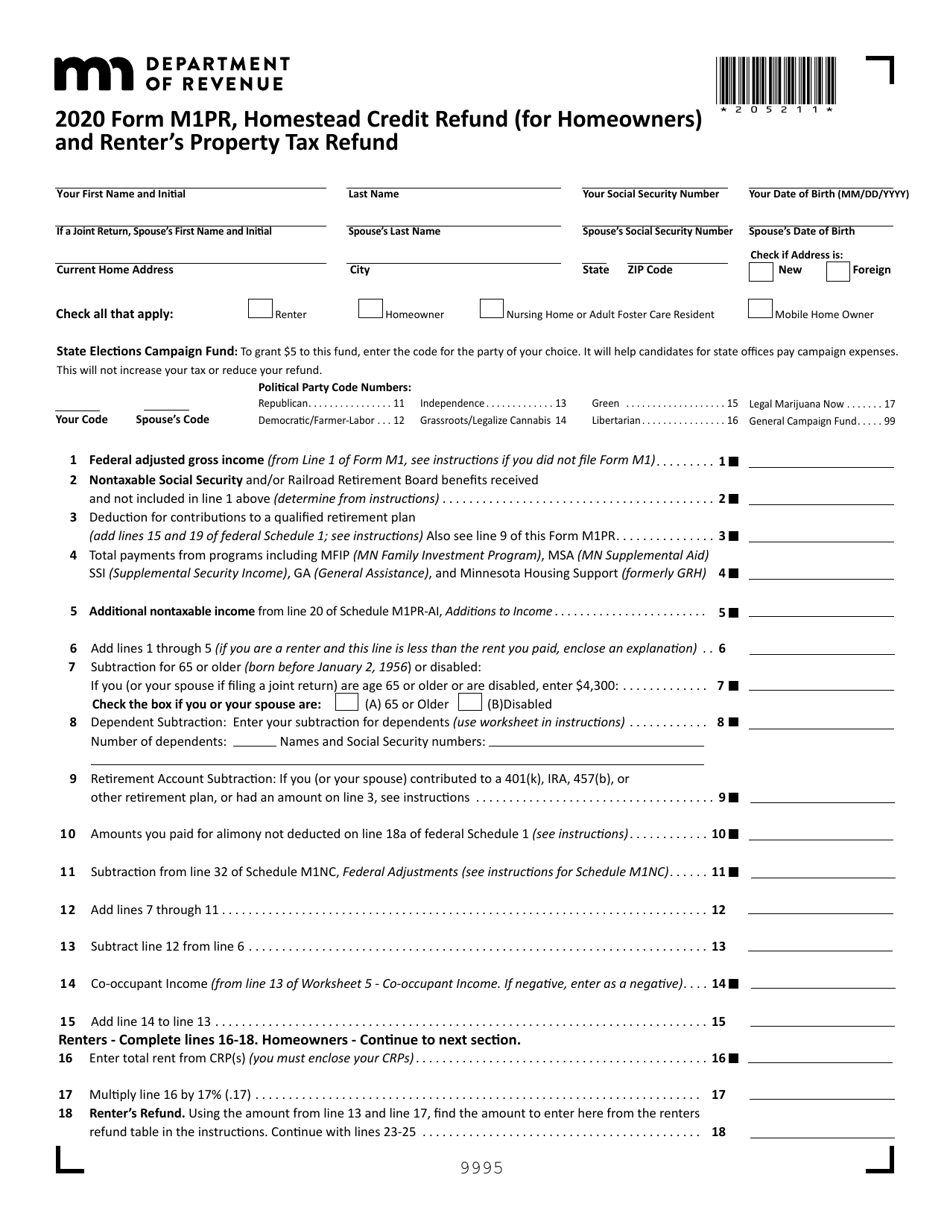

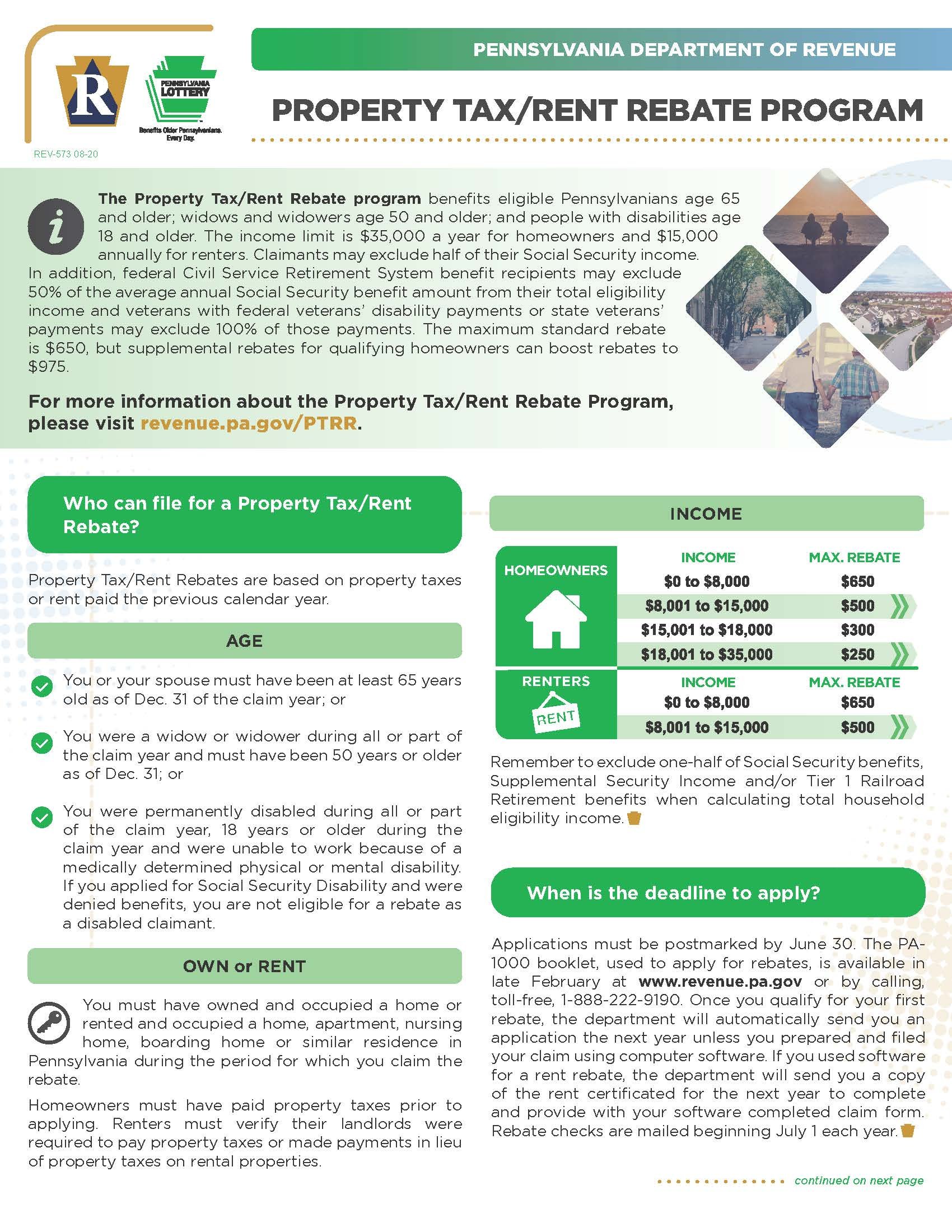

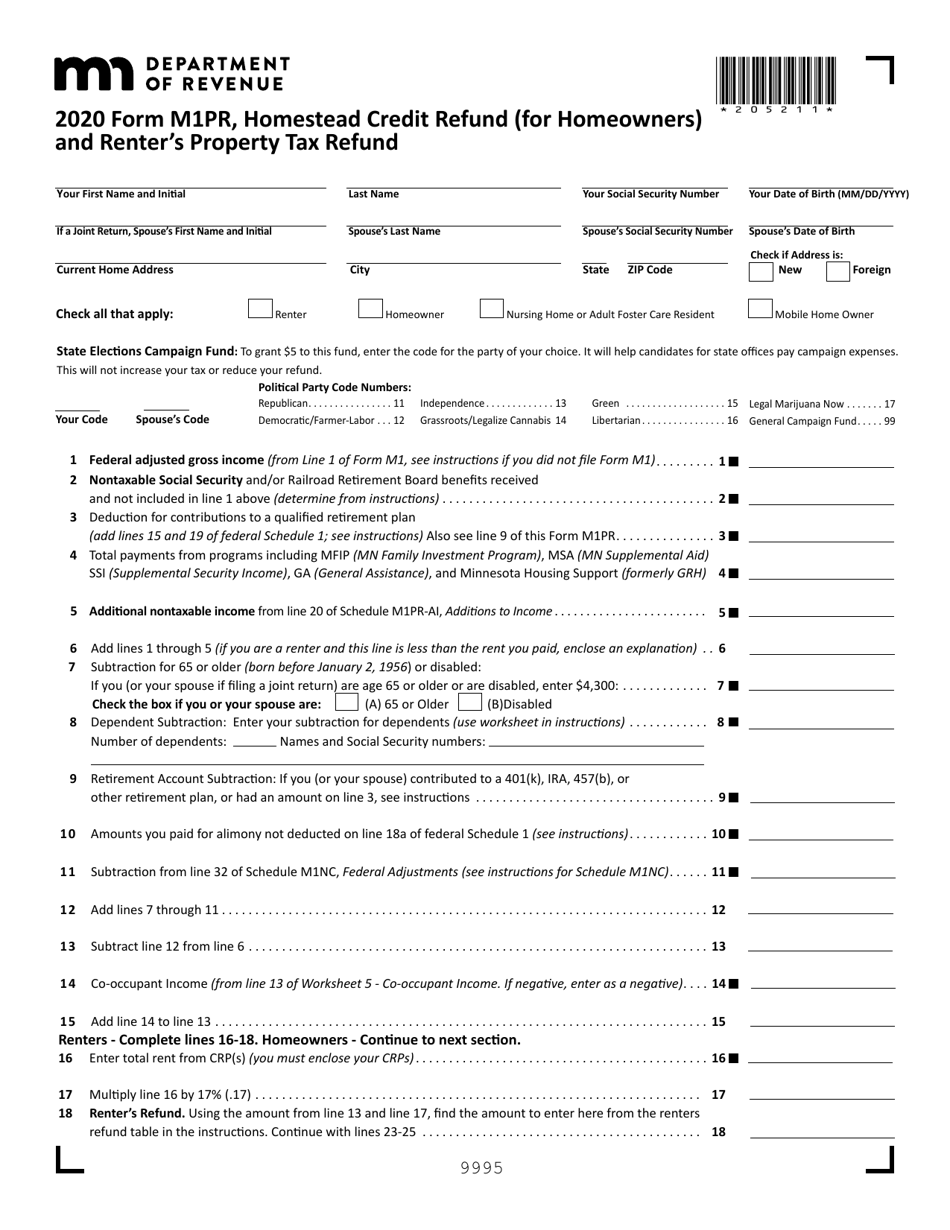

Mn Property Tax Refund Limits Web Your household income affects your eligibility and refund amount for the Property Tax Refund Generally it includes your federal adjusted gross income and certain nontaxable income To calculate household income including subtractions that may help you qualify see the line instructions for Form M1PR Homestead Credit Refund for Homeowners

Web If you are a homeowner you may also be eligible for a special property tax refund This refund has no income limit and the maximum refund is 2 500 You may qualify if all of these are true You owned and occupied your home on January 2 2022 and January 2 2023 Your net property tax on your homestead increased by more than 6 from Web There is no income limit Ready to apply Go to www revenue state mn us to file electronically or download Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund Call 651 296 3781 or 1 800 652 9094 to

Mn Property Tax Refund Limits

Mn Property Tax Refund Limits

https://i2.wp.com/data.templateroller.com/pdf_docs_html/1999/19996/1999680/form-m1pr-homestead-credit-refund-for-homeowners-and-renter-s-property-tax-refund-minnesota_print_big.png

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

https://data.templateroller.com/pdf_docs_html/2219/22192/2219253/form-m1pr-homestead-credit-refund-for-homeowners-and-renter-s-property-tax-refund-minnesota_print_big.png

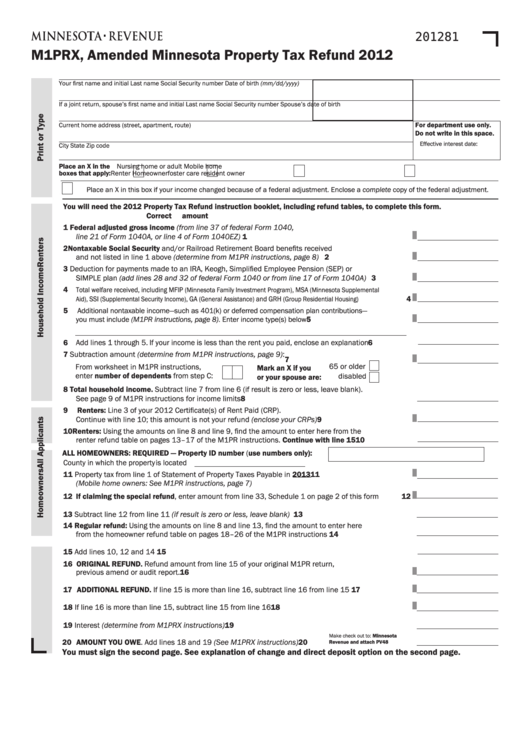

Minnesota Fiduciary Income Tax Return Instructions TAX

https://data.formsbank.com/pdf_docs_html/349/3498/349860/page_1_thumb_big.png

Web If you are a homeowner you may also be eligible for a special property tax refund This refund has no income limit and the maximum refund is 1 000 You may qualify if all of these are true You owned and occupied your home on January 2 Web What are the most recent changes to the program The 2011 and 2013 tax laws both expanded the refund program The 2011 changes increased the maximum refund for homeowners with incomes under about 37 000 and decreased the copayment percentage for most homeowners

Web The maximum refund is 1 000 The targeting refund is calculated prior to calculation of the homestead credit refund The following example shows how the refund is calculated The taxpayer s 400 increase i e 25 percent is reduced to an out of pocket property tax increase of 275 i e 17 2 percent as a result of the 125 refund Web August 11 2021 ST PAUL Minn The Minnesota Department of Revenue reminds homeowners and renters to file for their 2019 property tax refund before the August 15 2021 deadline Additionally claims for 2020 refunds

Download Mn Property Tax Refund Limits

More picture related to Mn Property Tax Refund Limits

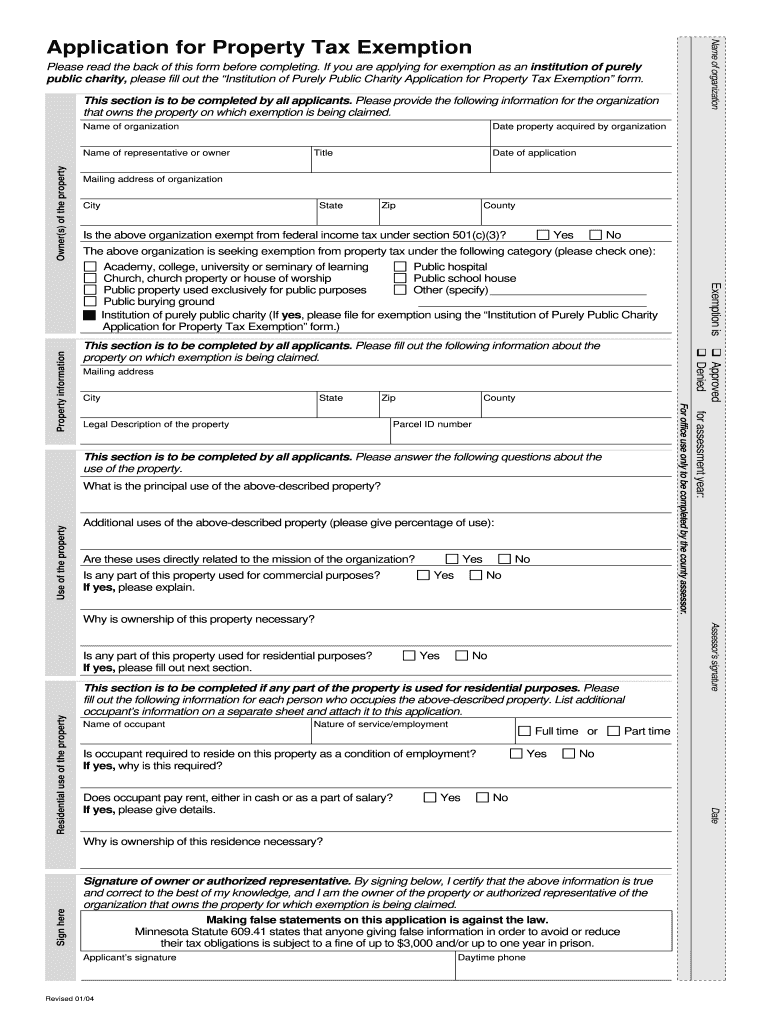

Minnesota Property Tax Exemptions Fill Online Printable Fillable

https://www.pdffiller.com/preview/0/211/211717/large.png

Property Tax Homestead Notice FB Post 2020 Redwood County MN

https://redwoodcounty-mn.us/wp-content/uploads/2020/11/Property-Tax-Homestead-Notice-FB-Post-2020.png

When Can I Expect My MN Property Tax Refund YouTube

https://i.ytimg.com/vi/8sk_okNq7U0/maxresdefault.jpg

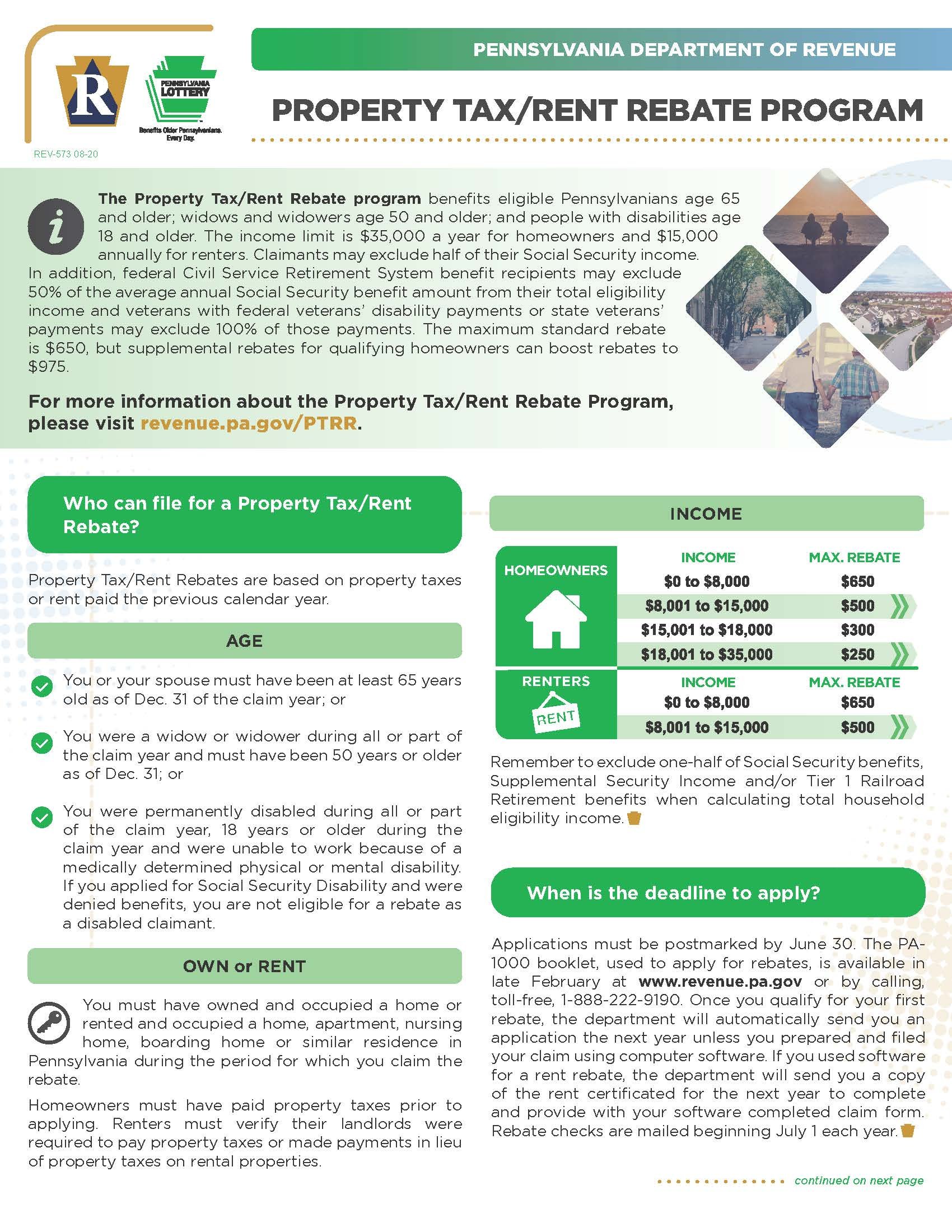

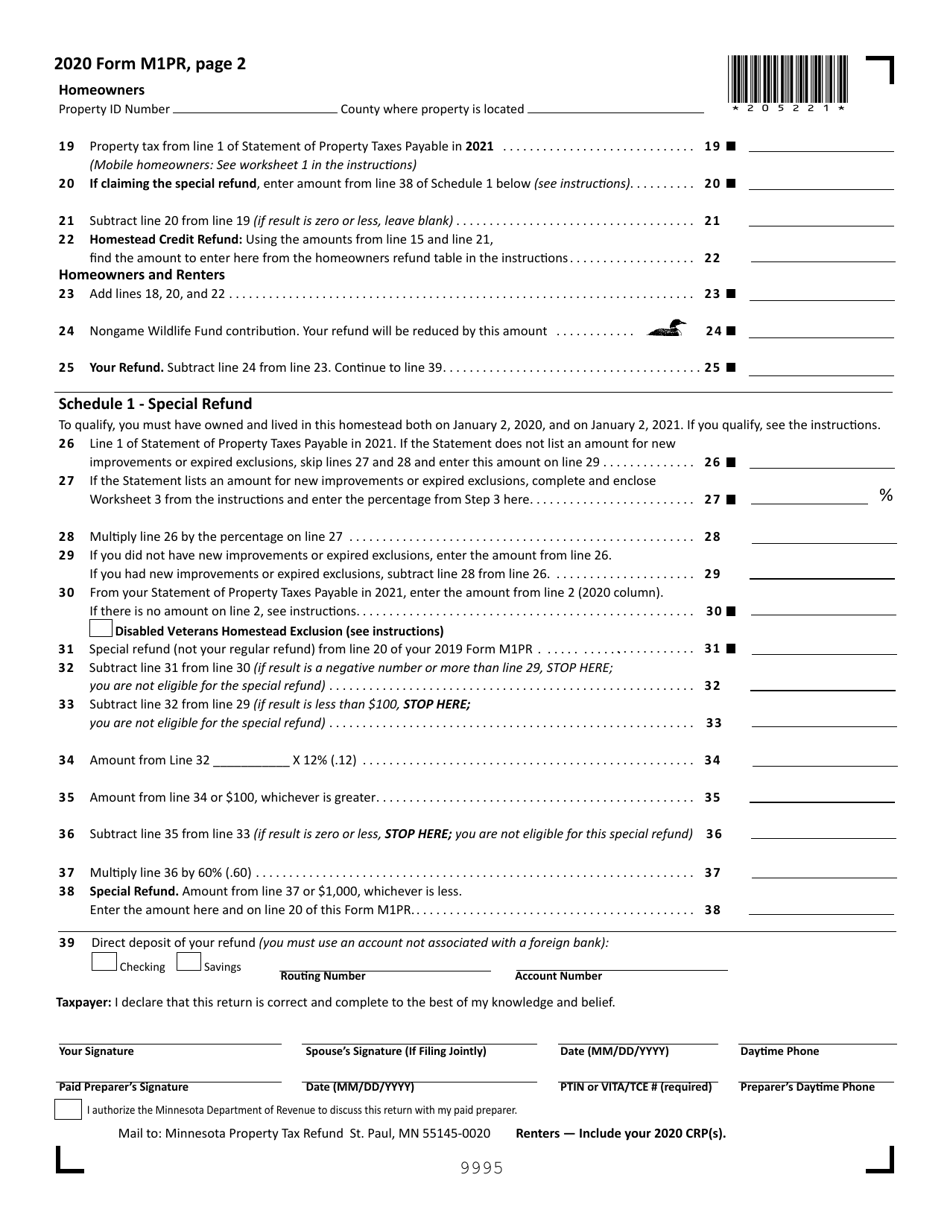

Web If you are a homeowner you may also be eligible for a special property tax refund This refund has no income limit and the maximum refund is 1 000 You may qualify if all of these are true You owned and occupied your home on January 2 2020 and January 2 2021 Your net property tax on your homestead increased by more than 12 from Web Many renters and homeowners can get a refund every year from the State of Minnesota The amount of your refund depends on how much rent or property tax you paid your income and how many dependents you have Who can get

Web Minnesota allows a property tax credit to renters and homeowners who were residents or part year residents of Minnesota during the tax year Who can claim the credit Homeowners with household income less than 135 410 can claim a refund up to 3 310 Homeowners and mobile home owners Web 11 Aug 2023 nbsp 0183 32 Minnesota homeowners and renters have four days to file their 2021 property tax refund claim Find out if you qualify for a property tax refund here Track your refund here The 2021 refund must be filed with the Minnesota Department of Revenue by Aug 15 The 2022 refund is due in August 2024

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

https://cdn.cheapism.com/images/2023-eitc.width-1000.png

https://www.revenue.state.mn.us/household-income-property-tax-re…

Web Your household income affects your eligibility and refund amount for the Property Tax Refund Generally it includes your federal adjusted gross income and certain nontaxable income To calculate household income including subtractions that may help you qualify see the line instructions for Form M1PR Homestead Credit Refund for Homeowners

https://www.revenue.state.mn.us/sites/default/files/202…

Web If you are a homeowner you may also be eligible for a special property tax refund This refund has no income limit and the maximum refund is 2 500 You may qualify if all of these are true You owned and occupied your home on January 2 2022 and January 2 2023 Your net property tax on your homestead increased by more than 6 from

How Do I Check My Mn Property Tax Refund Property Walls

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

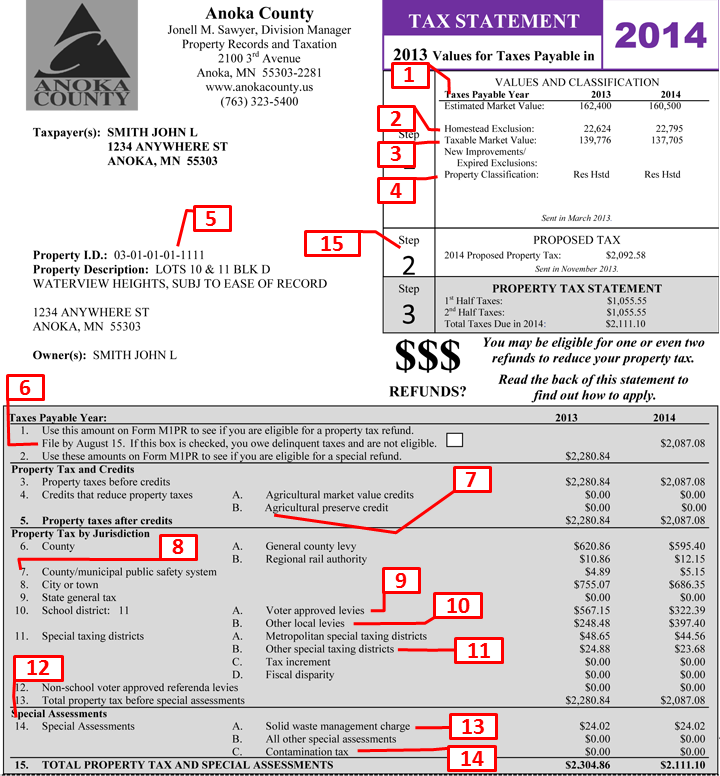

About Your Property Tax Statement Property Records Taxation Anoka

How To Check California State Refund Artistrestaurant2

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

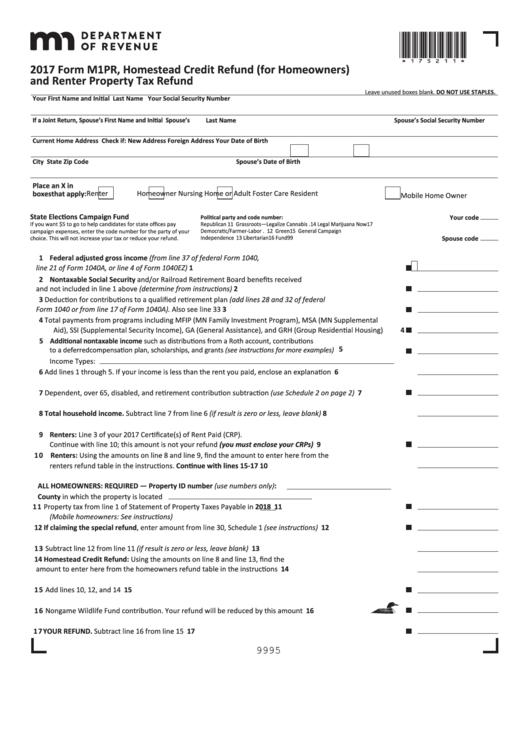

Fill Free Fillable Minnesota Department Of Revenue PDF Forms

Fill Free Fillable Minnesota Department Of Revenue PDF Forms

About Your Property Tax Statement Anoka County MN Official Website

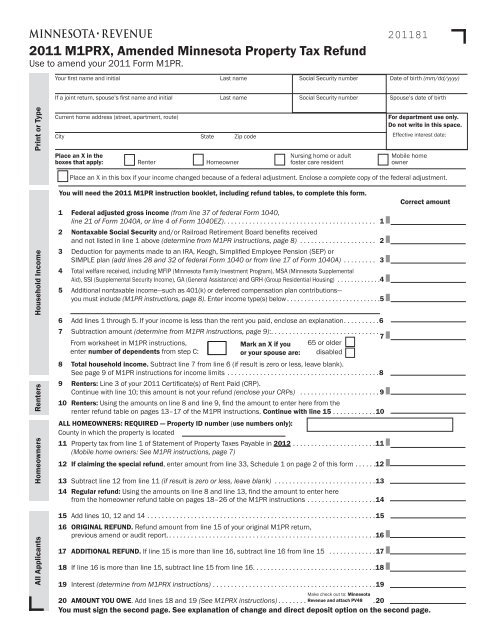

M1PRX Amended Property Tax Refund Return Minnesota

2022 Minnesota Renters Rebate RentersRebate

Mn Property Tax Refund Limits - Web What are the most recent changes to the program The 2011 and 2013 tax laws both expanded the refund program The 2011 changes increased the maximum refund for homeowners with incomes under about 37 000 and decreased the copayment percentage for most homeowners