Mn Special Property Tax Refund 2023 The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes To qualify you must You owned and lived in your home on January 2 2024 You owned and lived in the same home on January 2 2023 and on January 2 2024

If you owe Minnesota taxes criminal fines or debts to other government agencies we must apply any additional property tax refund to these debts If you participate in the Senior Citizens Property Tax Deferral Program we will apply your additional refund to your deferred property tax total The 2023 tax law Laws 2023 chapter 64 reduced co pay percentages for all filers by three percentage points The law also provided a onetime increase of 20 572 percent for all property tax refunds payable in 2023

Mn Special Property Tax Refund 2023

Mn Special Property Tax Refund 2023

https://www.pdffiller.com/preview/102/13/102013958/large.png

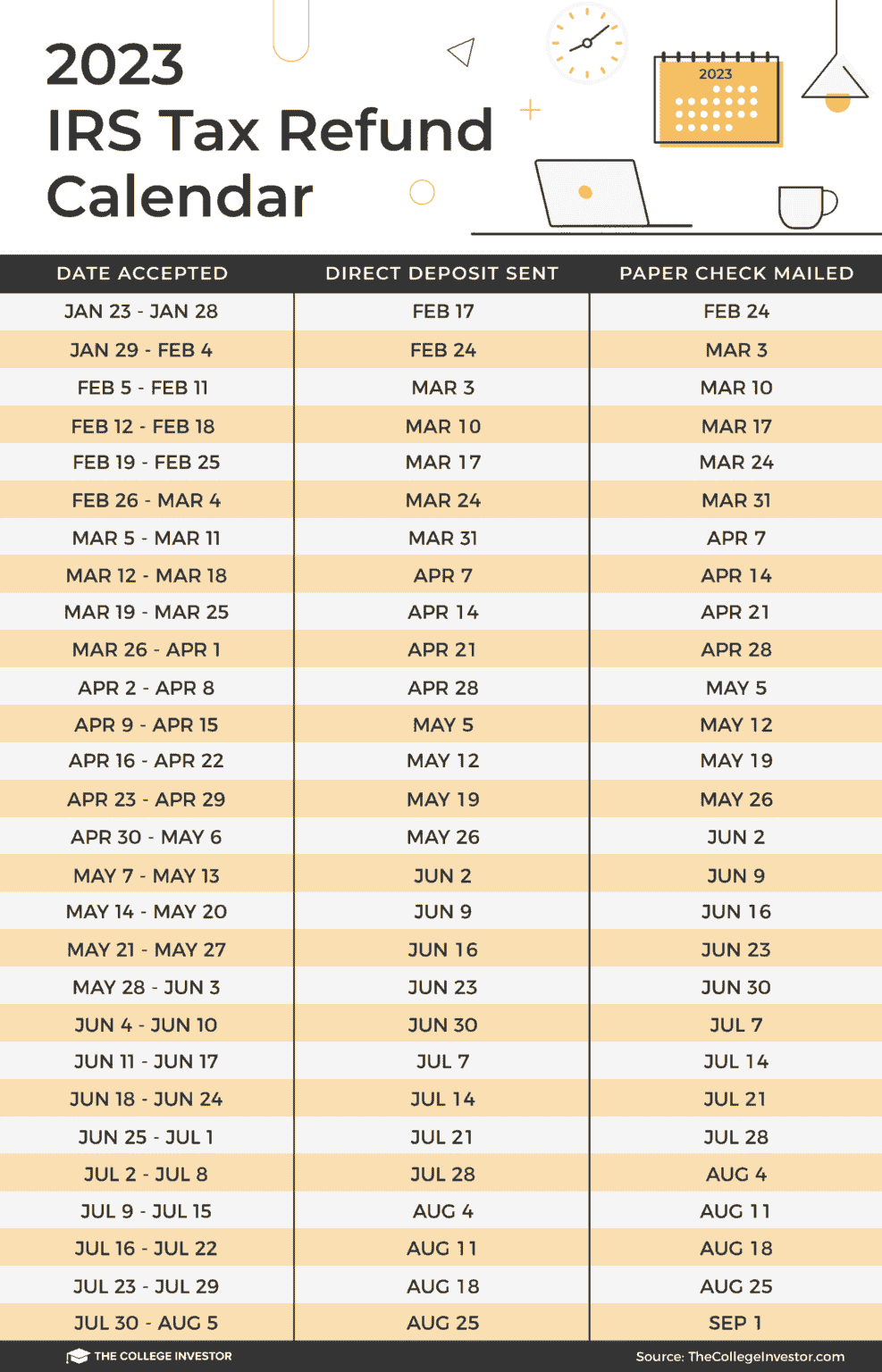

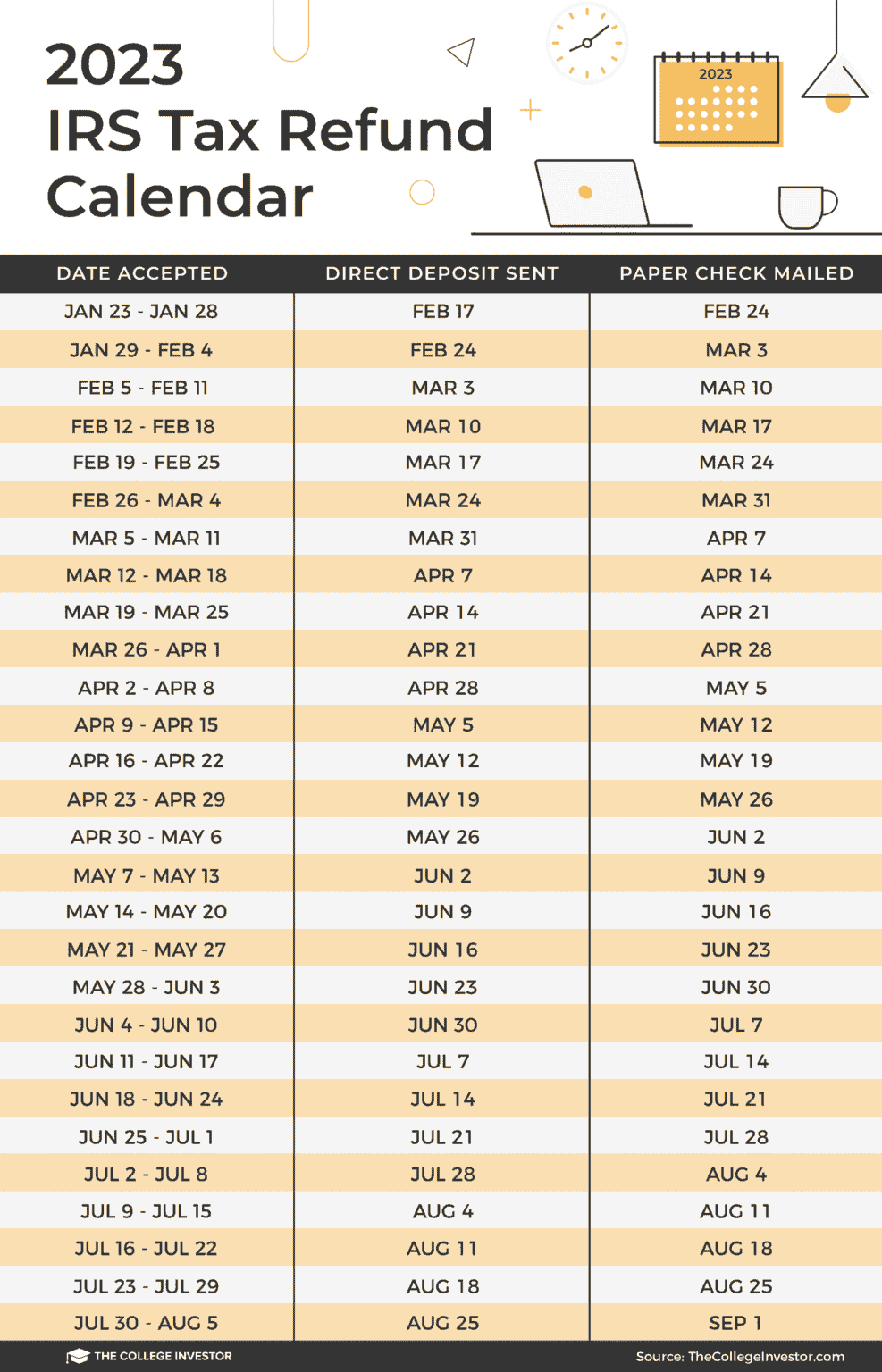

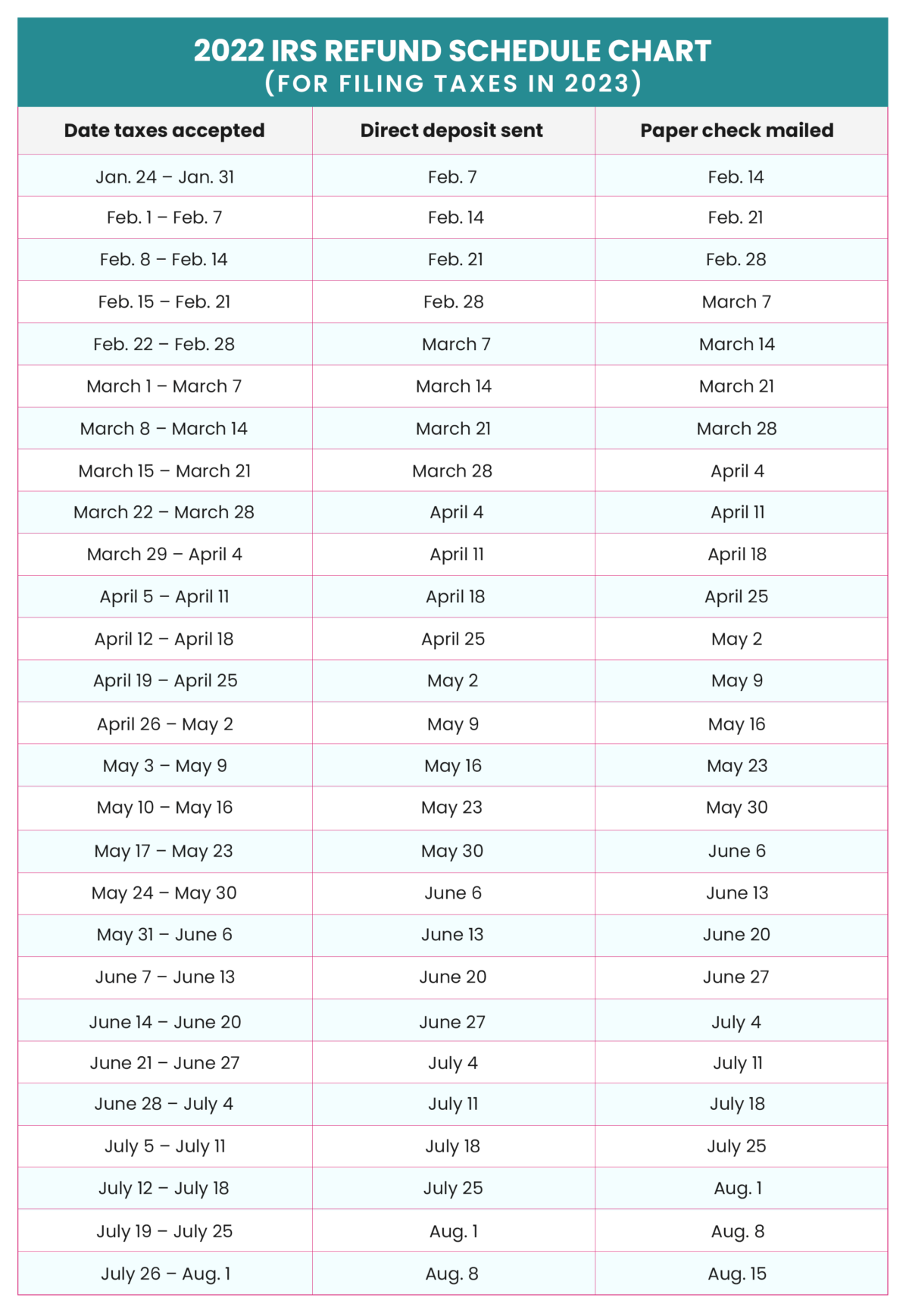

Federal Tax Return Dates Chart 2024 Fidela Rennie

https://texasbreaking.com/wp-content/uploads/2023/01/the-college-investor-calendar-987x1536.png

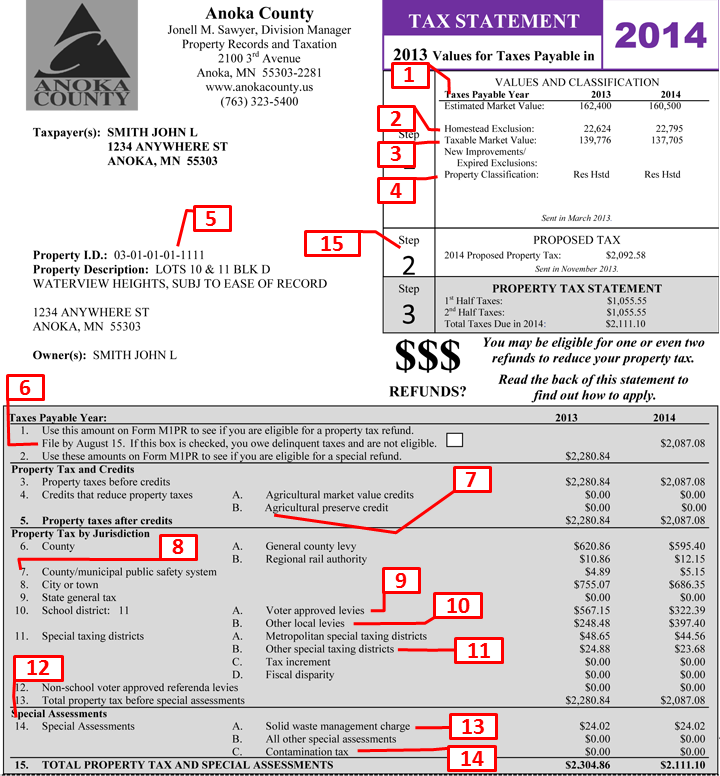

About Your Property Tax Statement Property Records Taxation Anoka

http://www.anokacounty.org/v1_departments/div-property-rec-tax/statements/images2014/property-tax-statement-2014.png

Minnesota Property Tax Refund Get relief for your rent or property tax If you re a Minnesota homeowner or renter you may qualify for the state s Homestead Credit Refund and Renter s Property Tax Refund The refund provides property tax relief depending on your income and rent or property taxes We adjusted the special property tax refund so that if your property taxes increased by more than 6 from 2022 to 2023 you ll qualify for a refund of up to 2 500 regardless of your income level We increased the Homestead Credit Refund and Renter s Property Tax Refund by 20 572

If your net property tax on your homestead increased by more than 12 from 2022 to 2023 and the increase was 100 or more you may be eligible for a special refund Homeowners should receive their refund by the later of September 30 or 60 days of filing the return You can access the Minnesota website s Where s My Refund tool to determine the status of your Minnesota return and the M1PR by selecting the correct return type

Download Mn Special Property Tax Refund 2023

More picture related to Mn Special Property Tax Refund 2023

Minnesota Fiduciary Income Tax Return Instructions TAX

https://www.signnow.com/preview/459/835/459835865/large.png

2024 Tax Season Calendar For 2023 Filings And IRS Refund Schedule

https://i0.wp.com/savingtoinvest.com/wp-content/uploads/2022/12/image-14.png?w=1908&ssl=1

Minnesota State Tax Form 2023 Printable Forms Free Online

https://var.fill.io/uploads/pdfs/html/373f030a-5386-4cf2-84f8-f7eddf986339/1593343871_thm.png

For property taxes payable ONLY in 2023 homeowners may be eligible for the special property tax refund if the net property tax on their homestead increased by more than 6 percent from the previous year and at least 100 If you re a homeowner or renter in Ramsey County you may qualify for one or more property tax refunds from the State of Minnesota Visit the Department of Revenue property tax refund page for details and a full list of refund programs

Homeowners may now qualify for a special refund if their property tax increased by more than 6 rather than 12 under old law from 2022 to 2023 Minnesota Revenue will adjust your return for the tax law change if you had already filed a 2022 Form M1PR claiming a refund due to an increase in property tax of 12 If you re a Minnesota homeowner or renter you may qualify for a Property Tax Refund The refund provides property tax relief depending on your income and property taxes

When To Expect Your Tax Refund In 2023 YouTube

https://i.ytimg.com/vi/cZ-f0xO-DJc/maxresdefault.jpg

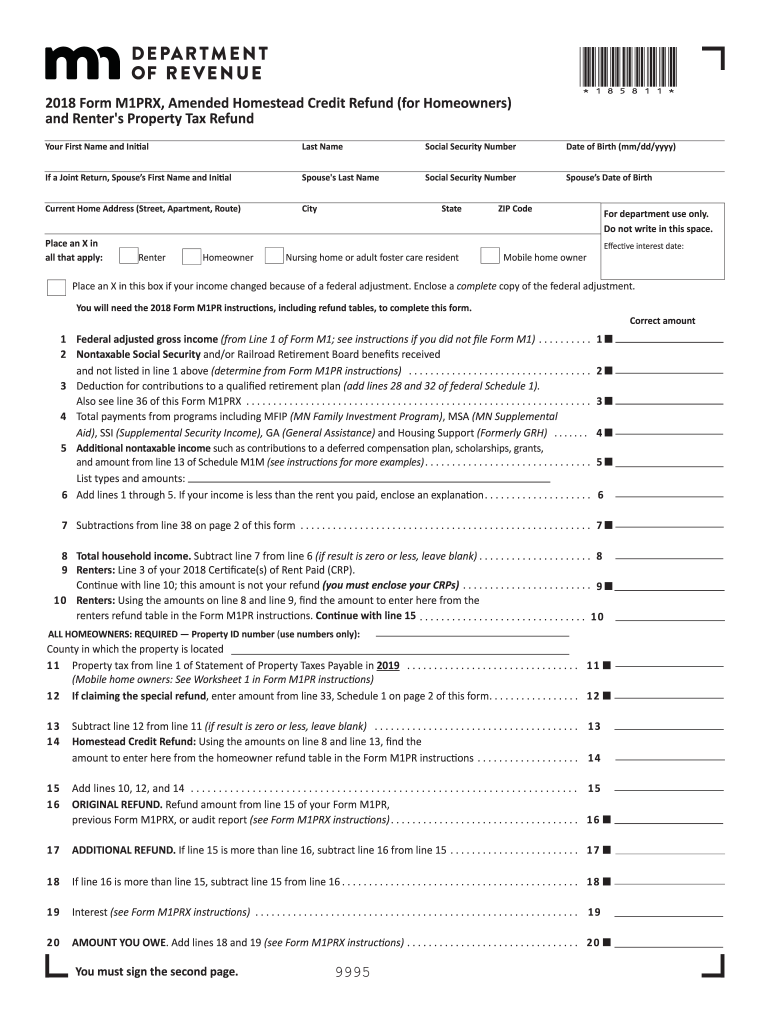

Minnesota Property Tax Refund 2019 2024 Form Fill Out And Sign

https://www.signnow.com/preview/513/825/513825734/large.png

https://www.revenue.state.mn.us/homeowners...

The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes To qualify you must You owned and lived in your home on January 2 2024 You owned and lived in the same home on January 2 2023 and on January 2 2024

https://dev.revenue.state.mn.us/sites/default/...

If you owe Minnesota taxes criminal fines or debts to other government agencies we must apply any additional property tax refund to these debts If you participate in the Senior Citizens Property Tax Deferral Program we will apply your additional refund to your deferred property tax total

2023 Tax Refund Schedule Chart Printable Forms Free Online

When To Expect Your Tax Refund In 2023 YouTube

How Do I Check My Mn Property Tax Refund Property Walls

Tax Refund Real Estate Tax Refund Minnesota

When Are Minnesota Property Tax Refunds Sent Out U ukumdesigns

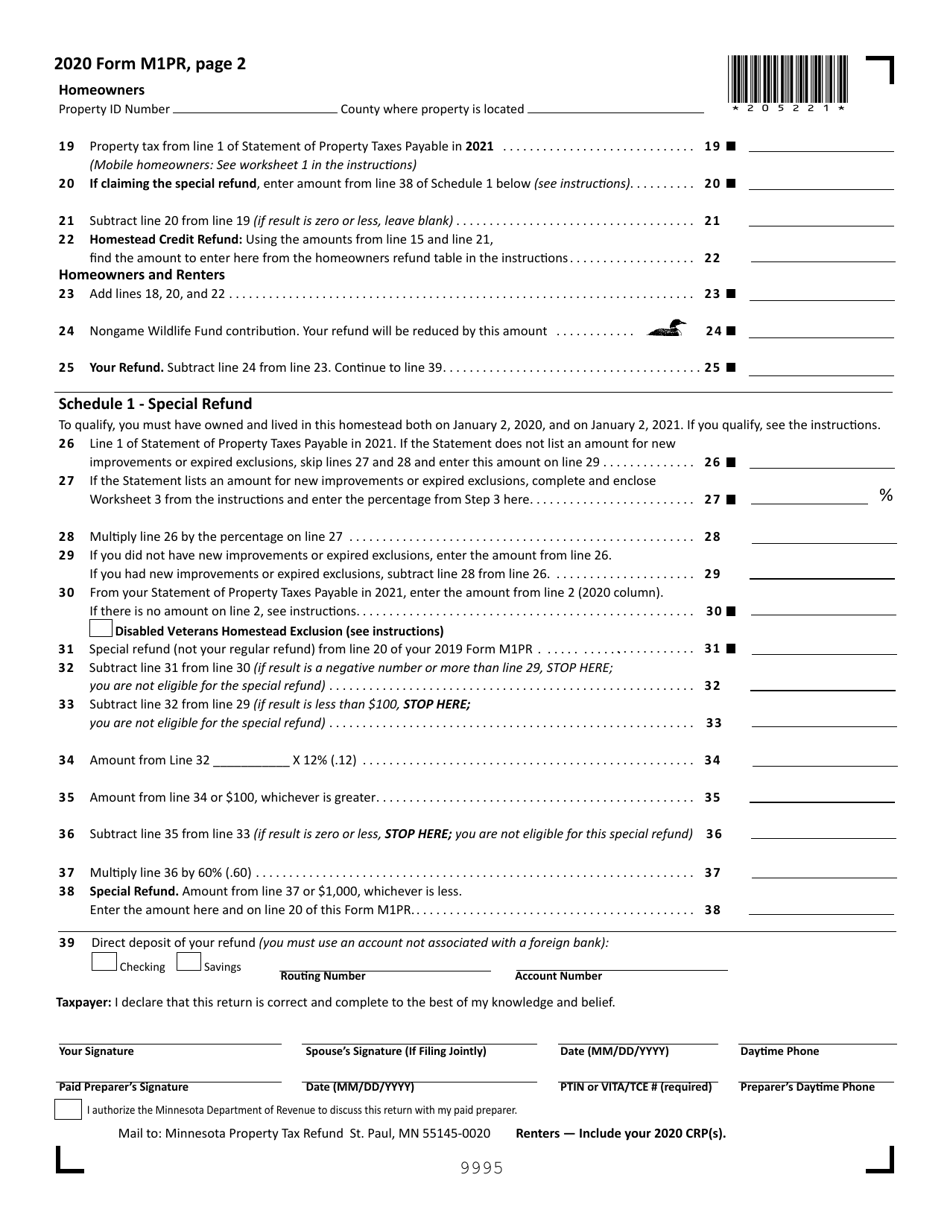

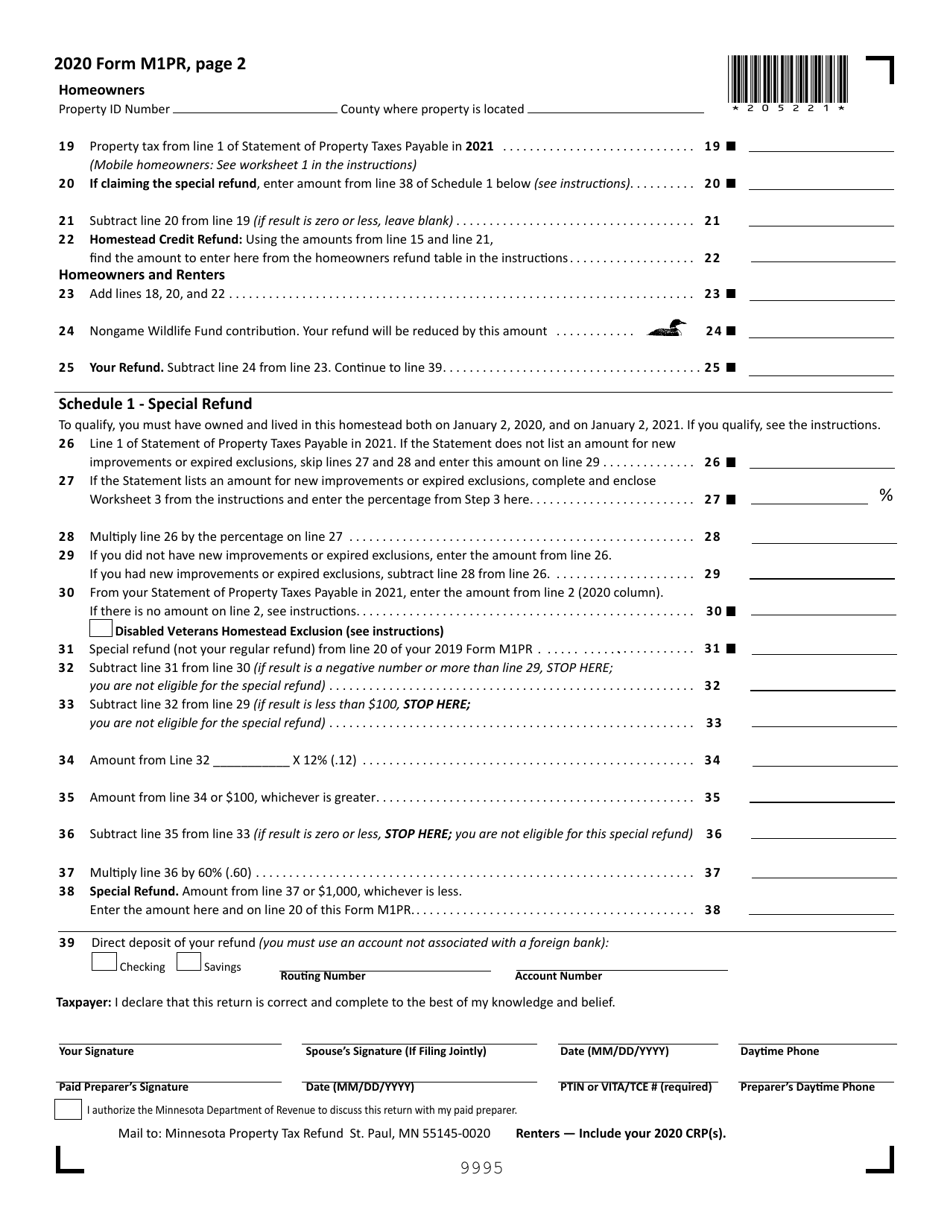

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

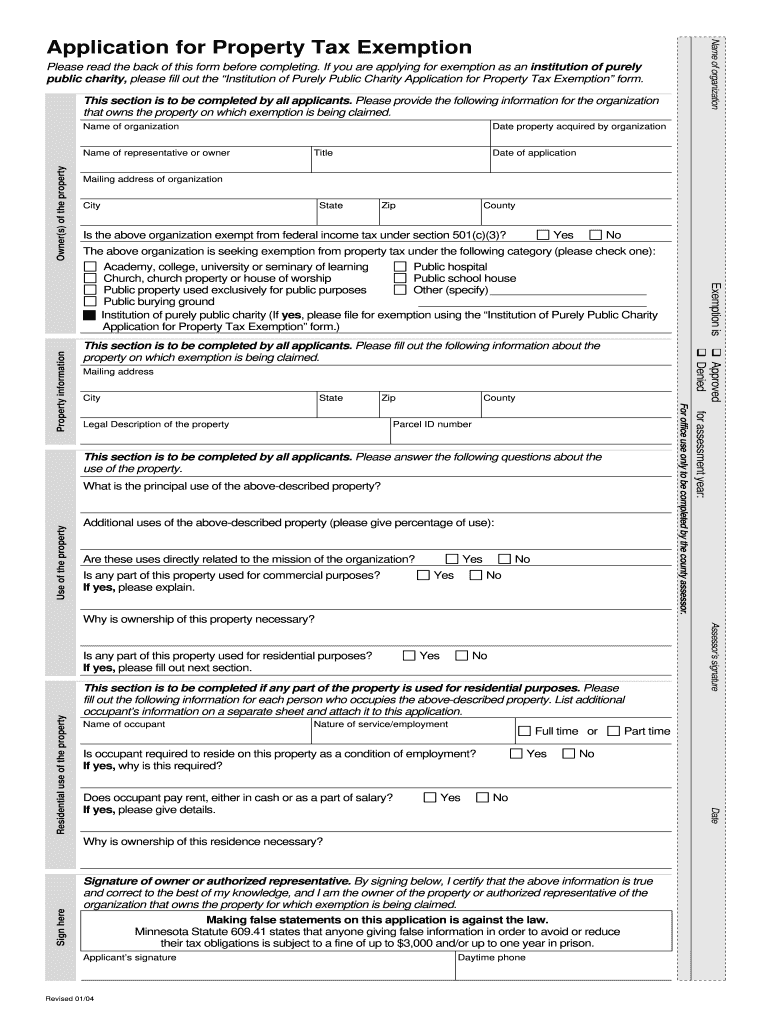

Minnesota Property Tax Exemptions Fill Online Printable Fillable

About Your Property Tax Statement Anoka County MN Official Website

IRS Check My Refund Check All The Necessary Details Here Eduvast

Mn Special Property Tax Refund 2023 - If your net property tax on your homestead increased by more than 12 from 2022 to 2023 and the increase was 100 or more you may be eligible for a special refund