Montana State Income Tax Standard Deduction Verkko 42 15 523 STANDARD DEDUCTION 1 Except as provided in 3 and 4 a taxpayer who does not claim itemized deductions is allowed the standard deduction 2 The

Verkko In Montana taxpayers can deduct up to 5 000 of Federal income tax from their Montana taxable income for individuals and 10 000 for married couples filing jointly Verkko Learn how to estimate your state income tax in Montana based on your filing status age and income Find out the standard deduction amount tax credits and tax

Montana State Income Tax Standard Deduction

Montana State Income Tax Standard Deduction

https://www.withholdingform.com/wp-content/uploads/2022/08/cryptocurrenty-income-tax-concept-image-free-image-download.jpg

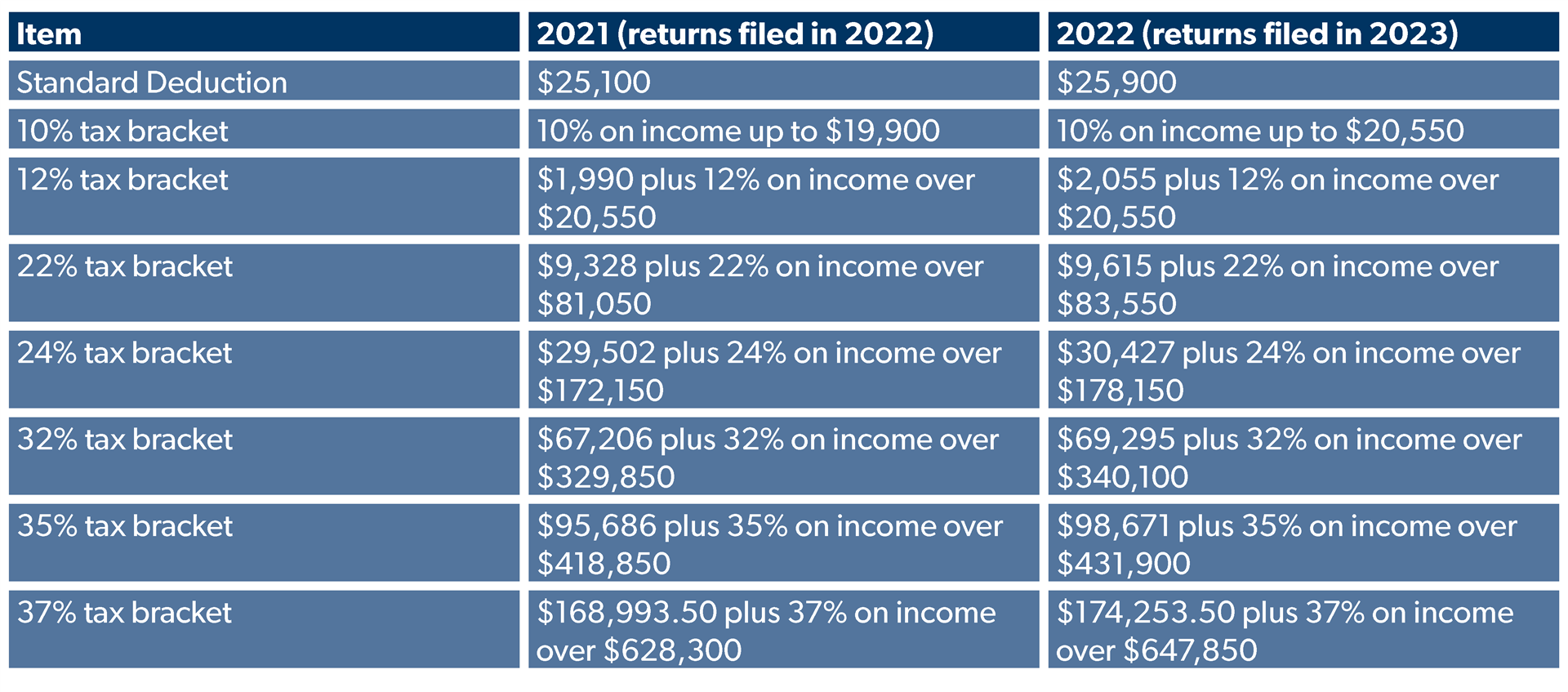

2022 Tax Brackets Married Filing Jointly Irs Printable Form

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Verkko Individual Income Tax If you live or work in Montana you may need to file and pay individual income tax These resources can help you determine your filing Verkko Montana Source Income times the highest marginal rate 2023 6 75 2024 5 9 Why make the election Deductible as a state income tax paid on the pass through s

Verkko The Montana specific itemized and standard deductions are subject to repeal on January 1 2024 based on the repeal of sections 15 30 2131 and 15 30 2132 in Verkko Montana law allows a federal income tax deduction of up to 5 000 or 10 000 for MFJ Taxpayers itemizing on the federal return receive the deduction for state

Download Montana State Income Tax Standard Deduction

More picture related to Montana State Income Tax Standard Deduction

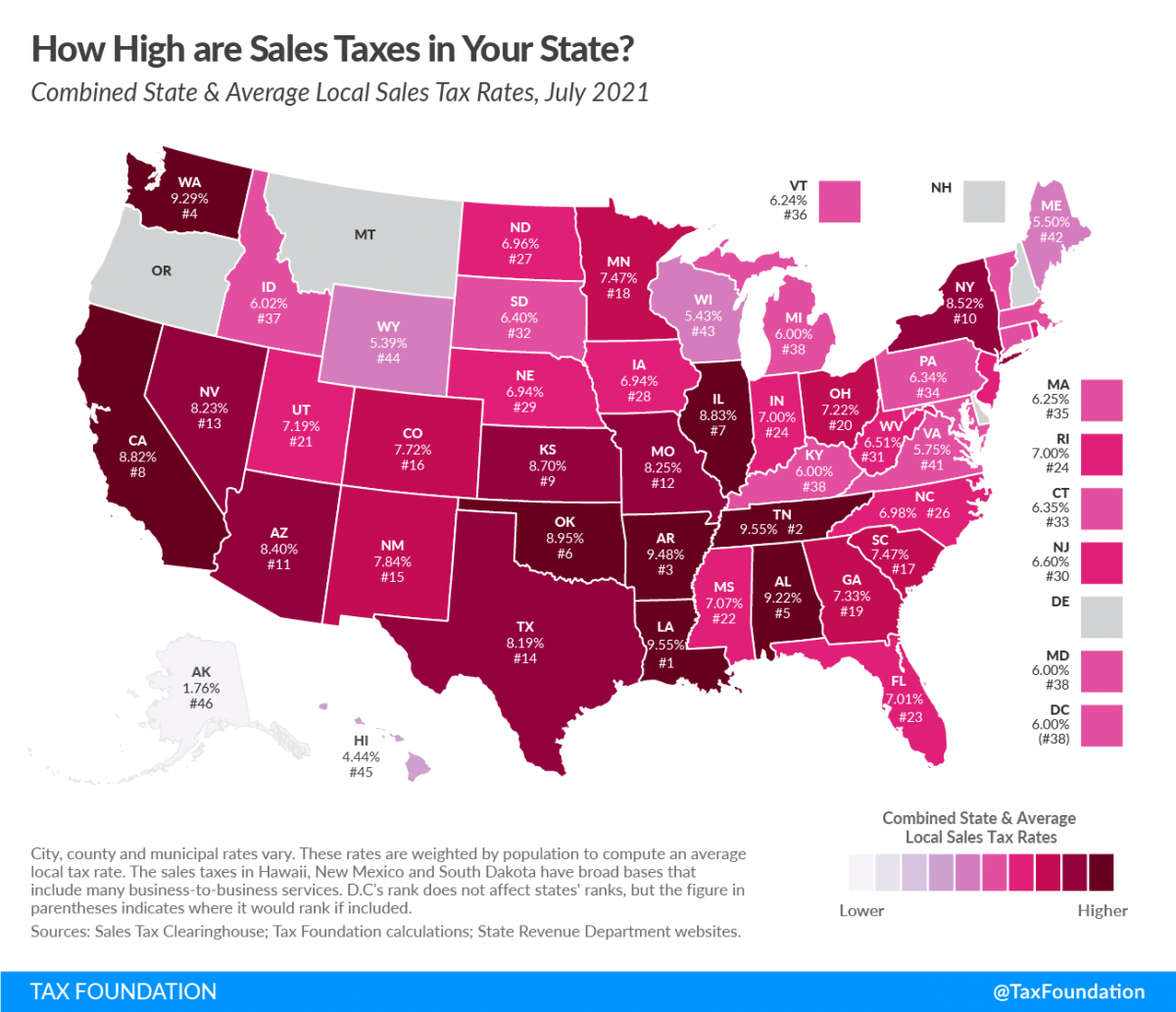

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

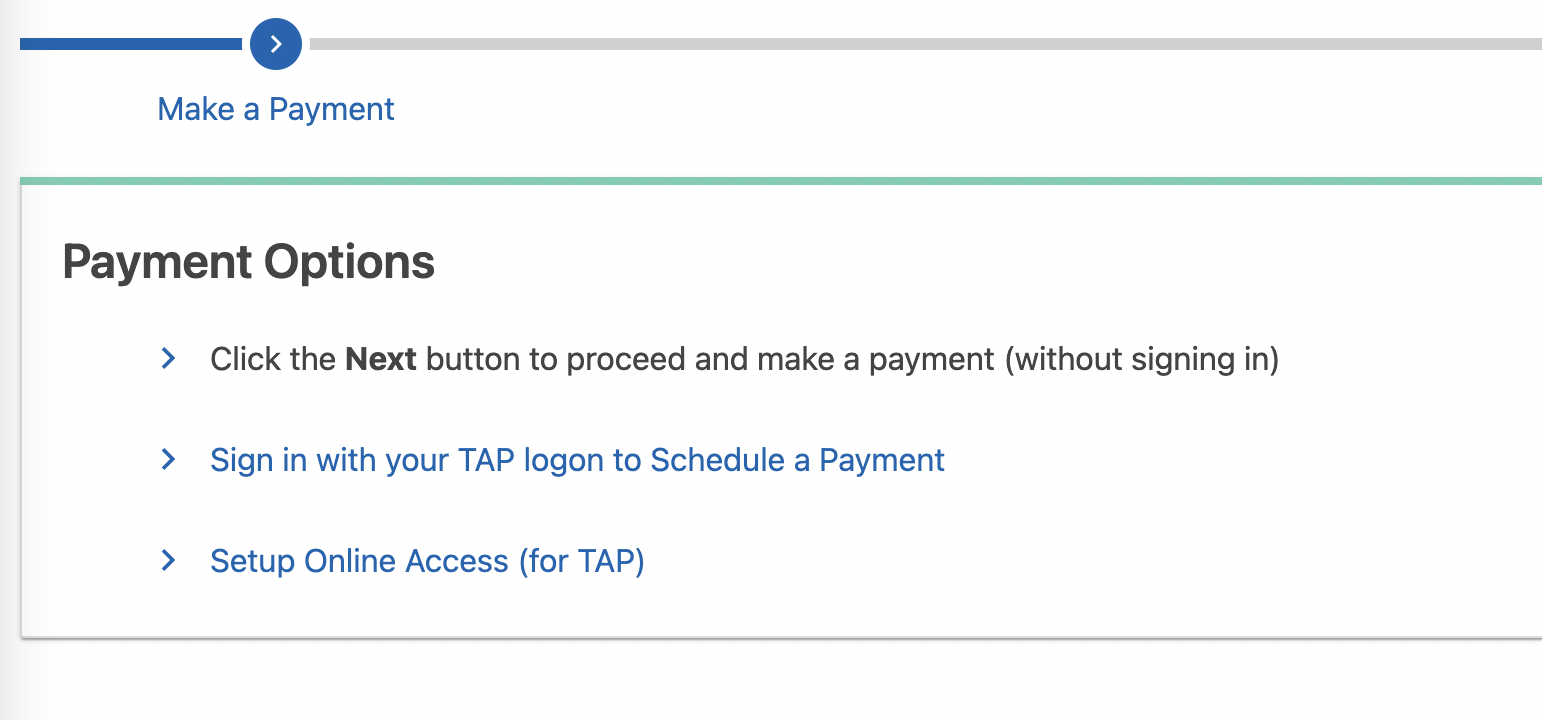

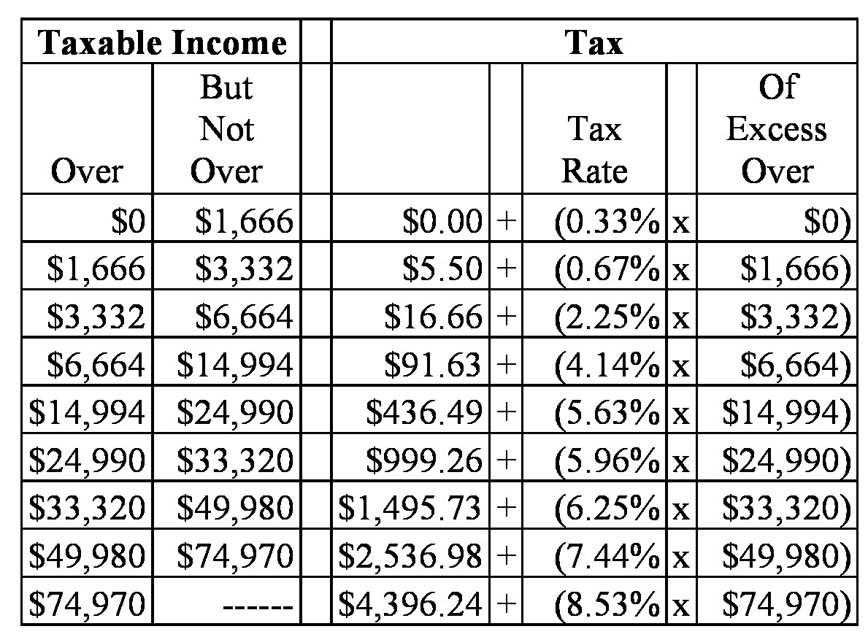

Paying State Income Tax In Montana Heard

https://support.joinheard.com/hc/article_attachments/5161904193431/Screen_Shot_2022-03-31_at_21.00.12.png

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Verkko The minimum standard deduction is 1 980 as adjusted under the provisions of subsection 2 or 20 of adjusted gross income whichever is greater to a maximum Verkko Montana Code Annotated 2019 TITLE 15 CHAPTER 30 Part 21 Standard Deduction 15 30 2132 Standard deduction 1 A standard deduction equal to 20 of

Verkko 1 tammik 2023 nbsp 0183 32 For filers who do not claim itemized deductions the standard deduction in Montana is equal to 20 of adjusted gross income within a minimum and maximum boundary The minimum Verkko June 1 20215 min read By Maxwell James Jared Walczak Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned

Montana Income Tax Information What You Need To Know On MT Taxes

https://www.taunyafagan.com/wp/wp-content/uploads/2021/10/2023-Montana-Individual-Income-Tax-Help-Form.png

Standard Deduction In Income Tax 2023 Examples InstaFiling

https://instafiling.com/wp-content/uploads/2022/12/Standard-Deduction-in-Income-Tax-980x551.png

https://rules.mt.gov/gateway/RuleNo.asp?RN=42.15.523

Verkko 42 15 523 STANDARD DEDUCTION 1 Except as provided in 3 and 4 a taxpayer who does not claim itemized deductions is allowed the standard deduction 2 The

https://www.tax-rates.org/montana/income-tax

Verkko In Montana taxpayers can deduct up to 5 000 of Federal income tax from their Montana taxable income for individuals and 10 000 for married couples filing jointly

Tax Rates Absolute Accounting Services

Montana Income Tax Information What You Need To Know On MT Taxes

Printable Itemized Deductions Worksheet

Nj Tax Refund Status 2010 Psawefield

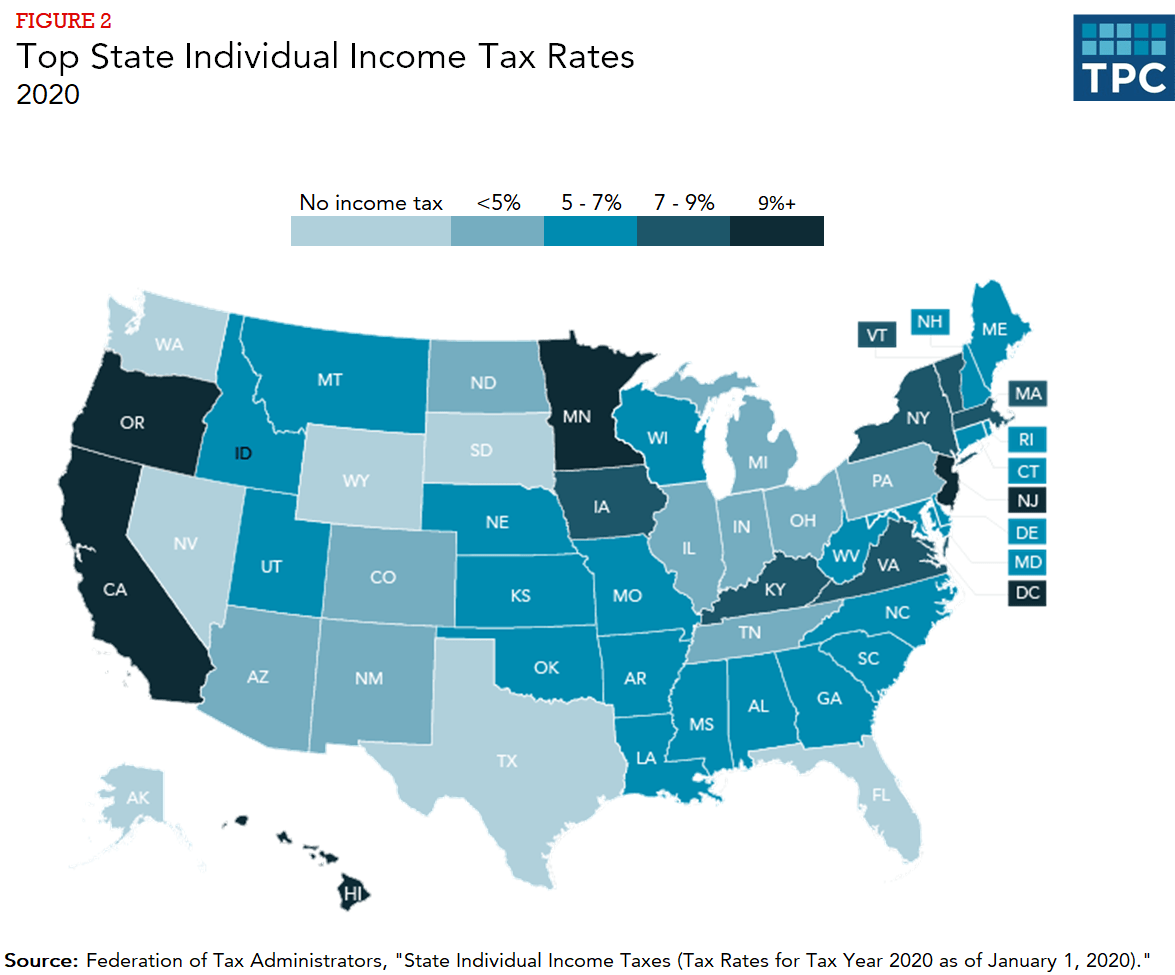

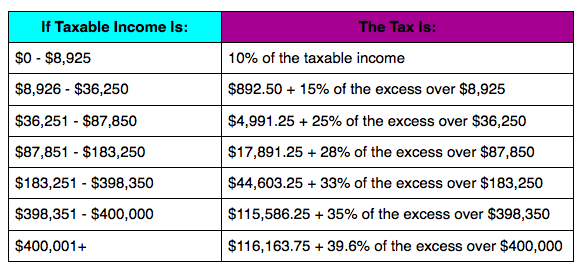

Federal Income Tax Rates

California Individual Tax Rate Table 2021 20 Brokeasshome

California Individual Tax Rate Table 2021 20 Brokeasshome

MT Worksheet V Standard Deduction 2017 2022 Fill Out Tax Template

IDR 2020 Interest Rates Standard Deductions And Income Tax Brackets

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

Montana State Income Tax Standard Deduction - Verkko Montana State Married Filing Jointly Filer Tax Rates Thresholds and Settings Montana State Single Filer Personal Income Tax Rates and Thresholds in 2024 Standard