Mortgage Interest Deduction Limit On Second Home You aren t limited to deducting the interest on the first home You can deduct interest paid on a second home up to the annual limit If itemizing a single filer would need to have over 12 950 in deductions to benefit from the

Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a primary residence Mortgage interest on a second home is tax deductible within the same limits as the mortgage on your first home Property taxes paid on additional homes can also be tax deductible regardless of the number of homes you own

Mortgage Interest Deduction Limit On Second Home

Mortgage Interest Deduction Limit On Second Home

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

Mortgage Interest Tax Relief Calculator DermotHilary

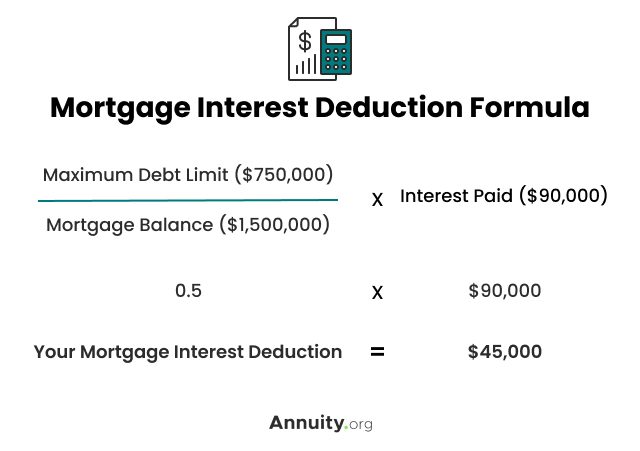

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

Interest Deduction Limit Regulations Coming Soon Crowe LLP

https://www.crowe.com/-/media/crowe/llp/content-images/tax/content-tax-news-interest-deduction-limit-tax2004-016g.jpg?rev=f61ca7a1138345e1bc963e9035698fd4

Is Mortgage Interest Deductible On A Second Home The short answer is yes Fortunately for taxpayers you can still deduct second mortgage interest but only under certain terms Factors affecting your ability to qualify You can usually deduct the interest you pay on a mortgage for your main home or a second home but there are some restrictions The maximum amount of debt eligible for the deduction was 1 million prior to

Yes you can include the mortgage interest and property taxes from both of your homes However the deduction for mortgage interest starts to be limited at either 750 000 or You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home

Download Mortgage Interest Deduction Limit On Second Home

More picture related to Mortgage Interest Deduction Limit On Second Home

10 Tax Credits Deductions You Need To Know About Brigit Blog

https://www.hellobrigit.com/wp-content/uploads/2022/09/iStock-1344766725-scaled.jpg

Mortgage Interest Deduction YouTube

https://i.ytimg.com/vi/xyHdUVv36lg/maxresdefault.jpg

Voxt

https://www.wallstreetmojo.com/wp-content/uploads/2020/05/Mortgage-Interest-Deduction.jpg

You can deduct interest on a second home as long as the mortgage on your primary residence is no more than 750 000 or 1 million if you bought it before Dec 15 2017 Only interest on mortgage and home equity debt used to purchase improve renovate or construct the home being mortgaged will qualify for the mortgage deduction

To take the mortgage interest deduction the interest paid must be on a qualified home Your first and second home may be considered qualified homes but there are some Here s what you can usually deduct on your taxes when you have a second home Interest on the mortgage or a home equity loan Property taxes Losses and capital gains

Mortgage Interest Deduction Limit Worksheet

https://i2.wp.com/standard-deduction.com/wp-content/uploads/2020/10/how-to-reduce-your-tax-bill-with-itemized-deductions-bench-2-1024x883.png

Understanding The Mortgage Interest Deduction The Official Blog Of

https://www.taxslayer.com/blog/wp-content/uploads/2022/05/Mortgage-Interest-Deduction-8-1594x2048.png

https://moneytips.com/mortgages/mana…

You aren t limited to deducting the interest on the first home You can deduct interest paid on a second home up to the annual limit If itemizing a single filer would need to have over 12 950 in deductions to benefit from the

https://www.irs.gov/faqs/itemized-deductions...

Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a primary residence

Is The Mortgage Interest Deduction In Play B Logics

Mortgage Interest Deduction Limit Worksheet

39 Mortgage Interest Deduction Limitation JuimaKalitza

Home Mortgage Interest Deduction 2023

What Is Mortgage Interest Deduction Buy Side From WSJ

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Fiscal Cliff Bill Saves Home Mortgage Interest Tax Deduction And PMI

33 Mortgage Interest Statement 2021 MasraMathieu

Mortgage Interest Deduction Here s A Guide To Limits And

Mortgage Interest Deduction Limit On Second Home - Mortgage interest deduction limit The deduction for mortgage interest is allowed for home acquisition debt A home mortgage is also called acquisition debt These debts are used to