Municipal Land Transfer Tax Rebate Web 3 avr 2023 nbsp 0183 32 In addition transfer tax is payable at a rate between 5 09 and 6 40 depending on the type and location of the relevant property or a reduced rate of 0 715 if a commitment to re sell the land within five years is made by the buyer or a 125 fixed fee if the buyer intends to erect a building on the land provided that the

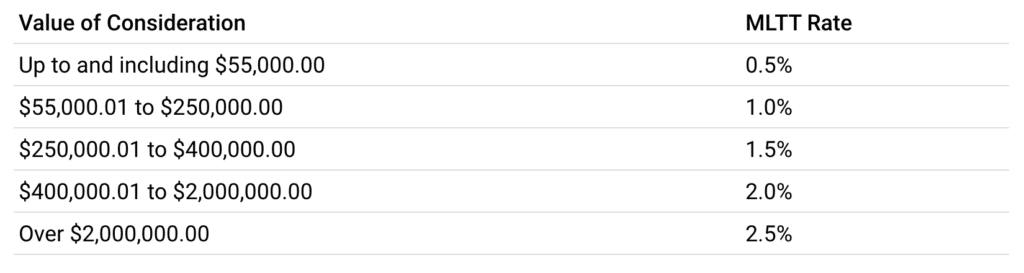

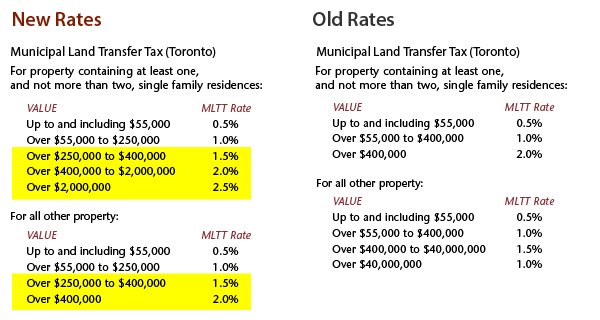

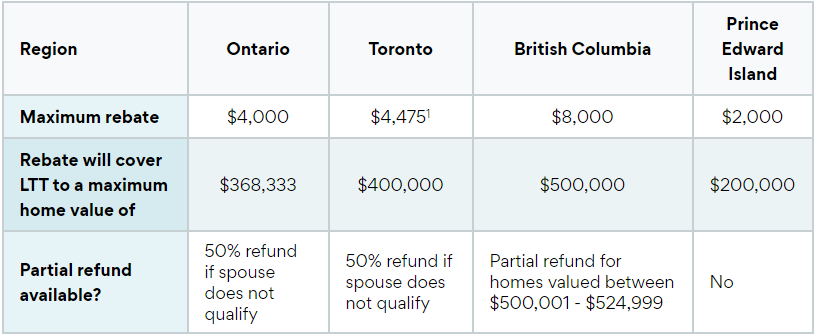

Web 8 mars 2022 nbsp 0183 32 1 60 for the 22 nd year 9 for each year beyond the 22 nd Individuals are fully exempted from social contributions in France as of 30 years of detention Rates After deduction of the allowances the net real estate capital gain is subject to a 19 income tax and 17 2 social contributions Web Municipal Land Transfer Tax MLTT Estimate your Municipal Land Transfer Tax MLTT Calculator Rates amp Fees MLTT rate structure and calculator Rebate Opportunities Rebate options for first time home buyers Resources for Lawyers How to process your MLTT transactions and payments Program Information MLTT program implementation and

Municipal Land Transfer Tax Rebate

Municipal Land Transfer Tax Rebate

https://images.squarespace-cdn.com/content/v1/58fcfe90414fb5f448a8137b/1594064748108-TUOCP7PST70NWHUWFC3B/LTT4.JPG

Land Transfer Tax BC Lola Oduwole

https://s.realtyninja.com/static/media/med/6455_f5ed2386_provincial_tax_results.png

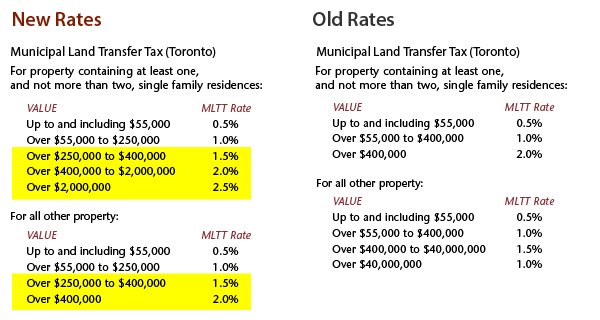

Land Transfer Tax In Toronto Ratehub ca

https://www.ratehub.ca/mortgage-blog/files/2013/07/toronto-ltt-charts.jpg

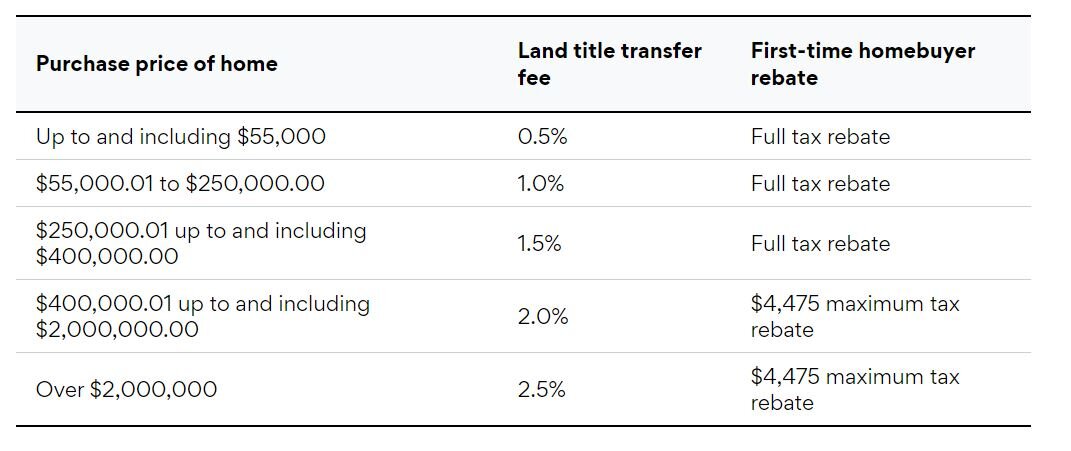

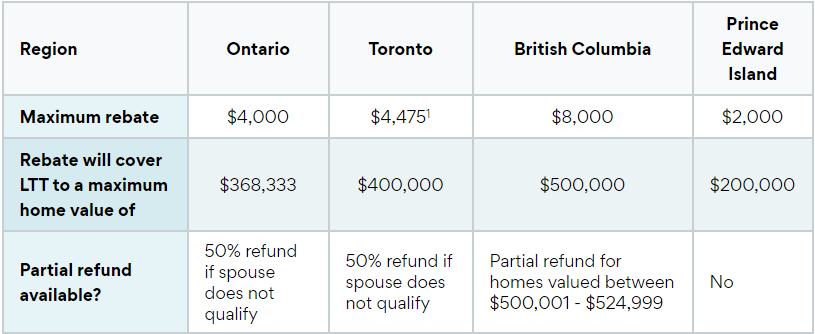

Web The total land transfer tax payable is 4 475 but as Jessica qualifies for the full rebate amount of 4 000 she only needs to pay 475 to cover the remaining balance Toronto In Toronto you can claim a Municipal Land Transfer Tax MLTT rebate in addition to the provincial rebate Web Cependant et pour ceux qui voudraient modifier ou ajuster les r 232 gles de r 233 partition pour 2023 l ordonnance du 14 juin 2022 relative au transfert 224 la DGFIP de la gestion de la taxe d am 233 nagement qui devrait entrer en vigueur prochainement modifie les dates d adoption des d 233 lib 233 rations relatives 224 la taxe d am 233 nagement

Web Le B du VI de l article 155 de la loi n 176 2020 1721 du 29 d 233 cembre 2020 pr 233 voit que le transfert de la gestion des taxes d urbanisme 224 la DGFiP s applique 224 compter d une date et selon des Web Le transfert de la liquidation des taxes d urbanisme taxe d am 233 nagement et la partie logement de la redevance arch 233 ologique pr 233 ventive 224 la direction g 233 n 233 rale des Finances publiques DGFiP a 233 t 233 act 233 par la circulaire du 12 juin 2019 du Premier Ministre relative 224 la mise en uvre de la r 233 forme de l organisation territoriale de l 201 tat OTE

Download Municipal Land Transfer Tax Rebate

More picture related to Municipal Land Transfer Tax Rebate

Land Transfer Tax In Vancouver Ratehub ca

https://www.ratehub.ca/mortgage-blog/files/2013/08/land-transfer-tax-calc-vancouver.jpg

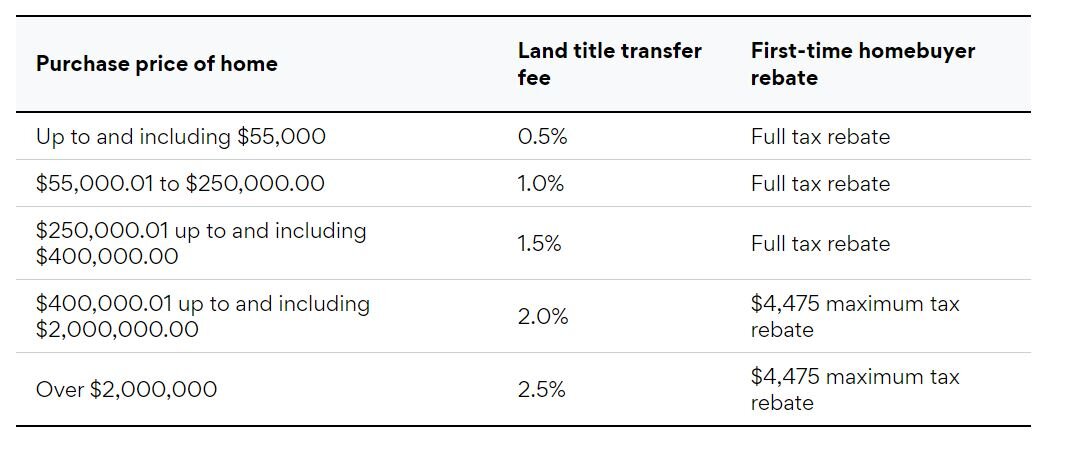

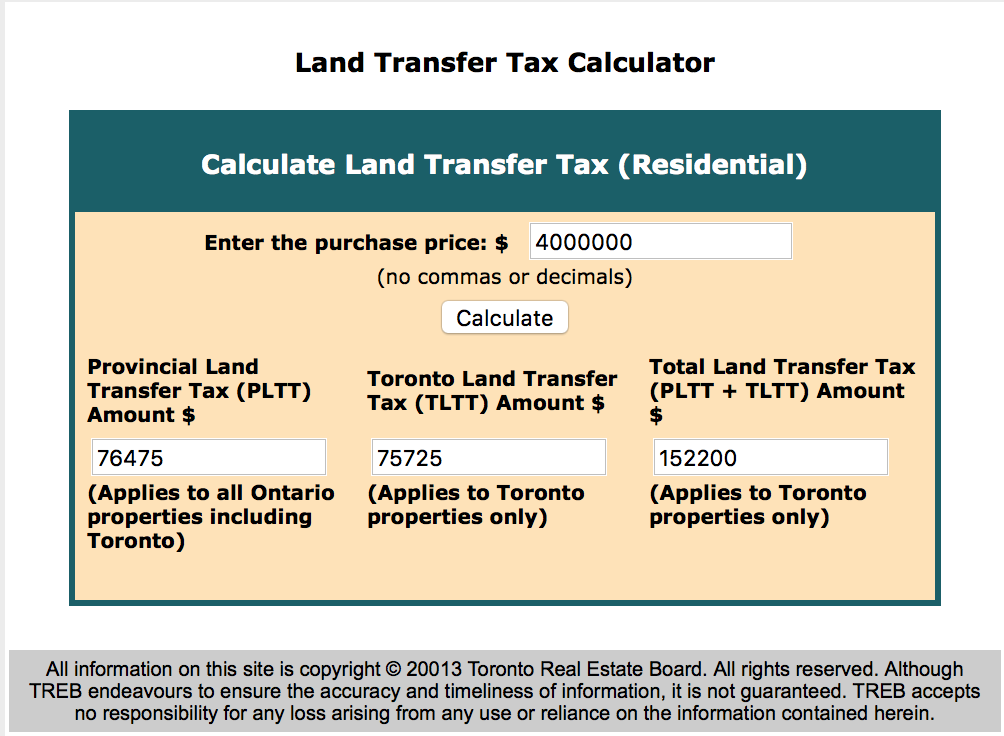

Land Transfer Tax Rebates Amit Patel Real Estate HomeLife Miracle

https://realtoramit.com/assets/uploads/pageuploads/20190908183934-govprog-LTT-0417-2.jpg

North Bay Seeks To Implement Municipal Land Transfer Tax

https://www.tslawyers.ca/wp-content/uploads/2021/09/Screen-Shot-2021-09-20-at-10.14.09-AM-1024x273.png

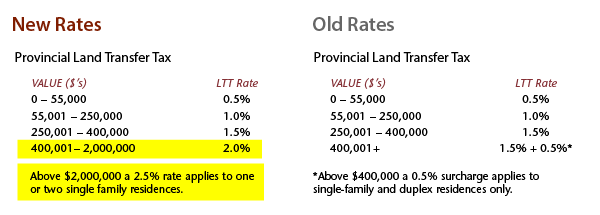

Web 5 24 Best fixed rate in Canada see my rates Ontario land transfer tax FAQ Who pays land transfer tax in Ontario How do I avoid land transfer tax in Ontario Is there a land transfer tax rebate in Ontario Find the right calculators for all your mortgage and homebuying needs renewal calculator refinance calculator affordability calculator Web 19 mai 2022 nbsp 0183 32 5 24 Get This Rate Pine 5 29 Get This Rate BMO 5 74 Promotional Rate TD 5 74 RBC 6 29 Scotiabank 6 54 Mortgage Term 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr Fixed Variable See More Rates Detailed Breakdown Municipal Land Transfer Tax

Web 27 juin 2022 nbsp 0183 32 25 000 To learn more about your mortgage payment try our Mortgage Payment Calculator Results Your Monthly Payment 1 965 Mortgage Amount Incl CMHC Premium 463 950 What You Should Know First time home buyers in Ontario can receive a land transfer tax refund of up to 4 000 Web Refunds of Land Transfer Tax including Non Resident Speculation Tax and Rebates of Non Resident Speculation Tax Exemption for Certain Transfers of Land Between Registered Charities Exemption for Certain Transfers of Land to Family Business Corporations Exemption for Certain Transfers of Farmed Land

Land Transfer Tax Important Updates Passit Blog

https://passit.ca/real-estate-pulse/wp-content/uploads/2018/09/land-transfer-tax-toronto.png

Land Transfer Taxes 101 Susan Bandler Toronto Real Estate

http://www.susanbandler.com/wp-content/uploads/2015/12/Ontario-Land-Transfer-Tax-Table-1.jpg

https://www.dlapiperrealworld.com/law/index.html?t=taxes&s=tax-on...

Web 3 avr 2023 nbsp 0183 32 In addition transfer tax is payable at a rate between 5 09 and 6 40 depending on the type and location of the relevant property or a reduced rate of 0 715 if a commitment to re sell the land within five years is made by the buyer or a 125 fixed fee if the buyer intends to erect a building on the land provided that the

https://www.rsm.global/france/en/insights/corporate-literature/selling-and...

Web 8 mars 2022 nbsp 0183 32 1 60 for the 22 nd year 9 for each year beyond the 22 nd Individuals are fully exempted from social contributions in France as of 30 years of detention Rates After deduction of the allowances the net real estate capital gain is subject to a 19 income tax and 17 2 social contributions

Ontario s New Land Transfer Tax Rebate For First Time Buyers Erie s Edge

Land Transfer Tax Important Updates Passit Blog

Land Transfer Tax Rebate Rental Property PropertyRebate

Will Ontario Cities Get The Right To Impose A Municipal Land Transfer

Municipal Land Transfer Tax MLTT City Of Toronto

Real Estate Government Incentives Gloria Plata Realtor

Real Estate Government Incentives Gloria Plata Realtor

Understanding Land Transfer Tax GTA Homes

TRREB Backs Adjusting Municipal Land Transfer Tax Rebate In Toronto

Land Transfer Tax Important Updates Passit Blog

Municipal Land Transfer Tax Rebate - Web Le transfert de la liquidation des taxes d urbanisme taxe d am 233 nagement et la partie logement de la redevance arch 233 ologique pr 233 ventive 224 la direction g 233 n 233 rale des Finances publiques DGFiP a 233 t 233 act 233 par la circulaire du 12 juin 2019 du Premier Ministre relative 224 la mise en uvre de la r 233 forme de l organisation territoriale de l 201 tat OTE