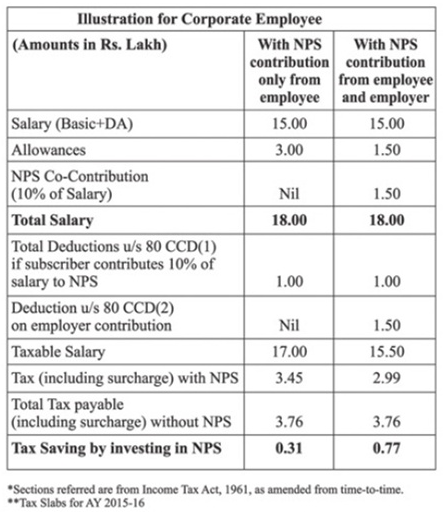

National Pension Scheme Nps Tax Rebate U S 80ccd 2 Web 21 sept 2022 nbsp 0183 32 Rs 15 600 for individuals in the highest income tax bracket of 30 Section 80CCD 2 deals with employer contribution to an employee s pension accounts The amount of deduction is limited to

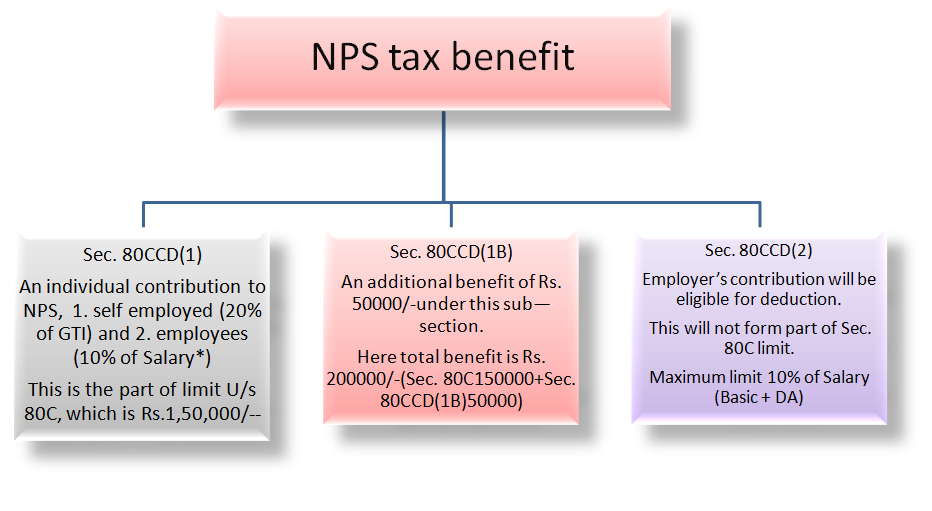

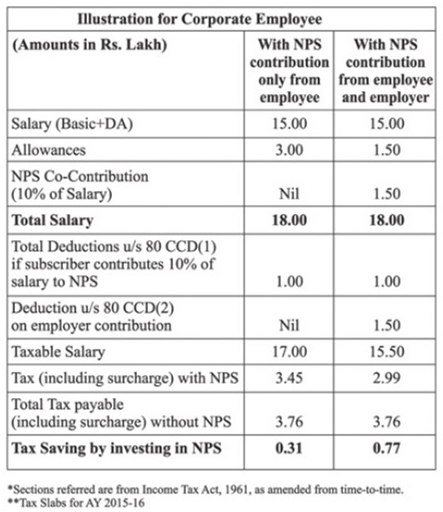

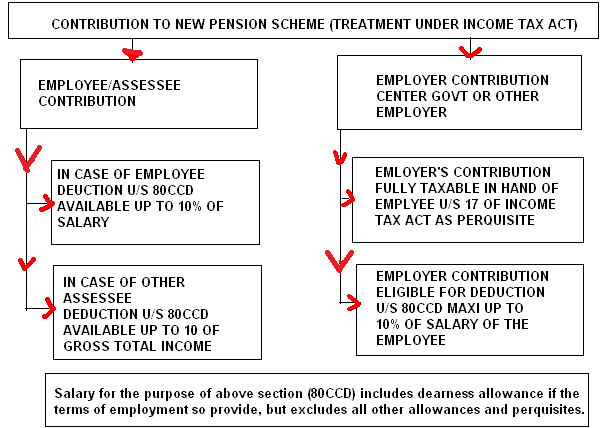

Web Section 80CCD 2 refers to a tax benefit for employers with respect to a contribution made to the pension scheme If your employer contributes to your NPS account your employer Web 22 sept 2022 nbsp 0183 32 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this

National Pension Scheme Nps Tax Rebate U S 80ccd 2

National Pension Scheme Nps Tax Rebate U S 80ccd 2

https://www.apnaplan.com/wp-content/uploads/2015/12/NPS-illustration-of-Tax-Exemption-on-NPS-by-restructing-of-Salary.png

Deduction U s 80CCD 2 In Respect Of Contribution To New Pension Fund

https://4.bp.blogspot.com/-MLKXVnaY0SQ/Vg58X0AxksI/AAAAAAAAAg8/rubmCN-JPGs/w1200-h630-p-k-no-nu/2-2.jpg

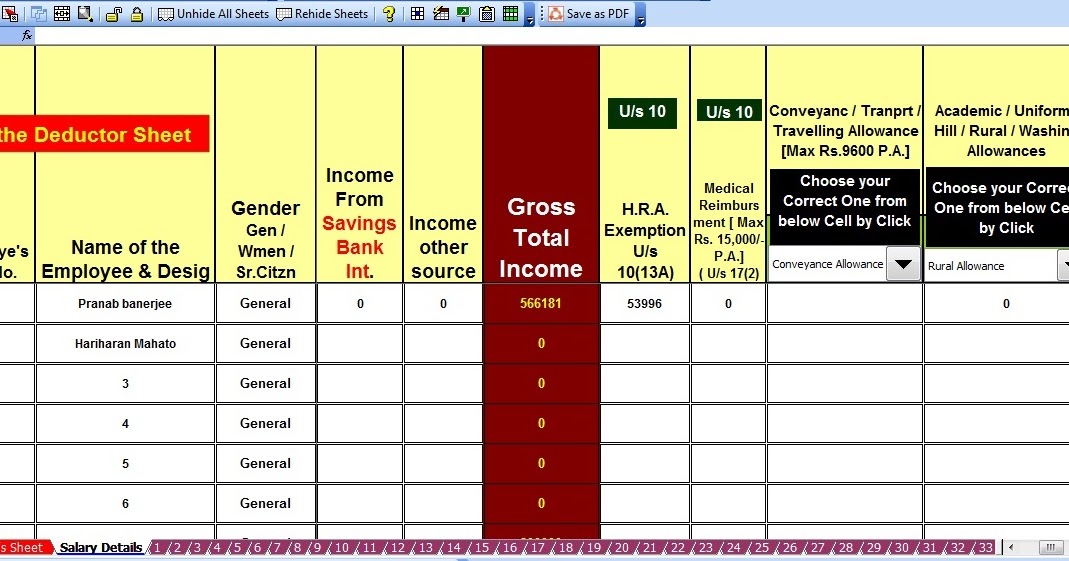

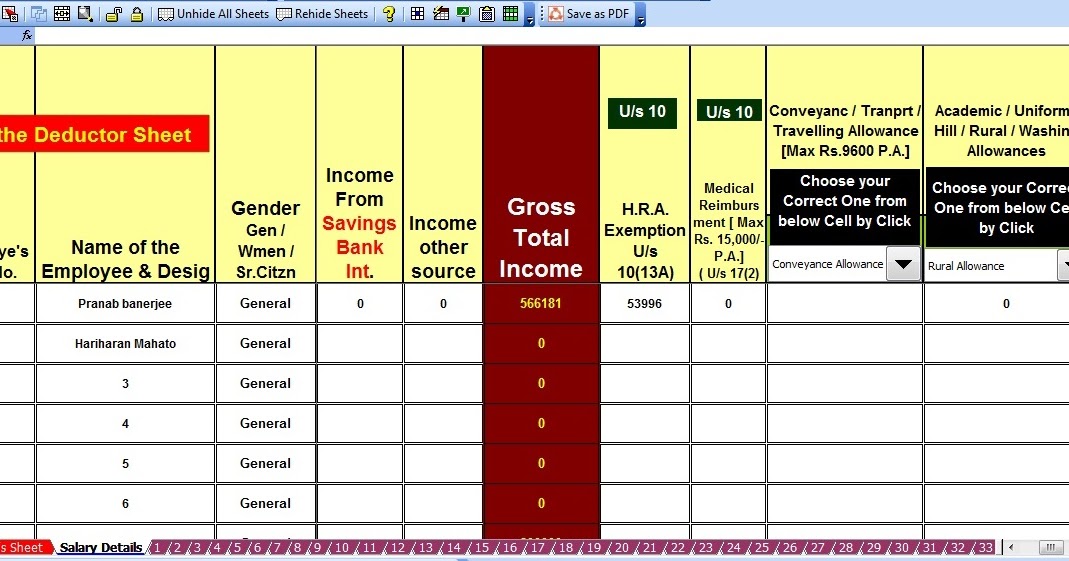

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

https://4.bp.blogspot.com/-SvVnB1wkeCE/WbqgPaPzH3I/AAAAAAAAFYo/IhBUL6eX4JU6J21Rqh9rNYJFmCxNzsJ7ACLcBGAs/s640/HRA%2BCalculator.jpg

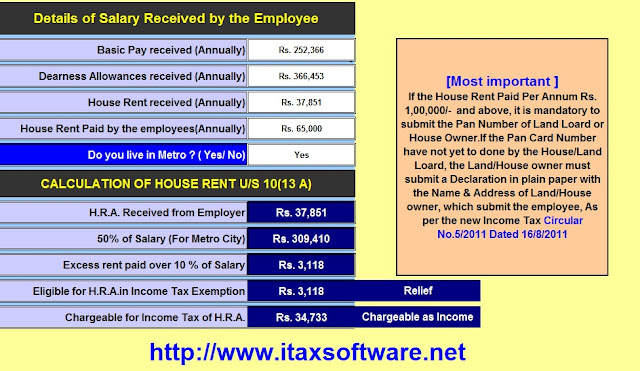

Web 3 f 233 vr 2023 nbsp 0183 32 Budget 2023 proposes to make the following deductions available to eligible individuals under the new tax regime from April 1 2023 i Standard deduction for Web 18 f 233 vr 2023 nbsp 0183 32 Section 80CCD 2 of the Income Tax Act 1961 is a provision that allows individuals to claim an additional deduction on contributions made towards the National

Web 7 f 233 vr 2020 nbsp 0183 32 NPS Tax Benefits NPS tax benefits are available through 3 sections 80CCD 1 80CCD 2 and 80CCD 1B We discuss each below 1 Section 80CCD 1 Employee contribution up to 10 of basic Web 1 What are the tax benefits under NPS Tax Benefit available to Individual Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall

Download National Pension Scheme Nps Tax Rebate U S 80ccd 2

More picture related to National Pension Scheme Nps Tax Rebate U S 80ccd 2

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2016/10/NPS-Tax-Benefits.jpg

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2020/04/tax-benefits-of-nps.jpg

Income Tax Information NPS Tax Benefit Sec 80CCD 1 80CCD 1B And

https://2.bp.blogspot.com/-M2x6C7-6FRs/Wv7FH91f_QI/AAAAAAAAAYA/a3qFywzgcPwMcFze1jMvhr6r0hgmni_hQCLcBGAs/s1600/NPS%2Bdeduction.png

Web 1 sept 2020 nbsp 0183 32 On the amount invested in NPS one can avail tax breaks under Section 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Act Importantly as per Section 80CCE the aggregate amount of Web 2 avr 2019 nbsp 0183 32 NPS Tax Benefit Sec 80C and Additional Tax Rebate NPS tax benefits are offered under section 80C Section 80 CCD 1 amp Section 80 CCD 1B and Section

Web 3 avr 2023 nbsp 0183 32 Home NPS NPS Tax Benefits Contribution to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act Web Section 80CCD 1 and 80CCD 2 Tax Benefits Under NPS Section 80CCD 1 and 80CCD 2 The Government of India notifies pension schemes that can help salaried

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

https://www.bankindia.org/wp-content/uploads/2018/12/nps-tax-benefits-80ccd1-80ccd2-80ccd1b.png

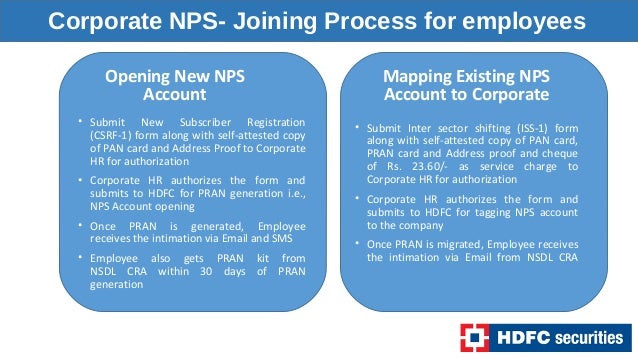

National Pension Scheme NPS Tax Benefits For Employees And Corpora

https://image.slidesharecdn.com/corporateppt-180530060127/95/national-pension-scheme-nps-tax-benefits-for-employees-and-corporates-17-638.jpg?cb=1529474694

https://www.etmoney.com/learn/nps/nps-tax-…

Web 21 sept 2022 nbsp 0183 32 Rs 15 600 for individuals in the highest income tax bracket of 30 Section 80CCD 2 deals with employer contribution to an employee s pension accounts The amount of deduction is limited to

https://groww.in/p/tax/section-80ccd

Web Section 80CCD 2 refers to a tax benefit for employers with respect to a contribution made to the pension scheme If your employer contributes to your NPS account your employer

Best NPS Funds 2019 Top Performing NPS Scheme

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

80ccd 2 Of Income Tax Act Pdf Tax Walls

NPS Tax Benefits Sec 80CCD 1 80CCD 2 And 80CCD 1B With Automated

Investing Can Be Interesting Financial Awareness Deduction Under

General Exemptions Deductions For Salaried Employees

General Exemptions Deductions For Salaried Employees

How To Claim Section 80CCD 1B TaxHelpdesk

Tax Benefits Of NPS Scheme Deduction Coming Under Section 80CCD 1B

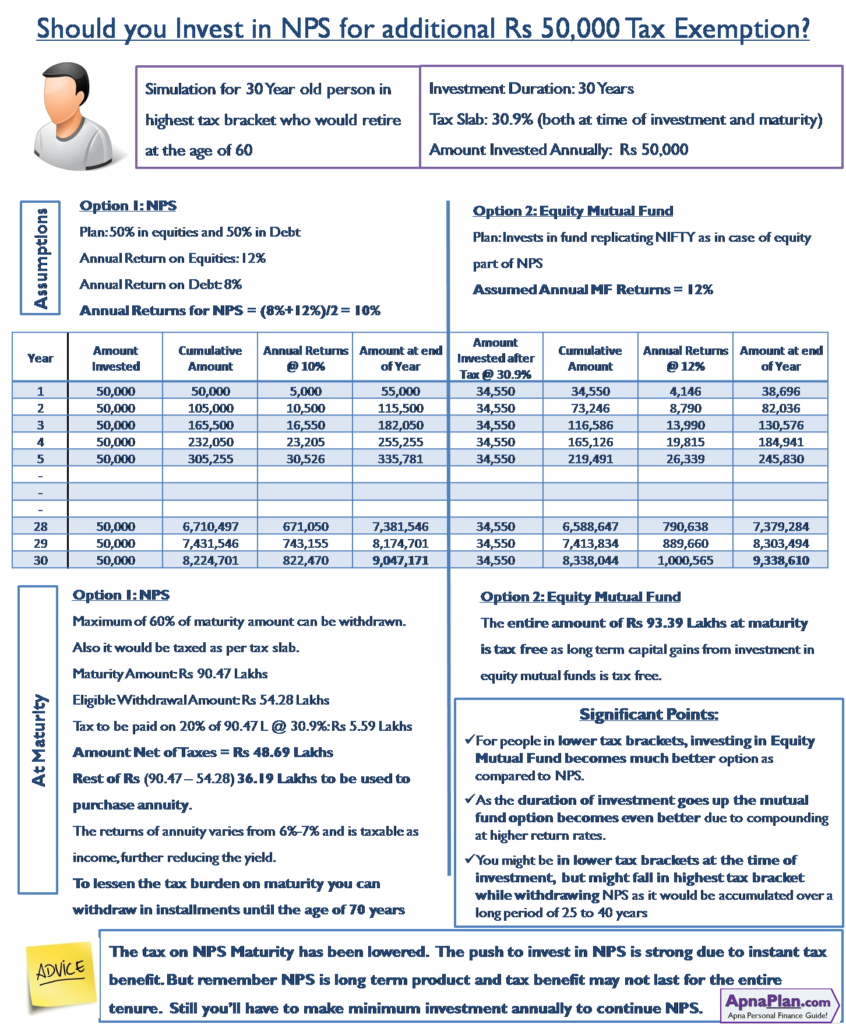

Invest Rs 50 000 In NPS To Save Tax U s 80CCD 1B

National Pension Scheme Nps Tax Rebate U S 80ccd 2 - Web The Income Tax Act of 1961 Section 80CCD 1 deals with offering tax deductions to all taxpayers or assessees contributing to the national pension system NPS Both