National Tax Credits Scam Letter These letters IRS Notice 3176c apply to potentially frivolous tax returns which includes incorrect claims for Fuel Tax Credits Sick and Family Leave Credits and household employment taxes Legitimate taxpayers qualifying for these credits can submit documentation showing they actually qualify for the credit

Aug 1 2024 If you get an unexpected letter email or text that claims to be from the IRS or another trusted source like a bank credit company or tax software provider here are some tell tale signs that it s a scam On Thursday the I R S issued a warning to businesses to be on the lookout for scams related to the tax credit saying it was fueling a flood of invalid applications

National Tax Credits Scam Letter

National Tax Credits Scam Letter

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Tax Scams DOR

https://www.dor.ms.gov/sites/default/files/inline-images/Letter Scams.jpeg

Research And Development Tax Credits

https://www.mstiller.com/wp-content/uploads/2022/08/MSTiller-VideoCover-Research-and-Development-Tax-Credits_CT-10630.jpg

The Internal Revenue Service warns about scams revolving around the Employee Retention Credit a tax credit for businesses that continued paying employees during the COVID 19 shutdowns or had The IRS says tax professionals are being pressured to claim credits improperly People and businesses can avoid this scheme and by not filing improper claims in the first place

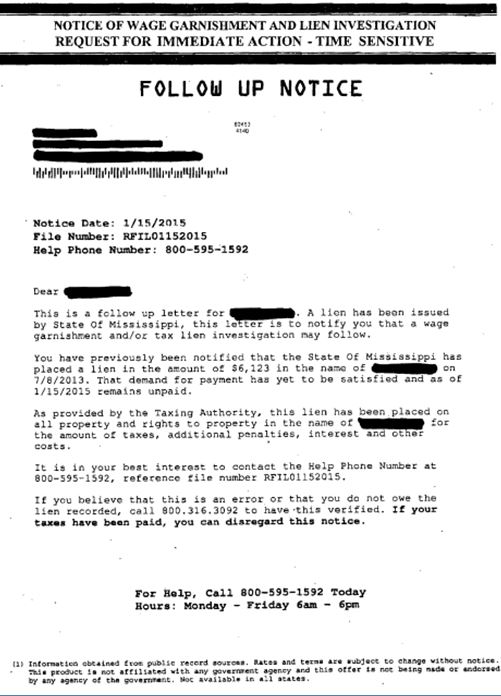

HMRC has issued a warning to tax credits customers who are renewing their tax credits claims to be alert to scammers trying to steal their information While many businesses around the country have been able to successfully apply and receive the Employee Retention Tax Credit ERTC all businesses should be aware of potential scams Below we have included an example scam letter as well as an official IRS letter and noting the differences

Download National Tax Credits Scam Letter

More picture related to National Tax Credits Scam Letter

Tax Credits Spsgz

https://www.taxformreporting.com/wp-content/uploads/Tax-Credits-1.png

Now Taxpayers In Berkeley Can Get Tax Relief With The Help Of The

https://image.isu.pub/211123075638-1124b8e95cbda79e468b63f09fb5f716/jpg/page_1.jpg

BEWARE Employee Retention Tax Credit Scams MyHRcounsel MyHRcounsel

https://myhrcounsel.com/wp-content/uploads/2023/04/Screenshot-2023-04-14-at-8.59.37-AM-1-700x908.png

Check a list of recent letters from HMRC to help you decide if a letter you ve received is a scam Thousands of people have lost millions of dollars and their personal information to tax scams Scammers use the regular mail telephone and email to set up individuals businesses payroll and tax professionals

If you receive a letter from HMRC the first thing to do is check the small but significant details that can so easily be overlooked Check the following both to check they are correct and to look for spelling and grammatical errors a sure giveaway of a scam letter The address Postcode The scam is run by mail If you don t owe taxes you should scan the letter and send it to phishing irs gov If you re not sure whether you owe taxes you can confirm the letter by calling the IRS at 800 829 1040

Upcoming Changes To R D Tax Credits Introducing The Additional

https://www.zest.tax/wp-content/uploads/2023/06/pexels-thisisengineering-3912480-scaled.webp

Scam Alert Fraudulent Tax Letters Claiming Distraint Warrant

https://www.cattco.org/sites/default/files/2022-03/20220324-scam-distraint-warrant.png

https://www.irs.gov › newsroom › irs-warns-taxpayers...

These letters IRS Notice 3176c apply to potentially frivolous tax returns which includes incorrect claims for Fuel Tax Credits Sick and Family Leave Credits and household employment taxes Legitimate taxpayers qualifying for these credits can submit documentation showing they actually qualify for the credit

https://www.irs.gov › newsroom › know-the-warning...

Aug 1 2024 If you get an unexpected letter email or text that claims to be from the IRS or another trusted source like a bank credit company or tax software provider here are some tell tale signs that it s a scam

Tax Credits To Help Cover The Costs Of Higher Education Lahrmer Company

Upcoming Changes To R D Tax Credits Introducing The Additional

Tax Credits Are Hidden Benefit For Homeowners

MAIL SCAM TAXES DO NOT PAY SHRED THROW AWAY 08 18 2022 Press

New Family Tax Credits What You Need To Know Catalyst Kids

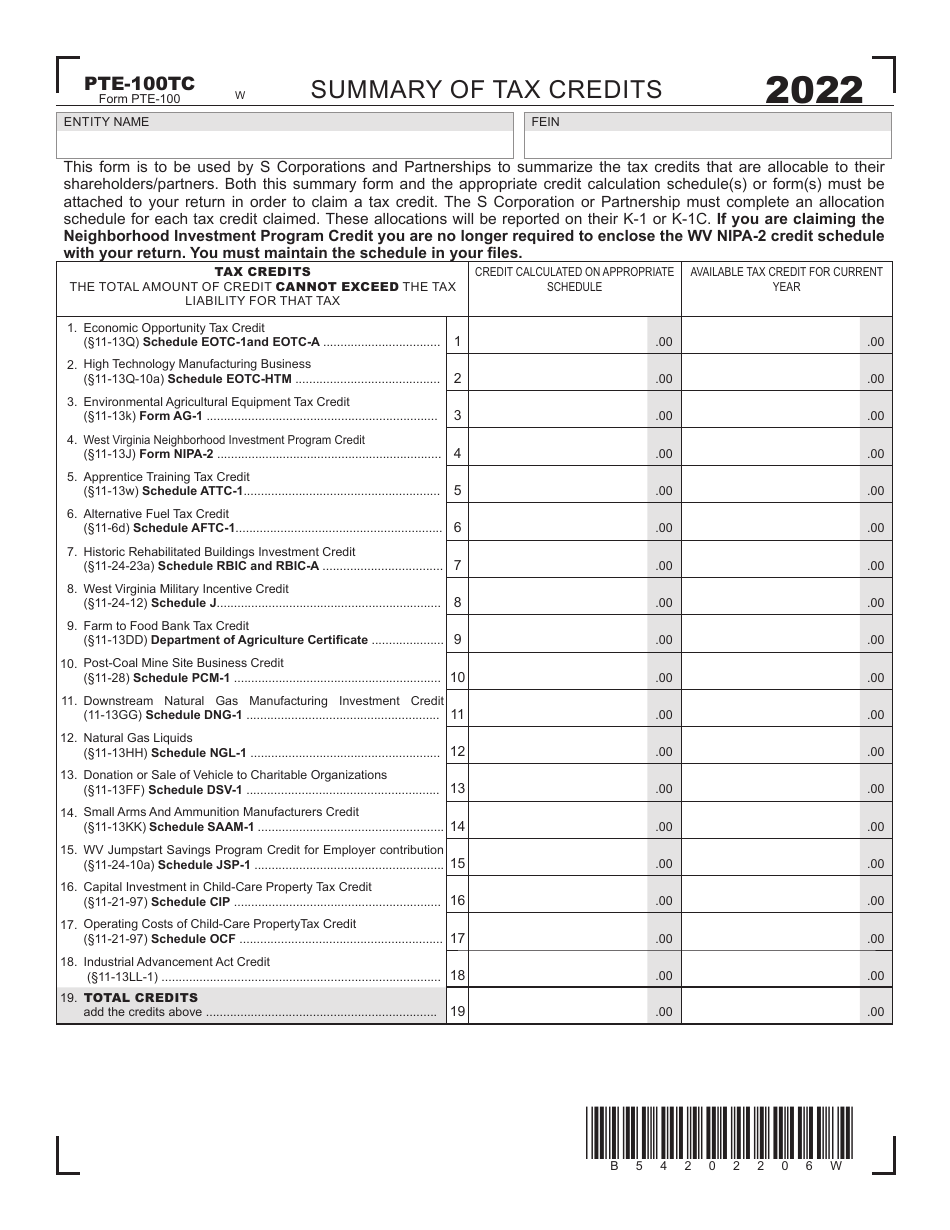

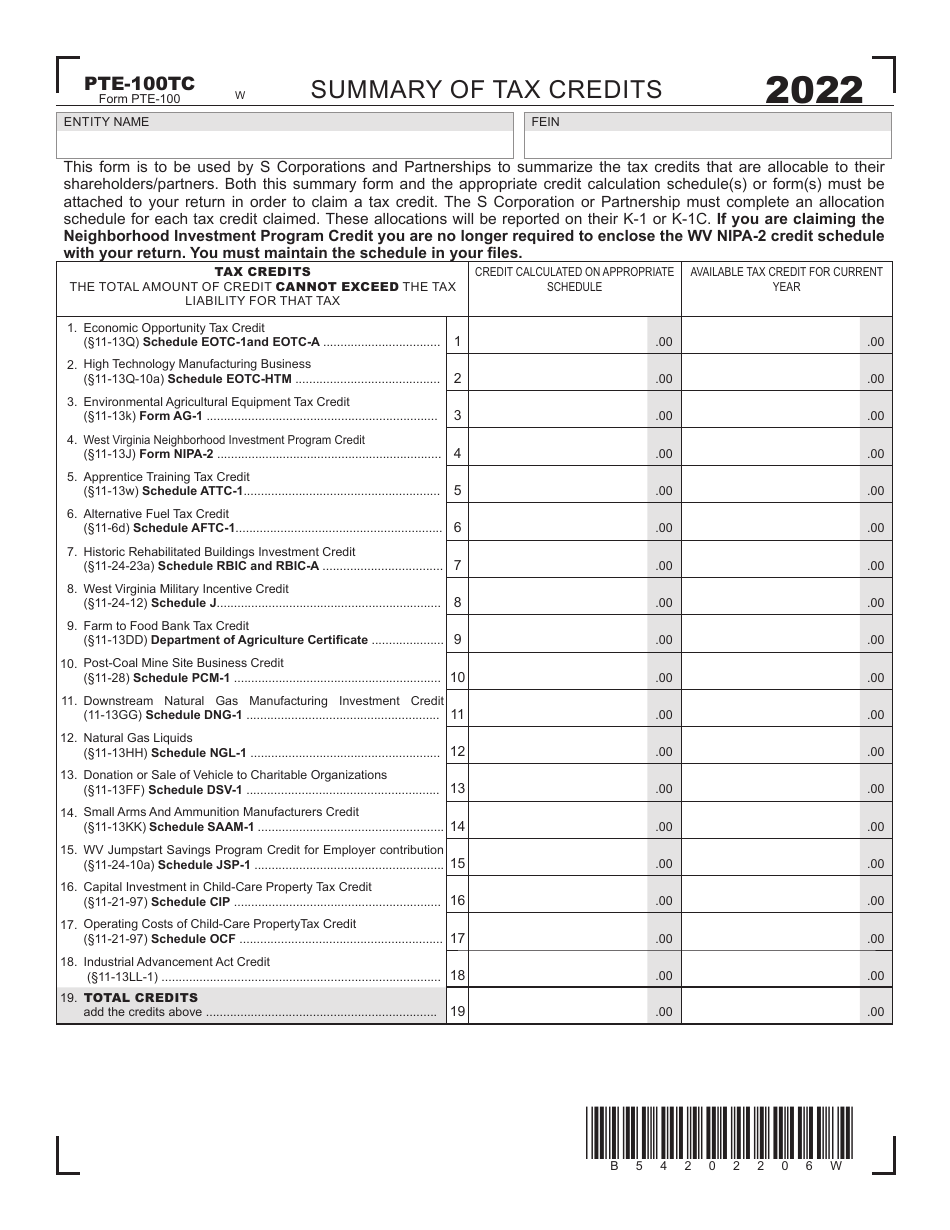

Form PTE 100TC Download Printable PDF Or Fill Online Summary Of Tax

Form PTE 100TC Download Printable PDF Or Fill Online Summary Of Tax

What Are Tax Credits For Health Insurance Smartly Guide

Potential Claims Arising From The Use and Abuse Of Research And

Understanding Tax Credits Avenue Tax Service

National Tax Credits Scam Letter - While many businesses around the country have been able to successfully apply and receive the Employee Retention Tax Credit ERTC all businesses should be aware of potential scams Below we have included an example scam letter as well as an official IRS letter and noting the differences