Nebraska Tax Return Calculator Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your

The Nebraska Tax Estimator Lets You Calculate Your State Taxes For the Tax Year The Federal or IRS Taxes Are Listed Easily and accurately calculate Nebraska personal income taxes online

Nebraska Tax Return Calculator

/cdn.vox-cdn.com/uploads/chorus_asset/file/19018922/945941002.jpg.jpg)

Nebraska Tax Return Calculator

https://cdn.vox-cdn.com/thumbor/uNCTSLvKrM11woMsyvGdxNTSIsw=/1400x1400/filters:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_asset/file/19018922/945941002.jpg.jpg

2020 Nebraska State Tax Calculator For 2021 Tax Return

https://ne-us.icalculator.com/img/og/US/20.png

BIR Chief Lumagui Taxpayers Can Now File And Pay 2022 Annual Income

https://i.pinimg.com/originals/2d/25/aa/2d25aa0df839864a2cc65f04c02831f6.jpg

Use this Nebraska State Tax Calculator to determine your federal tax amounts state tax amounts along with your Medicare and Social Security tax allowances For the 2024 tax year Nebraska s income tax rates range from 2 46 to 5 84 Updated on Dec 19 2024 Estimate your Nebraska state tax burden with our income tax calculator Enter your

The Nebraska Tax Calculator is for the 2025 tax year which means you can use it for estimating your 2026 tax return in Nebraska the calculator allows you to calculate income tax and payroll taxes and deductions in Nebraska Calculate your income tax in Nebraska and salary deduction in Nebraska to calculate and compare salary after tax for income in Nebraska in the 2025 tax year

Download Nebraska Tax Return Calculator

More picture related to Nebraska Tax Return Calculator

2022 Nebraska State Tax Calculator For 2023 Tax Return

https://ne-us.icalculator.com/img/og/US/22.png

Stock Return Calculator How To Use And Why It s Important Biz Brella

https://www.bizbrella.com/wp-content/uploads/2023/04/3-2048x1365.jpeg

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

The Nebraska Tax Calculator Lets You Calculate Your State Taxes For the Tax Year The Federal or IRS Taxes Are Listed Nebraska Income Tax Calculator is a great tool that balances ease of use with transparency It calculates your Nebraska tax using the most recent federal and state tax tables Read on to see how to use the Nebraska Income Tax

The tax calculation below shows exactly how much Nebraska State Tax Federal Tax and Medicare you will pay when earning 60 000 00 per annum when living and paying your taxes 300 000 00 Federal and Nebraska tax calculation example with full calculations with supporting Nebraska tax calculator calculate your own tax return with full deductions and allowances for

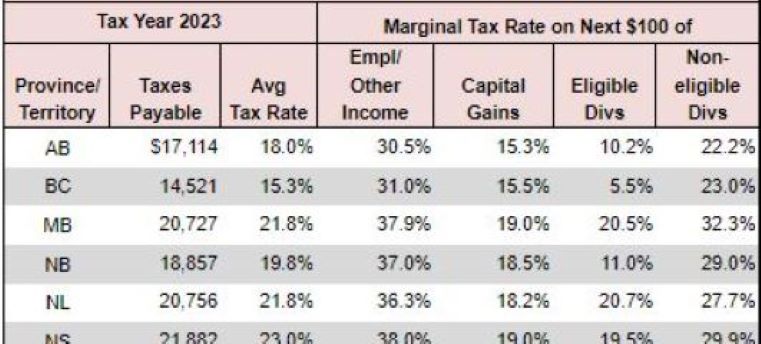

DO THIS TO SAVE ON TAXES IN CANADA Legally Complete Guide To

https://i.ytimg.com/vi/xHO6HbpYaXE/maxresdefault.jpg

164 525k Salary After Tax In Nebraska US Tax 2024

https://ne-us.icalculator.com/img/og/US/191.png

/cdn.vox-cdn.com/uploads/chorus_asset/file/19018922/945941002.jpg.jpg?w=186)

https://www.forbes.com › advisor › income-tax-calculator › nebraska

Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your

https://www.efile.com › nebraska-tax-estimator

The Nebraska Tax Estimator Lets You Calculate Your State Taxes For the Tax Year The Federal or IRS Taxes Are Listed

Annualized Return Options Calculator Formulas Examples And Definition

DO THIS TO SAVE ON TAXES IN CANADA Legally Complete Guide To

26 Pa Taxes Calculator DarmaveerShiv

Nebraska Estimated Tax Form 2023 Printable Forms Free Online

Five Common Tax Return Mistakes Mauro

Calculator Lock Hide Photos Android

Calculator Lock Hide Photos Android

IPhone I in WD Purple Storage Calculator ndir

NRIs How To File Your Income Tax Return On Rental Income From Indian

High definition Image Of An Emi Calculator

Nebraska Tax Return Calculator - Enter your income and filing status Claim exemptions and dependants Press Estimate to view your results You can use the income tax estimator to the left to calculate your