New Ev Tax Credit 2022 Income Limit Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a

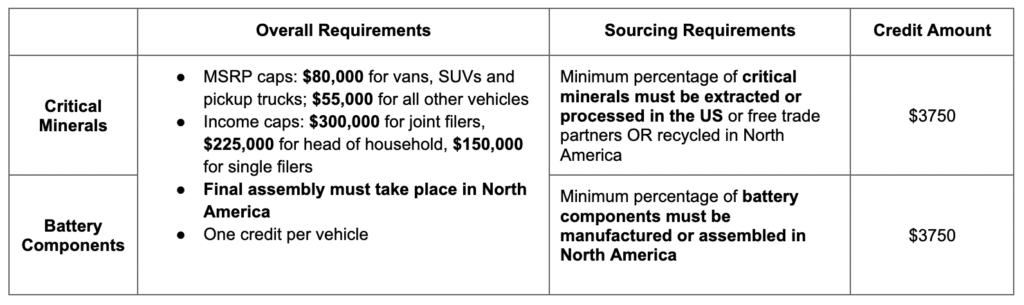

The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after IRS guidance limits the number of EVs that qualify for the full 7 500 EV tax credit Those EV tax credit rules address requirements for critical mineral and battery component requirements for

New Ev Tax Credit 2022 Income Limit

New Ev Tax Credit 2022 Income Limit

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

Payne How EV Tax Credit Bills Disadvantage Foreign Domestic Models

https://www.gannett-cdn.com/presto/2021/11/02/PDTN/af46539a-106d-4d75-bc9e-c93935bf56ca-EVcredits_FordMustangMachEGT.jpg?crop=3181

New EV Tax Credit 2023 What You Need To Know

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1g2ZVJ.img?w=1920&h=1378&m=4&q=79

For a broader view of what vehicles may now be eligible for this credit the Department of Energy published a list of Model Year 2022 and early Model Year 2023 electric vehicles that likely meet the final assembly requirement The eligibility for a specific vehicle should be confirmed using its VIN number People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to

Key Takeaways The Inflation Reduction Act established changes to the EV tax credit a federal incentive to encourage consumers to purchase electric vehicles Those who meet the income requirements Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly occurred in North America Further changes to the eligibility rules will begin in 2023

Download New Ev Tax Credit 2022 Income Limit

More picture related to New Ev Tax Credit 2022 Income Limit

Why Getting A 7 500 EV Tax Credit Will Be Easier In 2024 WSJ

https://images.wsj.net/im-865215/social

New US EV Tax Credit Here s Everything You Need To Know

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAX9y19.img?w=1920&h=1080&m=4&q=50

EV Tax Credit 2022 NEW Dates Pass Or Fail YouTube

https://i.ytimg.com/vi/9xQ9TIC3Nuw/maxresdefault.jpg

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 Simply put the Inflation Reduction Act includes a 7 500 tax credit at the point of sale for new EVs and 4 000 for used EVs The new tax credits replace the old incentive system which only

The new climate law also added income limits for the tax credit a maximum of 300 000 for a household 150 000 for an individual or 225 000 for a head of household Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500 for buyers of new all electric cars and

What The U S EV Tax Credit Means For Canada Financial Post

https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2021/11/biden-evs-1123.jpg

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

https://techcrunch.com/2022/09/02/a-complete-guide...

Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a

https://www.irs.gov/credits-deductions/credits-for...

The maximum credit is 7 500 It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after

The EV Tax Credit Is Changing In 2024 Here Are 10 Cars That Still

What The U S EV Tax Credit Means For Canada Financial Post

2022 EV Tax Credits From Inflation Reduction Act Plug In America

Ask Your Questions About EV Tax Credit Cars News Informer

EV Tax Credit 2022 Updates Shared Economy Tax

EV Tax Credits How To Get The Most Money For 2023 PCMag

EV Tax Credits How To Get The Most Money For 2023 PCMag

EVs Eligible For 7 500 EV Tax Credit In Inflation Reduction Act

Treasury Department Lays Out EV Tax Credit Foreign Sourcing Rules

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

New Ev Tax Credit 2022 Income Limit - The old credit offered 7 500 for new electric vehicle buyers until their automaker hit a 200 000 limit for available tax credits Plug in hybrid buyers received a smaller credit