New Jersey Property Tax Relief Fund Check About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included in the 50 6 billion

Murphy Administration and Legislative Leaders Encourage Eligible Homeowners Renters to Apply for Historic Property Tax Relief through New ANCHOR Program 09 12 2022 Application Instructions Being Mailed to Thousands of Residents Also Available Online By Phone TRENTON Important instructions on how to file for the Property Tax Reimbursement Inquiry NJ Taxation Taxation Privacy Policy Check the status of your New Jersey Senior Freeze Property Tax Reimbursement If a reimbursement has been issued the system will tell you the amount of the reimbursement and the date it was issued To use this service you will need the Social Security number

New Jersey Property Tax Relief Fund Check

New Jersey Property Tax Relief Fund Check

https://storage.googleapis.com/afs-prod/media/5fe324b049764928aa9d96084d397e16/3000.jpeg

New Jersey ANCHOR Property Tax Relief Program What You Need To Know

https://i0.wp.com/www.jerseycityupfront.com/wp-content/uploads/2020/06/City-Hall-Jersey-City.jpg?fit=1280%2C960&ssl=1

NJ 2 Property Tax Relief Programs V1 0

https://s2.studylib.net/store/data/005419817_1-7b61982b2fb1a8f6639d61909c72af8b-768x994.png

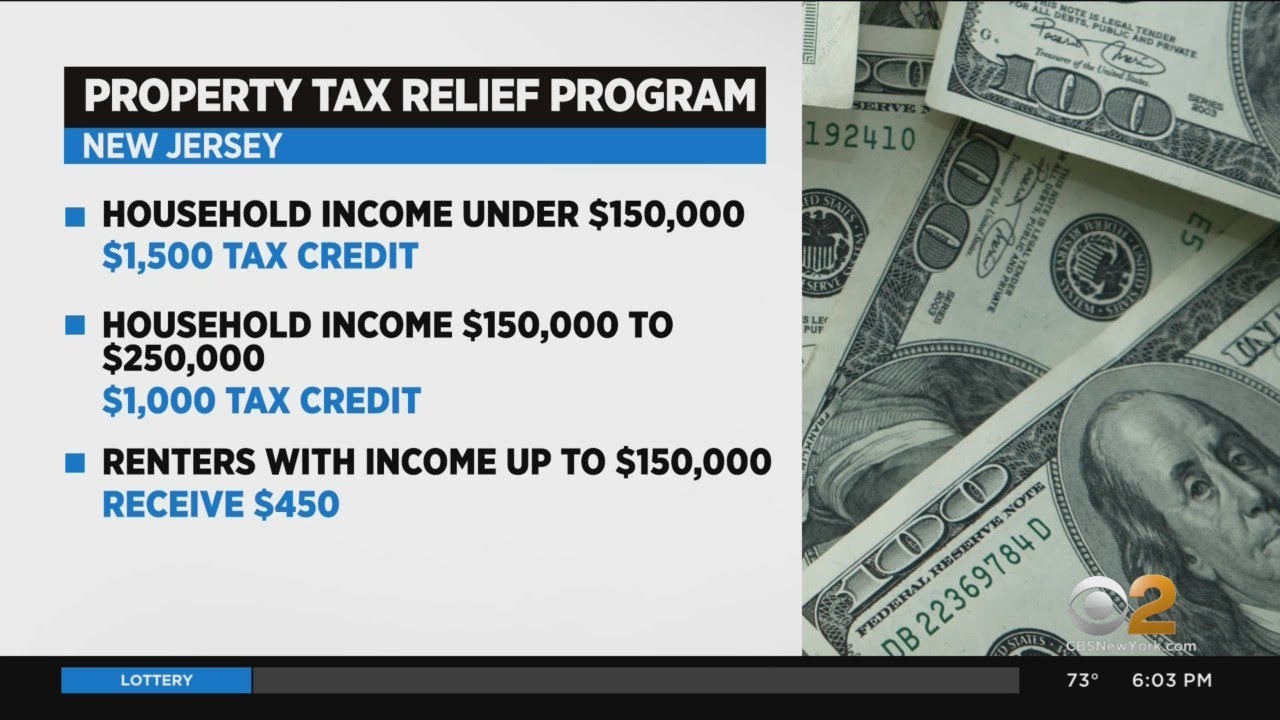

Under the ANCHOR Property Tax Relief Program homeowners making up to 250 000 per year are eligible to receive an average 700 rebate in FY2023 to offset property tax costs lowering the effective average property tax cost back to 2016 levels for many households that were previously ineligible for property tax relief Paper checks are issued from the Property Tax Relief Fund Direct deposits are deposited as State of N J NJSTTAXRFD Change Your Address Direct Deposit Issues Undeliverable Refunds Requests for More Information Claims Against Your Refund Interest Earned on Refunds

Senior Freeze Program Property Tax Reimbursement Stay NJ Property Tax Credit Program Deductions Exemptions and Abatements Homestead Benefit Program Replaced by ANCHOR Last Updated Monday 01 22 24 Definitions for the Senior Freeze Property Tax Reimbursement Program Nearly 1 7 million New Jersey households out of an eligible 2 million applied for the first year of a new state property tax relief program and rebates will begin going out later

Download New Jersey Property Tax Relief Fund Check

More picture related to New Jersey Property Tax Relief Fund Check

Millions Could Receive Property Tax Relief In New Jersey YouTube

https://i.ytimg.com/vi/PtNBk1VLWuM/maxresdefault.jpg

Attention NJ Applications For Property Tax Relief Are About To Start

https://i0.wp.com/townsquare.media/site/385/files/2022/09/attachment-47967851538_2e71e9cbda_k.jpg

New Jersey Property Tax Relief Program For Homeowners And Renters

https://mantuatownship.com/wp-content/uploads/2023/08/anchor-768x444.jpeg

A key provision of the envisioned program is the funding of tax credits that would be used to cut property taxes in half for many homeowners ages 65 and older up to a maximum of 6 500 annually Right now senior homeowners making up to 500 000 annually would be eligible for the promised benefits Officials in New Jersey are urging people to apply for property tax relief under the new ANCHOR program before the Jan 31 2023 deadline Qualified homeowners making less than 150 000 in 2021 will receive a tax credit of 1 500 while those making 150 000 to 250 000 will get a tax credit of 1 000

As the centerpiece of his latest budget proposal Governor Murphy announced a new property tax credit named ANCHOR Affordable New Jersey Communities for Homeowners and Renters This explainer outlines the size and scope of the proposal how it stacks up against existing property tax relief benefits and highlights who benefits Jun 21 2021 4 50 PM Updated 1 041 days ago Share New Jersey property owners could see a 500 property tax rebate under an agreement that state officials announced on Monday

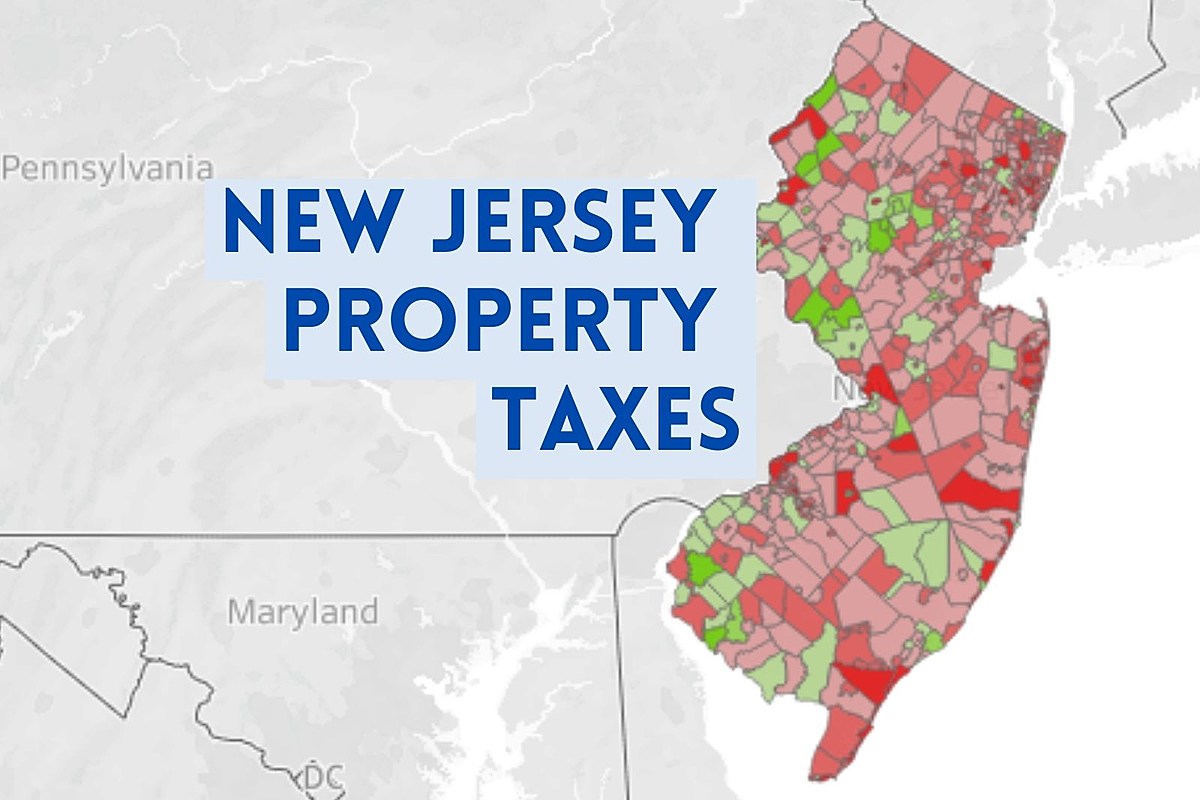

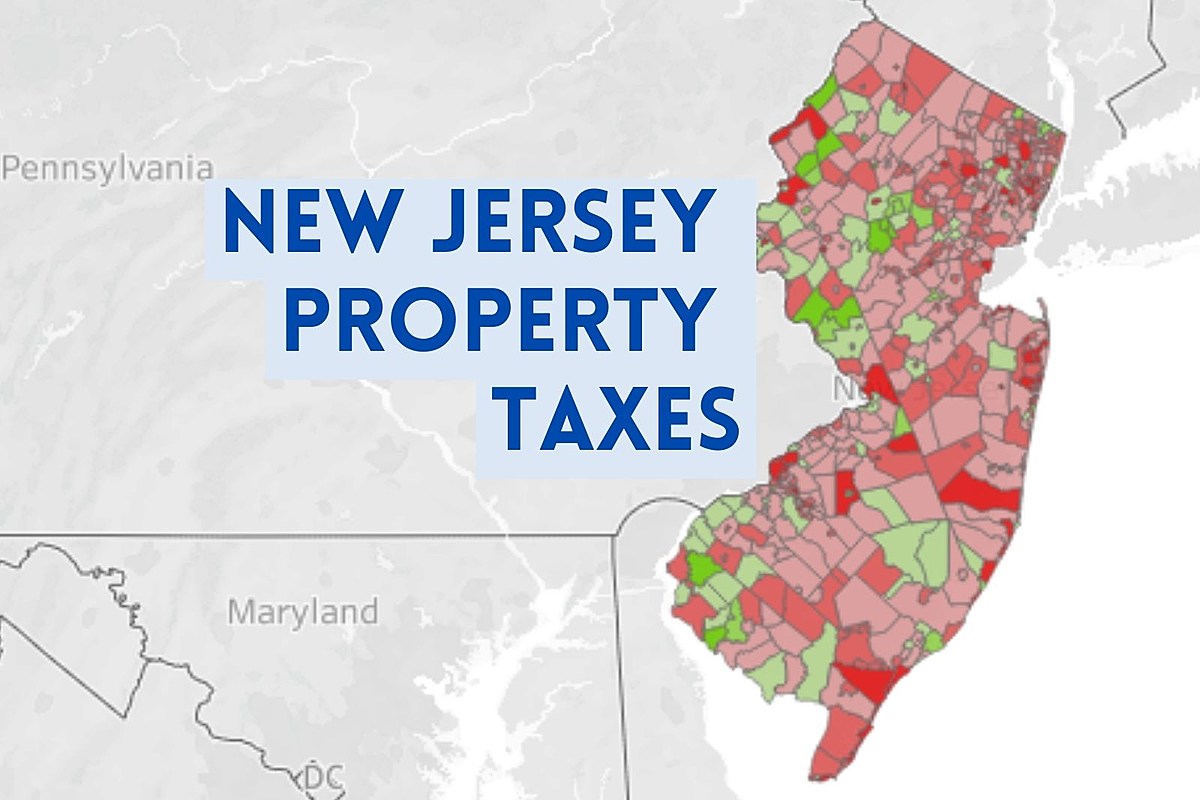

Average NJ Property Tax Bill Near 9 300 Check Your Town Here

https://townsquare.media/site/385/files/2022/01/attachment-New-Jersey-property-taxes.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

NJ ANCHOR Property Tax Relief Program Application Deadline Extended To

https://middletownship.com/wp-content/uploads/2022/11/315868169_675151700647024_4862430220857408753_n.jpg

https://www.nj.com/politics/2022/07/nj-now-has-2b...

About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included in the 50 6 billion

https://www.nj.gov/governor/news/news/562022/20220912b.shtml

Murphy Administration and Legislative Leaders Encourage Eligible Homeowners Renters to Apply for Historic Property Tax Relief through New ANCHOR Program 09 12 2022 Application Instructions Being Mailed to Thousands of Residents Also Available Online By Phone TRENTON Important instructions on how to file for the

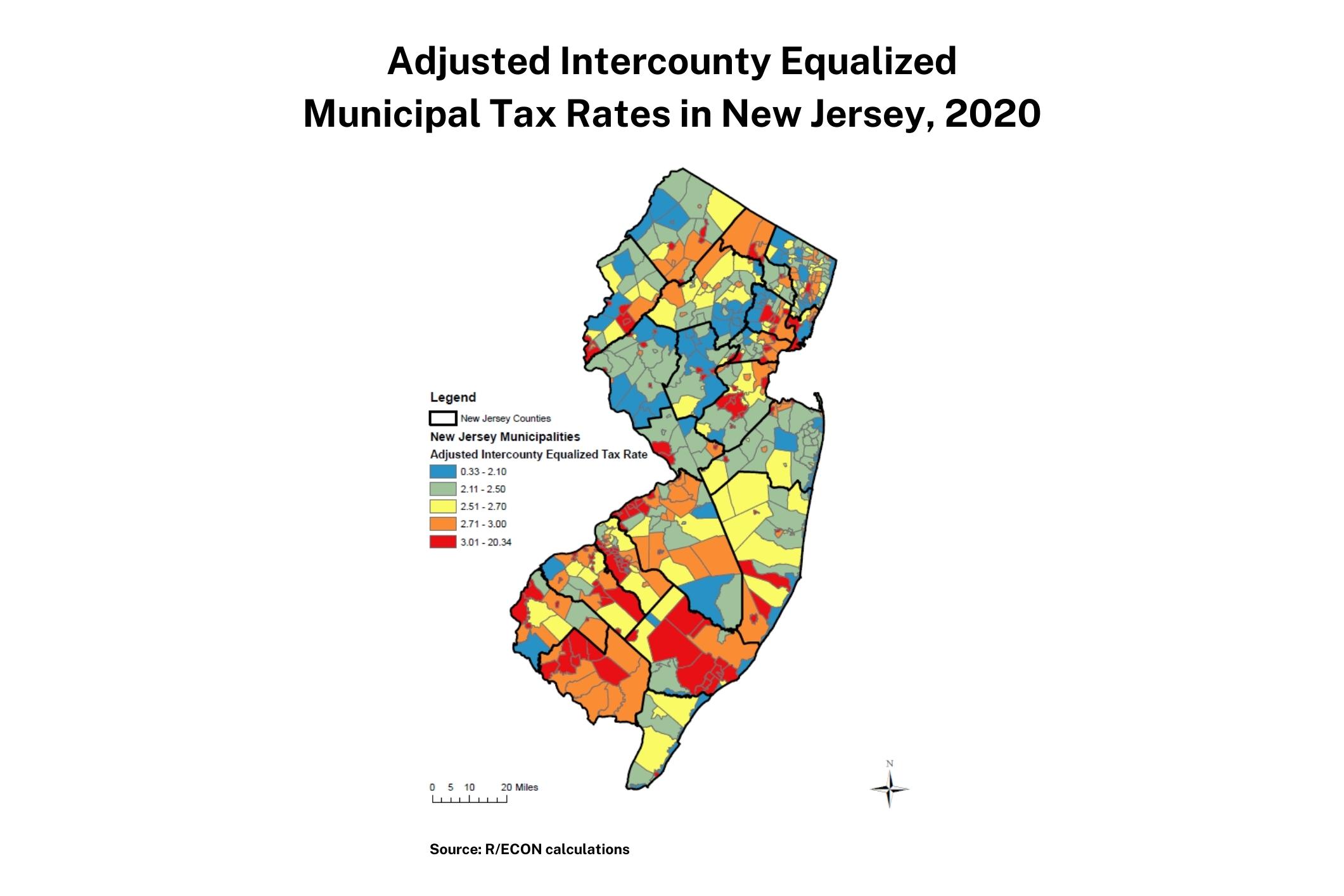

Interactive Map Tracking Results Of Property Tax Uptick Across NJ NJ

Average NJ Property Tax Bill Near 9 300 Check Your Town Here

Report Release What Influences Differences In New Jersey s Municipal

State Of New Jersey Property Tax Relief Programs Hawthorne NJ

Property Tax Relief LinkedIn

Property Tax Relief Available For New Jersey Homeowners Renters

Property Tax Relief Available For New Jersey Homeowners Renters

NJ Property Tax Relief Program Updates Access Wealth

N Y Has New Property Tax Relief What About N J NJMoneyHelp

New Jersey Property Records Search Owners Title Tax And Deeds

New Jersey Property Tax Relief Fund Check - Senior Freeze Program Property Tax Reimbursement Stay NJ Property Tax Credit Program Deductions Exemptions and Abatements Homestead Benefit Program Replaced by ANCHOR Last Updated Monday 01 22 24 Definitions for the Senior Freeze Property Tax Reimbursement Program