New York State Geothermal Tax Credit Web You may claim a credit for qualified geothermal energy system equipment and expenditures installed at residential property located in New York State and placed into service after January 1 2022

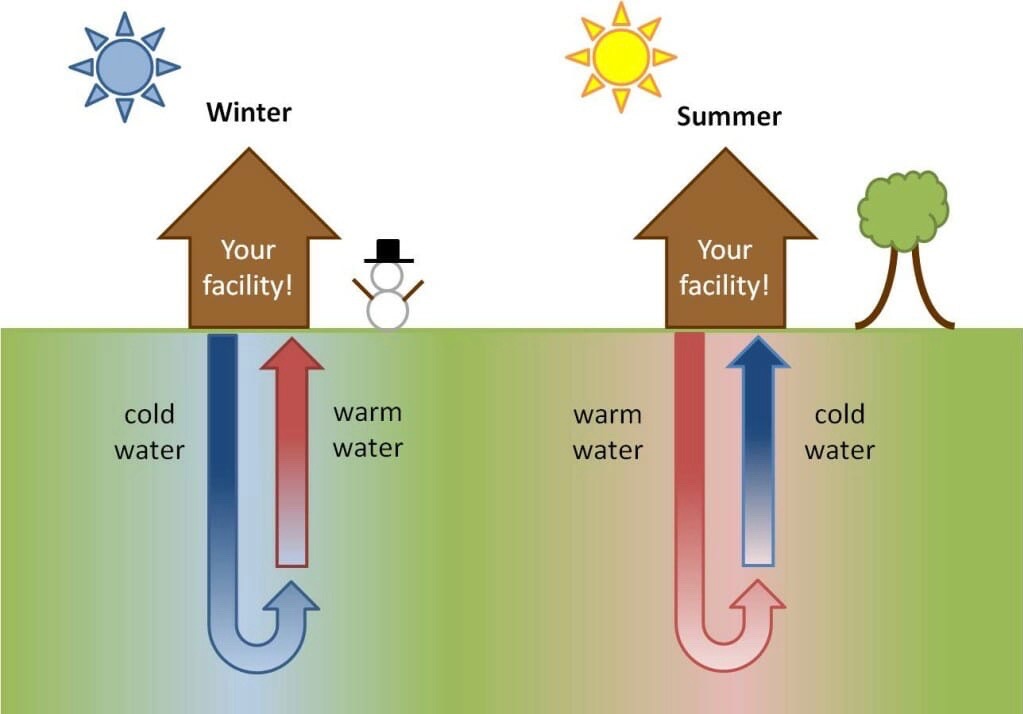

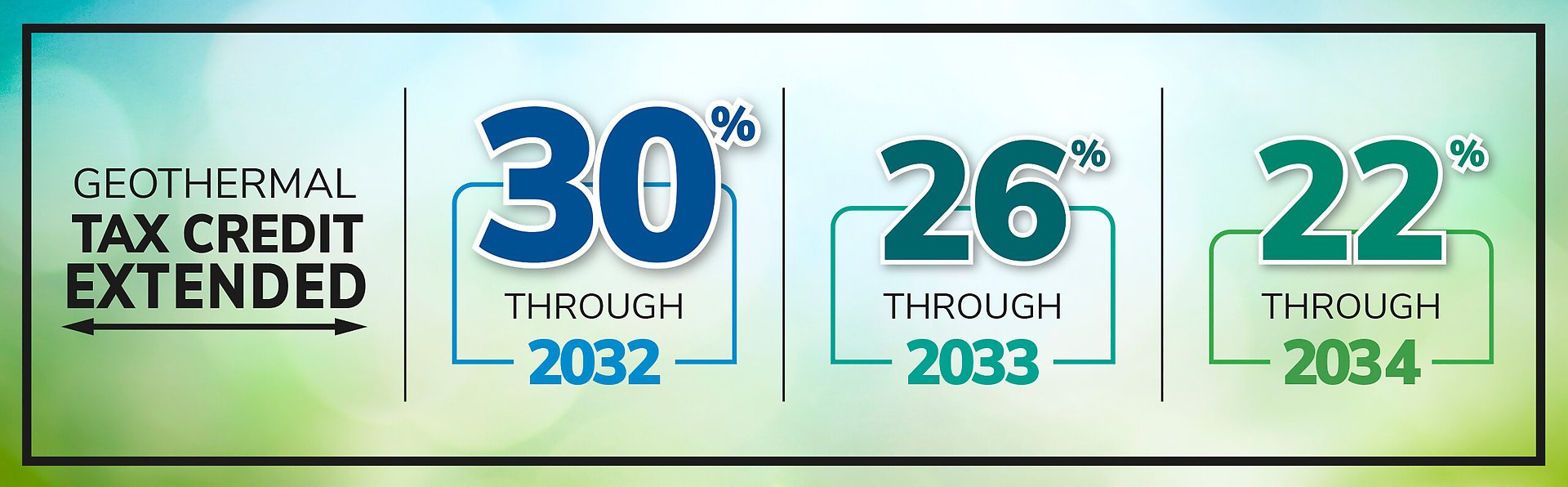

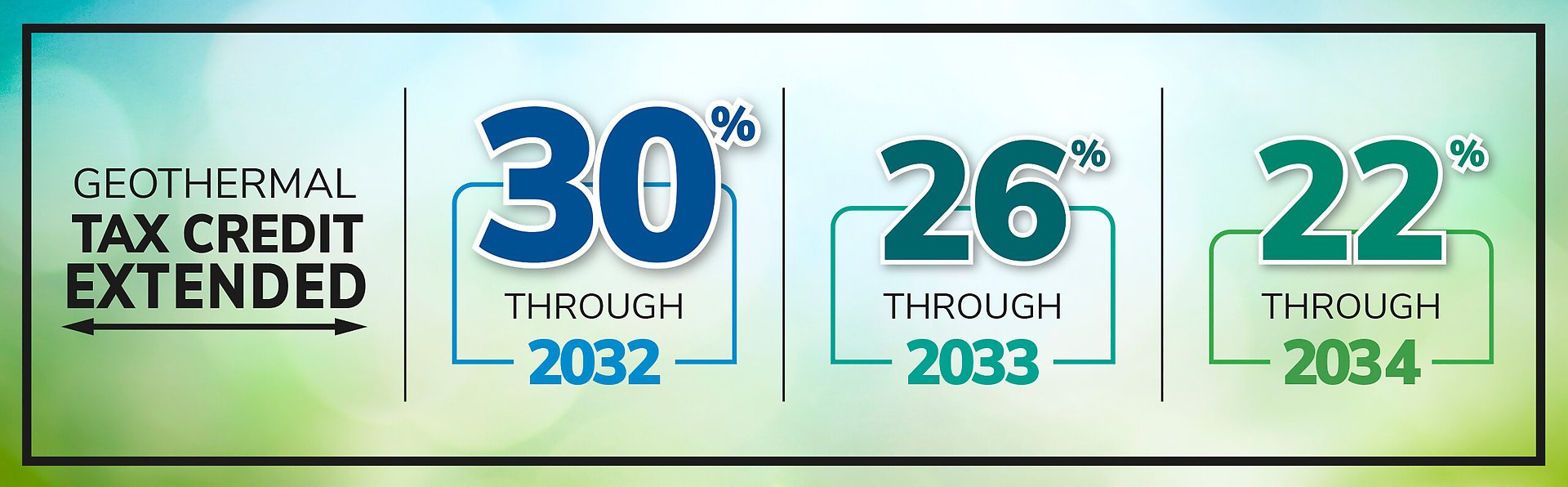

Web Leases If you qualify you may claim the credit for a geothermal energy system lease for the first 15 years of the lease No credit is allowed after the 15th year of any lease that is longer than 15 years in duration To qualify You must have a written agreement to lease the equipment from someone other than you Web NYS Clean Heat also provides rebates for ground source heat pumps which are eligible for a 30 IRA tax credit and 25 New York State income tax credit Heat pump systems are being installed more frequently across New York and the U S with national heat pump sales surpassing gas furnaces in 2022 Clean Heat Pump Program

New York State Geothermal Tax Credit

New York State Geothermal Tax Credit

https://www.buffalogeothermalheating.com/wp-content/uploads/2018/05/pexels-photo-544117-1024x683.jpeg

New York State s Geothermal Installation At 1 Java St Brooklyn Is

https://www.lendlease.com/siteassets/lendlease/shared/media-centre/insights/2023/03/500x700_18483_geothermaljava_007-03_rgb-1.jpg

New York State s Crypto Mining Ban Means A Foggy Future For Bitcoin And

https://img.thedailybeast.com/image/upload/c_crop,d_placeholder_euli9k,h_1688,w_3000,x_0,y_0/dpr_2.0/c_limit,w_740/fl_lossy,q_auto/v1655337779/061622-carleton-nycrypto-hero_orgsef

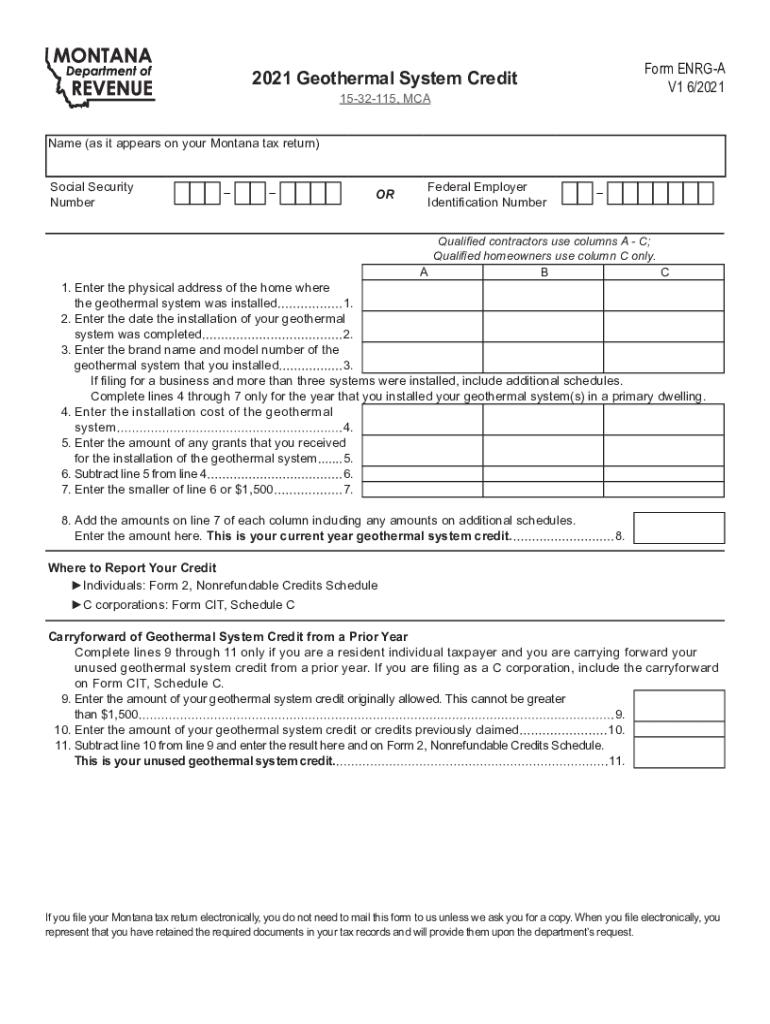

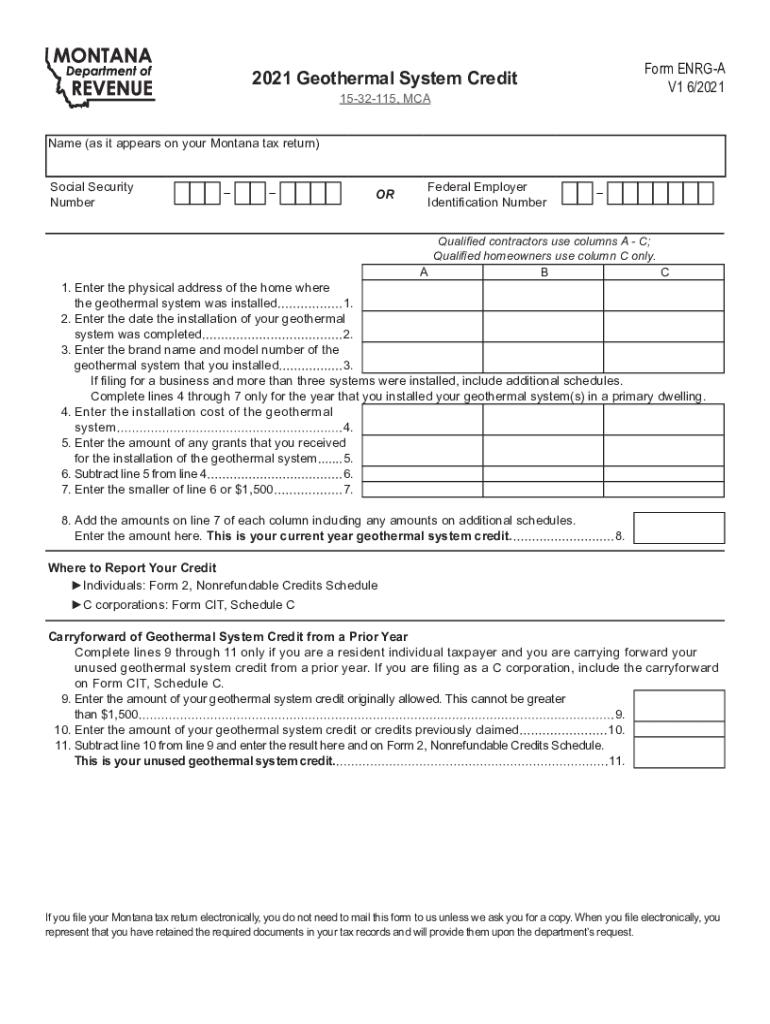

Web Geothermal Energy System Credit Tax Law Section 606 g 4 IT 267 Submit this form with Form IT 201 or Form IT 203 Name s as shown on return Your Social Security number Schedule A Computation of geothermal energy system credit Complete the information in the applicable chart for your geothermal energy system Web With available rebates tax credits and low interest financing geothermal heat pumps have never been more affordable Access 25 New York State tax credits up to 5 000 Get federal tax credits through the Inflation Reduction Act IRA for your project up to 30 of the installation cost including labor and equipment

Web 22 Apr 2022 nbsp 0183 32 New York homeowners who purchase and install geothermal heat pump systems could be in line for a tax credit under a provision given final approval in the state budget this month The measure will make homeowners eligible for a 25 tax credit of up to 5 000 for the installation of geothermal systems as New York seeks to transition to Web 15 Apr 2022 nbsp 0183 32 New Yorkers seeking to improve their carbon footprint by incorporating more renewable energy into their lives just got a helping hand from state lawmakers who have approved a tax credit for any geothermal energy system installed after Jan 1 2022

Download New York State Geothermal Tax Credit

More picture related to New York State Geothermal Tax Credit

Understanding The Geothermal Tax Credit Extension

https://s3.us-east-1.amazonaws.com/uniqueheatingandcooling/UIC_geothermalTax_Image.jpg?mtime=20191021110124&focal=none

The Geothermal Tax Credit Is Back

https://www.elderheatingandair.com/wp-content/uploads/2020/03/geothermal-illustration.jpg

2020 2021 Geothermal Tax Credits DropYourEnergyBill

https://dropyourenergybill.com/wp-content/uploads/2019/10/geo-basic.jpeg

Web 14 Apr 2022 nbsp 0183 32 The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years if their New York income tax liability is less than 5 000 When coupled with the 26 federal tax credit and rebates provided by New York s utilities this new income tax credit will help Web New York State Solar Tax Credits State tax credits and accelerated depreciation on the cost of installation Learn more NY Sun Financial incentives and financing to offset the cost of purchasing and installing a solar system for your business NYSERDA is also providing incentives for energy storage capacity Learn more

Web 14 Apr 2022 nbsp 0183 32 The new geothermal tax credit is available for any system installed after January 1 2022 and homeowners can carry the tax credit forward for five years if their New York income Web 18 Okt 2023 nbsp 0183 32 To claim your New York state tax credit you ll need to file IRS Form IT 267 along with your annual federal tax return Ensure you keep detailed records of your geothermal system purchase and installation including phots invoices and receipts as you may need to provide documentation to support your claim For utility incentives

Geothermal Wins With New IRA Tax Credits HVAC Distributors

https://www.climatemaster.com/images/18.4965ec86185e30c7df5eae/1677095040452/x1920p/Infographic-Geothermal-Tax-Credit-Extended.jpg

Geothermal Tax Credit New York Laticia Covington

https://www.nysfocus.com/wp-content/uploads/2022/03/image_6483441-1-scaled.jpg

https://www.tax.ny.gov/forms/current-forms/it/it267i.htm

Web You may claim a credit for qualified geothermal energy system equipment and expenditures installed at residential property located in New York State and placed into service after January 1 2022

https://www.tax.ny.gov/pdf/2022/printable-pdfs/inc/it267i-2022…

Web Leases If you qualify you may claim the credit for a geothermal energy system lease for the first 15 years of the lease No credit is allowed after the 15th year of any lease that is longer than 15 years in duration To qualify You must have a written agreement to lease the equipment from someone other than you

Cosmopolitan Rand McNally 1898 Map New York State Connecticut W RR Lines

Geothermal Wins With New IRA Tax Credits HVAC Distributors

Geothermal Gradient Map

Geothermal Tax Credits Are Back

Learning To Cope Without The Geothermal Tax Credit 2017 03 01

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

Fillable Online Understand The Geothermal Tax Credit Form Fill Out

Understanding The 26 Geothermal Heat Pump Tax Credit

US States With The Highest Geothermal Capacity WorldAtlas

USA NREL Map Of Geothermal Energy In The United States Of America

New York State Geothermal Tax Credit - Web If you re a New York State resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing The most commonly used forms and instructions are listed here We also encourage you to consult an accountant or tax advisor if you have any questions