New York State Property Tax Exemption For Veterans There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces Alternative Veterans Exemption Cold War Veterans

New York State NYS Real Property Tax Law section 458 a provides a limited exemption from real property taxes for real property owned by persons who rendered military service to the Such property must be the primary residence of the veteran or unremarried surviving spouse of the veteran unless the veteran or unremarried surviving spouse is absent

New York State Property Tax Exemption For Veterans

New York State Property Tax Exemption For Veterans

https://blog.veteransloans.com/wp-content/uploads/2022/08/Blog-Cover-Disabled-Veteran-Property-Tax-Exemption.jpg

Disabled Veterans Property Tax Exemptions By State Tax Exemption

https://i.pinimg.com/originals/72/de/b0/72deb08487ef56182fd2f5060ab36198.jpg

Which States Offer Disabled Veteran Property Tax Exemptions Military

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

The exemption provides a basic property tax exemption of either 10 or 15 percent of assessed value as adopted by the municipality to veterans who served during the Cold War period The Eligible Funds Exemption is for veterans who bought homes using eligible funds including pensions bonuses insurance and mustering out pay The exemption reduces the assessed value of the recipient s property before taxes

The Alternative Veterans Exemption is a primary residence property tax discount in New York for veterans and eligible family members You must meet veteran status residency and ownership requirements to qualify In 2023 qualifying Veterans can receive a property tax exemption of up to 161 083 on the full value of their property or up to 241 627 for Veterans whose annual household income does not exceed 72 335

Download New York State Property Tax Exemption For Veterans

More picture related to New York State Property Tax Exemption For Veterans

Hecht Group Do Veterans Have To Pay Property Taxes

https://img.hechtgroup.com/1663987909611.jpg

Top 15 States For 100 Disabled Veteran Benefits CCK Law

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Hecht Group Oklahoma Property Tax Exemption For Disabled Veterans

https://img.hechtgroup.com/1664933010645.jpg

New York State Department of Veterans Services Make an appointment 1 888 838 7697 Veterans Crisis line 988 Press 1 The NYS Senate approved legislation S 2028 sponsored by Senator Joseph P Addabbo Jr a member of the Veterans Homeland Security and Military Affairs Committee

The New York City Department of Finance s Alternative Veterans exemption provides a property tax exemption to qualifying veterans the spouses or un remarried widow er s of Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes Others are partially exempt such as

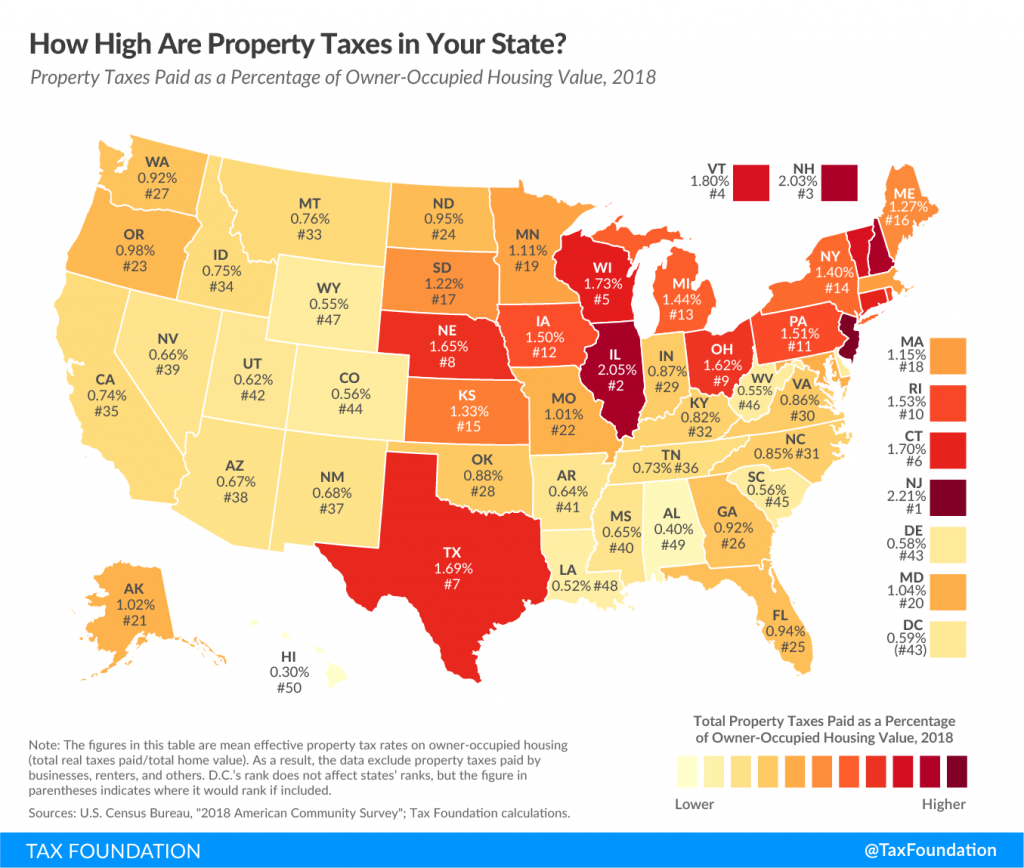

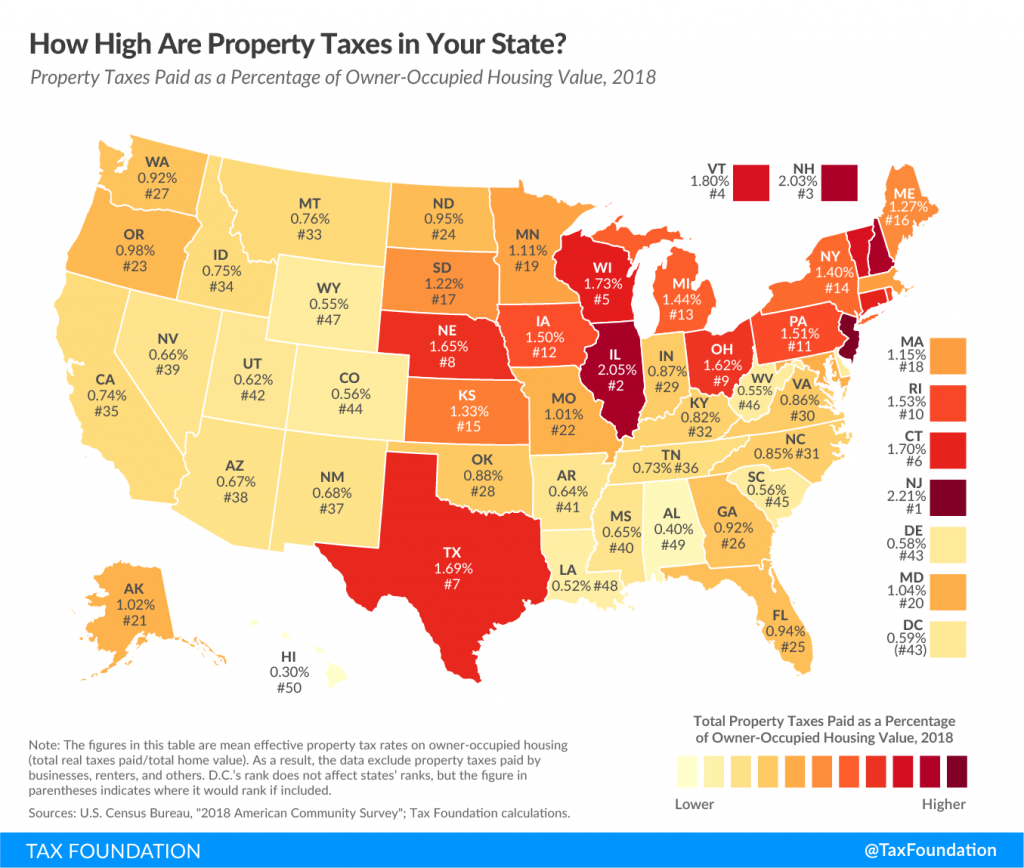

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

Tax Exemption Form For Veterans ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/veterans-property-tax-exemption-application-form-printable-pdf-download-1.png

https://veterans.ny.gov › property-tax-exemptions-veterans

There are three different property tax exemptions available to Veterans who have served in the United States Armed Forces Alternative Veterans Exemption Cold War Veterans

https://www.tax.ny.gov › pdf › current_forms › orpts

New York State NYS Real Property Tax Law section 458 a provides a limited exemption from real property taxes for real property owned by persons who rendered military service to the

State Lodging Tax Exempt Forms ExemptForm

How High Are Property Taxes In Your State American Property Owners

FAQ Veterans School Tax Exemption

2023 Disabled Veteran Property Tax Exemption Lake County Veterans And

Florida Military Exemption Tax Form Fill Out And Sign Printable PDF

Disabled Veterans Property Tax Exemptions By State

Disabled Veterans Property Tax Exemptions By State

Jefferson County Property Tax Exemption Form ExemptForm

Property Tax Exemption For Disabled Veterans

Seniors And Veterans Can Now Apply For Property Tax Exemption KGAN

New York State Property Tax Exemption For Veterans - In 2023 qualifying Veterans can receive a property tax exemption of up to 161 083 on the full value of their property or up to 241 627 for Veterans whose annual household income does not exceed 72 335