R D Tax Rebate Web 11 ao 251 t 2023 nbsp 0183 32 The 2023 Worldwide R amp D Incentives Reference Guide contains the latest updates as of February 2023 summarizing key incentives across 46 jurisdictions

Web 4 oct 2017 nbsp 0183 32 Research and Development R amp D tax relief Find information on the different types of Corporation Tax relief for companies that work on R amp D and what you need to do Web 23 d 233 c 2015 nbsp 0183 32 HM Revenue amp Customs Published 23 December 2015 Last updated 20 July 2023 See all updates Get emails about this page Contents Small and medium

R D Tax Rebate

R D Tax Rebate

https://www.abgi-uk.com/wp-content/uploads/2020/10/RD-Tax-Relief-Stats_-national_OCT20-copy.png

EOFY R D TAX REBATE ARE YOU ELIGIBLE

https://wynnes.com.au/media/k2/items/cache/4ab4b6df96c060fa741e97b50eafb07c_XL.jpg

Tax Rebate Solutions Professionalism Transparency Integrity

https://taxrebatesolutions.com/wp-content/uploads/2020/07/TRS-Logo1-Web2.png

Web R amp D Tax Credit and Deductions August 23 2022 The research and development tax credit is one of the most significant domestic tax credits remaining under current tax law Savvy Web 20 mars 2023 nbsp 0183 32 The Chancellor has announced the introduction of additional targeted relief for loss making research and development R amp D intensive small and medium sized

Web 21 nov 2022 nbsp 0183 32 Reforms to R amp D tax reliefs HTML Details For expenditure on or after 1 April 2023 the Research and Development Expenditure Credit RDEC rate will increase from Web 1 janv 2007 nbsp 0183 32 How to claim R amp D expenditure credit RDEC for Corporation Tax relief on your company s R amp D if you re a large company or small and medium sized enterprise

Download R D Tax Rebate

More picture related to R D Tax Rebate

R D Tax Rebates Iuadvice

https://independentutilityadvice.org.uk/assets/imgs/r_and_d.jpg

Hedy Brent

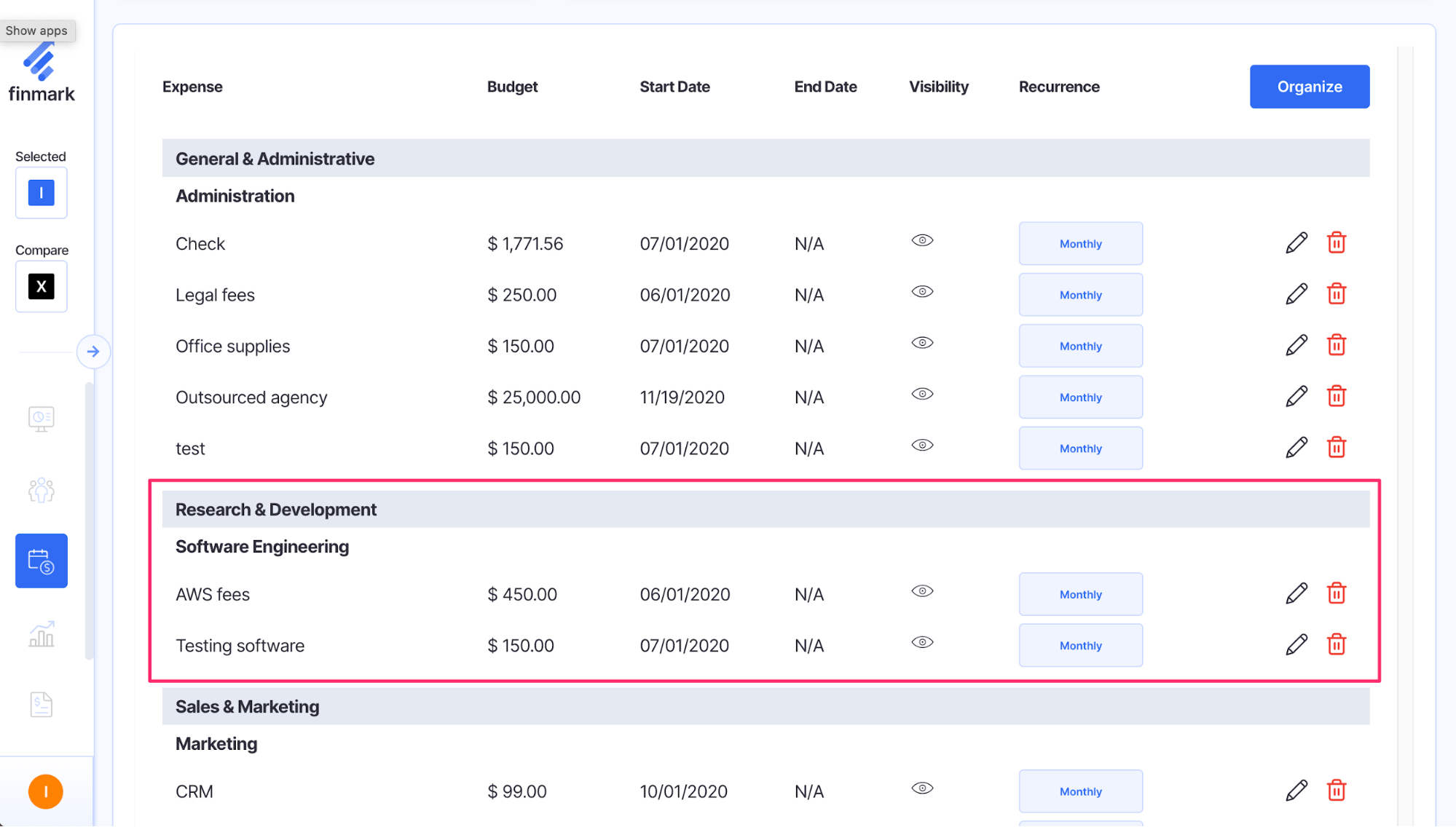

https://finmark.com/wp-content/uploads/2021/02/research-and-development-expenses.png

R D Tax Credit Denied Where Taxpayer Failed To Demonstrate And Document

https://f.hubspotusercontent40.net/hubfs/3465794/R&D-Tax-Credit.jpg

Web 15 mars 2023 nbsp 0183 32 These changes will affect companies that carry out Research amp Development R amp D and claim R amp D tax relief under either of two schemes the Web 30 nov 2021 nbsp 0183 32 R amp D Tax Reliefs Report A report on Research and Development R amp D tax reliefs with detail of changes announced at Budget and next steps It provides a

Web The measure The government has announced a number of measures in relation to the research and development R amp D tax relief regimes and the ongoing R amp D reforms to Web 1 juil 2021 nbsp 0183 32 Research and development tax incentive Apply for the research and development R amp D tax offset for income years commencing on or after 1 July 2021 See

Reasons To Do Business In Ireland Research And Development R D Tax

http://www.robertsnathan.com/wp-content/uploads/2015/10/RD-edit.jpg

Residents Urged To Cash Energy Rebate Cheques Rotherham Metropolitan

https://www.rotherham.gov.uk/images/Council_Tax_rebate.JPG

https://www.ey.com/en_gl/tax-guides/worldwide-r-and-d-incentives...

Web 11 ao 251 t 2023 nbsp 0183 32 The 2023 Worldwide R amp D Incentives Reference Guide contains the latest updates as of February 2023 summarizing key incentives across 46 jurisdictions

https://www.gov.uk/.../collections/research-and-development-rd-tax-relief

Web 4 oct 2017 nbsp 0183 32 Research and Development R amp D tax relief Find information on the different types of Corporation Tax relief for companies that work on R amp D and what you need to do

R D Tax Credits For Software Development Everything You Need To Know

Reasons To Do Business In Ireland Research And Development R D Tax

Pin On Tigri

Home RD Tax Rebate

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

2007 Tax Rebate Tax Deduction Rebates

2007 Tax Rebate Tax Deduction Rebates

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Council Tax Rebate Single Person

R D Tax Rebate - Web 30 juin 2021 nbsp 0183 32 For R amp D entities with aggregated turnover of less than 20 million the refundable R amp D tax offset is your corporate tax rate plus an 18 5 premium Turnover