Ni Tax Rebate Web Applying for Rate Rebate To claim Rate Rebate you must be entitled to Universal Credit You apply online for Rate Rebate Before you can apply you need to create a Rate

Web To get Rate Rebate tenants and homeowners must apply online to Land amp Property Services LPS Contents Housing rent Universal Credit People eligible for Rate Rebate Web 22 mai 2023 nbsp 0183 32 At the start of the new tax year on 6 April 2022 workers started paying more national insurance The NI rate increased by 1 25 taking the amount you pay from

Ni Tax Rebate

Ni Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/banner-img.png

Leonardo Dicaprio Wolf Of Wall Street Meme Imgflip

https://i.imgflip.com/wx6b5.jpg

Why Is My Tax Rebate So Low Lowesrebate

https://www.lowesrebate.net/wp-content/uploads/2022/08/why-is-my-tax-rebate-so-low.jpg

Web 1 f 233 vr 2022 nbsp 0183 32 For those new to a childcare voucher scheme from that date the amount that s disregarded for National Insurance contributions purposes is 163 55 a week for ordinary rate Web 6 nov 2022 nbsp 0183 32 The NI increase was due to be replaced by a new Health and Social Care Levy at a rate of 1 25 in April 2023 But the government has now scrapped these

Web 31 ao 251 t 2007 nbsp 0183 32 The tax relief on these three tranches of payment is calculated at the rate of 22 per cent of the employee element of the rebate which is deemed to be 1 6 per cent Web Il y a 1 jour nbsp 0183 32 All Minnesota taxpayers with a 2021 adjusted gross income of 75 000 or less are eligible for a payment of 260 Married couples that jointly filed taxes in 2021 with an

Download Ni Tax Rebate

More picture related to Ni Tax Rebate

My Tax Rebate Application My Tax Rebate

https://www.mytaxrebate.co.uk/wp-content/uploads/2021/01/Apply-MTR-768x286.png

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/27/773/27773189/large.png

Web Claim a National Insurance rebate self employed with profits over 163 6 725 for 2023 24 In some circumstances it is possible to overpay NICs for example if you are self Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get the

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web All the information to claim back a national insurance refund is on Gov UK There are different procedures depending on the Class of NICs and the reason that you are

Uniform Tax Rebate Claim HMRC My Tax Rebate

https://www.mytaxrebate.co.uk/wp-content/uploads/2021/04/Plain-Style-MTR-Insta.png

Tax Ireland How To Claim Tax Back My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/10/How-It-Works-Webpage-Content-Final-Resized.png

https://www.nidirect.gov.uk/articles/applying-rate-rebate

Web Applying for Rate Rebate To claim Rate Rebate you must be entitled to Universal Credit You apply online for Rate Rebate Before you can apply you need to create a Rate

https://www.nidirect.gov.uk/articles/homeowners-and-tenants-applying...

Web To get Rate Rebate tenants and homeowners must apply online to Land amp Property Services LPS Contents Housing rent Universal Credit People eligible for Rate Rebate

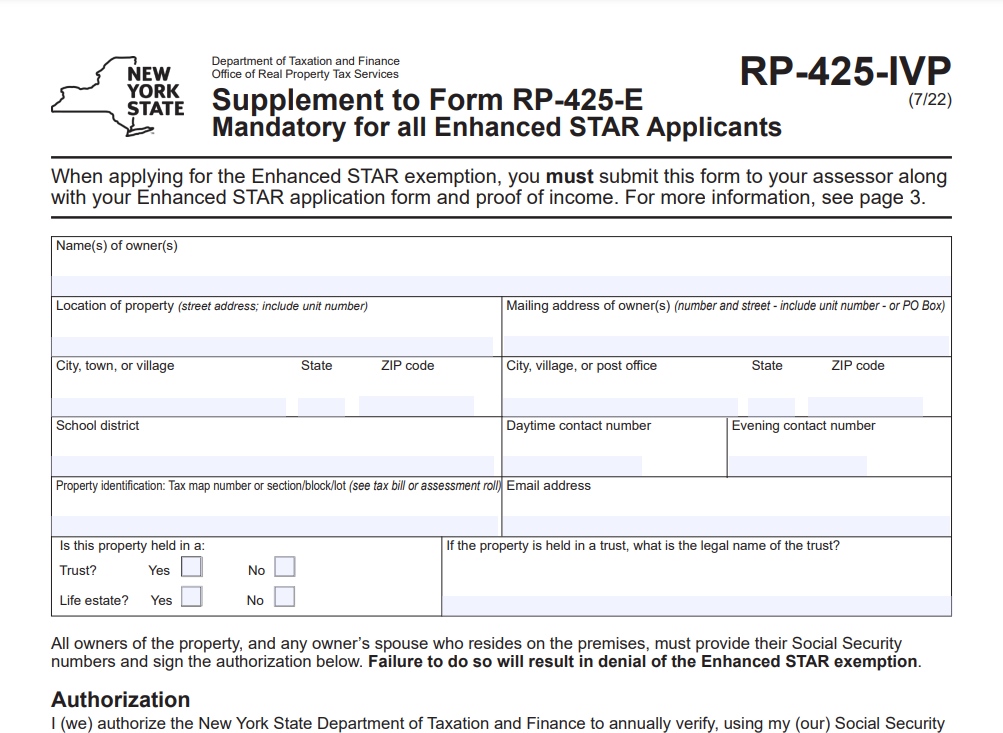

NYS Property Tax Rebate 2023 Eligibility Criteria And Application

Uniform Tax Rebate Claim HMRC My Tax Rebate

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

4 150

Revenue Taxback Tax Returns Ireland My Tax Rebate

The 150 Council Tax Rebate

The 150 Council Tax Rebate

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Can I Claim Ppi Back From My Catalogue

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Ni Tax Rebate - Web 1 f 233 vr 2022 nbsp 0183 32 For those new to a childcare voucher scheme from that date the amount that s disregarded for National Insurance contributions purposes is 163 55 a week for ordinary rate