Nj Homestead Rebate 2023 Application Web All other applicants have until Friday December 29 2023 to file applications All property tax relief program information provided here is based on current law and is subject to

Web 14 juil 2023 nbsp 0183 32 Homestead Benefit Program The filing deadline for the 2018 Homestead Benefit was November 30 2021 The Affordable New Jersey Communities for Web 11 janv 2023 nbsp 0183 32 The state says up to 2 million taxpayers both homeowners and renters should get an average rebate of 971 from the ANCHOR program which is short for the Affordable New Jersey

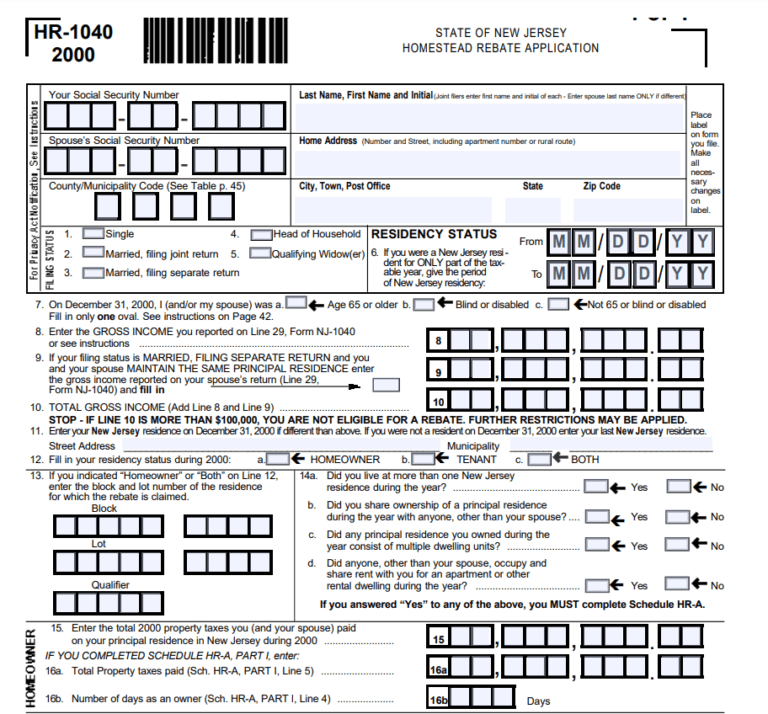

Nj Homestead Rebate 2023 Application

Nj Homestead Rebate 2023 Application

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/2018-new-jersey-homestead-rebate-application-fill-out-sign-online-1.png?w=770&ssl=1

Nj Homestead Rebate 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/homestead-rebate-not-received-this-year-hackettstown-nj.png

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/New-Jersey-Tax-Rebate-2023.jpg?ssl=1

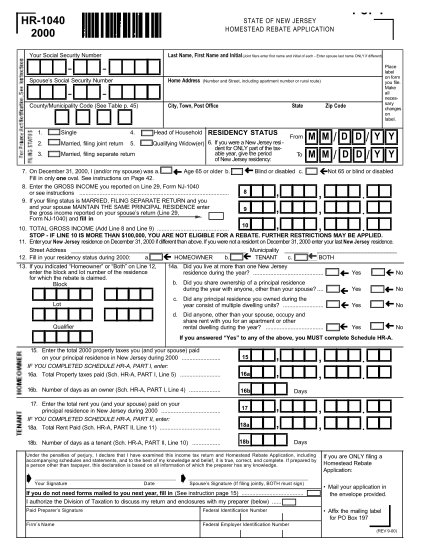

Web 8 sept 2022 nbsp 0183 32 A You re correct that the ANCHOR program will be replacing the Homestead Rebate That s short for the Affordable New Jersey Communities for Homeowners and Web All other applicants have until Friday December 29 2023 to file applications When will I receive my ANCHOR Benefit Payments will be issued on a rolling basis Most

Web 7 sept 2022 nbsp 0183 32 The applications will be available this fall by phone or mail like the Homestead Rebate and need to be completed by Dec 30 and benefits are expected to Web 19 oct 2022 nbsp 0183 32 Applications for the Anchor program can be made online by phone at 877 658 2972 or with a paper application The filing deadline is Dec 30 2022 The Homestead Rebate program does not

Download Nj Homestead Rebate 2023 Application

More picture related to Nj Homestead Rebate 2023 Application

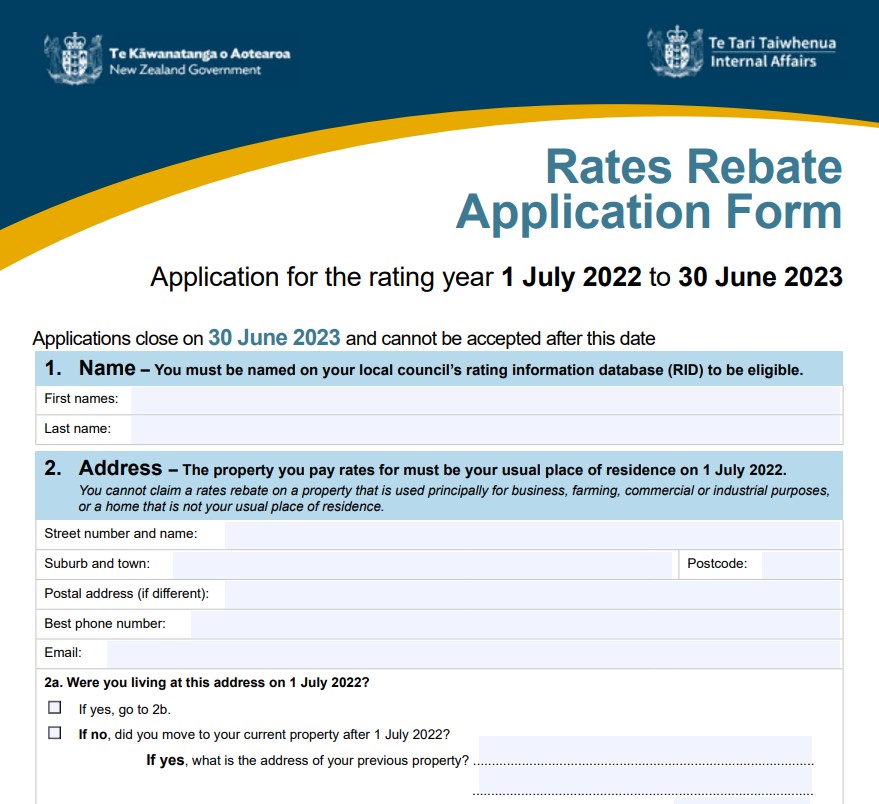

NJ Home Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/01/NJ-Rent-Rebate-Form-2023-768x707.png

Missouri Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

File Nj Homestead Rebate Form Online Application Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online-768x714.png

Web 18 juil 2022 nbsp 0183 32 In late June with the June 30 budget adoption deadline approaching the governor announced an expansion of the ANCHOR program proposal with tax rebates Web 12 ao 251 t 2022 nbsp 0183 32 Nj Homestead Rebate 2023 Application Illinois Taxpayers who live in Illinois will receive their tax free rebate in the spring of 2023 The tax payers must file

Web 1 juil 2023 nbsp 0183 32 According to the law eligible homeowners and renters 65 and older in the Garden State will get an immediate increase of 250 in the fiscal year that starts Saturday under an existing rebate Web 24 avr 2023 nbsp 0183 32 How to Apply You can apply for the NJ Senior Freeze Program by completing the application form and submitting it along with the required documents You can

Is There A Nj Homestead Rebate For 2023 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/what-happens-to-the-homestead-rebate-and-my-tax-return-njmoneyhelp.jpg?w=689&h=458&ssl=1

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

https://www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-iowa-energy-rebates-printable-rebate-form-from-bayer-rebates-2023-post.png

https://www.state.nj.us/treasury/taxation/anchor/home.shtml

Web All other applicants have until Friday December 29 2023 to file applications All property tax relief program information provided here is based on current law and is subject to

https://www.nj.gov/treasury/taxation/homestead/geninf.shtml

Web 14 juil 2023 nbsp 0183 32 Homestead Benefit Program The filing deadline for the 2018 Homestead Benefit was November 30 2021 The Affordable New Jersey Communities for

O Reilly Rebate Status Printable Rebate Form Rebate2022

Is There A Nj Homestead Rebate For 2023 Rebate2022

Gst New Housing Rebate Application Form Printable Rebate Form

121 P45 Form Page 4 Free To Edit Download Print CocoDoc

South Jersey Seniors Stressed About Homestead Property Tax Rebate Delay

Alconchoice Rebate 2023 Printable Rebate Form

Alconchoice Rebate 2023 Printable Rebate Form

Can I Qualify For The Homestead Rebate If A Trust Owns My Condo Nj

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

2023 Rent Rebate PA Eligibility Application Process And Deadlines

Nj Homestead Rebate 2023 Application - Web 8 sept 2022 nbsp 0183 32 A You re correct that the ANCHOR program will be replacing the Homestead Rebate That s short for the Affordable New Jersey Communities for Homeowners and