Nj Homestead Rebate Phone Number Web Automated Phone Numbers General Tax Information 609 826 4400 or 1 800 323 4400 Listen to prerecorded information on common tax issues Homestead Benefit Filing and

Web Your 2020 New Jersey gross income was not more than 250 000 New ANCHOR Benefit Confirmation Letter Filing deadline If you received the ANCHOR Benefit Confirmation Web 20 sept 2022 nbsp 0183 32 Calling the program s enrollment number 877 658 2972 which residents have been told to call to apply online once they receive their mailing or email packet

Nj Homestead Rebate Phone Number

Nj Homestead Rebate Phone Number

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/2018-new-jersey-homestead-rebate-application-fill-out-sign-online.png

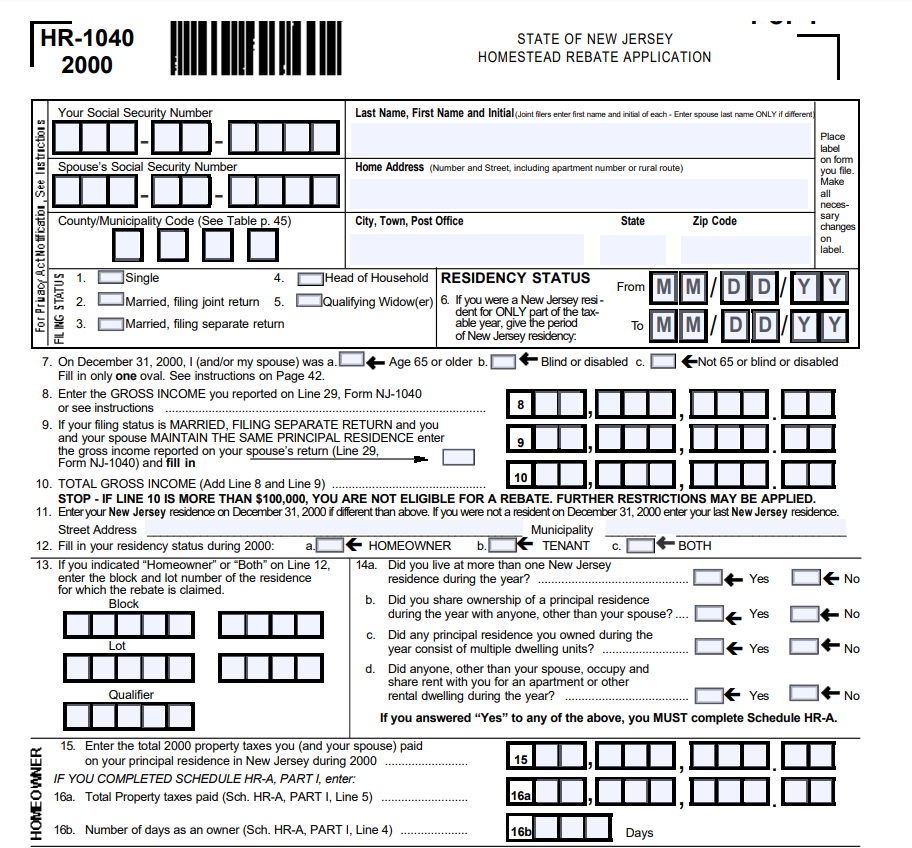

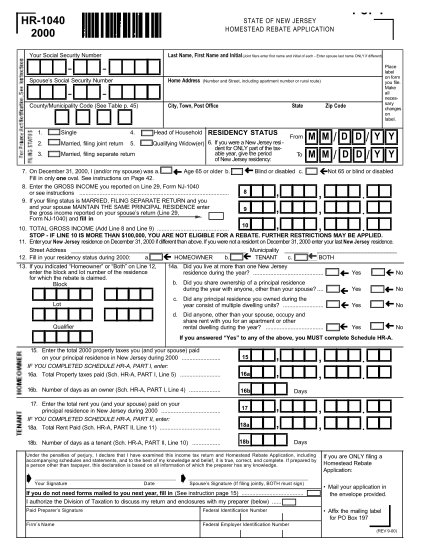

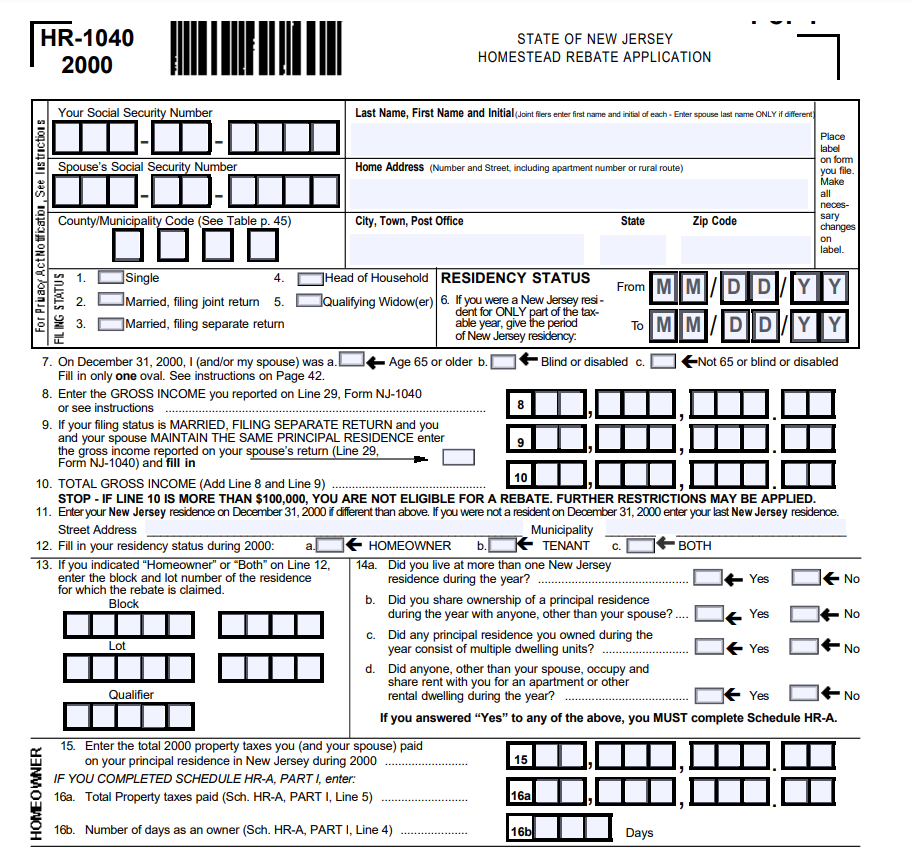

NJ Homestead Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/File-NJ-Homestead-Rebate-Form-Online.png

2018 New Jersey Homestead Rebate Application Fill Out Sign Online

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/2018-new-jersey-homestead-rebate-application-fill-out-sign-online-1.png?w=770&ssl=1

Web 27 sept 2021 nbsp 0183 32 You will need the assigned Identification Number and PIN of your principal residence you owned and occupied on Oct 1 2018 to file by phone at 877 658 2972 Web Most homeowners may file online or by phone at 877 658 2972 with an identification number ID and PIN However if you bought your home in 2020 altered your deed or

Web the date we issued a benefit including if it was applied to your property tax bill for tax year 2018 To use this service you will need your valid Social Security Number SSN Web 18 nov 2022 nbsp 0183 32 To be eligible for this year s benefit homeowners and renters must have occupied their primary residence on October 1 2019 and file or be exempt from NJ

Download Nj Homestead Rebate Phone Number

More picture related to Nj Homestead Rebate Phone Number

121 P45 Form Page 4 Free To Edit Download Print CocoDoc

https://cdn.cocodoc.com/cocodoc-form/png/64456293--HR-1040-Homestead-Rebate-Application-State-of-New-Jersey-nj--x-01.png

Can I Qualify For The Homestead Rebate If A Trust Owns My Condo Nj

https://www.nj.com/resizer/CSsRqnnhfZgKnX0qCL2rTateEpg=/1280x0/smart/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/WLTTETQJCZEB3KZCLMQOR775T4.jpg

N J s New ANCHOR Property Tax Program Your Questions Answered Nj

https://www.nj.com/resizer/mG8HoEC03Z_laQKwr9yycp9fj8o=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OCDIN5URIBBRVLQX5ZOGNBVHZI.jpg

Web 17 nov 2021 nbsp 0183 32 Questions 1 888 238 1233 or in person assistance at Taxation Regional Information Centers nj gov treasury taxation contact shtml The email address for Web 10 juin 2020 nbsp 0183 32 What is the NJ homestead rebate program Who s eligible for the program How much is the rebate worth How can I get the rebate Is other New Jersey property tax relief available How has COVID 19

Web 18 juil 2022 nbsp 0183 32 Under the ANCHOR program homeowners would be eligible for an average first year rebate of 700 if income does not exceed 250 000 he said In late June Web 13 sept 2022 nbsp 0183 32 Eligible homeowners and rents will be able to apply either online by phone or via mail similar to the Homestead Rebate s process To receive a paper

NJ Homestead Rebate Due 11 30 2018 YouTube

https://i.ytimg.com/vi/GvEfUWo4XYI/maxresdefault.jpg

How Can I Apply For ANCHOR The New Property Tax Relief Program NJ

https://i2.wp.com/www.nj.com/resizer/w1al58UkdvTw2WgJCNb1BKP-qeE=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/ZBN6IUATPVHXXHEESAUNOWSDTE.jpg?resize=780,470

https://nj.gov/treasury/taxation/contact.shtml?open=call

Web Automated Phone Numbers General Tax Information 609 826 4400 or 1 800 323 4400 Listen to prerecorded information on common tax issues Homestead Benefit Filing and

https://www.state.nj.us/treasury/taxation/anchor/home.shtml

Web Your 2020 New Jersey gross income was not more than 250 000 New ANCHOR Benefit Confirmation Letter Filing deadline If you received the ANCHOR Benefit Confirmation

Fortune Salaire Mensuel De Nj Budget 2022 Homestead Rebate Combien

NJ Homestead Rebate Due 11 30 2018 YouTube

Can The State Seize My Homestead Rebate And Give It To The IRS Nj

Nj Homestead Rebate 2022 Renters RentersRebate

I Missed The Homestead Rebate Deadline What Now Nj PropertyRebate

If I Sell My Home Do I Get The Homestead Rebate Biz Brain Nj

If I Sell My Home Do I Get The Homestead Rebate Biz Brain Nj

Berkeley Mayor Wants State To Restore Full Homestead Rebate Berkeley

NJ Property Tax Rebate Thousands Waiting For ANCHOR Credit

NJ Tax Rebate The ANCHOR Program Formerly Homestead Rebates

Nj Homestead Rebate Phone Number - Web the date we issued a benefit including if it was applied to your property tax bill for tax year 2018 To use this service you will need your valid Social Security Number SSN