Nj Property Tax Deduction Income Limit Web 4 Dez 2023 nbsp 0183 32 The property tax deduction reduces your taxable income You can deduct your property taxes paid or 15 000 whichever is less For Tax Years 2017 and earlier

Web All examples assume all other prerequisites for eligibility for Property Tax Deduction have been met Income may be excluded from only ONE of the three categories when Web 21 Juni 2023 nbsp 0183 32 Under the program known as StayNJ any homeowner 65 or older with an annual income of 500 000 or less would be eligible for the tax cut starting in January 2026

Nj Property Tax Deduction Income Limit

Nj Property Tax Deduction Income Limit

https://www.nj.com/personal-finance/static/79e571dffad353b7936e2a6162295946/48efe/property-tax-deduction-guide.jpg

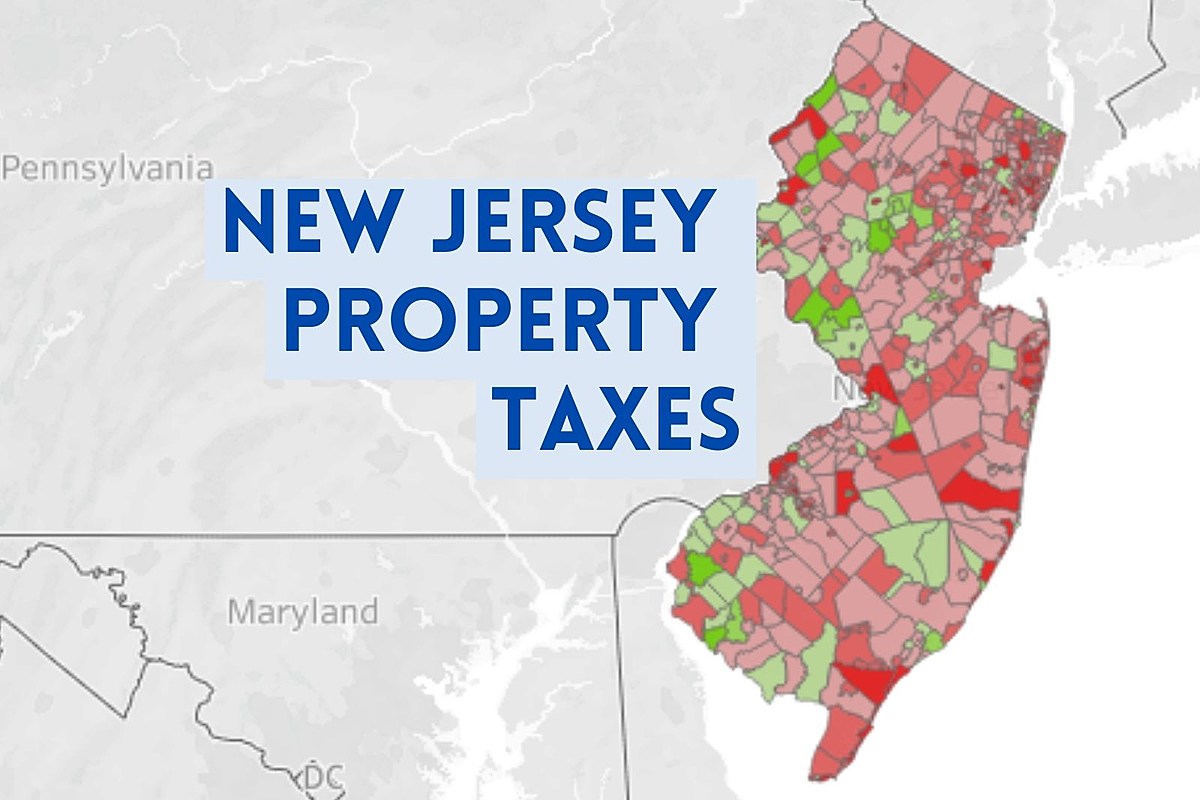

Average NJ Property Tax Bill Near 9 300 Check Your Town Here

https://townsquare.media/site/385/files/2022/01/attachment-New-Jersey-property-taxes.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

Interactive Map Wealthy Suburbs Biggest Winners In NJ Property Tax

https://www.njspotlightnews.org/wp-content/uploads/sites/123/2018/04/assets1804052005.png

Web 5 Dez 2023 nbsp 0183 32 Property Tax Deduction Credit Eligibility Answer Based on the information provided you are eligible to claim a property tax deduction or credit for Tax Year Web Residents of New Jersey that pay property tax on the home they own or rent may qualify for a refundable tax credit or a deduction on their return You may claim only one of the

Web 1 Feb 2023 nbsp 0183 32 Home All Taxes Property Tax Relief Programs Senior Freeze Income Standards Income Standards With few exceptions all income that you received during Web 9 Dez 2021 nbsp 0183 32 Under the proposal taxpayers making up to 400 000 would be able to deduct up to 80 000 in state and local income and property taxes The 80 000 figure

Download Nj Property Tax Deduction Income Limit

More picture related to Nj Property Tax Deduction Income Limit

NJ Property Taxes Have Been Rising At A Slower Pace NJ Spotlight News

https://www.njspotlightnews.org/wp-content/uploads/sites/123/2022/02/Property-tax-graph-pic--900x506.jpg

Income Tax Deductions While Filling ITR In India RJA

https://carajput.com/blog/wp-content/uploads/2017/03/Income-Tax-Deductions-Financial-Year-2020-21..jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Web The benefit is either a deduction from taxable income of the total amount of property taxes paid on principal residence for tenants 18 of rent or 10 000 whichever is Web 18 Okt 2023 nbsp 0183 32 If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction

Web 26 Feb 2023 nbsp 0183 32 The SALT limitations limit the amount of state and local taxes that can be deducted to 10 000 per year 5 000 for those who file married filing separately This includes property taxes Web For 2023 this program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2020 and met the 2020 gross

Property Tax Deduction Exemption In Income Tax Paytm Blog

https://paytm.com/blog/wp-content/uploads/2021/06/MunicipalBill_59_Income-Tax-Deduction-on-Property.jpeg

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

https://www.nj.gov/treasury/taxation/njit35.shtml

Web 4 Dez 2023 nbsp 0183 32 The property tax deduction reduces your taxable income You can deduct your property taxes paid or 15 000 whichever is less For Tax Years 2017 and earlier

https://www.nj.gov/treasury/taxation/pdf/lpt/incomeguidelines…

Web All examples assume all other prerequisites for eligibility for Property Tax Deduction have been met Income may be excluded from only ONE of the three categories when

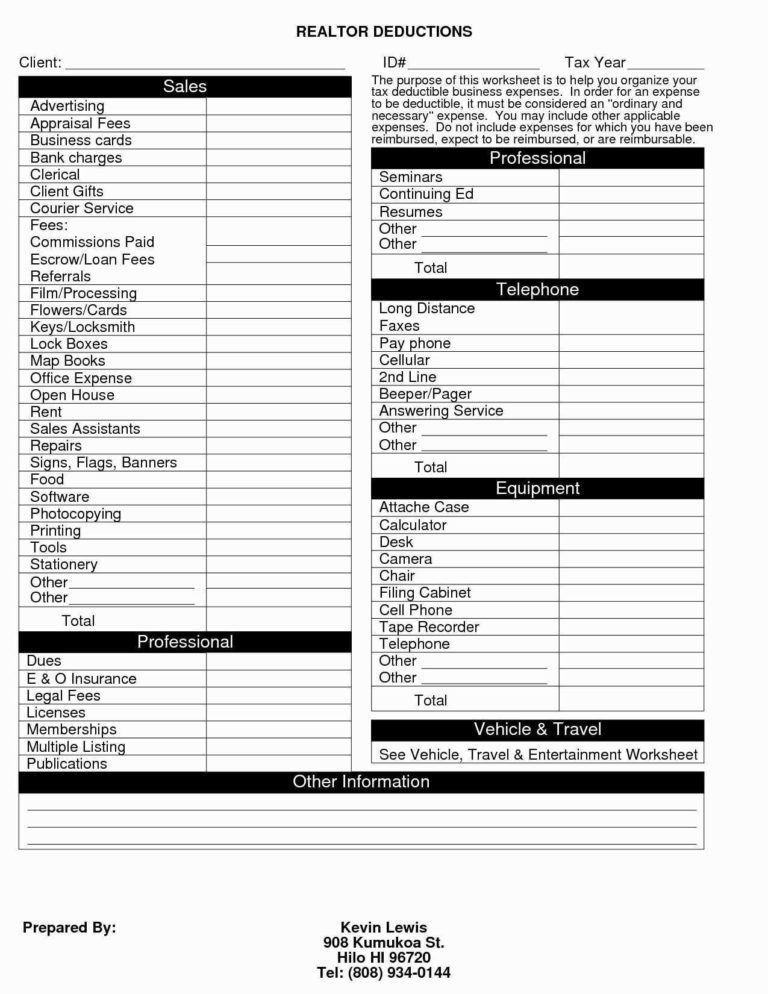

Self Employment Tax Deduction Worksheet

Property Tax Deduction Exemption In Income Tax Paytm Blog

Rental Property Tax Deductions Worksheet

Section 194K Tax Deduction On Income From Mutual Fund Units

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Do I Qualify For The Qualified Business Income QBI Deduction Alloy

Tax Deductions For Financial Year 2018 19 WealthTech Speaks

Irs 2017 Tax Tables Married Filing Jointly Awesome Home

Nj Property Tax Deduction Income Limit - Web 19 Nov 2021 nbsp 0183 32 U S Sen Robert Menendez and Senate Budget Committee Chair Bernie Sanders I Vt are working on a plan to remove the entire cap but impose an income