Non Taxable Payments To Employees Find out about benefits and expenses that you do not need to put on the Employment pages of your tax return This is because they re covered by concessions or

The following benefits provided by your employer are not taxable From 1 January 2022 up to two small benefits that are not in cash and are worth 1 000 or less in total For Your employer may provide you with benefits or pay expenses or reimburse them but these expenses payments and benefits are not always taxable We explain which ones are non taxable below

Non Taxable Payments To Employees

Non Taxable Payments To Employees

https://www.johnsoncpatax.com/wp-content/uploads/2020/04/disaster-relief-blog-800x671.jpg

Taxable Payments Annual Reports TPAR

https://lirp.cdn-website.com/47e41bc5/dms3rep/multi/opt/iStock-1164946738-scaled-1920w.jpg

What Counts As Taxable And Non Taxable Income For 2023

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

Employee discounts are non taxable if they meet certain criteria under IRC Section 132 Discounts on goods or services are non taxable if they do not exceed the employer s Non taxable allowances help employees manage various work related expenses without tax implications A clear understanding of these allowances can aid in efficient tax planning and

For federal purposes if an employer pays or reimburses an employee s professional dues because membership in the association is of benefit to the employer the amount is not a Non taxable employee benefits and payments Benefits on which the employee is not taxable are listed in chapter 5 of HMRC Booklet 480 A tax guide expenses and benefits This can be

Download Non Taxable Payments To Employees

More picture related to Non Taxable Payments To Employees

Taxable Payments Annual Report Tips Yield Business Advisory

https://yieldba.com.au/wp-content/uploads/2021/07/Website-blog-images-4.png

A Round Up Of Some Non taxable Payments And Benefits Purlieus Consulting

https://purlieusconsulting.co.uk/wp-content/uploads/2018/07/2014-12-24-695724.jpg

What Compensation Is Taxable And What s Not GABOTAF

https://gabotaf.com/wp-content/uploads/2020/01/img_3738.jpg

Here s what you need to know about non taxable benefits and allowances 1 What do I need to consider There are lots of things that come under the heading of non Providing non taxable benefits to your staff means you won t need to pay employer s National Insurance contributions on their value and your employee won t need to pay tax on them As ever with anything tax related

Detailed below are 15 various options Where employees work for substantial periods outside the employer s business premises in the course of the performance of the Knowing about taxable and non taxable benefits can help you run your payroll smoothly Learn which benefits are taxable and which are non taxable and how offering them to your

Salary Exchange For Companies By Broadstone Get In Touch With Us

https://www.broadstone.co.uk/wp-content/uploads/2021/09/Untitled-design-58.png

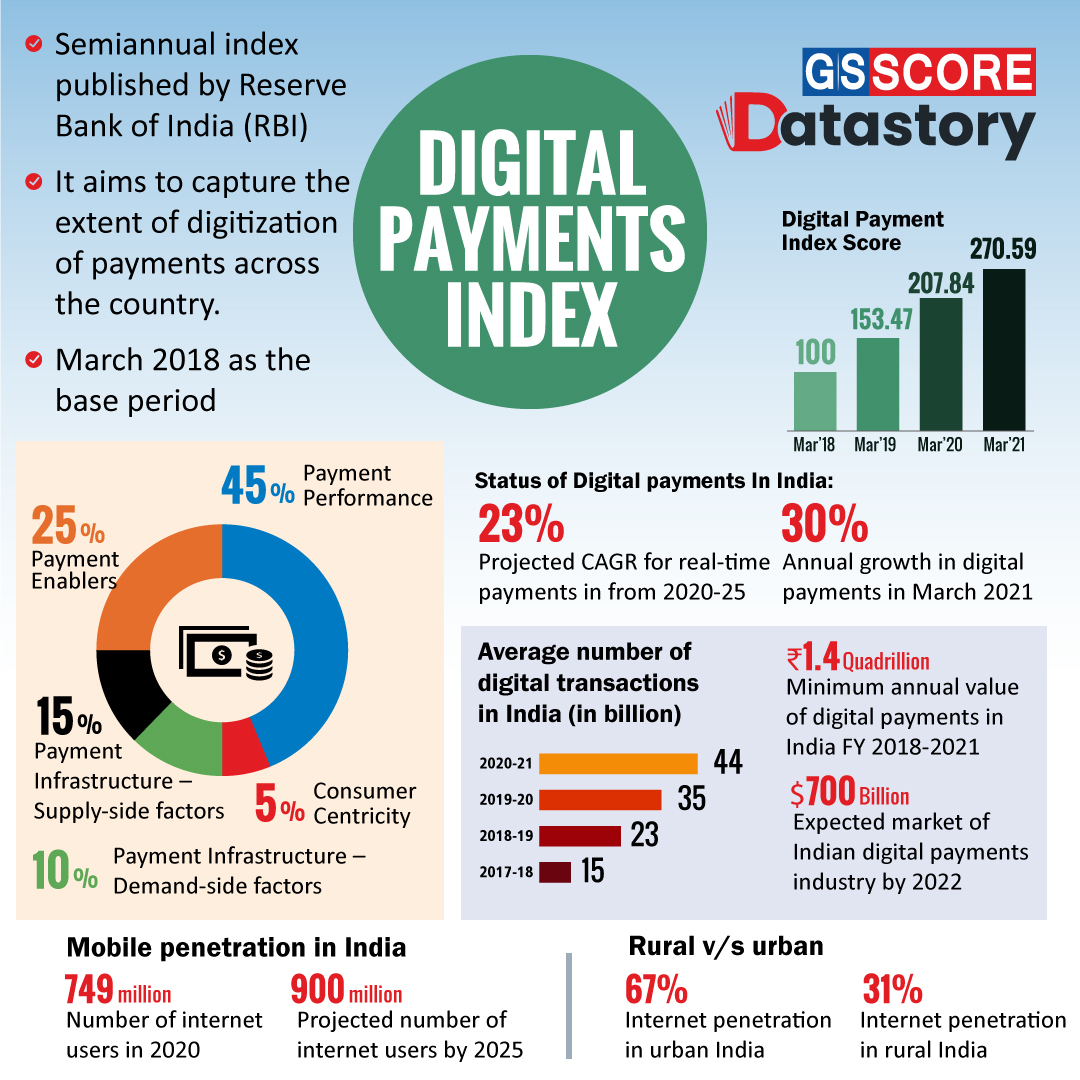

Data Story Digital Payments Index GS SCORE

https://uploads.iasscore.in/image/Datastory-Day-21.jpg

https://www.gov.uk › government › publications › non...

Find out about benefits and expenses that you do not need to put on the Employment pages of your tax return This is because they re covered by concessions or

https://www.revenue.ie › en › jobs-and-pensions › ...

The following benefits provided by your employer are not taxable From 1 January 2022 up to two small benefits that are not in cash and are worth 1 000 or less in total For

Non Taxable Employee Benefits And Payments Sterling Finance

Salary Exchange For Companies By Broadstone Get In Touch With Us

How To Calculate Taxable Income A Comprehensive Guide The Tech Edvocate

Employee Benefits

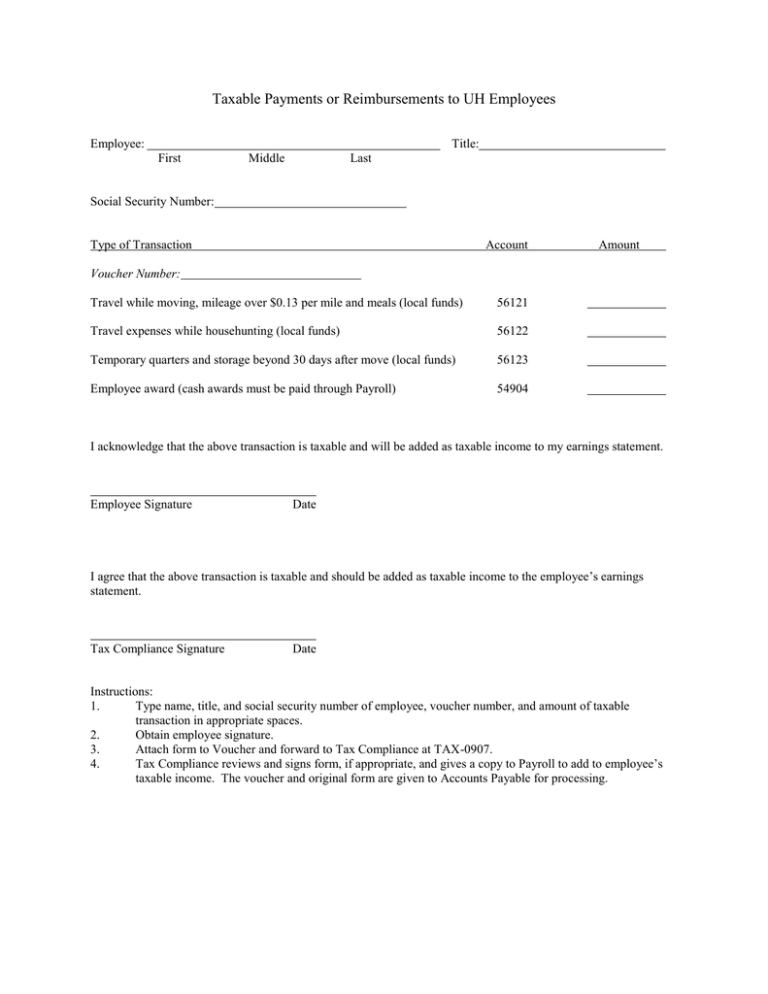

Taxable Payments Or Reimbursements To UH Employees

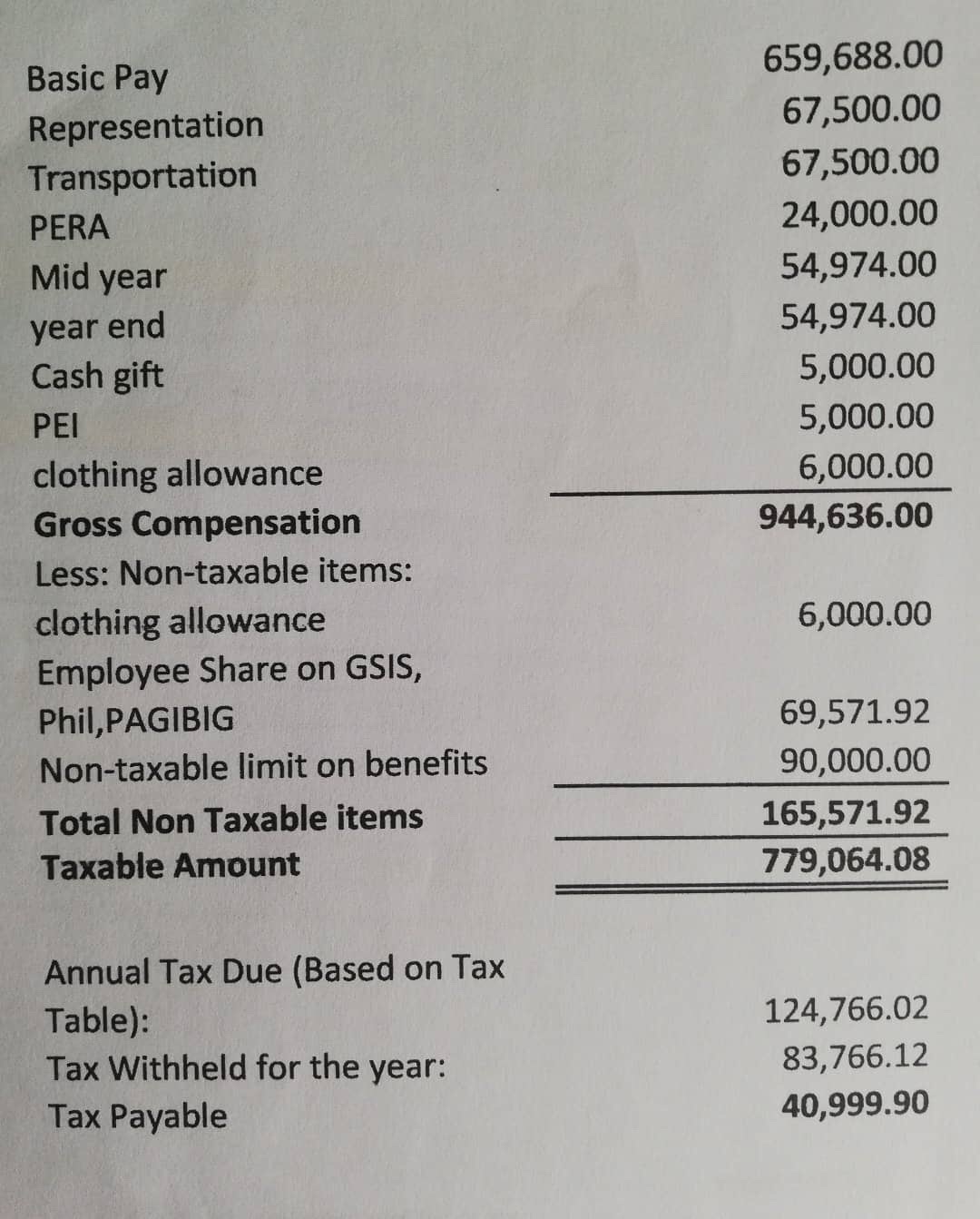

12 Non Taxable Compensation Of Government Employees 12 Non taxable

12 Non Taxable Compensation Of Government Employees 12 Non taxable

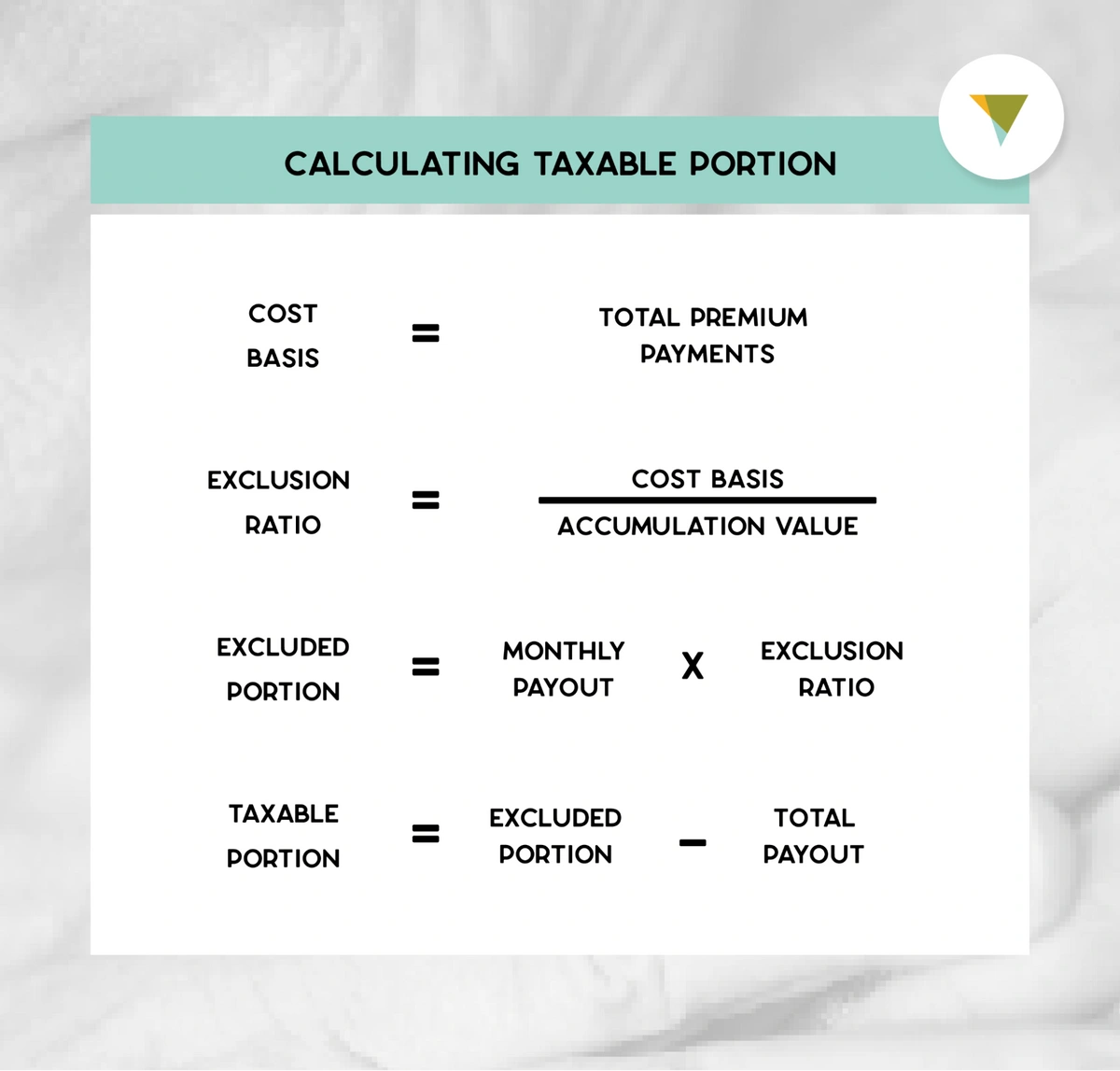

How To Calculate The Taxable Income Of An Annuity

Compensation Taxes And Benefits What Should You Discuss With

P3 14 Entries Directly Into T Accounts Income Statement Hudson Company

Non Taxable Payments To Employees - Employee discounts are non taxable if they meet certain criteria under IRC Section 132 Discounts on goods or services are non taxable if they do not exceed the employer s