Nps Employee Contribution Salary Deduction Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals

A Employee Contribution Deduction upto 10 of salary basic DA within overall ceiling Rs 1 50 Lakh u s 80C B Voluntary Contribution Deduction upto Rs 50 000 u s What are the tax benefits of NPS to employees on Employer contribution As per Section 80 CCD 2 if your employer is also contributing to your NPS account then you can claim a tax deduction of upto 0 of

Nps Employee Contribution Salary Deduction

Nps Employee Contribution Salary Deduction

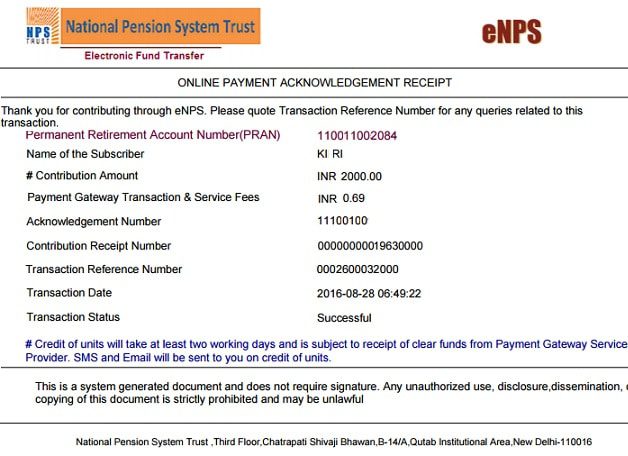

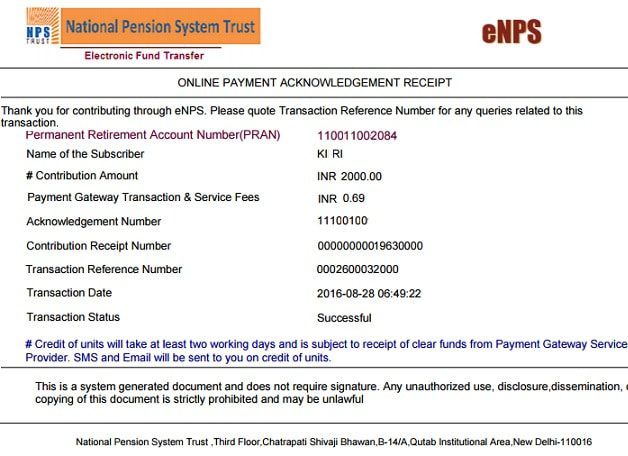

https://bemoneyaware.com/wp-content/uploads/2016/10/nps-contribution-payment-receipt.jpg

Is Employer s Contribution To NPS Added To Gross Salary Value Research

https://www.valueresearchonline.com/content-assets/images/30245_nps-withdrawal-made-tax-free-like-ppf-epf__w660__.jpg

Inform Employees Of Salary Deduction Letter 4 Templates Writolay

https://writolay.com/wp-content/uploads/2021/08/46-letter-to-inform-about-salary-deduction-to-employee.png

Employer s Contribution towards NPS up to 10 of salary Basic DA can be deducted as Business Expense from their Profit Loss Account How to make the Investment to Tax benefits to employees on Self Contribution Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary

Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section

Download Nps Employee Contribution Salary Deduction

More picture related to Nps Employee Contribution Salary Deduction

Creating Employees NPS Deduction Pay Head

https://help.tallysolutions.com/docs/te9rel50/Payroll/Images_1/1_NPS_Employee_Deduction.gif

Government Mandated Employee Benefits In The Philippines 2022

https://25174313.fs1.hubspotusercontent-eu1.net/hubfs/25174313/assets_moneymax/SSS-Contribution-Schedule-Effective-January-2021.jpg

Creating Employer s NPS Contribution Pay Head

https://help.tallysolutions.com/docs/te9rel50/Payroll/Images/5_NPS_Employer_contribution.gif

Employer contributions to NPS are valid expense deductions for businesses from their income Such contributions will reduce the income tax burden for employers NPS Government Contribution An employee can claim a deduction of upto 10 of the salary 14 of the salary in case of Central or State government employee w r t the employer s contribution to NPS

Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS So the total deduction you can claim is 2 lakh For more information on NPS and Govt employee you can read our article NPS and Government Employees

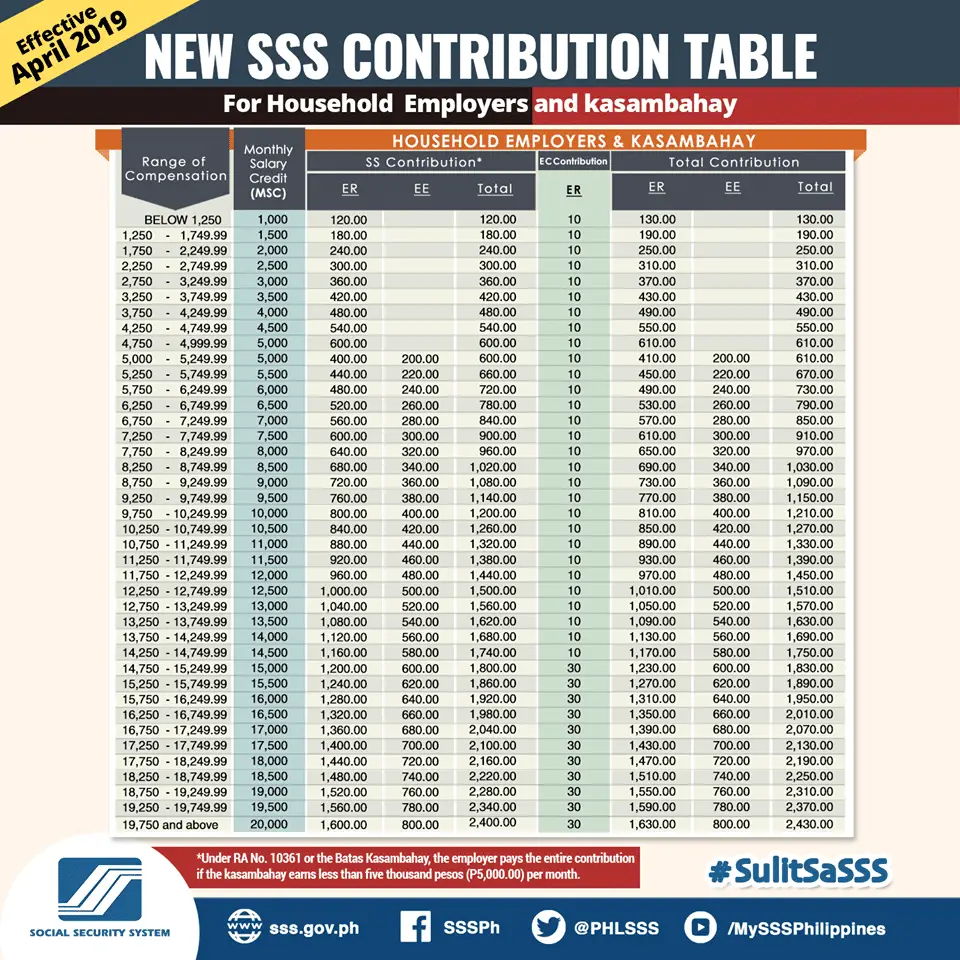

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

What Are EPF Contribution Categories Digi X Master

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/2043419249397/original/ia_CN1nDr2WbSD5KLsNgQD0GLUO2kwbSmg.png?1675844132

https://taxguru.in/income-tax/income-tax …

Section 80CCD 1 of Act provides tax deductions to an individual who contributes to National Pension Scheme NPS The deduction under the section is available to both salaried individuals

https://npscra.nsdl.co.in/download/Nodal Office/NPS...

A Employee Contribution Deduction upto 10 of salary basic DA within overall ceiling Rs 1 50 Lakh u s 80C B Voluntary Contribution Deduction upto Rs 50 000 u s

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

Salary Deduction Letter To Employee For Loan Dollar Keg

2023 Updated SSS Contribution Rate Escape Manila

Deduction Under Section 80CCD 2 For Employer s Contribution To

Why Do Companies Choose Defined Contribution Plans LiveWell

Why Do Companies Choose Defined Contribution Plans LiveWell

SSS Contributions Table And Payment Deadline 2020 SSS Inquiries

Payroll Deduction Form Template

Latest Philhealth Contribution Table 2023 Life Guide PH

Nps Employee Contribution Salary Deduction - A central or state government employer can claim a tax deduction of 14 of the employee s salary Any other employer can claim a tax deduction of 10 of the