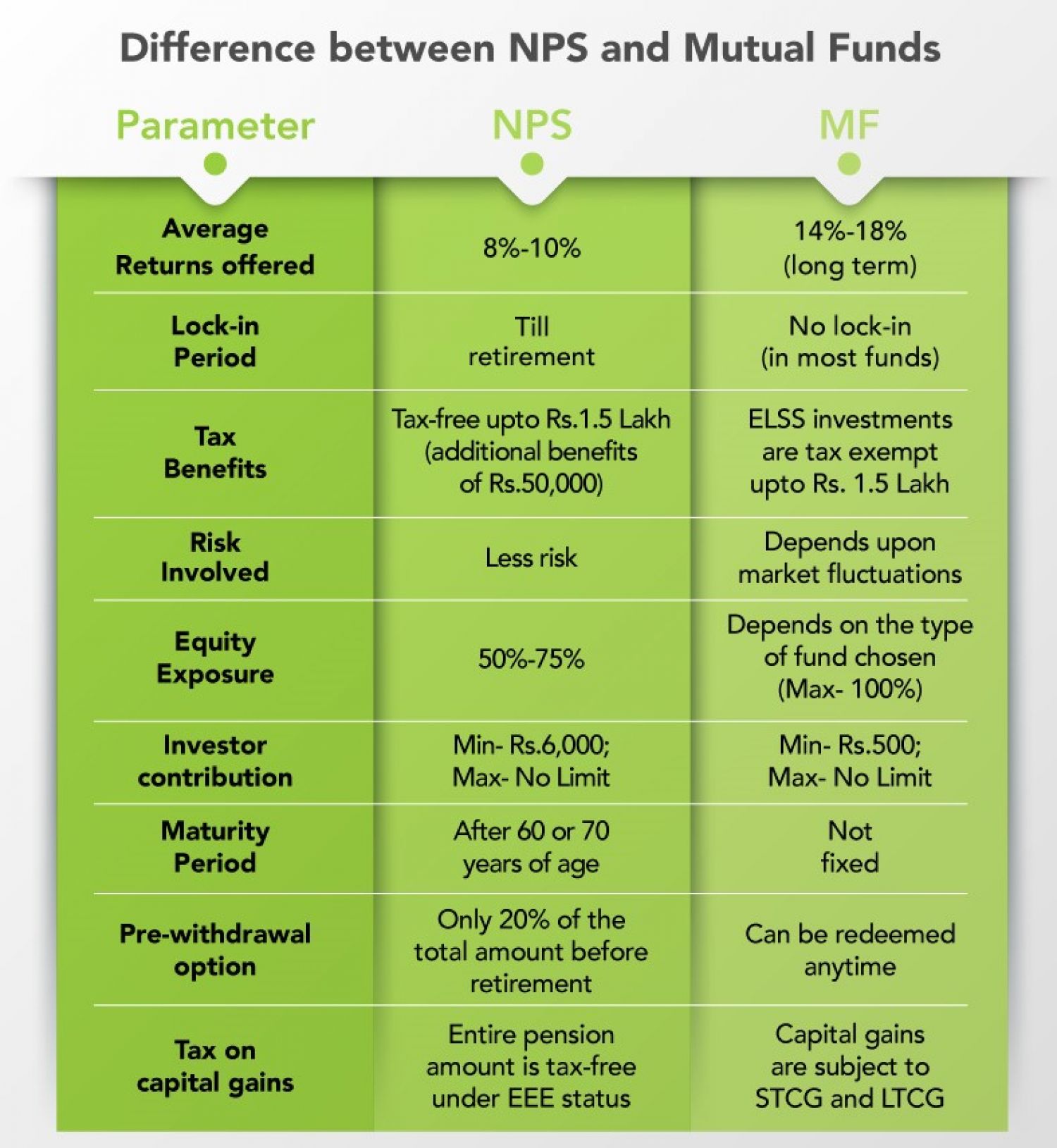

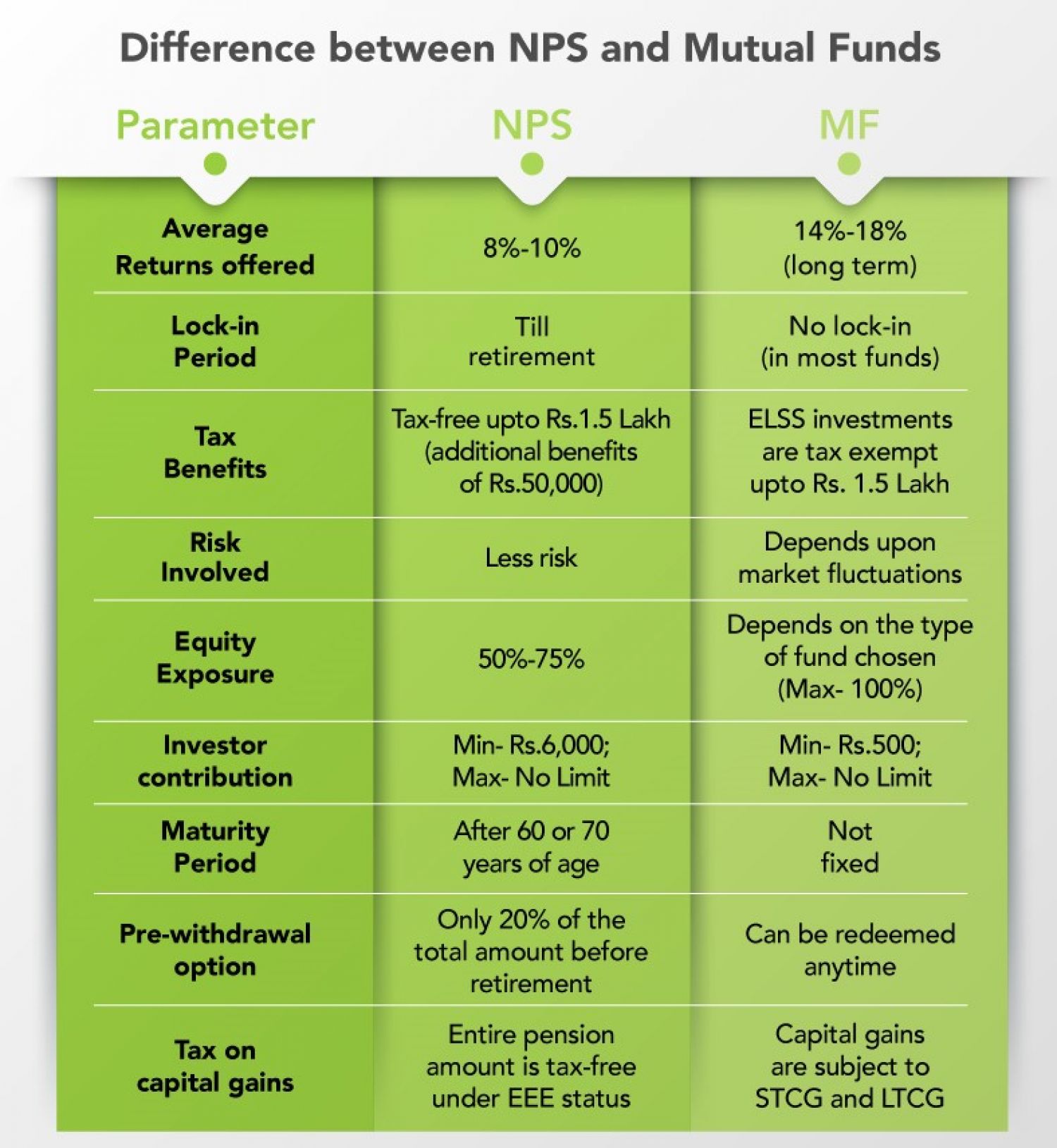

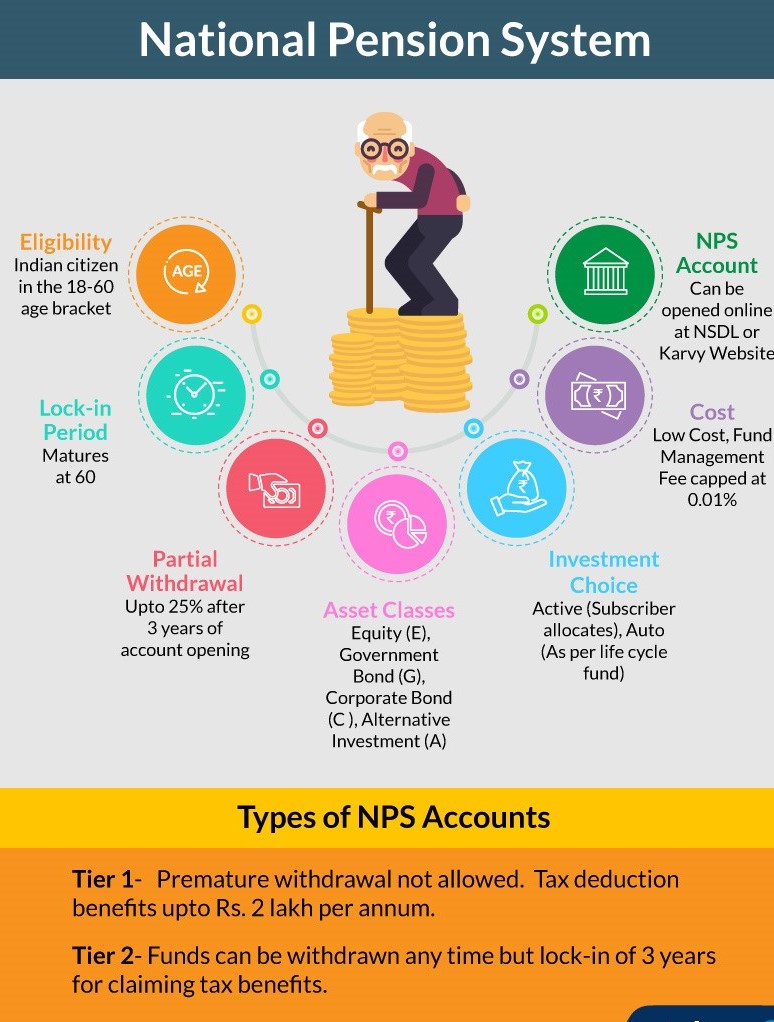

Nps For Tax Deduction Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such contribution is made by the Central Government under Section 80CCD 2 beyond the Rs 1 5 lakh limit provided under Section 80CCE Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and 80CCD 2 under the old income tax regime Tax deductions for investments in NPS are available under the new income tax regime as well

Nps For Tax Deduction

Nps For Tax Deduction

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Should Invest In NPS Just For The Tax Benefits NPS

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

Income Tax Deduction For NPS Subscribers

https://gservants.com/wp-content/uploads/2022/02/Income-Tax-Deduction-for-NPS.png

Tax Benefits Under NPS As Per June 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act 1961 Contribution towards NPS by the taxpayer himself allows deduction from the Gross Total Income of an individual in three different sections of the Income tax Act 1961 viz Sec 80CCD 1 80CCD 1B and will be available only under the old tax regime

Under this section employees can claim a tax deduction of up to 10 of their salary which includes basic pay and dearness allowance However the NPS rules for Government employees are slightly different Government employees can claim a tax deduction of up to 14 of salary Employer s Contribution towards NPS up to 10 of salary Basic DA can be deducted as Business Expense from their Profit Loss Account How to make the Investment to avail the Tax Benefit

Download Nps For Tax Deduction

More picture related to Nps For Tax Deduction

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD 1 of Income Tax Act up to 10 of salary Basic DA Self contribution of up to Rs 50 000 can be claimed as an NPS tax deduction NPS employee contributions to Tier II accounts are not eligible for any benefits However these contributions are liquid meaning they can be withdrawn at any time according to the NPS Withdrawal rule

Under the updated tax regulations individuals can avail the advantage of employer contributions to their National Pension System NPS account as per Section 80CCD 2 of the Income Tax Act Section 80CCD 2 of the Income Tax Act allows employed individuals to claim income tax deductions for employer contributions It is conditional on the following Employees in the private sector can deduct up to 10 of their compensation base salary dearness allowance under Section 80CCD 2

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

https://www.relakhs.com/wp-content/uploads/2019/08/Latest-NPS-Income-Tax-Benefits-for-FY-2019-2020-AY-2020-2021-pic.jpg

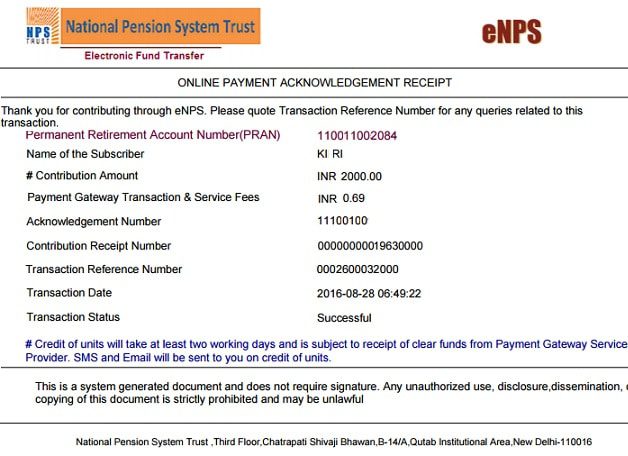

Nps contribution payment receipt

https://bemoneyaware.com/wp-content/uploads/2016/10/nps-contribution-payment-receipt.jpg

https://cleartax.in/s/section-80-ccd-1b

Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction on the NPS contribution of up to 10 of salary 14 of salary for

https://cleartax.in/s/nps-national-pension-scheme

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such contribution is made by the Central Government under Section 80CCD 2 beyond the Rs 1 5 lakh limit provided under Section 80CCE

What Will My Tax Deduction Savings Look Like The Motley Fool

Latest NPS Income Tax Benefits 2019 20 Tax Saving Through NPS

Nps Contribution By Employee Werohmedia

Is Deduction For NPS Available Under New Tax Section 115BAC

10 2014 Itemized Deductions Worksheet Worksheeto

NPS Deduction In Income Tax 2023 Guide India s Leading Compliance

NPS Deduction In Income Tax 2023 Guide India s Leading Compliance

Income Tax Slabs 2022 23 LIVE Updates Will Sitharaman Give Much Needed

All About Of National Pension Scheme NPS CA Rajput Jain

Tax Deductions You Can Deduct What Napkin Finance

Nps For Tax Deduction - If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs 1 5 lakh Here is a look at the tax benefits one gets by investing in NPS