Nps Tier Ii Tax Rebate Web National Pension Scheme Tier II Tax Saver Scheme 2020 Contact us Compare Rules NEW Choose Rules

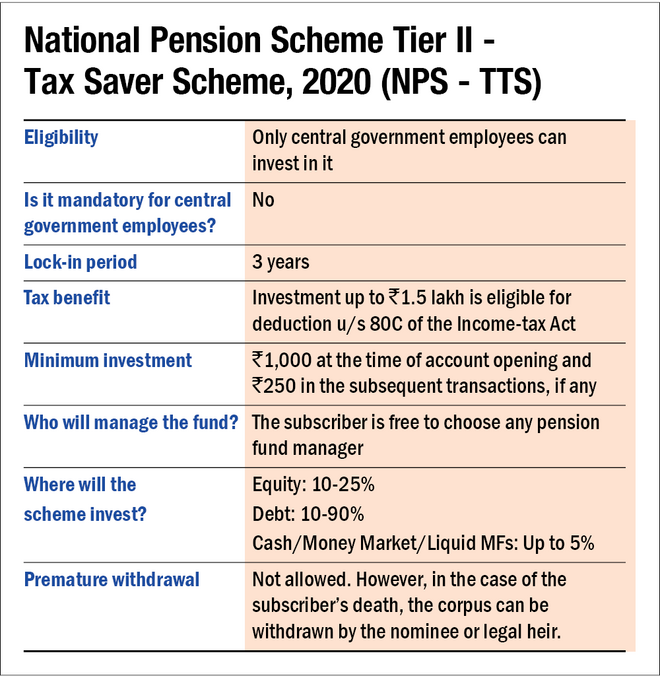

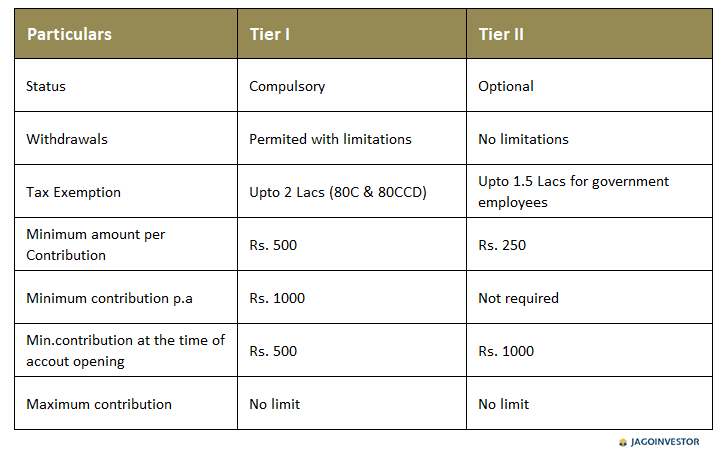

Web 21 sept 2022 nbsp 0183 32 Tier I is a mandatory account for all NPS investors while Tier II is voluntary Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of Web Unlike a Tier I NPS account Tier II NPS accounts do not qualify for a tax rebate under Section 80C of the Income Tax Act When it comes to NPS tax benefits another point to

Nps Tier Ii Tax Rebate

Nps Tier Ii Tax Rebate

https://www.valueresearchonline.com/content-assets/images/48432_national_pension_scheme_tier_ii-table1__w660__.png

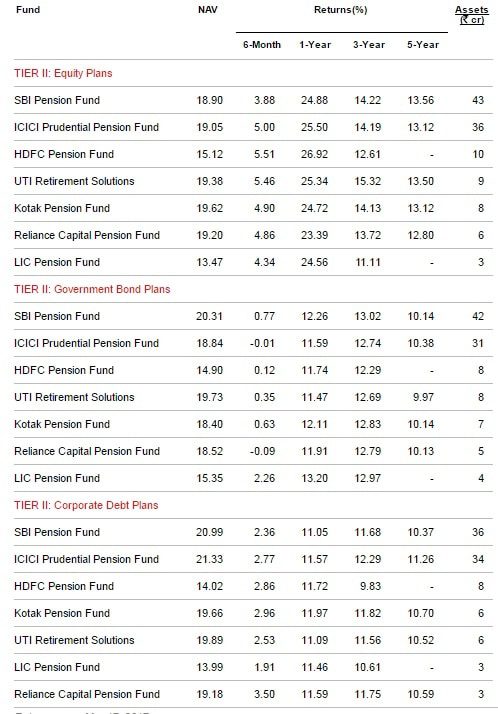

With 11 Returns NPS Tier II Outshines Bank FDs Liquid Funds Mint

https://images.livemint.com/img/2020/09/23/original/Capture_1600850918894.PNG

Nps tier2 returns

https://bemoneyaware.com/wp-content/uploads/2017/03/nps-tier2-returns.jpg

Web 8 f 233 vr 2019 nbsp 0183 32 This means you can invest up to Rs 2 lakhs in an NPS Tier 1 account and claim a deduction for the full amount i e Rs 1 50 lakh under Sec 80 CCD 1 and Rs Web 16 sept 2022 nbsp 0183 32 Tax Benefits on NPS Tier 1 amp Tier 2 Returns The contributions made to an NPS Tier 1 account are eligible for tax deductions Contributions to an NPS Tier 2 account do not offer any tax benefits

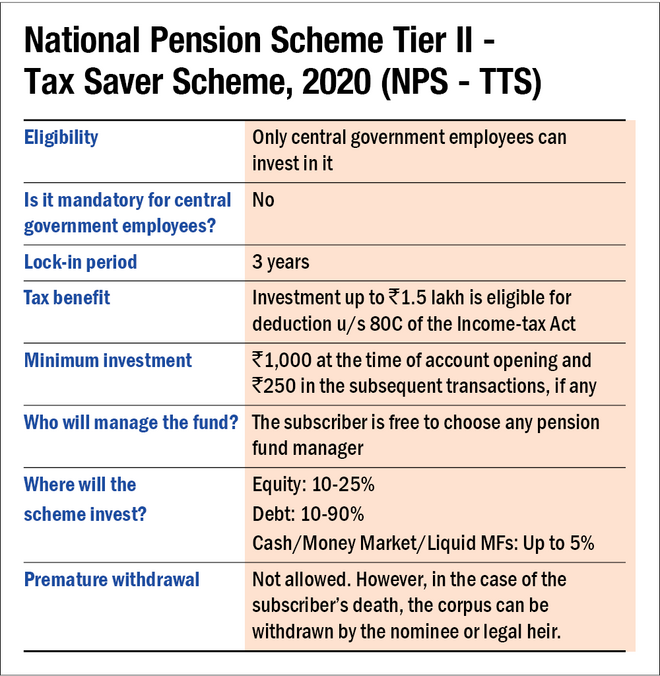

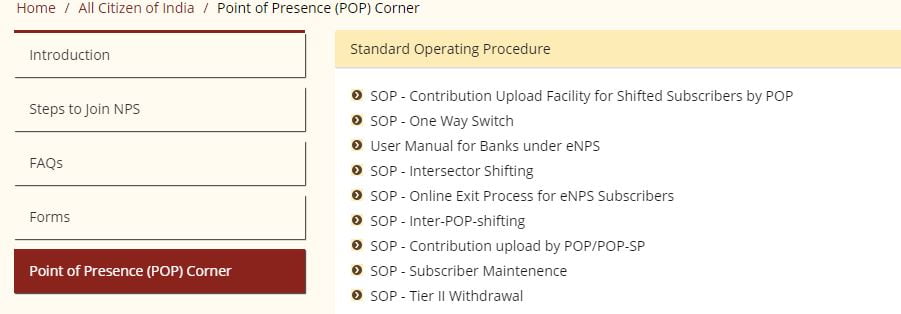

Web 24 juin 2020 nbsp 0183 32 If a Government employee contributes towards Tier II of NPS the tax benefit of Section 80C for deduction up to Rs 1 50 lakh will be available to them provided that Web Deposits up to Rs 1 5 lakhs in Tier 2 NPS account would be allowed as a deduction under Section 80C of the Income Tax Act 1961 This deduction can be claimed by only Central

Download Nps Tier Ii Tax Rebate

More picture related to Nps Tier Ii Tax Rebate

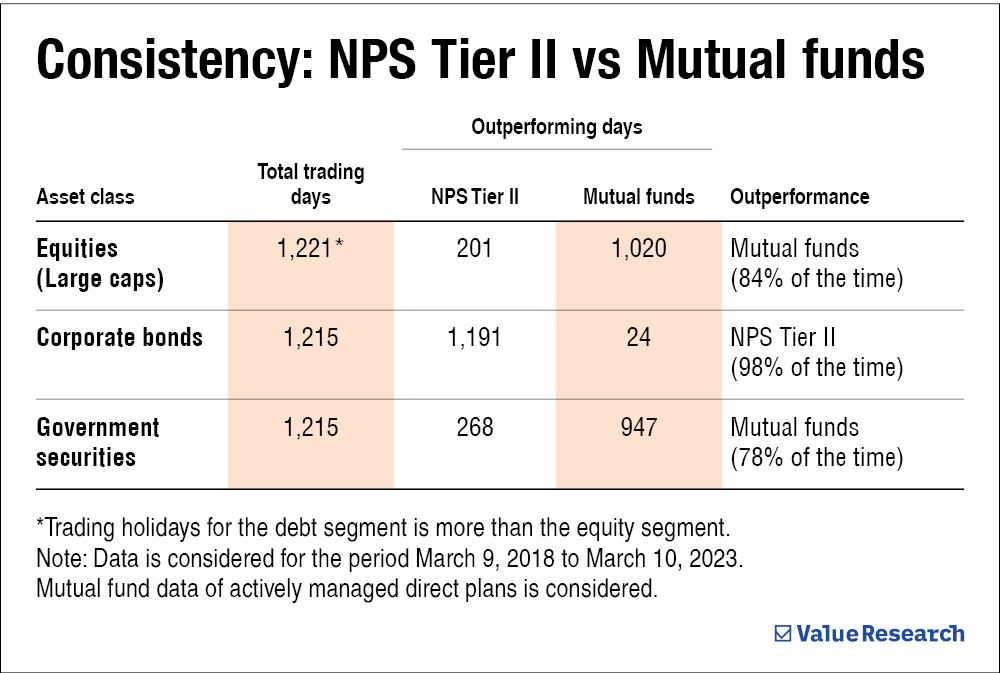

Low cost NPS Tier II Has Beaten Direct MFs The Economic Times

https://img.etimg.com/photo/53393680/another-gfx.jpg

NPS Tier 2 Alternative To Savings Account FDs Or Debt Mutual Funds

http://www.basunivesh.com/wp-content/uploads/2016/08/NPS-Tier-2-Asset-Class-C.jpg

Comparing Large cap And Debt Funds With NPS Tier 2 Value Research

https://www.valueresearchonline.com/content-assets/images/52335_nps_tier_ii-2__w1000__.png

Web 10 juil 2020 nbsp 0183 32 According to the notification such central employees who deposit money in Tier 2 account of NPS They can claim tax rebate of Rs 1 50 lakh annually under Web 27 ao 251 t 2020 nbsp 0183 32 Here are 10 things to know about NPS Tier II income tax saver scheme 1 Only central government employees are entitled to obtain income tax benefits under the National Pension System Tier II program

Web 30 janv 2023 nbsp 0183 32 Thus the total maximum tax rebate an individual can avail on NPS is of INR 2 lakh including INR 1 5 lakh which is a part of Section 80 C limit NPS Tier II Account The members of Web Tax Benefit Under NPS Show All 1 What are the tax benefits of NPS Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution

Best NPS Funds 2019 Top Performing NPS Scheme

https://www.relakhs.com/wp-content/uploads/2019/01/Latest-NPS-rules-changes-norms-2019-revised-NPS-scheme-Tier-2-tax-benefits-80c.jpg

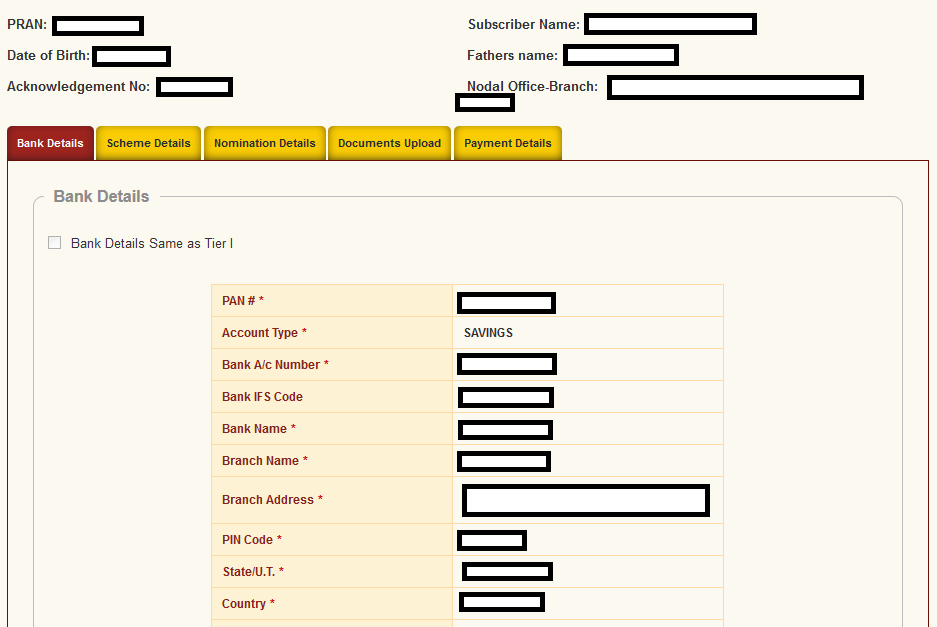

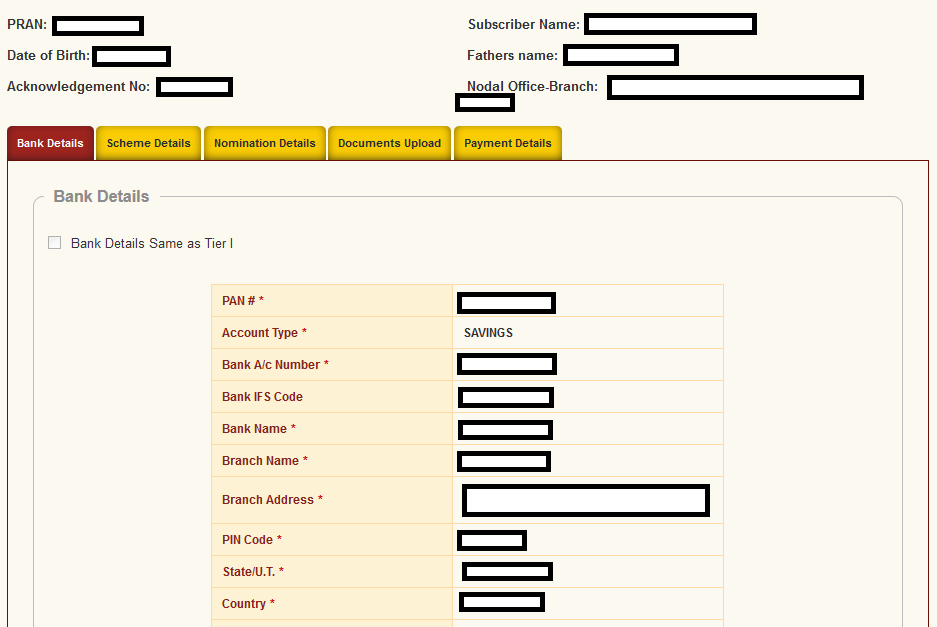

NPS Tier 2 Withdrawal Via Online In 2021 Taxation Time Charges

https://profitsolo.b-cdn.net/wp-content/uploads/2020/12/POP.jpg

https://incometaxindia.gov.in/Pages/rules/nps-tax-saver-scheme-2020.as…

Web National Pension Scheme Tier II Tax Saver Scheme 2020 Contact us Compare Rules NEW Choose Rules

https://www.etmoney.com/learn/nps/nps-tax-…

Web 21 sept 2022 nbsp 0183 32 Tier I is a mandatory account for all NPS investors while Tier II is voluntary Tier I investments are eligible for NPS deductions or NPS tax saving benefits under Section 80C and Section 80CCD 1B of

PDF NPS S12 Withdrawal Form Tier II PDF Download InstaPDF

Best NPS Funds 2019 Top Performing NPS Scheme

NPS National Pension Scheme A Beginners Guide For Rules Benefits

NPS Should You Invest In Its Tier II Account

NPS New Update NPS Tier II Account Tax Benefit Along With 3 Year Lock

Should You Invest In National Pension System NPS Tier 2 Account

Should You Invest In National Pension System NPS Tier 2 Account

NPS Tier II Taxability And Safety Taxation Trading Q A By Zerodha

How To Activate Nps Tier 2 Account Online NPS Tier 2 Online Open

How To Open NPS Tier II Account Online Here s A Step by step Guide

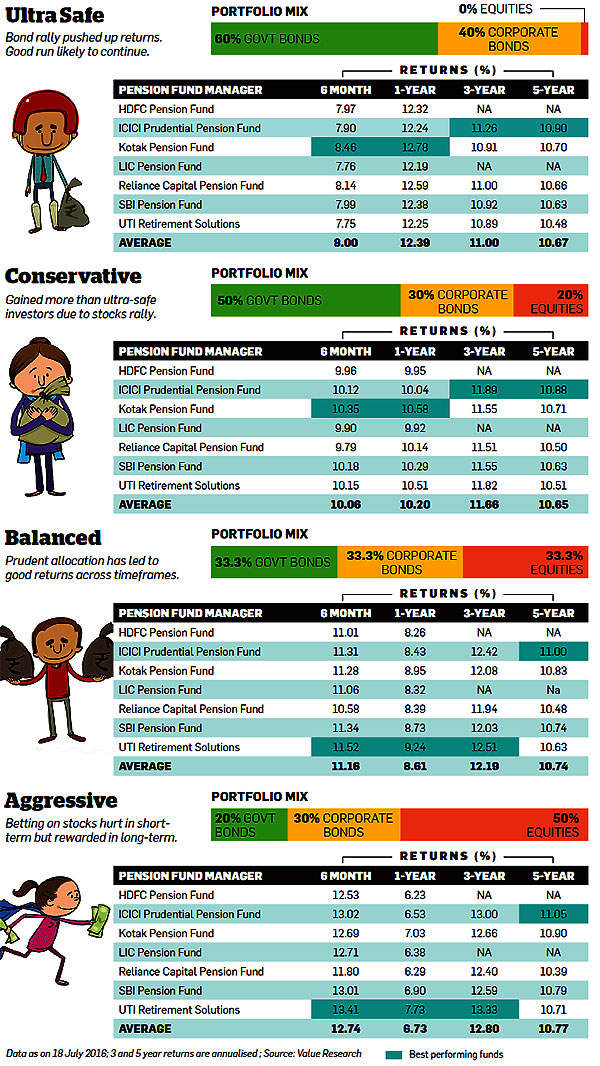

Nps Tier Ii Tax Rebate - Web 20 ao 251 t 2020 nbsp 0183 32 The asset class allocation is mix of equity debt and cash money market liquid funds under the NPS Tier II account income tax saving scheme NPS Tier