Nps Under Section 80ccd 2 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you

A Govt employee Corporate employee can claim a deduction of your employer s contribution towards NPS under Section 80CCD 2 up to a limit of 10 of your salary i e Section 80CCD 2 of the Income Tax Act 1961 provides an additional tax deduction to individuals who make contributions towards the National Pension System NPS

Nps Under Section 80ccd 2

Nps Under Section 80ccd 2

https://i.ytimg.com/vi/9zU4iMCWPdM/maxresdefault.jpg

Section 80CCD 2 Employer s Contribution To NPS NPS In New Tax

https://i.ytimg.com/vi/EpqXDIqNGX0/maxresdefault.jpg

Section 80CCD Deductions For NPS And APY Contributions

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Section-80CCD-Deductions-For-NPS-And-APY-Contributions.jpg

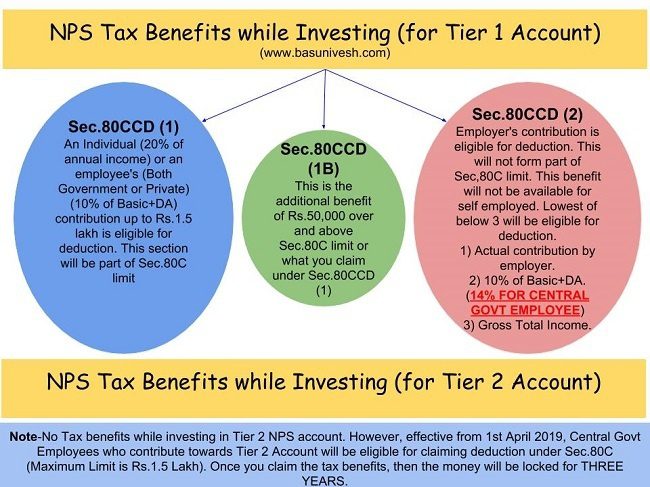

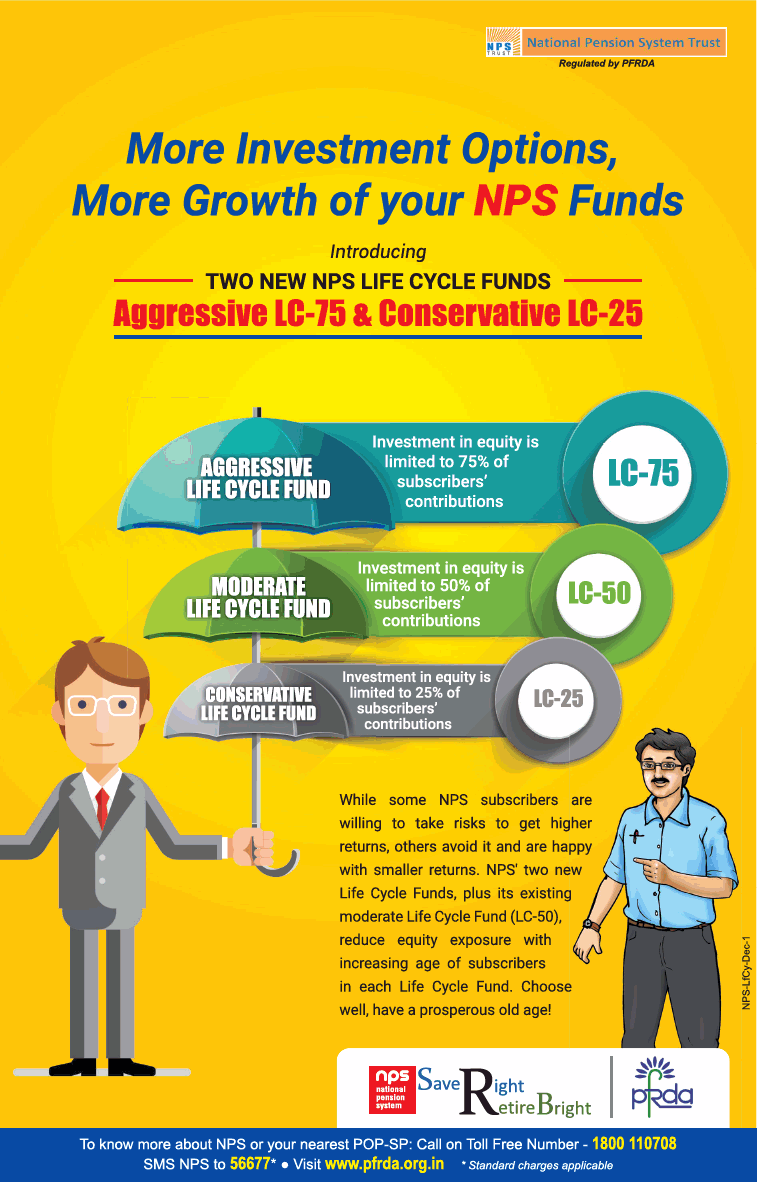

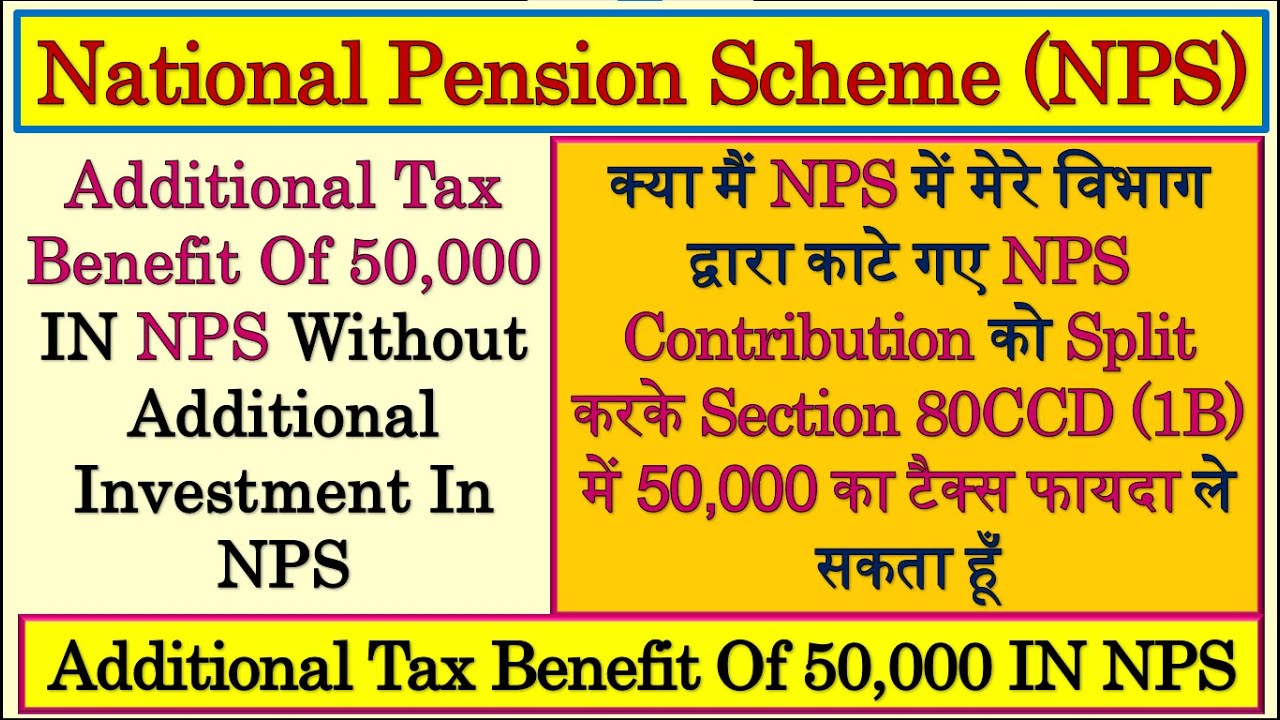

In essence by investing in NPS you can claim tax deductions of up to Rs 2 lakhs in total Rs 1 5 lakhs under Section 80C and an additional Rs 50 000 under Section 80CCD Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and

Under Section 80CCD 2 the deduction is calculated based on the employer s contribution to the employee s NPS account The key features include Maximum Limit The If your employer contributes to your NPS account your employer gets a tax benefit under section 80CCD 2 This tax benefit is limited to 20 of the total income of the employer in the previous

Download Nps Under Section 80ccd 2

More picture related to Nps Under Section 80ccd 2

NPS Tax Benefits 2020 Sec 80CCD 1 80CCD 2 And 80CCD 1B BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2018/12/NPS-Tax-Benefits-2019-Sec.80CCD1-80CCD2-and-80CCD1B.jpg?lossy=1&strip=1&webp=1

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

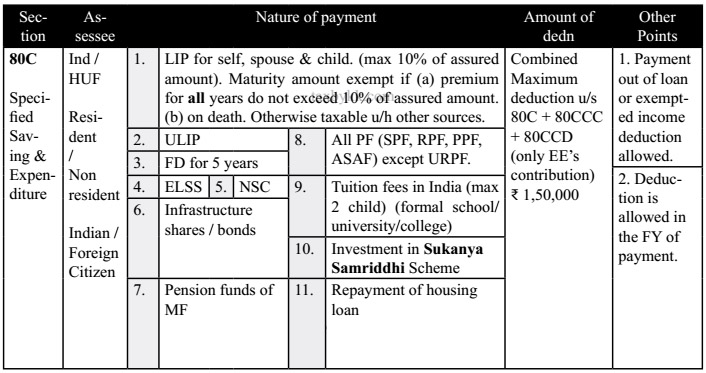

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

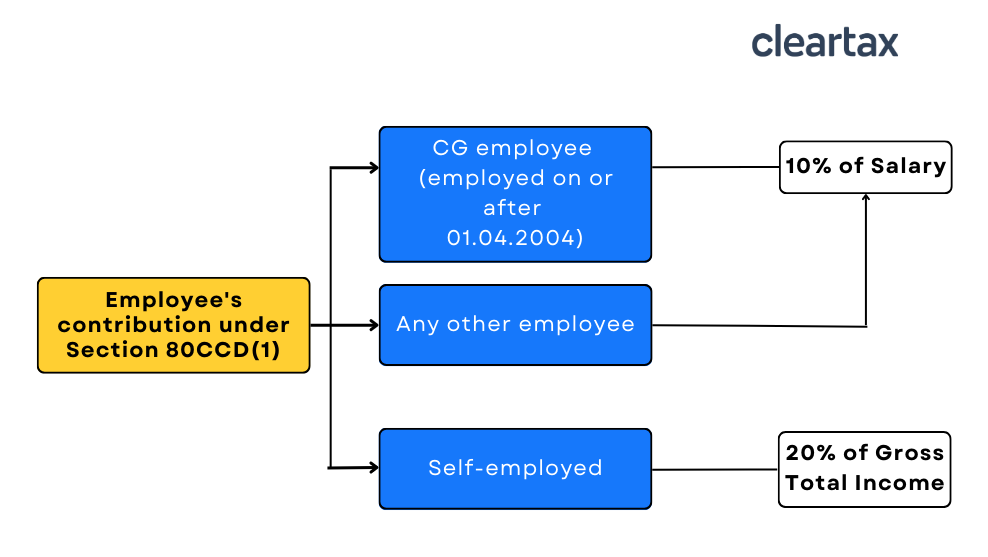

Over and above deduction up to 1 50 lakh toward own NPS account all taxpayer are eligible for an additional exclusive deduction of up to 50 000 under Section 80CCD 1B A salaried person is eligible to claim the following deduction under Section 80CCD 2 a maximum contribution from the Central Government or State Government to NPS of

[desc-10] [desc-11]

Deductions Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Tax Savings Deductions Under Chapter VI A Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03105750/FigJam-Basics-1-1024x870.jpg

https://www.etmoney.com/learn/income-tax/section-80ccd-deductions

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you

https://bemoneyaware.com/nps-tax-benefits-and-sections-80ccd1...

A Govt employee Corporate employee can claim a deduction of your employer s contribution towards NPS under Section 80CCD 2 up to a limit of 10 of your salary i e

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Deductions Under Section 80C Its Allied Sections

Money Musingz Personal Finance Blog Section 80D 80CCD Explained

Deduction For NPS Allowed Under Overall Limit Of Rs 1 5 Lakh With Extra

Can I Split NPS Deduction Into 80CCD 1B 80CCD 1 How To Get

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

Deductions Under Section 80CCD Of Income Tax

80CCD Income Tax Deduction Under Section 80CCD FY 20 21

Nps Under Section 80ccd 2 - Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and