Nsc Deduction In Income Tax Learn about National Savings Certificate NSC a government issued investment scheme with tax advantages Find out the eligibility denominations purchase options and features of NSC VIII and NSC IX issues

NSC is a government backed fixed income scheme that offers tax deduction under Section 80C up to Rs 1 5 lakh Learn how to calculate NSC tax exemption interest rate and other features and benefits of NSC Learn how to claim deduction for NSC investments under Section 80 C and how to pay tax on interest accrued or received on NSC Find out the difference between accrual and receipt basis of

Nsc Deduction In Income Tax

Nsc Deduction In Income Tax

https://instafiling.com/wp-content/uploads/2022/12/Standard-Deduction-in-Income-Tax-1080x675.png

How To Avail Tax Deductions On National Savings Certificate NSC

https://i.ytimg.com/vi/ohJO0wbYP_k/maxresdefault.jpg

Income Tax Deduction

http://www.trutax.in/blog/wp-content/uploads/2018/02/income-tax-deduction.png

Interest on NSC is taxable under the head of Income from Other Sources However in the first four years interest is reinvested and therefore can be claimed as a deduction under Section 80C of the ITA The final year s i e 5th year s interest is taxable according to your income tax slab The primary tax benefit of NSC is under Section 80C of the Income Tax Act This allows investors to claim tax deduction of up to 1 5 lakh in a financial year offered u s 80C However this 1 5

The interest income earned on both NSC and tax saving fixed deposits is taxable as per the tax bracket of the investors However the interest earned on NSC is not paid to the investor every According to the Futuregenerali website Interest earned on NSC is taxable under the head Income from Other Sources However the interest is reinvested for the initial 4 years and

Download Nsc Deduction In Income Tax

More picture related to Nsc Deduction In Income Tax

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Deduction Vs Tax Exemption Vs Tax Rebate 2021 What Is Tax Deduction

https://i.ytimg.com/vi/zg_bWbGeYms/maxresdefault.jpg

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Learn how to declare and claim tax deduction on interest income from National Savings Certificates NSC while filing ITR The tax rule depends on whether you offer interest on accrual or NSC is a government backed fixed income investment scheme that offers tax savings under Section 80C Learn how to invest in NSC online or offline the eligibility criteria the interest rates the tax benefits and more

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25 File Now National Savings Certificate or NSC currently offers an interest rate of 7 9 the same as that of another popular small savings instrument PPF Apart from guaranteed returns NSC which

Types Of Standard Deduction In Income Tax For 2022

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/11/Types-of-Standard-Deduction-in-Income-Tax-1536x864.png

NSC National Savings Certificate Eligibility Interest Rate Tax

https://emailer.tax2win.in/assets/guides/infographics/national-savings-certificate.jpg

https://taxguru.in/income-tax/nsc-tax-benefit.html

Learn about National Savings Certificate NSC a government issued investment scheme with tax advantages Find out the eligibility denominations purchase options and features of NSC VIII and NSC IX issues

https://tax2win.in/guide/nsc-national-savings-certificate

NSC is a government backed fixed income scheme that offers tax deduction under Section 80C up to Rs 1 5 lakh Learn how to calculate NSC tax exemption interest rate and other features and benefits of NSC

Standard Deduction 2020 Self Employed Standard Deduction 2021

Types Of Standard Deduction In Income Tax For 2022

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

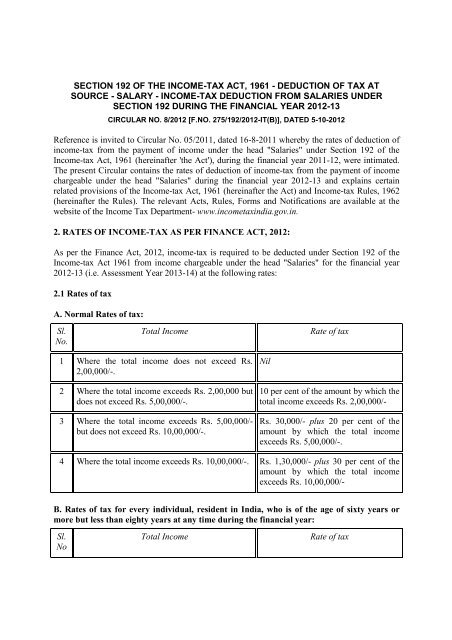

Income tax Deduction From Salaries Under Section

How To Calculate Nsc Interest For Income Tax CETDGO

Income Tax Deductions For The FY 2019 20 ComparePolicy

Income Tax Deductions For The FY 2019 20 ComparePolicy

What Is A Tax Deduction

Section 10 Of Income Tax Act Deductions And Allowances

What Is Section 10AA Of Income Tax Act Ebizfiling

Nsc Deduction In Income Tax - The primary tax benefit of NSC is under Section 80C of the Income Tax Act This allows investors to claim tax deduction of up to 1 5 lakh in a financial year offered u s 80C However this 1 5