Nsc Income Tax Deduction National Saving Certificates NSC Income tax rules on interest explained A tax payer can claim deduction in respect of investments made by him in NSC in the year of investments

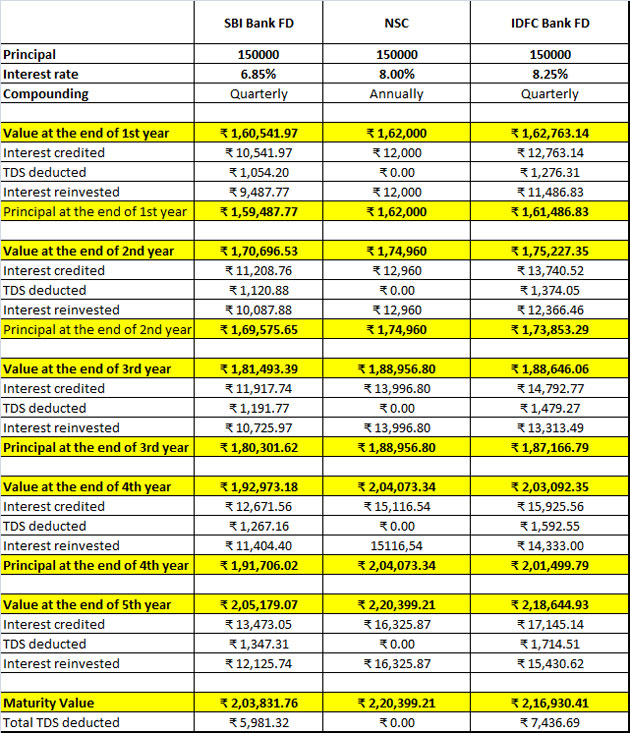

Tax treatment of NSC Investment and Interest on NSC Deposits up to Rs 1 50 lakh in NSC qualify for Deduction Section 80C of the Income Tax Act Accrued interest on NSC also qualifies for deduction u s 80C NSC interest is taxable Tax Deduction The amount invested in NSC is eligible for a tax deduction under Section 80C The maximum deduction allowed under this section is currently up to Rs 1 5 lakh in a financial year subject to any changes in tax laws

Nsc Income Tax Deduction

Nsc Income Tax Deduction

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

How To Avail Tax Deductions On National Savings Certificate NSC

https://i.ytimg.com/vi/ohJO0wbYP_k/maxresdefault.jpg

NSC Income Tax Misconceptions interestrates incometax nsc

https://i.ytimg.com/vi/t353bddJhms/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYciBNKDUwDw==&rs=AOn4CLBbNP9M-xWXR4h9I3SQNvAUuOVbHw

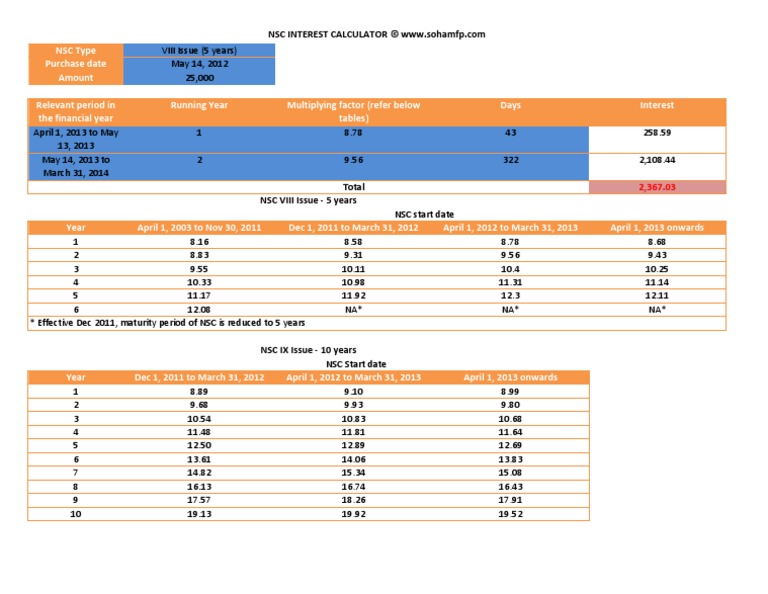

Income tax rule If you have shown it on accrual basis you can start offering the interest income from NSC from second year onward on accrual basis and claim the 80C deduction says Balwant Interest on NSC is taxable under the head of Income from Other Sources However in the first four years interest is reinvested and therefore can be claimed as a deduction under Section 80C of the ITA The final year s i e 5th year s interest is taxable according to your income tax slab

The primary tax benefit of NSC is under Section 80C of the Income Tax Act This allows investors to claim tax deduction of up to 1 5 lakh in a financial year offered u s 80C However this 1 5 lakh limit of tax saving investment includes other options such as PPF EPF ELSS Mutual Funds along with life insurance premium payments Investors with low and moderate incomes are encouraged to save with this savings bond Most importantly NSC also offers tax deductions NSC investments up to 1 5 lakhs are tax free under Section 80C of the Income Tax Act They are locked in for 5 years in case of NSC VIII issue and 10 years in case of IX issue

Download Nsc Income Tax Deduction

More picture related to Nsc Income Tax Deduction

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

Abolition Of State Tax Deduction Keeps NJ Tax In Check

https://d.newsweek.com/en/full/718411/gettyimages-109917953.jpg

Images Of NSC JapaneseClass jp

https://img.etimg.com/photo/msid-66749547,quality-100/nsc-vs-bankfd.jpg

You can claim income tax deductions of up to Rs 1 5 lakh under Section 80C of the Income tax Act 1961 for booking tax saving fixed deposits or investing in NSC The interest earned or accrued on a National Savings Certificate NSC is taxable For taxation purposes it should be added to the taxable income of the investor every year not just at the time of maturity and taxed as per the applicable slab

6 Investment in NSC up to 1 5 lakh a year under Section 80C qualifies for tax deduction The amount is deducted from gross total income to arrive at taxable income Tax Saver As a government backed tax saving scheme the principal invested in NSC qualifies for tax savings under Section 80C of the Income Tax Act up to Rs 1 5 lakhs annually Investment Flexibility You can invest as small as Rs 100 as an initial investment with no maximum limit

Income Tax Deduction

http://www.trutax.in/blog/wp-content/uploads/2018/02/income-tax-deduction.png

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

https://c1.staticflickr.com/9/8606/28374128013_523fe7f52b_b.jpg

https://www.livemint.com/money/personal-finance/...

National Saving Certificates NSC Income tax rules on interest explained A tax payer can claim deduction in respect of investments made by him in NSC in the year of investments

https://taxguru.in/income-tax/nsc-tax-benefit.html

Tax treatment of NSC Investment and Interest on NSC Deposits up to Rs 1 50 lakh in NSC qualify for Deduction Section 80C of the Income Tax Act Accrued interest on NSC also qualifies for deduction u s 80C NSC interest is taxable

NSC National Savings Certificate Eligibility Interest Rate Tax

Income Tax Deduction

Section 80C Deductions List To Save Income Tax FinCalC Blog

National Saving Certificates NSC Income Tax Rules On Interest

How To Calculate Nsc Interest For Income Tax Haiper

NSC Calculator 2020 Tax Benefit On Interest Earned

NSC Calculator 2020 Tax Benefit On Interest Earned

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

How To Calculate Nsc Interest For Income Tax CETDGO

Tax Reduction Company Inc

Nsc Income Tax Deduction - Interest on NSC is taxable under the head of Income from Other Sources However in the first four years interest is reinvested and therefore can be claimed as a deduction under Section 80C of the ITA The final year s i e 5th year s interest is taxable according to your income tax slab