Ny State Solar Tax Credit 2023 Verkko Tax Law section 606 g 1 provides for the solar energy system equipment credit The credit is allowed for certain solar energy system equipment expenditures To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use

Verkko New York City Real Property Tax Abatement Program In addition to our incentive programs and financing options you may qualify for federal and or New York State tax credits for installing solar at home Verkko 16 jouluk 2019 nbsp 0183 32 The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000 The solar energy system equipment credit is not refundable However any credit amount in excess of the tax due can be carried over for up to five years Additional information

Ny State Solar Tax Credit 2023

Ny State Solar Tax Credit 2023

https://iveeleaguesolar.com/wp-content/uploads/2020/12/Untitled-design-1-1536x1024.png

How To Claim Solar Tax Credit A Step by Step Guide

https://www.gov-relations.com/wp-content/uploads/2023/06/How-To-Claim-Solar-Tax-Credit.jpg

Is There Still A CT Solar Tax Credit For 2023 Advanced BC

https://advancedbc.org/wp-content/uploads/2022/06/solar.jpg

Verkko 13 jouluk 2023 nbsp 0183 32 What You Should Know About the New York Solar Energy System Equipment Credit New York is one of the few states that offer a statewide tax credit in addition to the federal one and it comes in the form of the NY Solar Energy Equipment Credit The credit value is for up to 25 of your entire system total or 5 000 Verkko New York State Solar Equipment Tax Credit Incentive Value 25 of home solar system costs up to 5 000 Frequency Once when purchasing a solar panel system New York offers a 25 state tax

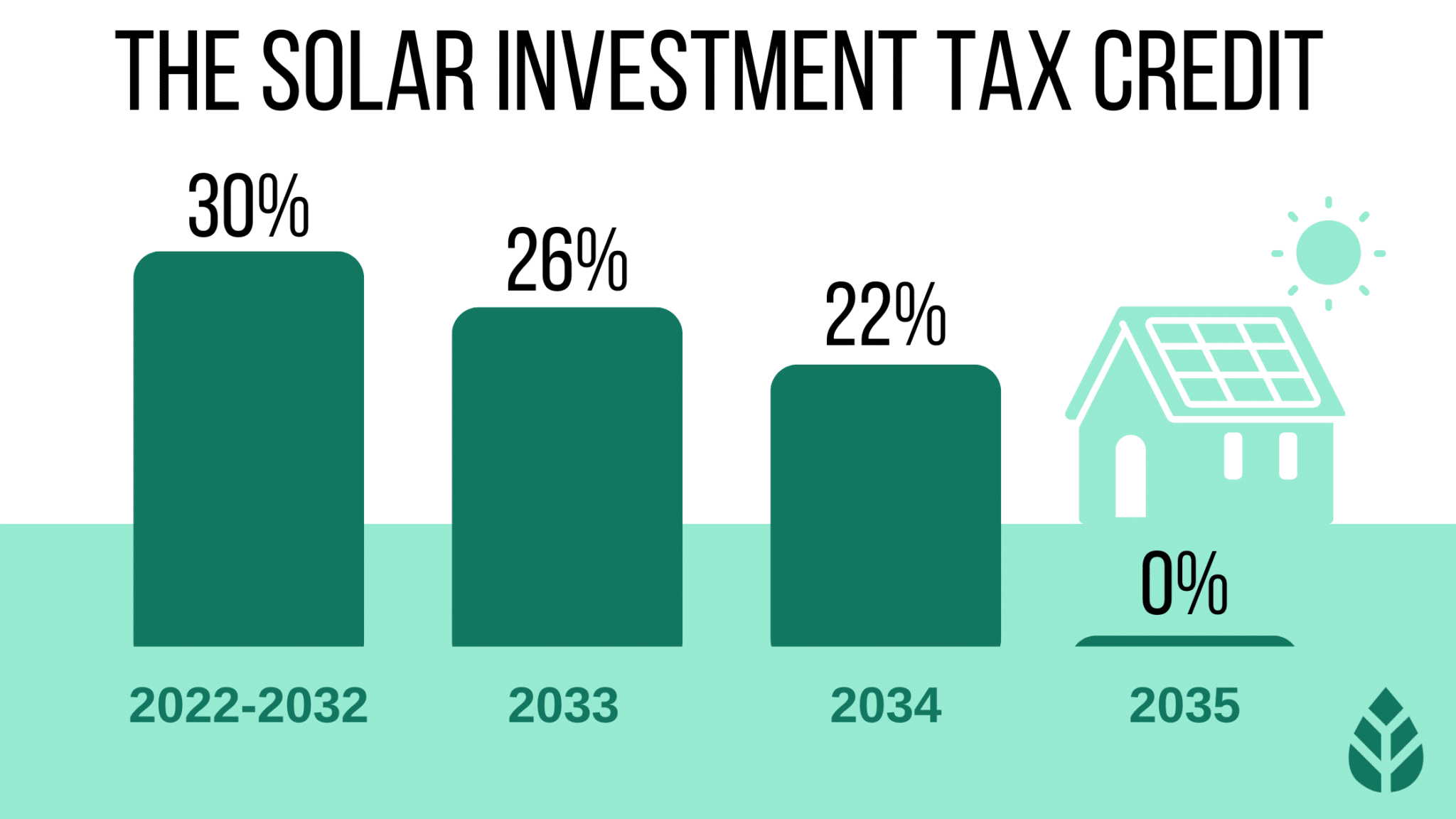

Verkko Open Monday Friday 8 30 am to 5 00 pm NY Sun provides incentives and financing to make solar generated electricity accessible and affordable for all New York homeowners renters and businesses Using solar can help lower energy costs compared to using conventionally generated electricity Verkko Federal solar investment tax credit The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in New York If you install your photovoltaic system before the end of 2032 the federal tax credit is 30 of the cost of your solar panel system

Download Ny State Solar Tax Credit 2023

More picture related to Ny State Solar Tax Credit 2023

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/12/solar-tax-credit-2023-750x422.png

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Graphic-06-2048x1136.png

Verkko 26 jouluk 2023 nbsp 0183 32 On Aug 16 2022 P L 117 169 commonly known as the Inflation Reduction Act was signed into law Among other things the Act drastically expanded the scope of green energy tax credits and other Verkko Form IT 255 Claim for Solar Energy System Equipment Credit Tax Year 2023 Department of Taxation and Finance Claim for Solar Energy System IT 255 Equipment Credit Tax Law Section 606 g 1 Submit this form with Form IT 201 or Form IT 203 Name s as shown on return Your Social Security number

Verkko Federal IRA Tax Credit 2023 2032 New York State Incentives and Tax Credits Cold climate Air Source Heat Pumps 30 of cost up to 2 000 per year Incentives Partial home solutions 100 400 on average Whole home solutions 2 000 3 000 on average Heat Pump Water Heaters 30 of cost up to 2 000 per year Incentives 700 1 Verkko The New York solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower The great advantages of the Solar Equipment Tax Credit are twofold first you don t have to purchase your system to claim the credit i e it applies to you even if you went solar with a lease or

Federal Solar Tax Credits For Businesses Department Of Energy

https://energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

Utah State Solar Tax Credit Lanette Huber

https://i.pinimg.com/originals/08/f8/7e/08f87e7239d73ae06d9a37a65f1a1c7b.jpg

https://www.tax.ny.gov/pdf/current_forms/it/it255i.pdf

Verkko Tax Law section 606 g 1 provides for the solar energy system equipment credit The credit is allowed for certain solar energy system equipment expenditures To qualify for the credit the solar energy system must use solar radiation to produce energy for heating cooling hot water or electricity for residential use

https://www.nyserda.ny.gov/.../Paying-for-Solar/Tax-Credit

Verkko New York City Real Property Tax Abatement Program In addition to our incentive programs and financing options you may qualify for federal and or New York State tax credits for installing solar at home

26 Federal Solar Tax Credit Extended SolarTech

Federal Solar Tax Credits For Businesses Department Of Energy

Texas Solar Incentives Tax Credits Rebates More In 2023

The 30 Solar Tax Credit Has Been Extended Through 2032

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

NY Solar Tax Credit Incentives 2022 2023 Internal Revenue Code

NY Solar Tax Credit Incentives 2022 2023 Internal Revenue Code

How Does The Federal Solar Tax Credit Work PB Roofing Co

Irs Solar Tax Credit 2022 Form

Solar Tax Credit Guide And Calculator

Ny State Solar Tax Credit 2023 - Verkko Open Monday Friday 8 30 am to 5 00 pm NY Sun provides incentives and financing to make solar generated electricity accessible and affordable for all New York homeowners renters and businesses Using solar can help lower energy costs compared to using conventionally generated electricity