Ontario Farm Property Class Tax Rate Program If you qualify we will place your farmland and associated outbuildings in the farm property tax class Your municipality applies the farm property tax class rate to your property tax bill and

One of the ways the Government of Ontario supports agriculture is through the Farm Property Class Tax Rate Program also known as the Farm Tax Program If you are eligible for the For a farm to be classified as farm a property owner must apply for the Farm Property Tax Class Rate Program with Agricorp Properties in the Farm Property Class Tax Rate Program will be

Ontario Farm Property Class Tax Rate Program

Ontario Farm Property Class Tax Rate Program

https://www.theglobeandmail.com/resizer/ykaMTT6P-AvPlPGKDo27Md0ztz0=/1200x0/filters:quality(80)/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/FVPMBRSUABC2VB6Q27ACFGVEIA

Calculating Rate Of Return On Farm Assets Farm And Dairy

http://d27p2a3djqwgnt.cloudfront.net/wp-content/uploads/2018/06/27110059/ohio-114098_1280-1.jpg

Ontario Cities With The Highest And Lowest Property Tax Rates REPORT

https://www.zoocasa.com/blog/wp-content/uploads/2019/07/ontario-property-tax-rates-2019-zoocasa.png

MPAC assesses all properties in Ontario including farms Eligible farmland is classified in the farm classification For more information download OFA s Farm Property Tax Agricorp assesses your property s eligibility for the Farm Property Class Tax Rate Program also known as the Farm Tax Program based on four program eligibility requirements MPAC has

9 rowsBe sure to provide the required supporting tax documents listed on the form 2024 Income Exemption for Start up Farm Businesses For a new farm business Income MPAC assesses all properties in Ontario including farms Eligible farmland is classified in the farm classification The farmhouse plus one acre remain classified in the residential classification

Download Ontario Farm Property Class Tax Rate Program

More picture related to Ontario Farm Property Class Tax Rate Program

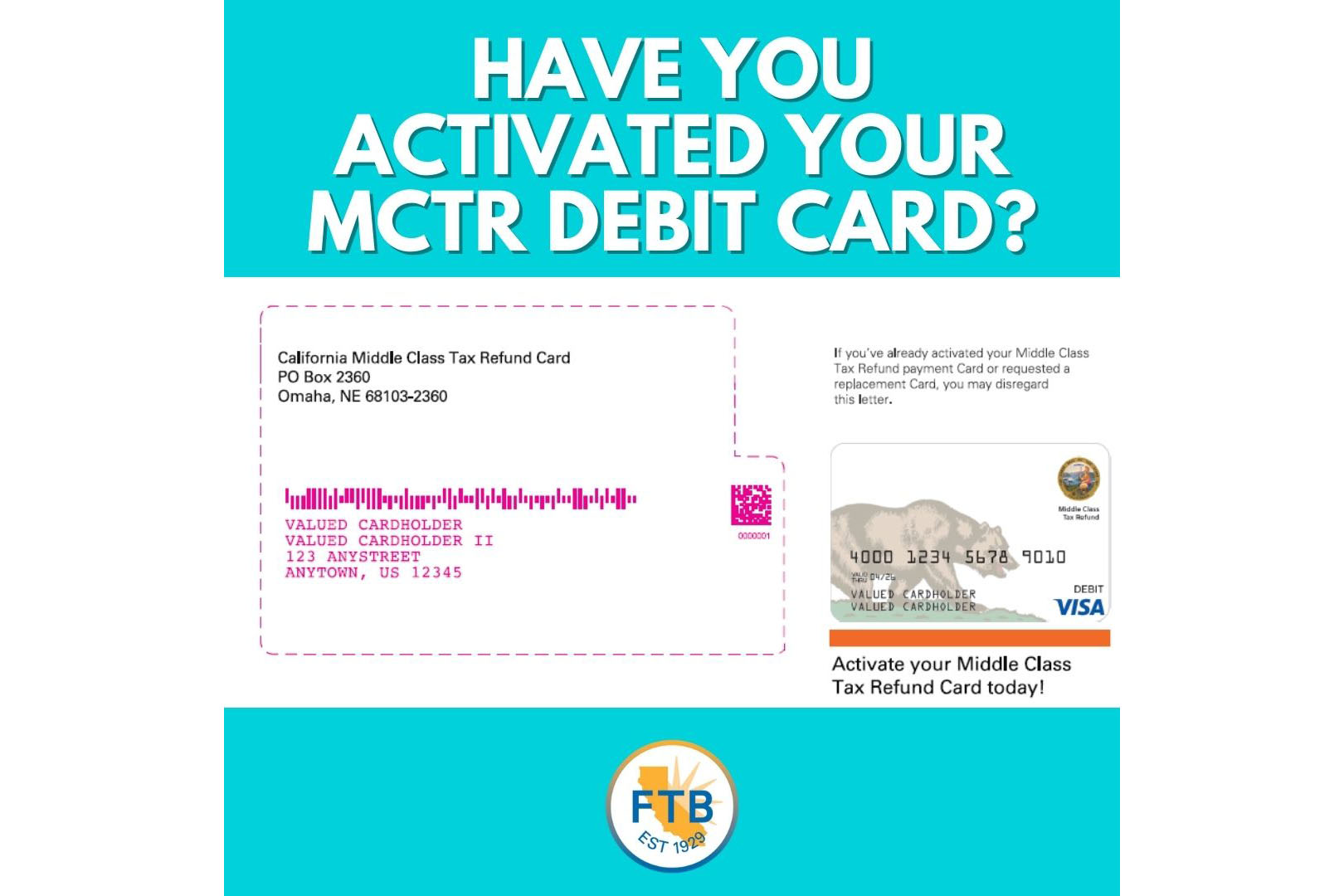

Over 1 Million Californians Still Didn t Get Middle class Tax Refunds

https://s.hdnux.com/photos/01/32/30/45/23693694/3/rawImage.jpg

5 Signs That You Need Farm Insurance In Ontario Halwell Blog

http://www.halwellmutual.com/wp-content/uploads/2016/07/signs-need-farm-insurance-ontario.jpg

Petition Support Ontario s Family Farm Wineries Scrap Unfair Taxes

https://assets.change.org/photos/9/gn/ib/higniBlMNldDwfT-1600x900-noPad.jpg?1595612309

Farmland farm buildings and eligible bunkhouses are classified in the farm tax class if approved by Agricorp under the Farm Property Class Tax Rate Program Check your MPAC assessment notice to verify your farmland One way the Government of Ontario supports agriculture is through the Farm Property Class Tax Rate Program also known as the Farm Tax Program Your farmland will be taxed at no more

We are writing to express our appreciation in particular for the ongoing success of the Farm Property Class Tax Rate Program This program has many benefits for farmers and The Farm Property Class Tax Rate Program Farm Tax Program is one of the ways the province of Ontario supports agriculture Through the program eligible farmland owners

Farm Property Class Tax Rate Program Publications Ontario

https://www.publications.gov.on.ca/store/20170501121/assets/items/largeimages/CL29553.jpg

Solved Calculate The Tax Liability After tax Earnings And Average

https://www.coursehero.com/qa/attachment/19720397/

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/FVPMBRSUABC2VB6Q27ACFGVEIA?w=186)

https://www.mpac.ca/en/MakingChangesUpdates/...

If you qualify we will place your farmland and associated outbuildings in the farm property tax class Your municipality applies the farm property tax class rate to your property tax bill and

https://www.agricorp.com/en-ca/Programs/FarmTaxProgram

One of the ways the Government of Ontario supports agriculture is through the Farm Property Class Tax Rate Program also known as the Farm Tax Program If you are eligible for the

Farm Land Tax Benefits P E A C E

Farm Property Class Tax Rate Program Publications Ontario

PROVINCIAL LAND TAX ACT

State Tax Exemption Forms Tp Tools And Equipment Free Hot Nude Porn

Farm Land Tax Benefits P E A C E

How The Middle Class Has Benefited From The U S Tax System For Decades

How The Middle Class Has Benefited From The U S Tax System For Decades

Farm Land Sign Hot Sex Picture

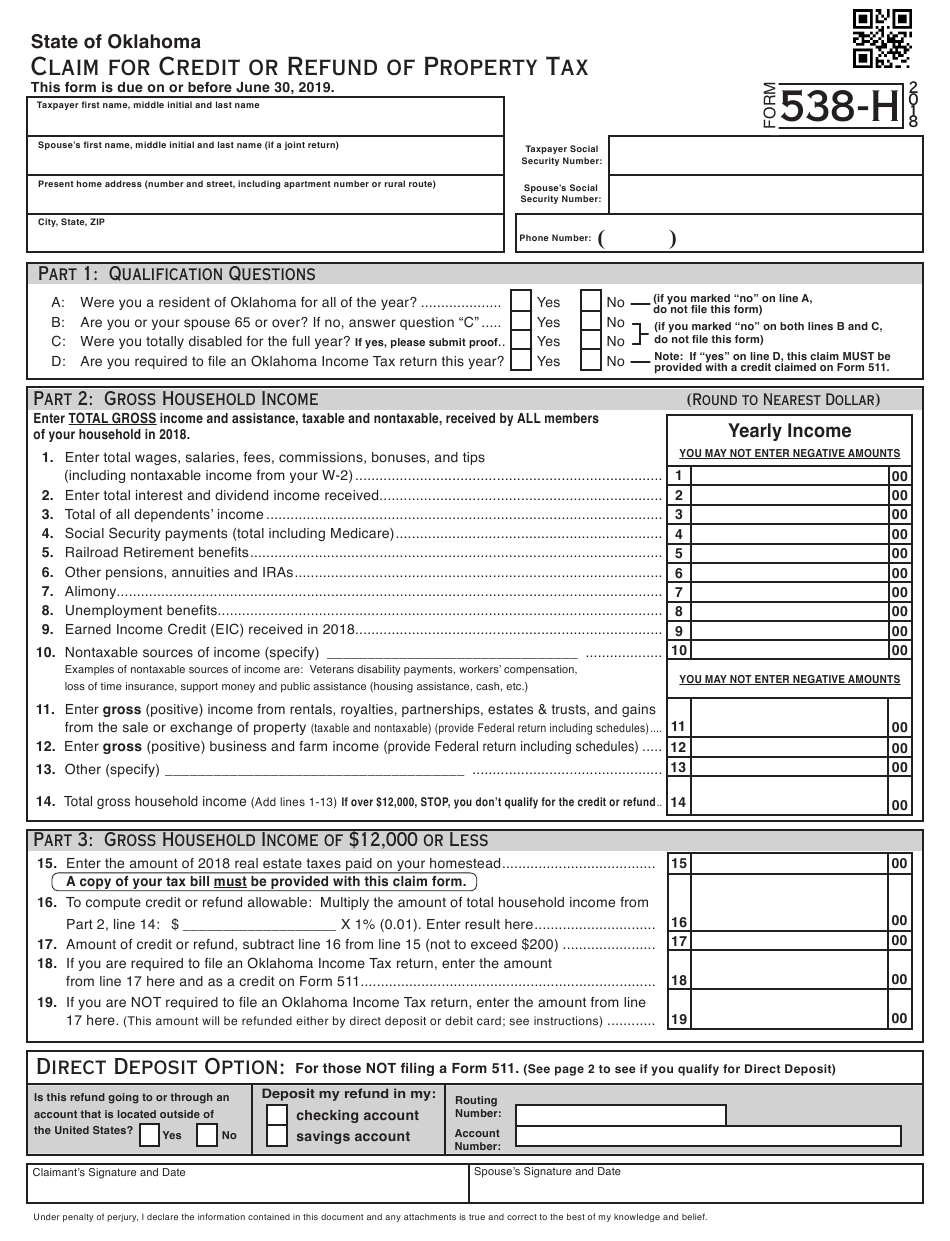

Fillable Oklahoma Tax Commission Application For Agriculture Exemption

Farm Land Tax Benefits P E A C E

Ontario Farm Property Class Tax Rate Program - Agricorp assesses your property s eligibility for the Farm Property Class Tax Rate Program also known as the Farm Tax Program based on four program eligibility requirements MPAC has

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/FVPMBRSUABC2VB6Q27ACFGVEIA)