Ontario Tax Reduction Calculator Discover Talent s income tax calculator tool and find out what your payroll tax deductions will be in Ontario for the 2024 tax year

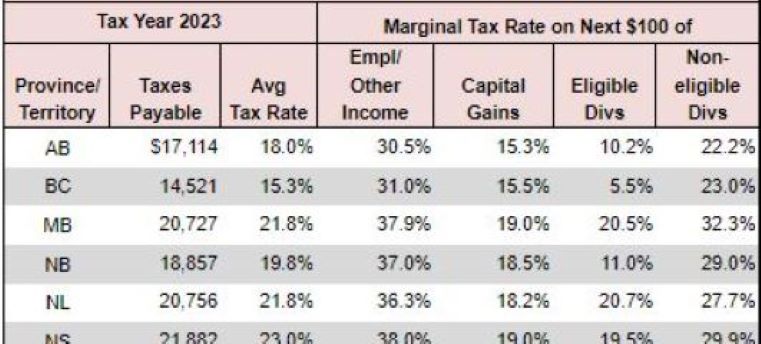

Estimate your provincial taxes with our free Ontario income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed TurboTax s free Ontario income tax calculator Estimate your 2023 tax refund or taxes owed and check provincial tax rates in Ontario

Ontario Tax Reduction Calculator

Ontario Tax Reduction Calculator

https://image5.slideserve.com/10844375/income-tax-calculator-ontario-accufile-n.jpg

26 Pa Taxes Calculator DarmaveerShiv

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

Will The Inflation Reduction Act Raise Your Taxes Flipboard

https://aurn.com/wp-content/uploads/2022/08/AP22209625086601-scaled.jpg

Most Accurate free Ontario income tax calculator Estimate your 2023 tax refund or taxes owed and check provincial tax rates in Ontario The Ontario Tax Reduction is a credit that reduces or eliminates the provincial tax you have to pay For 2023 the basic amount was 274 and the amount for every dependent

Calculate your income tax in Ontario and salary deduction in Ontario to calculate and compare salary after tax for income in Ontario in the 2024 tax year A comprehensive suite of free income tax calculators for Ontario each tailored to a specific tax year These user friendly tools are designed to help individuals and businesses in Ontario

Download Ontario Tax Reduction Calculator

More picture related to Ontario Tax Reduction Calculator

Grocery Tax Reduced To 1 Beginning Jan 1 2023 Virginia Tax

https://www.tax.virginia.gov/sites/default/files/news-images/2022-12/grocery-tax-reduction.jpg

Debt Reduction Calculator With Amortization Schedule Find Word Templates

https://www.findwordtemplates.com/wp-content/uploads/2022/05/debt-reduction-calculator-sample-47769204.jpg

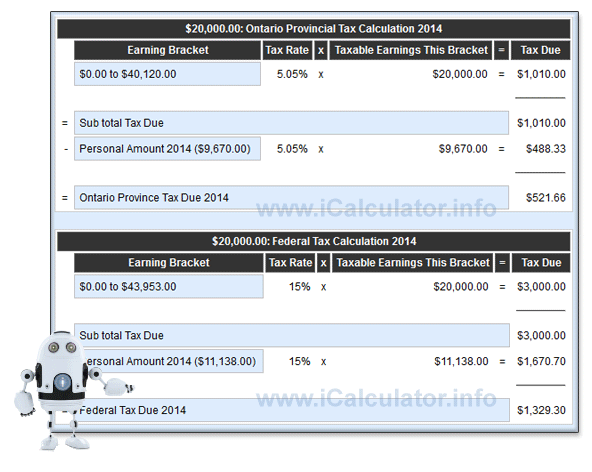

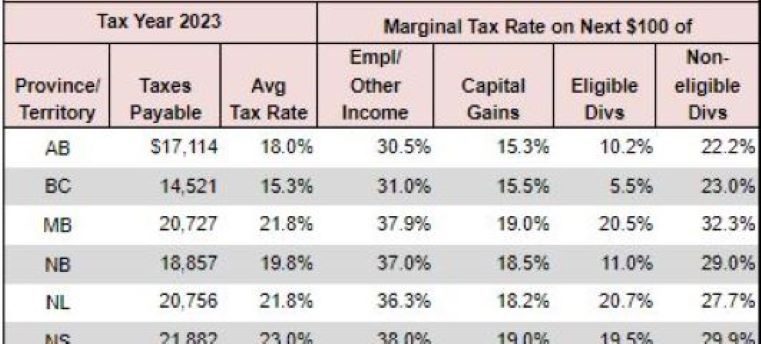

What Is Provincial Tax Canada Tax ICalculator

https://www.icalculator.com/images/ca/ontario-tax-calculator.png

Use our income tax calculator to find out what your take home pay will be in Ontario for the tax year Enter your details to estimate your salary after tax The Ontario Tax Calculator below is for the 2024 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Ontario This includes calculations for Employees in Ontario to calculate their annual salary

For 2024 the basic personal amount in Ontario is 12 399 This means that you can multiply this amount by 5 05 and subtract it from your income tax In addition the province also offers a special tax reduction credit Information on what s new for 2023 the Ontario benefits for individuals and families completing form ON428 Ontario tax form ON479 Ontario credits and form ON BEN application for the

Ontario Weightlifting Association Ottawa ON

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100063690631566

EP 175 The Value Of The Tax Reduction Measure e Receipt The

https://theactive.net/wp-content/uploads/2024/01/ActPod-promo-04-200923-1920x1080-4.jpg

https://ca.talent.com/tax-calculator/Ontario

Discover Talent s income tax calculator tool and find out what your payroll tax deductions will be in Ontario for the 2024 tax year

https://www.wealthsimple.com/en-ca/too…

Estimate your provincial taxes with our free Ontario income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed

Tax Reduction Streamline Financial Planning

Ontario Weightlifting Association Ottawa ON

Tax Reduction Methods B i T p M n T i Ch nh C ng Tax Reduction

Tax Reduction Strategy Program

Council Tax Reduction Scheme CTRS Eligibility Calculator Benefit

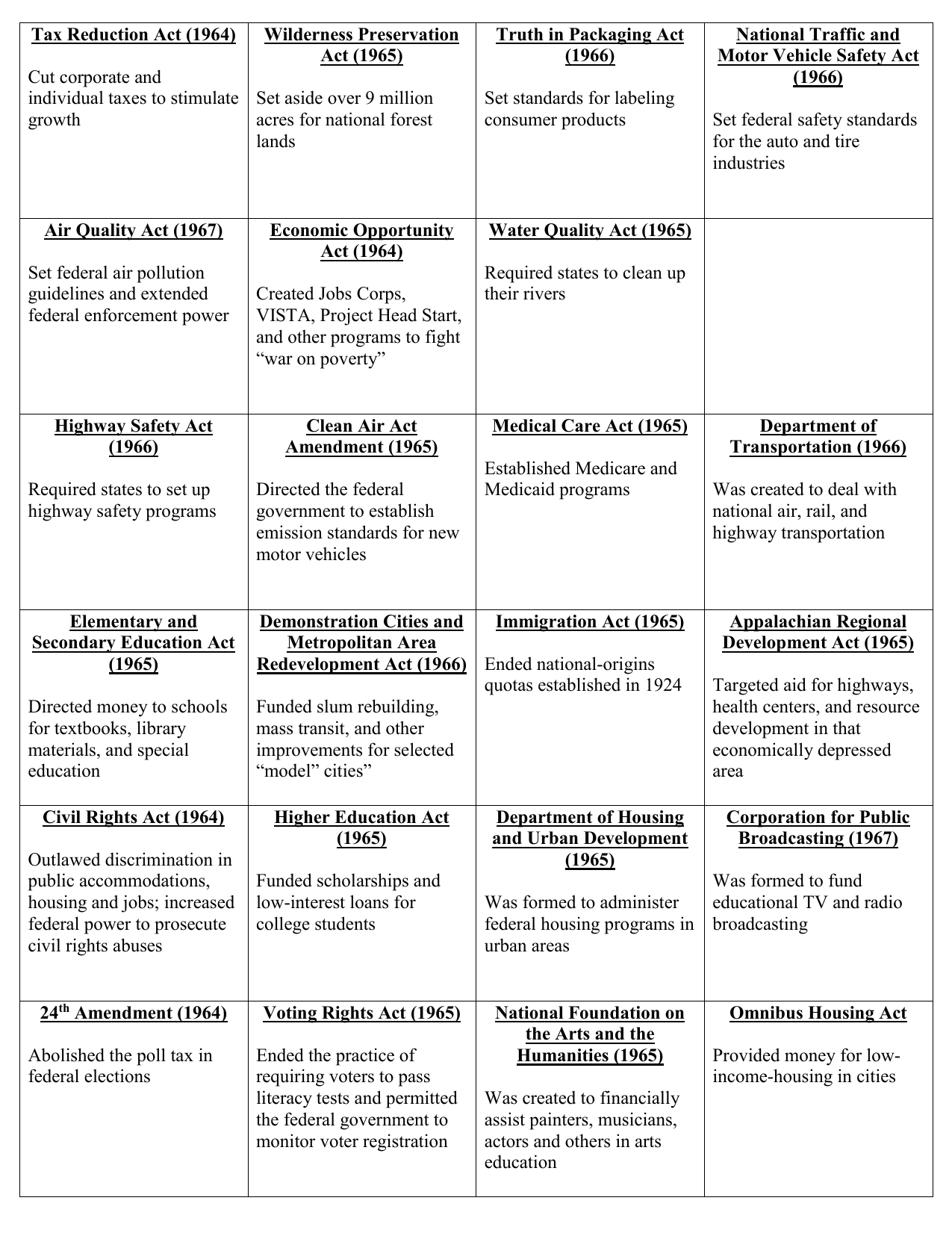

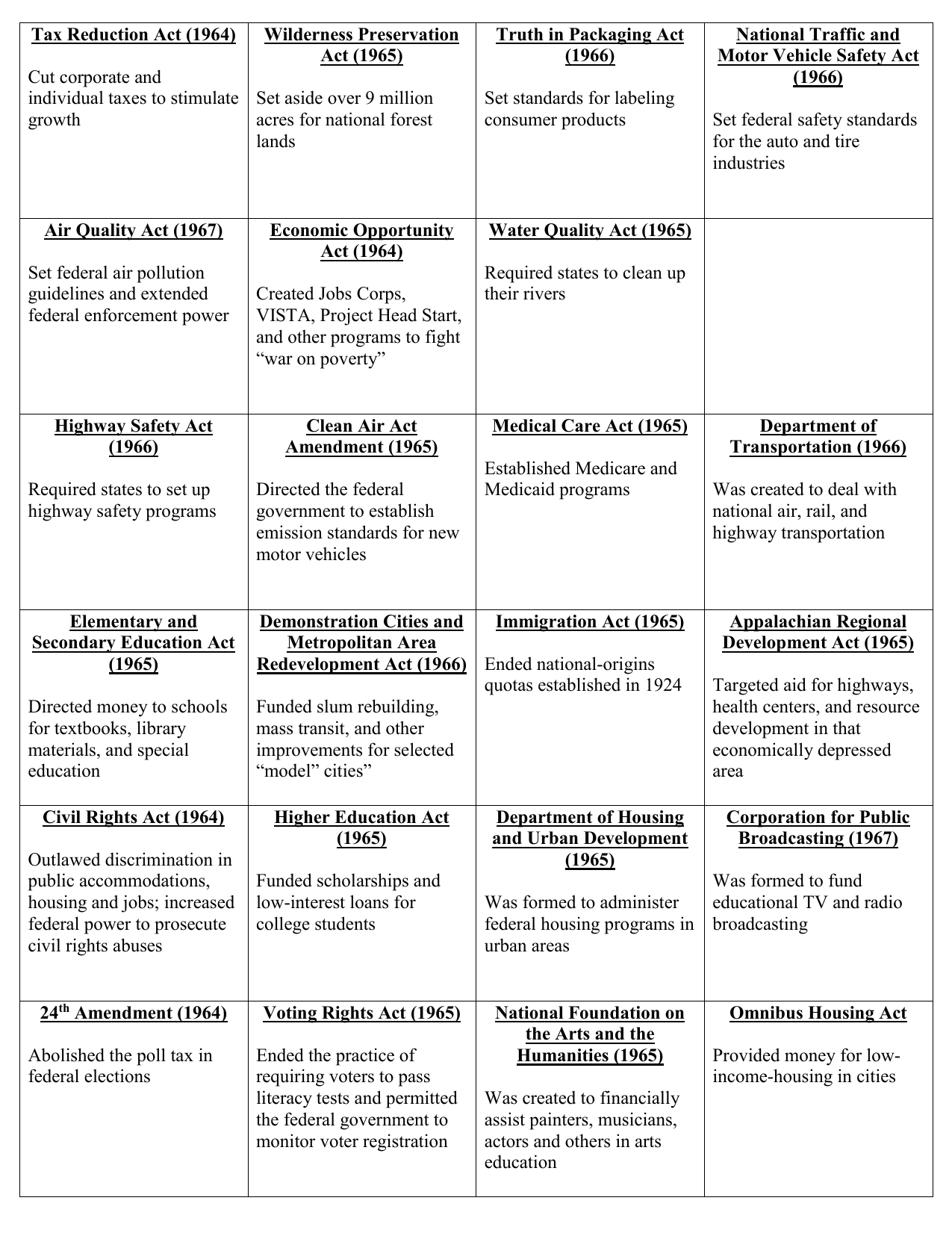

Tax Reduction Act 1964

Tax Reduction Act 1964

Tax Reduction Strategy Program

Tax Reduction Strategies With Bradford Tax Solutions Coeur D Alene

Democratic Plan Would Close Tax Break On Exchange traded Funds

Ontario Tax Reduction Calculator - If you live in Ontario and earn a gross annual salary of 75 753 or 6 313 per month your monthly take home pay will be 4 743 This results in an effective tax rate of 25 as