Ontario Tax Deduction Calculator If you live in Ontario and earn a gross annual salary of 75 753 or 6 313 per month your monthly take home pay will be 4 743 This results in an effective tax rate of 25 as estimated by our Canadian salary calculator

Estimate your provincial taxes with our free Ontario income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed 2023 Ontario provincial and federal income tax brackets Here are the tax brackets for Ontario and Canada based on your taxable income Federal tax bracket Federal tax rates 53 359 or

Ontario Tax Deduction Calculator

Ontario Tax Deduction Calculator

https://mediacloud.kiplinger.com/image/private/s--X-WVjvBW--/f_auto,t_content-image-full-desktop@1/v1636590821/Tax_Form_And_Calculator.jpg

Janice Plut Minor Ontario Tax Calculator Cobor i In Fiecare Zi Te

https://kalfalaw.com/wp-content/uploads/2019/01/Marginal-Tax-Rates-2020-01.png

Payroll Tax Deduction Calculator 2023 ShellyDivine

https://fincalc-blog.in/wp-content/uploads/2021/10/mw-erFuYboM-1024x576.jpg

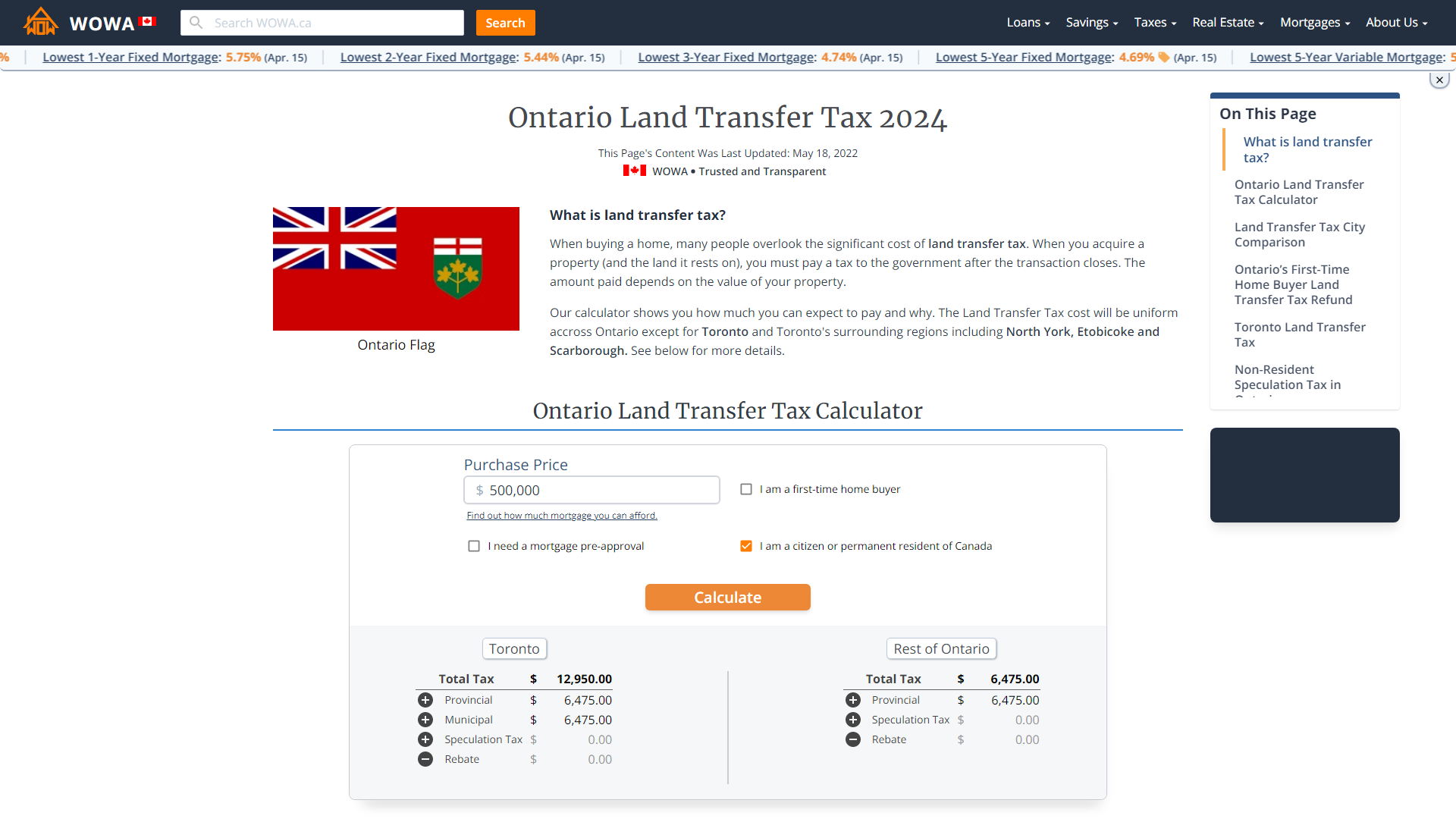

Calculate your income tax in Ontario and salary deduction in Ontario to calculate and compare salary after tax for income in Ontario in the 2024 tax year Estimate your income tax and after tax income in Ontario for the year 2024 Compare your tax rate and net pay with other provinces and territories in Canada

Plug in a few numbers and we ll give you visibility into your tax bracket marginal tax rate average tax rate and payroll tax deductions along with an estimate of your tax refunds and For 2024 the basic personal amount in Ontario is 12 399 This means that you can multiply this amount by 5 05 and subtract it from your income tax In addition the province also offers a special tax reduction credit

Download Ontario Tax Deduction Calculator

More picture related to Ontario Tax Deduction Calculator

Download Canadian Payslip Paystub Maker For Free Good For Employers And

https://i.pinimg.com/originals/32/f2/9f/32f29ff36a3d02446405e8ec76a9ac8f.png

How Much Tax Deduction For A Donated Car

https://www.thenextcars.com/wp-content/uploads/2019/07/Car-Donation-Tax-Deduction-Calculator-630x380.jpg

Ira Tax Deduction Calculator CamranAdbah

https://i.pinimg.com/originals/fd/c7/23/fdc723c07463d51948a23e84d8155caa.jpg

The Ontario Tax Reduction is a credit that reduces or eliminates the provincial tax you have to pay For 2023 the basic amount was 274 and the amount for every dependent Estimate your income taxes with our free Canada income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed

Estimate your provincial and federal income taxes for 2023 using this online tool Enter your personal income and see the tax brackets rates and surtaxes for Ontario and Canada 2023 income tax calculators based on provinces FREE Simple tax calculator to quickly estimate your Canadian Income Tax for 2023 Check how much taxes you need to pay on

Charitable Tax Deduction

https://iqcalculators.com/calculator/charitable-tax-deduction-calculator/banner.6741ffbc73820efb664b16b16444c55f.png

Why You Should Use A Canadian Payroll Tax Deduction Calculator

https://www.thepayrolledge.com/hs-fs/hubfs/Why You Should Use a Canadian Payroll Tax Deduction Calculator.jpg?width=3000&name=Why You Should Use a Canadian Payroll Tax Deduction Calculator.jpg

https://salaryaftertax.com › ca

If you live in Ontario and earn a gross annual salary of 75 753 or 6 313 per month your monthly take home pay will be 4 743 This results in an effective tax rate of 25 as estimated by our Canadian salary calculator

https://www.wealthsimple.com › en-ca › t…

Estimate your provincial taxes with our free Ontario income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes owed

Donate Car Tax Deduction Calculator YouTube

Charitable Tax Deduction

Car Donation Tax Deduction Calculator IrsDailyNews

Learn More About The Section 179 Tax Deduction QBSI A Xerox Company

Excel Payroll Calculator 2023 JeremyMaiya

Payroll Tax Deduction Calculator 2023 ShellyDivine

Payroll Tax Deduction Calculator 2023 ShellyDivine

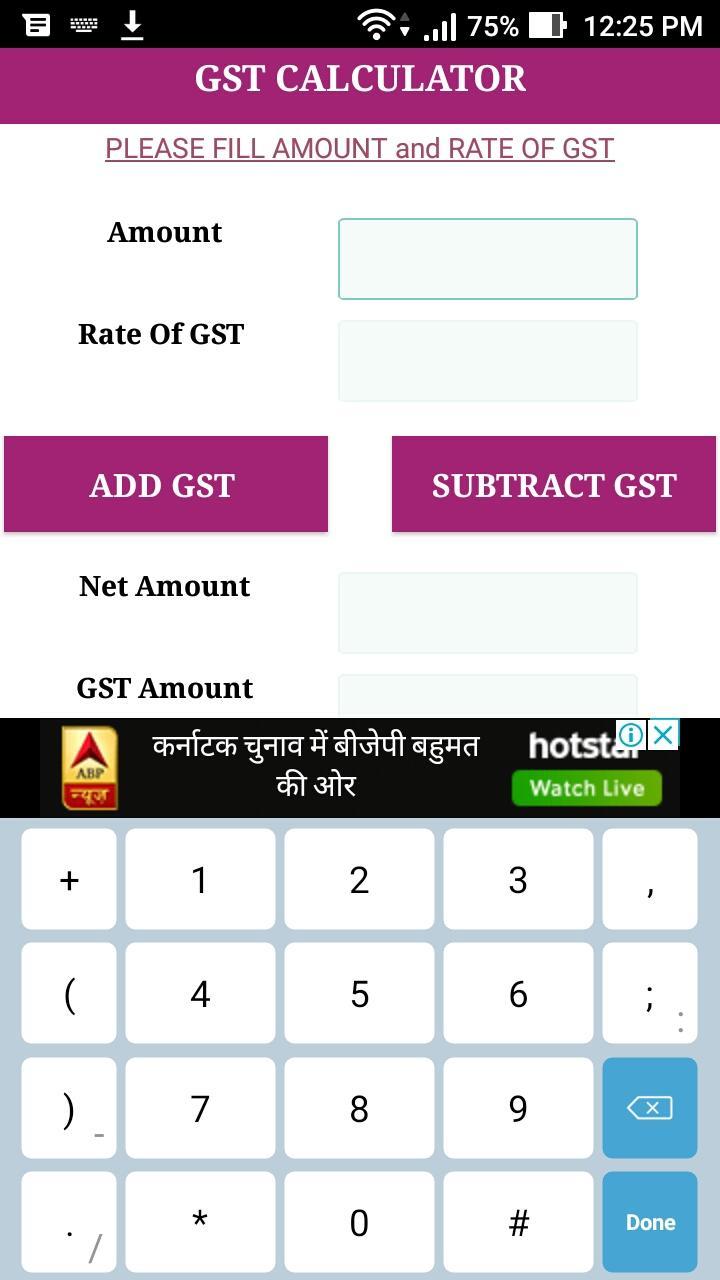

GST Calculator With Tax Deduction APK For Android Download

Itemized Tax Deduction Calculator Turbo Tax

Ontario Tax Calculator Take Home Mochikodesign

Ontario Tax Deduction Calculator - Calculate your income tax in Ontario and salary deduction in Ontario to calculate and compare salary after tax for income in Ontario in the 2024 tax year