Ontario Tax Return Dates For most people the 2023 return has to be filed on or before April 30 2024 and payment is due April 30 2024 File your return early or before the due date to avoid being

The deadline for most Ontario residents to file their 2022 income tax and benefit returns is April 30 2023 Learn about the new benefits credits and services How and when to file your tax return Learn how to fill out your return using tax preparation software or on paper Learn what you need to know before you hire someone to file your

Ontario Tax Return Dates

Ontario Tax Return Dates

https://i.pinimg.com/originals/d3/7f/83/d37f830fdf0e55518f62e71ed96aa8bd.png

What Is Line 15000 Tax Return formerly Line 150 In Canada

https://thefinancekey.com/wp-content/uploads/2022/02/what-is-line-15000-on-tax-return-canada.jpg

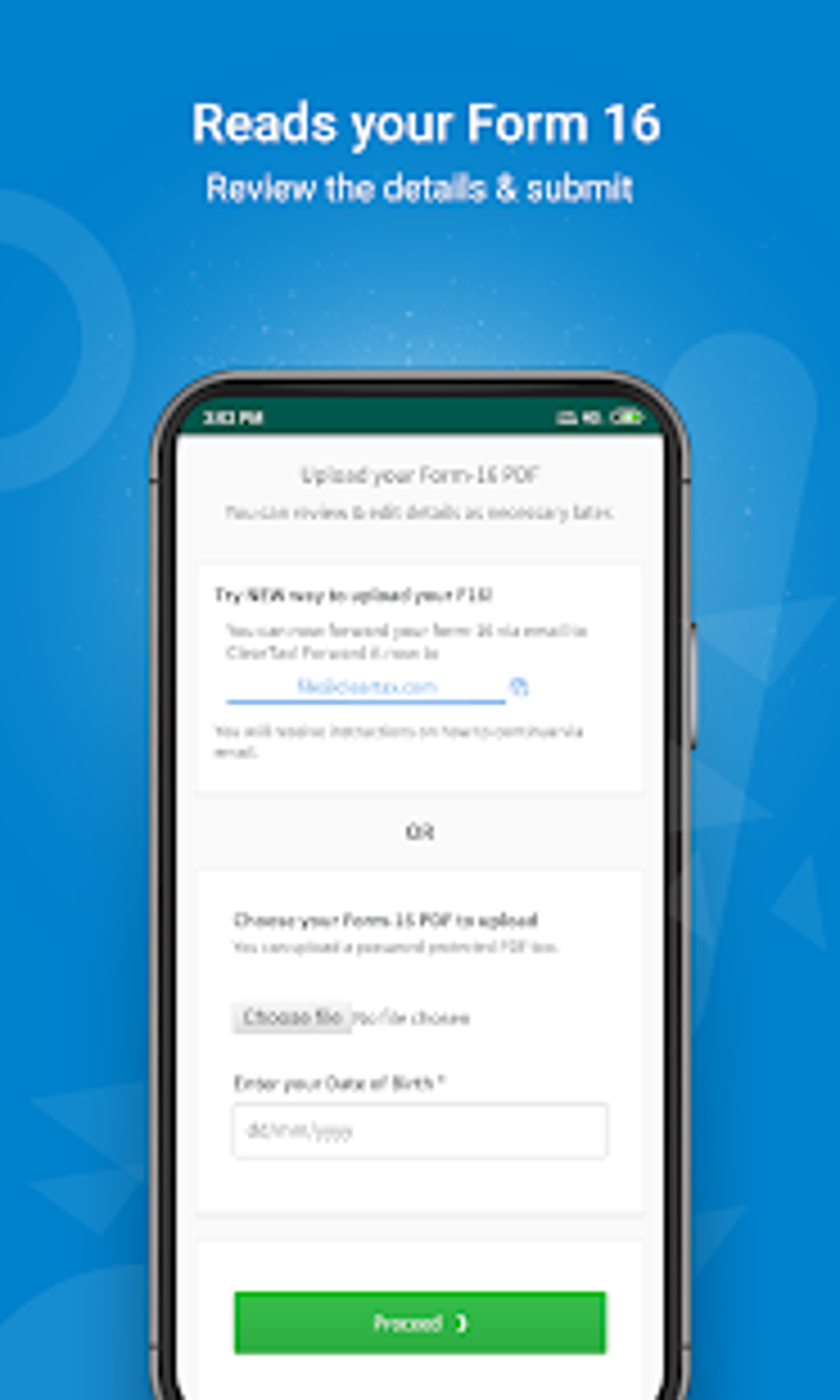

Android File FREE Income Tax Return ClearTax ITR E filing

https://images.sftcdn.net/images/t_app-cover-l,f_auto/p/7db9b7c2-9ff1-41ac-bbee-27dcf1be0514/1391937416/file-free-income-tax-return-cleartax-itr-e-filing-screenshot.png

Key Takeaways The 2024 tax filing deadline is April 30 2024 for individuals and June 17 2024 for the self employed The CRA Due Date for 2023 Tax Returns Payments is Tuesday April 30 2024 Personal income tax returns except for those of individuals with self employment income are normally due by April 30th as is any

June 15 2024 Deadline for self employed persons If you or your spouse common law partner had a business in 2023 your 2023 tax return has to be filed on or before June You may know that your income tax return is due on April 30 2024 but that is not the only date to know about Find out when you can download your T4s your last chance to contribute to

Download Ontario Tax Return Dates

More picture related to Ontario Tax Return Dates

Estate Tax Return Due Date Canada Leeann Broadway

https://www.canada.ca/content/dam/cra-arc/serv-info/tax/individuals/edu-prgms/mdls-xrcss/t1-nonrtc-2-en.png

NRIs How To File Your Income Tax Return On Rental Income From Indian

https://arthgyaan.com/assets/images/nri-tax-filing-rental-income-india.jpg

What Is Line 15000 Tax Return formerly Line 150 In Canada

https://thefinancekey.com/wp-content/uploads/2022/02/what-is-line-10100-on-tax-return-canada-768x512.jpg

Keep these dates in mind when filing your tax return in 2024 Individual tax return April 30 2024 Self employed tax return June 15 2024 you must pay taxes owed by April 30 2024 to avoid penalties April 30 2025 Payment of Tax Any tax owing must be paid no later than this date however your tax return is due on June 16 2025 The deadline is extended to the next business day if the normal filing

Here are some new numbers and key dates to consider for 2024 starting with tax brackets on employment income 1 15 on the first 55 868 of employment and other income compared with the first We work hard to file your tax returns on time to try to avoid penalties and interest Canadian tax filing deadlines are generally due April 30 th after the tax year end For self

Tax Return Deadline Extension

https://i0.wp.com/www.bachesamuels.com/wp-content/uploads/2022/01/Tax-return-red-1.png?fit=6912%2C3456&ssl=1

Irs Tax Tax Season Tax Preparation Tax Return Income Tax Filing

https://i.pinimg.com/originals/fd/11/5f/fd115f348c368086c68152a7ffa74b5b.png

https://www.canada.ca/en/revenue-agency/services...

For most people the 2023 return has to be filed on or before April 30 2024 and payment is due April 30 2024 File your return early or before the due date to avoid being

https://www.canada.ca/en/revenue-agency/news/2023/...

The deadline for most Ontario residents to file their 2022 income tax and benefit returns is April 30 2023 Learn about the new benefits credits and services

Fixing Tax Returns The Qualified Amended Return

Tax Return Deadline Extension

Extension Of Timelines For Filing Of Income tax Returns And Various

How To Read And Understand A Tax Return C2P Central

Income Tax Return Last Date Direct Link To File Itr Other Details Riset

Democratic Plan Would Close Tax Break On Exchange traded Funds

Democratic Plan Would Close Tax Break On Exchange traded Funds

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

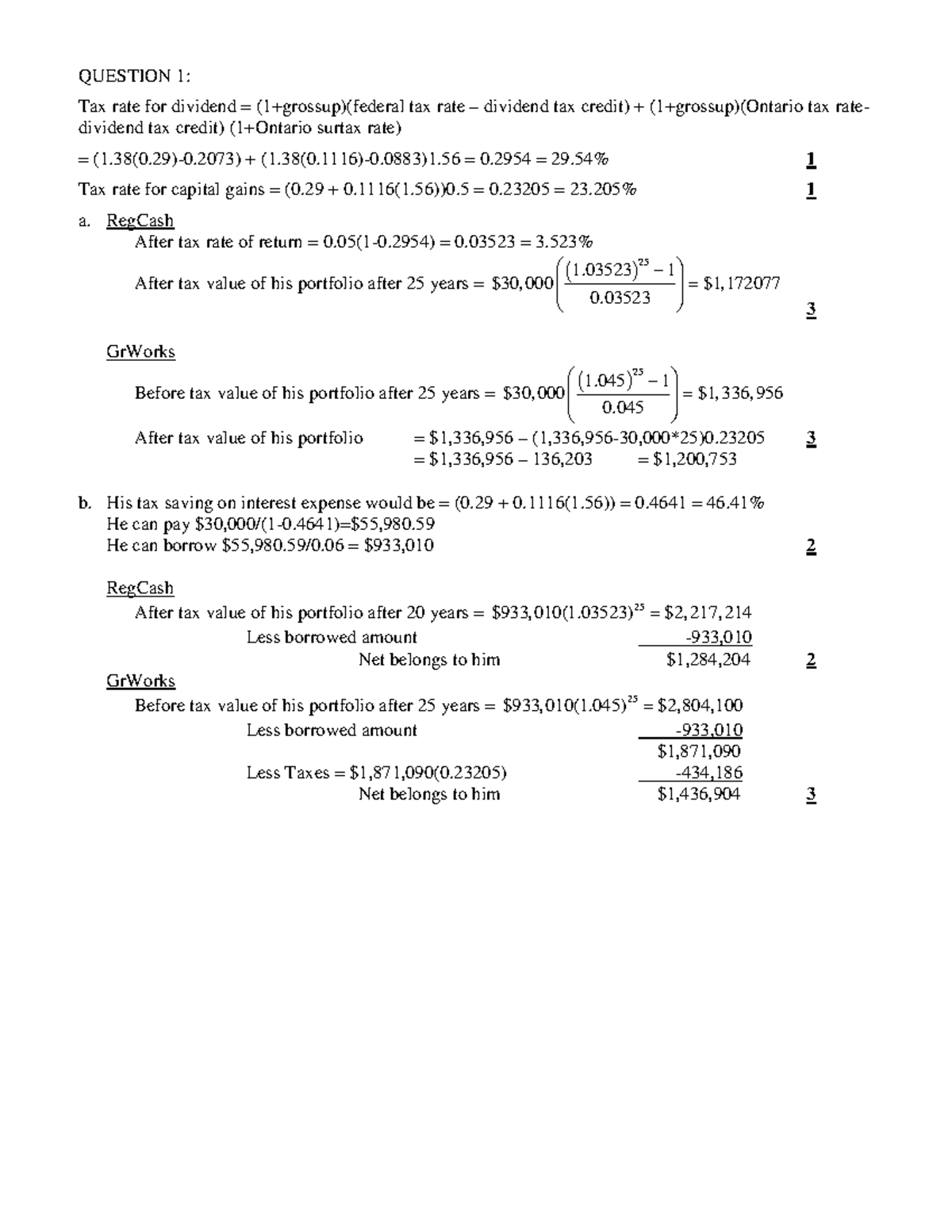

Final 2019 Answers QUESTION 1 Tax Rate For Dividend 1 grossup

Withholding Tax Return

Ontario Tax Return Dates - Key Takeaways The 2024 tax filing deadline is April 30 2024 for individuals and June 17 2024 for the self employed The CRA