Oregon Disabled Veteran Income Tax Exemption Web ORS 307 250 grants an exemption to any qualified disabled veteran You must have been a member of and discharged or released under honorable conditions from the U S

Web Disability compensation is a monthly tax free benefit paid to veterans who are at least 10 percent disabled because of injuries diseases or conditions that were incurred or Web 4 Dez 2023 nbsp 0183 32 State fiscal analysts estimated that one third of the eligible veterans had an adjusted gross income below 80 000 one third fell between 80 000 and 150 000 and

Oregon Disabled Veteran Income Tax Exemption

Oregon Disabled Veteran Income Tax Exemption

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Alabama-100-Percent-Disabled-Veteran-Property-Tax-Exemption-scaled.jpg

Veteran Tax Exemptions By State

https://www.communitytax.com/wp-content/uploads/2019/10/vet3-1024x862.png

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Nebraska-100-Disabled-Veteran-Property-Tax-Exemption-1536x922.jpg

Web Disabled Veteran or Surviving Spouse Oregon Homestead Property Tax Exemptions Oregon offers property tax exemptions of 25 537 or 30 646 for disabled Veterans Web As used in this section and ORS 307 260 Claiming exemption 307 262 Tax years for which exemption may be claimed upon receipt of federal certification of disability and

Web If so you can also claim the refundable Oregon earned income credit Your Oregon credit is 9 percent of your federal EITC or 12 percent of your EITC if you have a dependent Web 19 Okt 2023 nbsp 0183 32 A veteran with at least a 10 service related disability may get a 5 000 property tax exemption Meanwhile a 100 service

Download Oregon Disabled Veteran Income Tax Exemption

More picture related to Oregon Disabled Veteran Income Tax Exemption

Disabled Veteran Tax Exemption Workshops

https://hickoryhillsil.org/wp-content/uploads/2016/02/workshop.jpg

Veteran Disability Exemptions By State VA HLC

https://www.vahomeloancenters.org/wp-content/uploads/2014/10/Veteran-Disability-Exemptions-by-State-1024x837.png

Veterans Tax Exemption Veterans

https://vets.umatillacounty.gov/fileadmin/_processed_/a/f/csm_tax_cf6af4b83c.jpg

Web 18 Jan 2023 nbsp 0183 32 Veterans rated at 40 or more disabled by the VA may qualify for a property tax exemption Oregon Veterans Emergency Assistance Oregon offers emergency financial assistance for veterans Web If you re a disabled veteran or the surviving spouse or registered domestic partner partner of a veteran you may be entitled to exempt 25 537 or 30 646 of your home

Web 26 Apr 2023 nbsp 0183 32 There are federal tax deductions and exemptions that can reduce the amount of taxes disabled veterans pay VA disability benefit payments aren t taxed Web Provides 100 percent property tax exemption for homestead or personal property of veteran aged 65 years or older with service connected disabilities of 100 percent or

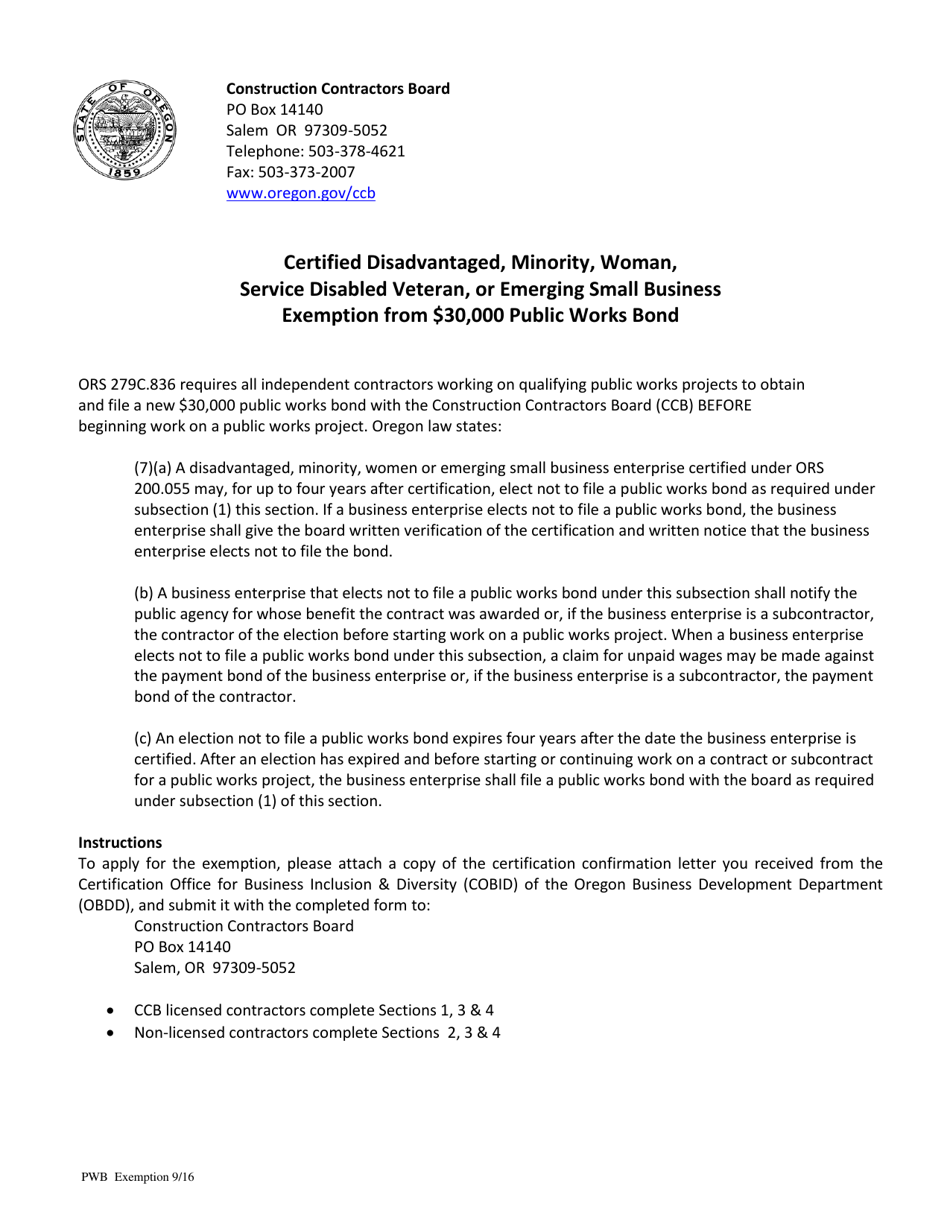

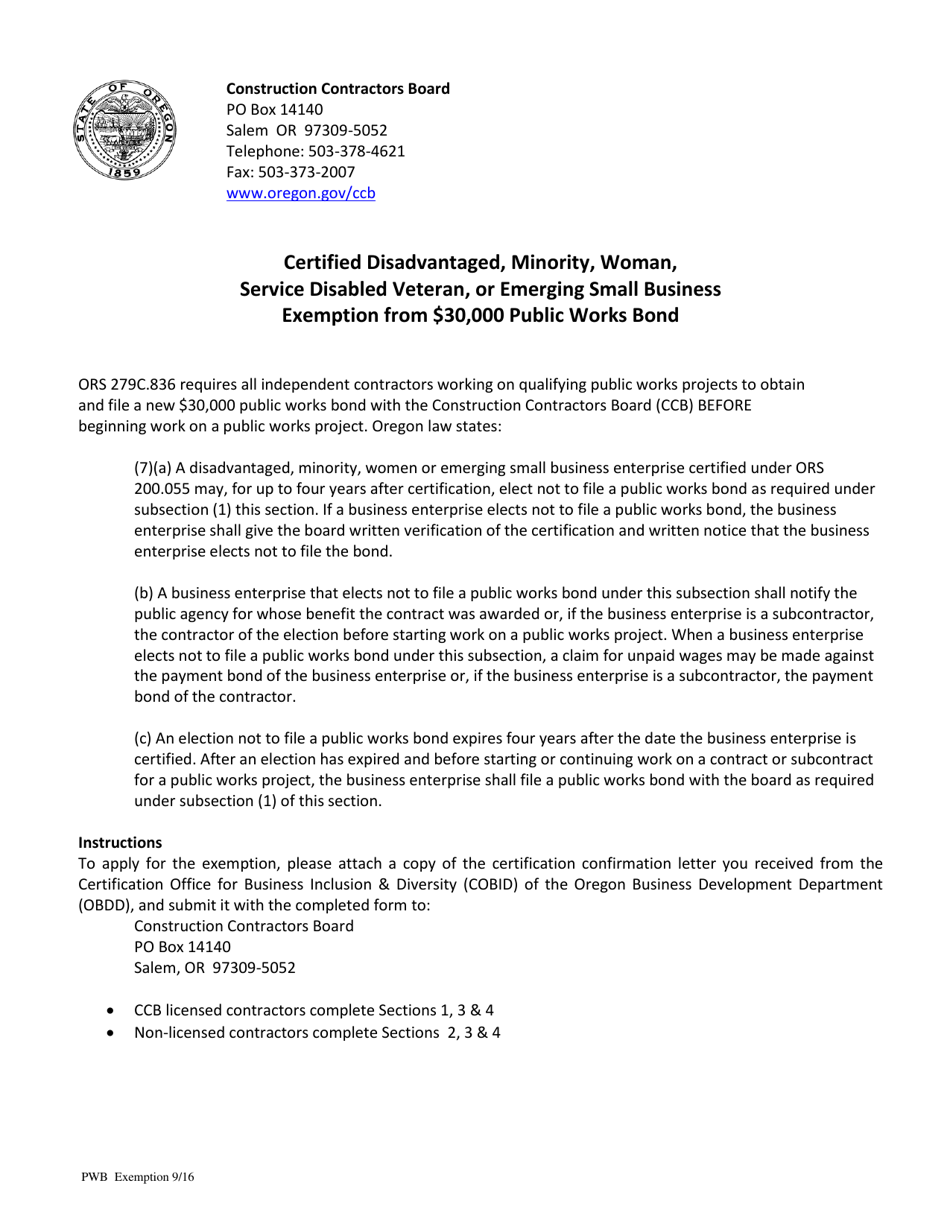

Oregon Certified Disadvantaged Minority Woman Service Disabled

https://data.templateroller.com/pdf_docs_html/2284/22840/2284029/certified-disadvantaged-minority-woman-service-disabled-veteran-or-emerging-small-business-exemption-from-30-000-public-works-bond-oregon_print_big.png

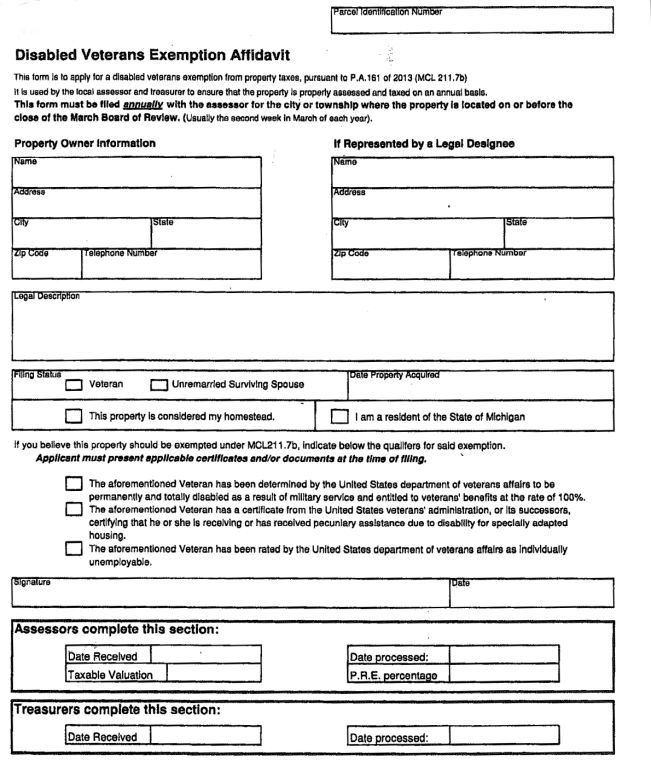

Fill Free Fillable 2021 CLAIM FOR DISABLED VETERANS PROPERTY TAX

https://var.fill.io/uploads/pdfs/html/c5f4391e-1654-4e63-bee2-ec54a53e7c28/bg5.png

https://www.oregon.gov/DOR/forms/FormsPubs/veteran-exe…

Web ORS 307 250 grants an exemption to any qualified disabled veteran You must have been a member of and discharged or released under honorable conditions from the U S

https://www.oregon.gov/odva/benefits/pages/disability-compensation.as…

Web Disability compensation is a monthly tax free benefit paid to veterans who are at least 10 percent disabled because of injuries diseases or conditions that were incurred or

2023 Disabled Veteran Property Tax Exemption Lake County Veterans And

Oregon Certified Disadvantaged Minority Woman Service Disabled

Veteran Tax Exemption 100 Disabled Veteran Benefits YouTube

City Hall Ceremony Celebrates Increased Tax Exemption For Disabled

All Veteran Property Tax Exemptions By State And Disability Rating

Tax Exemption Form For Veterans ExemptForm

Tax Exemption Form For Veterans ExemptForm

Houghtaling Bill Grants Tax Exemption For Disabled Veterans Red Bank

Senior Citizen Or Disabled Veteran Property Tax Exemption Applicaton

Veteran Income Tax Exemption Submission Form ExemptForm

Oregon Disabled Veteran Income Tax Exemption - Web 8 Juni 2021 nbsp 0183 32 If the disabled person was employed in a substantially gainful occupation the fact that a physical or mental condition will not permit the resumption in the same