Pa Off Road Fuel Tax Credit Taxes on motor and alternative fuels used to propel vehicles on public highways are imposed to fund highway and bridge construction maintenance and improvement and

Motor Fuels Tax The oil company franchise tax is imposed on all taxable liquid fuels an fuels on a cents per gallon equivalent basis and it is remitted by distributors of liquid Payments may be made via check addressed to the PA Department of Revenue using the information provided below PA Department of Revenue Motor and Alternative Fuel

Pa Off Road Fuel Tax Credit

Pa Off Road Fuel Tax Credit

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

Vertical Off Road Diesel Not For Use In Sign OSHA DANGER

https://media.compliancesigns.com/media/catalog/product/o/s/osha-fuel-sign-odep-31164_1000_1.gif

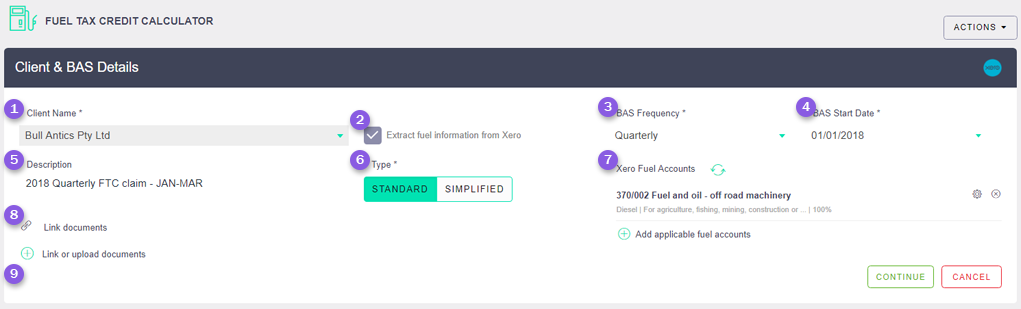

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

How do I request a Motor Fuels Tax reimbursement Answer ID 3906 Published 11 03 2020 11 47 AM Updated 01 01 2024 10 05 AM For large farming fishing or other fuel intensive businesses the amount of the refund can be significant In 2010 the federal tax per gallon generally was 18 3 cents for gasoline

Information about Form 4136 Credit For Federal Tax Paid On Fuels including recent updates related forms and instructions on how to file Use Form 4136 to claim a credit Answer ID 1631 Published 05 13 2004 11 19 AM Updated 11 14 2022 05 01 AM Is the reimbursement provided to farmers on gas taxes for the off road use of tractors and

Download Pa Off Road Fuel Tax Credit

More picture related to Pa Off Road Fuel Tax Credit

Fuel Off Road Warp Alloy Wheels Photos And Prices TyresAddict

https://cdn.tyresaddict.com/wheels/fuel-off-road/warp-d733/fuel-off-road-warp-d733.10058.full.png

Figure 2 1 From Identifying Excessive Vehicle Idling And Opportunities

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/2ad0eef4b6ef79e1d0b840a6fffb32255139d922/17-Figure2.1-1.png

Congestion Pricing Tax Bill And Traffic U2 How We Roll Dec 1 The

https://i0.wp.com/thesource.metro.net/wp-content/uploads/2017/12/RudeDudeShirt.png

Eligibility for this credit involves recording the gallons of gas and fuel used for off road purposes For example if you put 10 gallons of road diesel in your skid steer you can 2024 Federal Motor Fuel Income Tax Rates and Credits Pennsylvania Petroleum Association December 17 2023 Superfund Tax The Superfund tax was reinstated

Posted Jun 7 2023 05 55 PM EDT Updated Jun 9 2023 05 38 PM EDT WHTM Legislation that would replace Pennsylvania s Alternative Fuels Tax for electric vehicle This is the easiest way to electronically fill out the forms and prevent losing any information that you ve entered Motor Carrier Road Tax IFTA Forms Motor Fuels Tax Forms

Fuel Filter Off Road DRD Motorcycles

https://www.drdmotorcycles.co.uk/wp-content/uploads/2021/02/33D-E4620-00-00-Fuel-filter-offroad-44mm-Studio-001_Tablet.jpg

What Are ATO Fuel Tax Credits YouTube

https://i.ytimg.com/vi/abP2teHmXcs/maxresdefault.jpg

https://www. revenue.pa.gov /TaxTypes/MAFT

Taxes on motor and alternative fuels used to propel vehicles on public highways are imposed to fund highway and bridge construction maintenance and improvement and

https://www. revenue.pa.gov /TaxTypes/MAFT/MFT

Motor Fuels Tax The oil company franchise tax is imposed on all taxable liquid fuels an fuels on a cents per gallon equivalent basis and it is remitted by distributors of liquid

Fuel Tax Credit UPDATED JUNE 2022

Fuel Filter Off Road DRD Motorcycles

REDUCTION IN FUEL TAX CREDITS

Fuel Tax Reporting Software Verizon Connect Australia

Fuel Tax Credit Calculator AccountKit Support Center

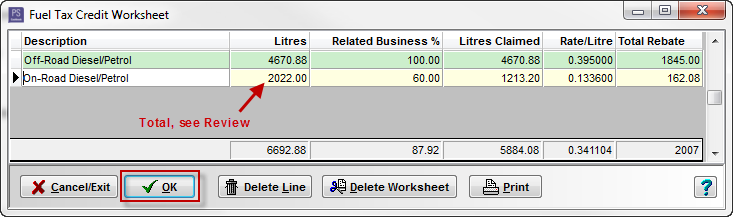

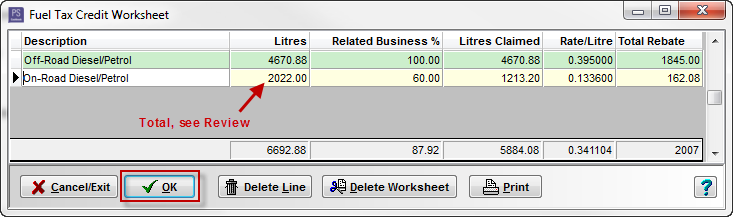

Calculating Fuel Tax Credit Manually PS Support

Calculating Fuel Tax Credit Manually PS Support

Fuel Tax Credits CIB Accountants Advisers

FUEL TAX CREDIT RATE INCREASE FROM 5 FEBRUARY 2018 Stubbs Wallace

Off Road Fuel Tanks Stafross

Pa Off Road Fuel Tax Credit - How do I request a Motor Fuels Tax reimbursement Answer ID 3906 Published 11 03 2020 11 47 AM Updated 01 01 2024 10 05 AM