Pennsylvania Homestead Exemption Judgment Pennsylvania and Federal law provide numerous exemptions of property from execution including the following Exemptions under Pennsylvania Law 1 General 300 statutory

The federal bankruptcy homestead exemption amount is 22 975 as of 2013 The exemption may be used for homes condos co ops mobile homes and How to Use a Homestead Exemption in a Pennsylvania Bankruptcy The homestead exemption protects equity in your home from creditors The examples

Pennsylvania Homestead Exemption Judgment

Pennsylvania Homestead Exemption Judgment

https://coloradobankruptcyguide.com/wp-content/uploads/2014/06/Should-I-File-Chapter-7-Or-Chapter-13-Bankruptcy-To-Keep-My-Home.jpg

Homestead Exemption Explained Clarke County Tribune

https://www.clarkecountytrib.com/sites/default/files/3045584.jpg

Homestead Exemption A Guide To Property Tax Relief ELIKA New York

https://www.elikarealestate.com/blog/wp-content/uploads/2023/07/homestead-exemption.jpeg

Property tax reduction will be through a homestead or farmstead exclusion Generally most owner occupied homes and farms are eligible for property tax reduction What is the Homestead Exclusion The Homestead Exclusion allows eligible Pennsylvania homeowners to lower the taxable value of their primary

However the homestead exemption is powerful protection for the small business owner who may face judgment liens from personal guarantees he or she A homestead exemption is the amount of money protected from the reach of judgment creditors over and above consensual liens such as mortgages and home

Download Pennsylvania Homestead Exemption Judgment

More picture related to Pennsylvania Homestead Exemption Judgment

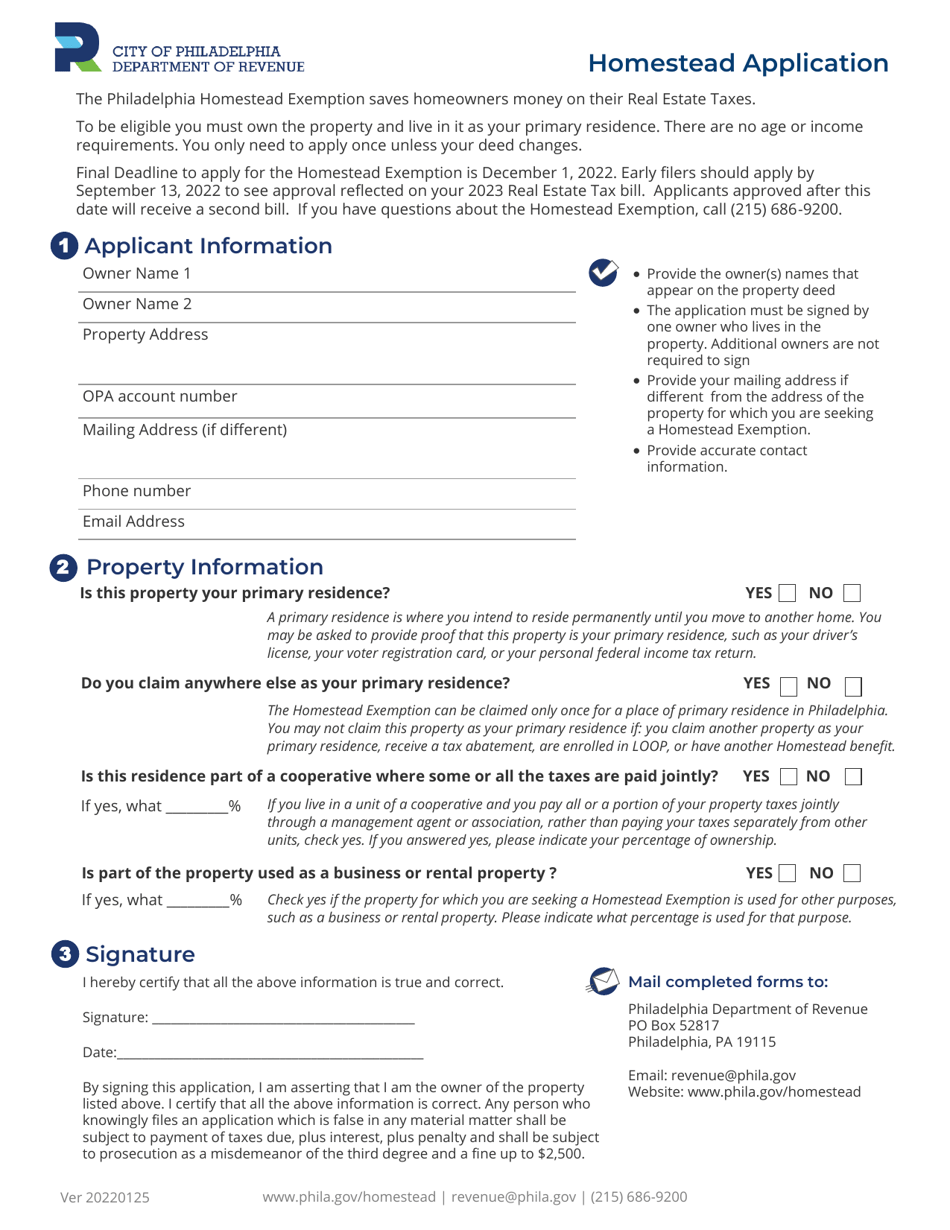

Complaint Judgment Sample Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/319/497319456/large.png

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

Homestead Exemption Deborah Bethune

https://deborahbethune.com/files/2023/02/RE-Flyer-Homestead-2023.jpg

Rule 3252 Writ of execution money judgments a The writ of execution shall include a notice to the defendant a summary of major exemptions and a claim for Pennsylvania General Assembly Share Home Statutes of Pennsylvania Consolidated Statutes Title 42 Title 42 Text Size A A A Print A provision of this

You can claim the federal homestead exemption when you initially file for bankruptcy The process can be as simple as naming the exemption and the property you wish to protect When a creditor seeks to collect a judgment against you all your property that s not exempt under state law could be taken to satisfy the judgment State laws

What Is A Homestead Exemption

https://bt-wpstatic.freetls.fastly.net/wp-content/blogs.dir/5422/files/2022/12/Socials-Template-1-23a2e91c9dc6aa43257c90ce605aa5b7af9c616f-1024x1024.png

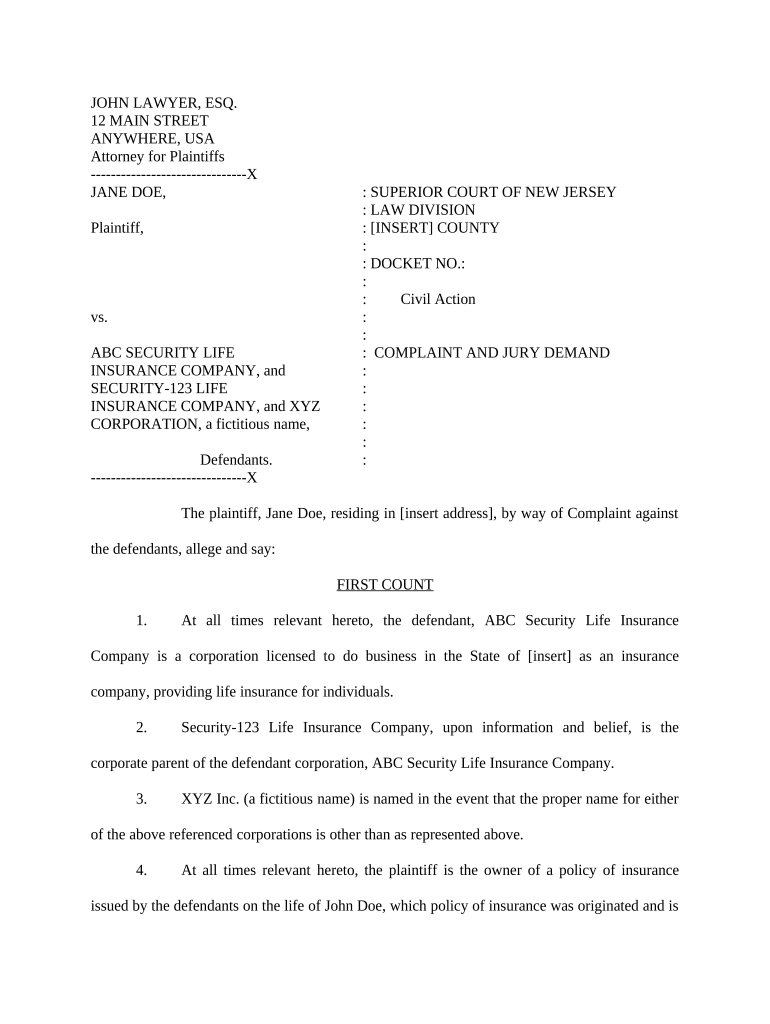

City Of Philadelphia Pennsylvania Homestead Exemption Application

https://data.templateroller.com/pdf_docs_html/2412/24128/2412862/homestead-exemption-application-city-of-philadelphia-pennsylvania_print_big.png

https://www.pacodeandbulletin.gov/Display/pacode?...

Pennsylvania and Federal law provide numerous exemptions of property from execution including the following Exemptions under Pennsylvania Law 1 General 300 statutory

https://www.findlaw.com/state/pennsylvania-law/...

The federal bankruptcy homestead exemption amount is 22 975 as of 2013 The exemption may be used for homes condos co ops mobile homes and

THE HOMESTEAD EXEMPTION DEADLINE IS MARCH 1st The Sheehan Agency

What Is A Homestead Exemption

Are You Aware Of The Benefits Of Homestead Exemptions

Homestead Exemption Welcome Home Team Naples

Homestead Exemption Protection Judgment Liens Roberts Law PLLC

What Is The Homestead Exemption

What Is The Homestead Exemption

How A Homestead Exemption Can Save You Taxes Orchard

Homestead Exemption

Homestead Exemption

Pennsylvania Homestead Exemption Judgment - Pennsylvania doesn t have any homestead exemptions though homeowners may be able to use federal exemptions Homesteads owned by more than