What Qualifies For Homestead Exemption In Pa Eligibility Criteria To be eligible for the Homestead Exclusion the property must be your primary residence This means it should be the place where you live for most of the year and consider your permanent home Both houses and condos are eligible provided they are the homeowner s primary place of residence

Homestead and farmstead exemption A portion of your Pennsylvania home s value may be excluded from property tax The amount will depend on the tax jurisdiction or school district in which the home is located To qualify for the Homestead Exemption you must own the property and you must live in the property as your primary residence There are no income or age limits to qualify for the Homestead Exemption If part of your house is a business and the other part is your primary residence can you get a partial Homestead

What Qualifies For Homestead Exemption In Pa

What Qualifies For Homestead Exemption In Pa

https://www.yourwaypointe.com/wp-content/uploads/2017/07/Florida-Homestead-Tax-Exemption.jpg

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

https://i.ytimg.com/vi/1EcmMvUwEp8/maxresdefault.jpg

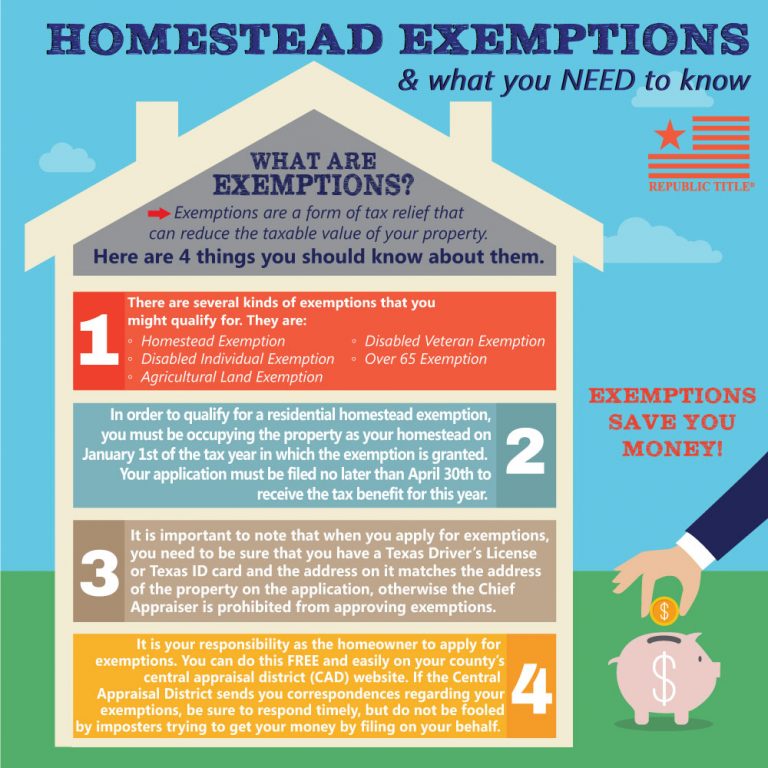

Homestead Exemptions

https://www.pbcgov.org/papa/_images/Five_Ways_to_Lose_Homestead.png

What are homestead and farmstead exclusions How does a taxpayer become eligible to receive a homestead or farmstead exclusion Will every property owner receive property tax relief To what extent will property taxes be reduced Will every homeowner in the state get the same amount of property tax relief Local Income Tax The homestead exemption protects equity in your home from creditors The examples below assume your home is worth 220 000 and you have a 50 000 homestead exemption available Example 1 If you own a house worth 220 000 and have a mortgage balance of 170 000 you have 50 000 of equity in the property

A homeowner can only have one homestead exclusion Any other homesteads will be removed and the owner is subject to interest penalties and fines up to 2 500 Properties that may qualify for the homestead exclusion include Owner occupied residential property and certain farmstead properties Church s rectory or manse that is a primary The Homestead Exemption reduces the taxable portion of your property s assessed value With this exemption the property s assessed value is reduced by 80 000 Most homeowners will save about 1 119 a year on their Real Estate Tax bill starting in 2023

Download What Qualifies For Homestead Exemption In Pa

More picture related to What Qualifies For Homestead Exemption In Pa

Texas Homestead Tax Exemption Guide New For 2024

https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg

How To Calculate Homestead Exemption In Texas Just For Guide

https://lh3.googleusercontent.com/proxy/mbURpfS4-608iEfJ4jyDuNVbLg080qRAWN5HQatGYGRXgt9_pgHoqzR3hduwxTFS_CWF6CwpIAKbGa3EYjlET46QimfKo1dsXs_BgIO-7QupBrafXrGPSXCU56CVMyKZ=w1200-h630-p-k-no-nu

Homestead Reminder Shayla Twit

https://www.sarasotarealestatesold.com/wp-content/uploads/2021/12/GaY66es9TaScia2JjL6t_DONT-Forget.png

The exemption may be used for homes condos co ops mobile homes and burial plots Married couples may double this exemption to 45 950 Whether you may keep your home in a bankruptcy filing will depend on how much equity you have in the property and how much of that is exempt from creditors Under a homestead or farmstead property tax exclusion the assessed value of each homestead or farmstead is reduced by the same amount before the property tax is computed On June 27 2006 Governor Edward G Rendell signed Special Session House Bill 39 SS HB 39 into law

Claiming Eligibility To be eligible for a homestead exclusion a natural person must be the owner of the property and that property must be both your domicile Key Takeaways A homestead exemption reduces homeowners state property tax obligations The exemption can help protect a home from creditors in the event of a spouse dying or a homeowner

Texas Homestead Tax Exemption Cedar Park Texas Living

https://cedarparktxliving.com/wp-content/uploads/2020/12/Homestead-Tax-Exemption-810x810.jpg

Texas Homestead Tax Exemption

https://sistaticv2.blob.core.windows.net/rattikin/img/resources/Texas-Homestead-Law-Revision-2023-01-12422513.jpg

https://www.montcoliving.com/real-estate/2024/2/9/...

Eligibility Criteria To be eligible for the Homestead Exclusion the property must be your primary residence This means it should be the place where you live for most of the year and consider your permanent home Both houses and condos are eligible provided they are the homeowner s primary place of residence

https://www.nolo.com/legal-encyclopedia/are-you...

Homestead and farmstead exemption A portion of your Pennsylvania home s value may be excluded from property tax The amount will depend on the tax jurisdiction or school district in which the home is located

Tourshabana What Is The Homestead Exemption Definition Tax

Texas Homestead Tax Exemption Cedar Park Texas Living

File Your Homestead Exemption Amy Kolb

Homestead Exemption Mojgan JJ Panah

Montgomery County Homestead Exemption 2019 2024 Form Fill Out And

Homestead Exemptions Reminder Due January 1 April 30

Homestead Exemptions Reminder Due January 1 April 30

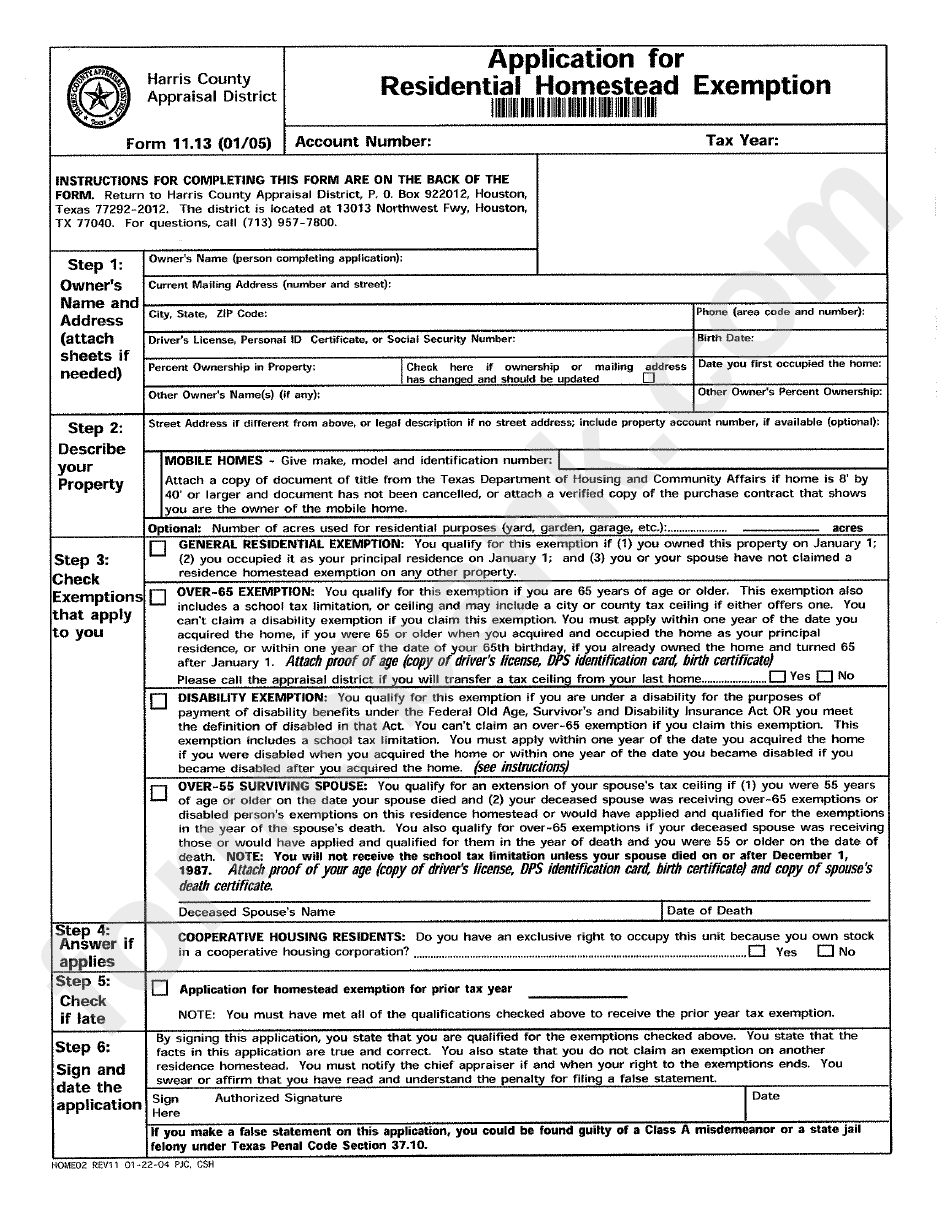

Harris County Homestead Exemption Form Printable Pdf Download

How To File For Florida Homestead Exemption Tutorial Pics

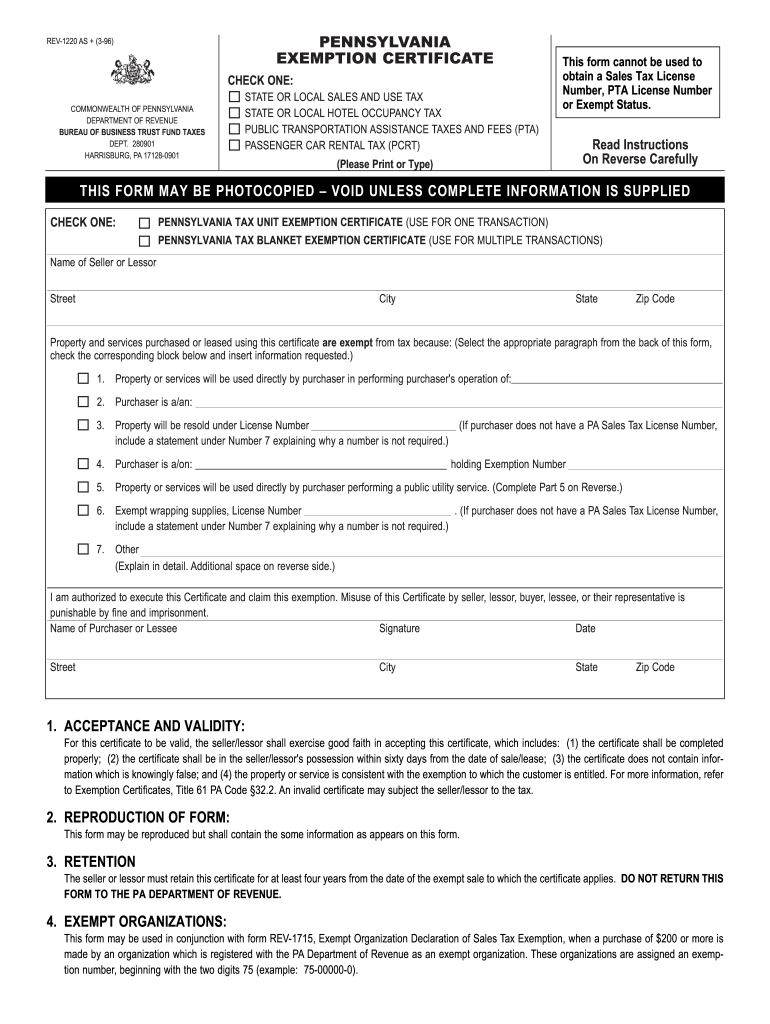

Pa Tax Exempt Form 2023 ExemptForm

What Qualifies For Homestead Exemption In Pa - A homeowner can only have one homestead exclusion Any other homesteads will be removed and the owner is subject to interest penalties and fines up to 2 500 Properties that may qualify for the homestead exclusion include Owner occupied residential property and certain farmstead properties Church s rectory or manse that is a primary