Personal Tax Credits Return Canada 102 rowsAll deductions credits and expenses Find out which deductions credits and

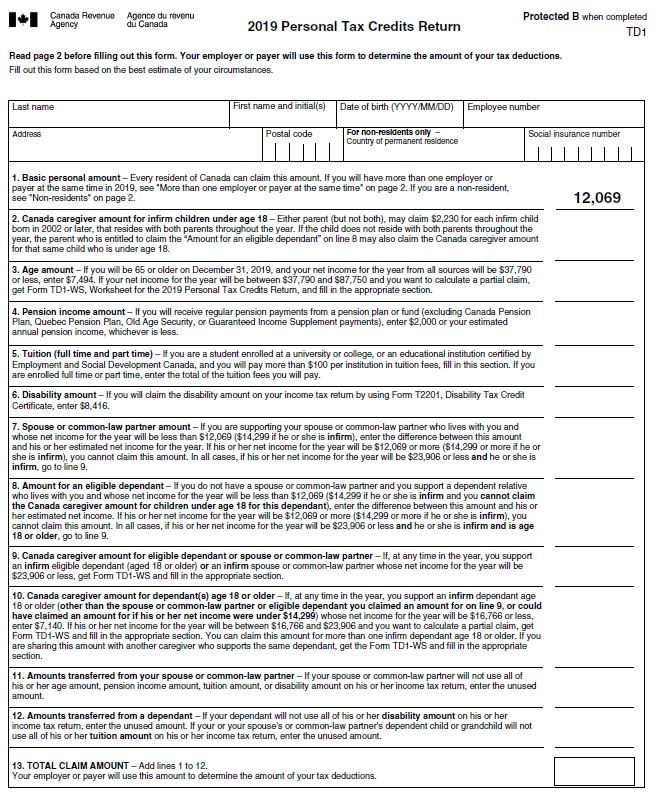

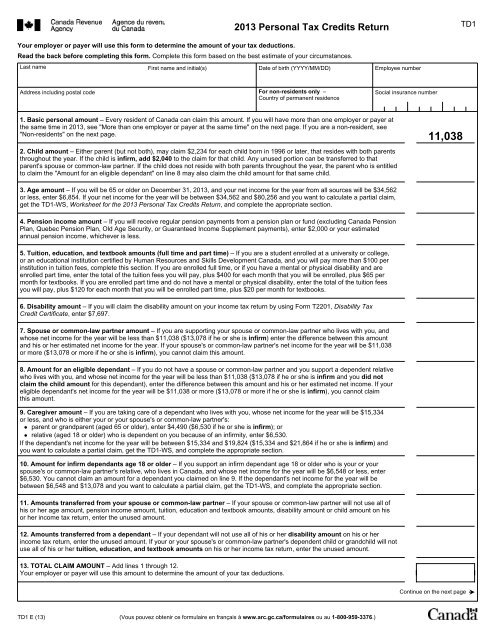

The TD1 Tax Form or Personal Tax Credits Return is used to calculate the amount of income tax that will be deducted or withheld by your employer or from The TD1 Form formally known as the Personal Tax Credits Return is used by Canadian taxpayers to estimate the amount of tax taken from their income by employers who run

Personal Tax Credits Return Canada

Personal Tax Credits Return Canada

https://www.taxback.com/resources/blogimages/20190220140632.1550664392267.a5796b2b428f31965ec36805340.jpg

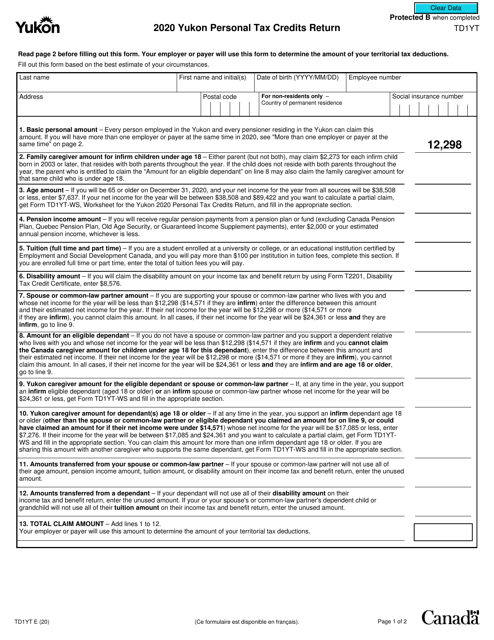

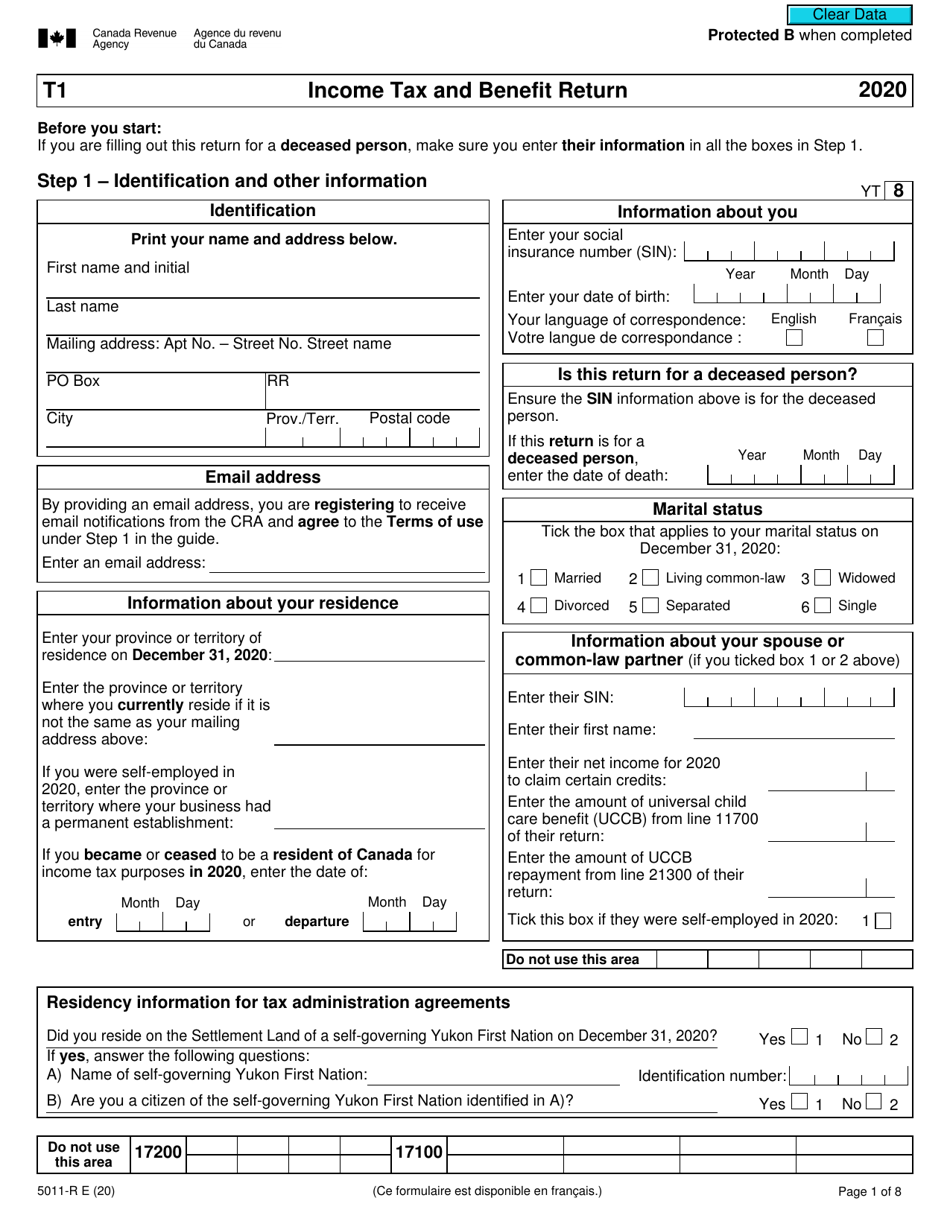

Form TD1YT 2020 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2002/20028/2002848/form-td1yt-yukon-personal-tax-credits-return-yukon-canada_big.png

Alberta Tax Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/633/753/633753558/large.png

Claiming deductions credits and expenses Find deductions credits and expenses you can claim on your tax return to help reduce the amount of tax you have to pay Personal income tax Who should file a tax return how to get ready for taxes filing and payment due dates reporting your income and claiming deductions and how to make a

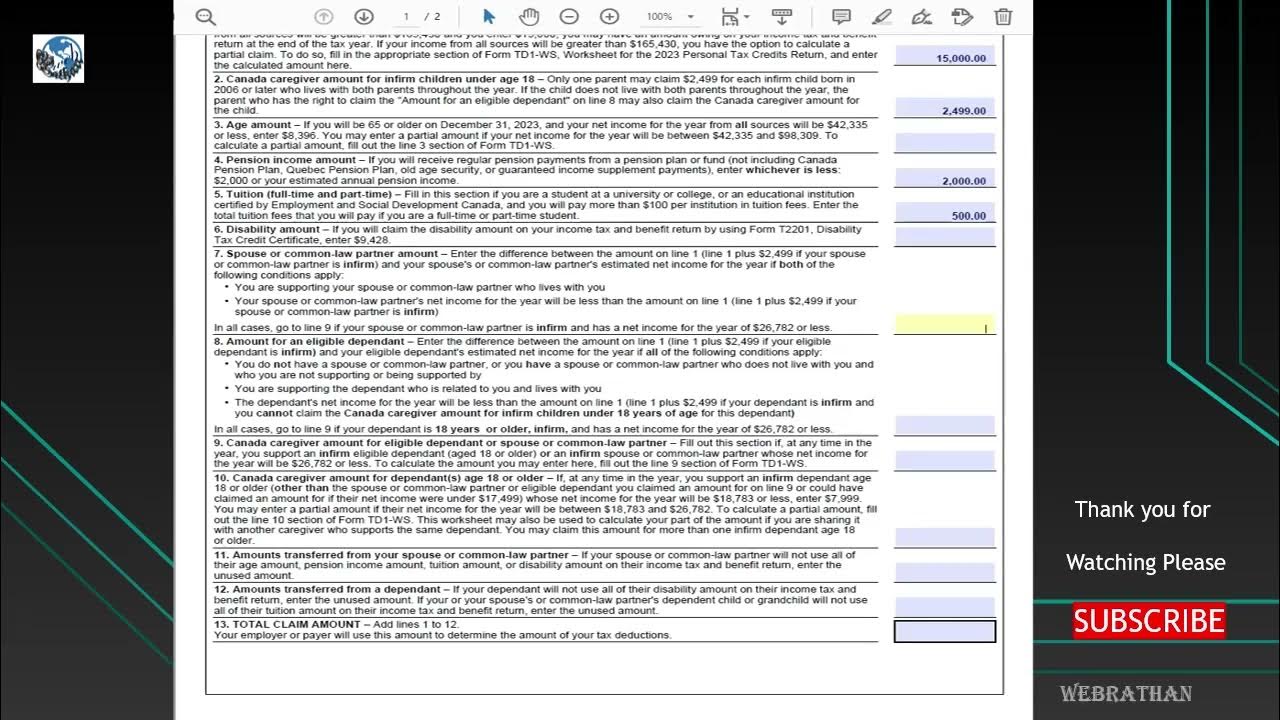

2022 Personal Tax Credits Return TD1 Read page 2 before filling out this form Your employer or payer will use this form to determine the amount of your tax deductions The basic personal amount for your federal TD1 is 15 000 This means that you won t be required to pay tax on the first 15 000 that you earn This is why this is

Download Personal Tax Credits Return Canada

More picture related to Personal Tax Credits Return Canada

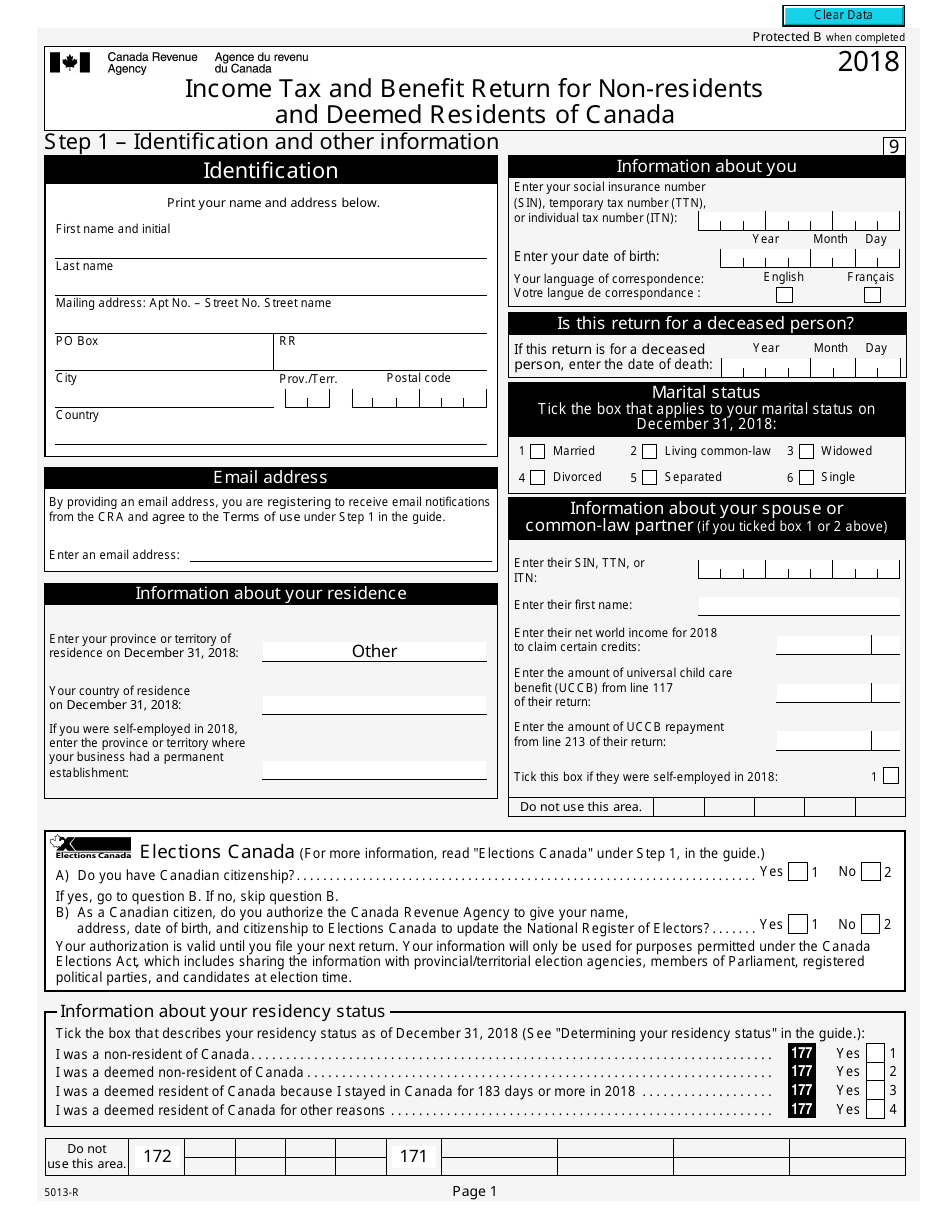

Form 5013 R 2018 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/1867/18679/1867929/form-5013-r-income-tax-and-benefit-return-for-non-residents-and-deemed-residents-of-canada-canada_print_big.png

2019 Form Canada T3 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/535/269/535269134/large.png

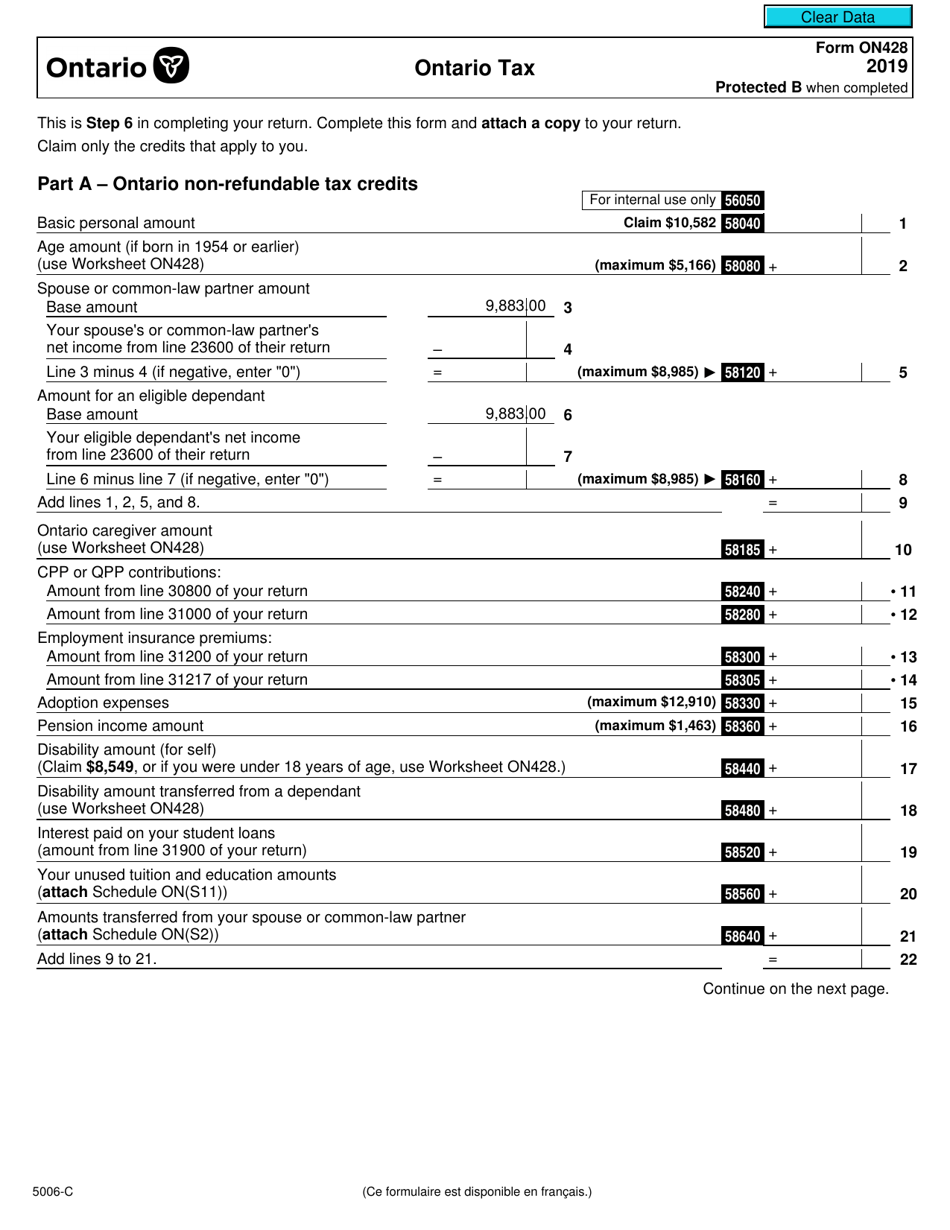

Form ON428 5006 C 2019 Fill Out Sign Online And Download

https://data.templateroller.com/pdf_docs_html/2066/20665/2066552/form-on428-5006-c-ontario-tax-canada_print_big.png

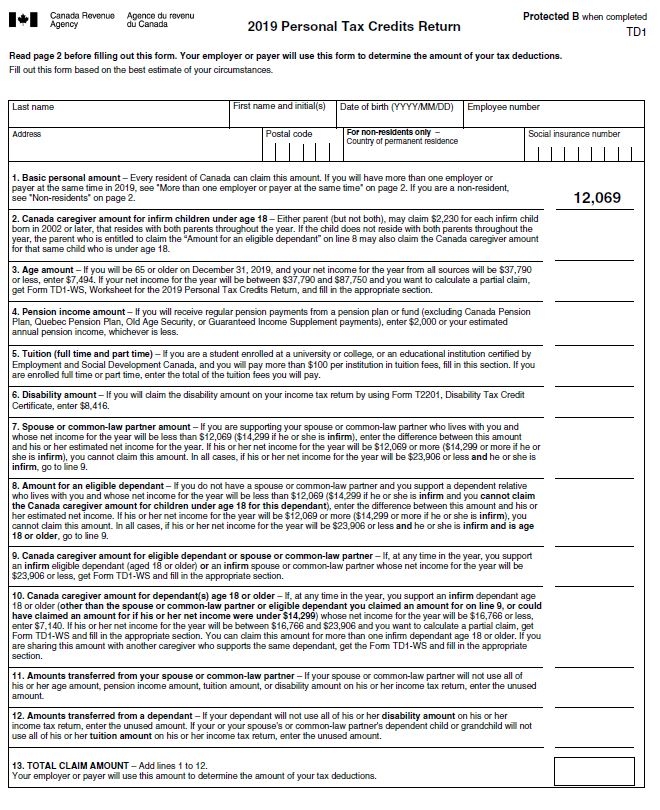

Basic personal amount Every resident of Canada can enter a basic personal amount of 13 229 However if your net income from all sources will be greater than 150 473 and Filling out the TD1 form is simple and straightforward By accounting for and estimating the potential tax credits available you can gain a picture of what you will owe Here are

A TD1 form is required if A new employee starts working for you An employee needs to alter or modify the amounts of claims and income An employee Get the latest tax news to your email Email Address By clicking the Subscribe button you consent to receiving electronic messages from H R Block Canada regarding product

TaxTips ca TD1 Forms For Employees Make Sure They Are Up To Date

https://www.taxtips.ca/personaltax/employees/td1-2023.jpg

How To Fill TD1 2023 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/GhVvNvHpO9M/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLA1GWVUtAc4s-DKgsChFuSuhonPog

https://www.canada.ca/en/revenue-agency/services/...

102 rowsAll deductions credits and expenses Find out which deductions credits and

https://turbotax.intuit.ca/tips/td1-tax-form...

The TD1 Tax Form or Personal Tax Credits Return is used to calculate the amount of income tax that will be deducted or withheld by your employer or from

First Name And Initials Fill Out Sign Online DocHub

TaxTips ca TD1 Forms For Employees Make Sure They Are Up To Date

2023 Canada Tax Checklist What Documents Do I Need To File My Taxes

Free Electronic TD1NB Form TD1 New Brunswick Free Template From Pandadoc

Form TD1NU 2020 Fill Out Sign Online And Download Fillable PDF

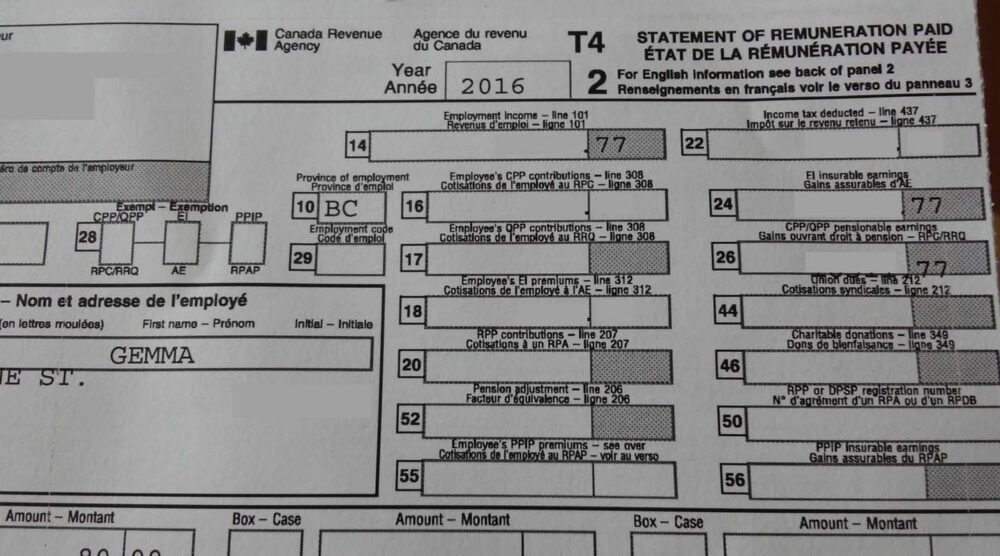

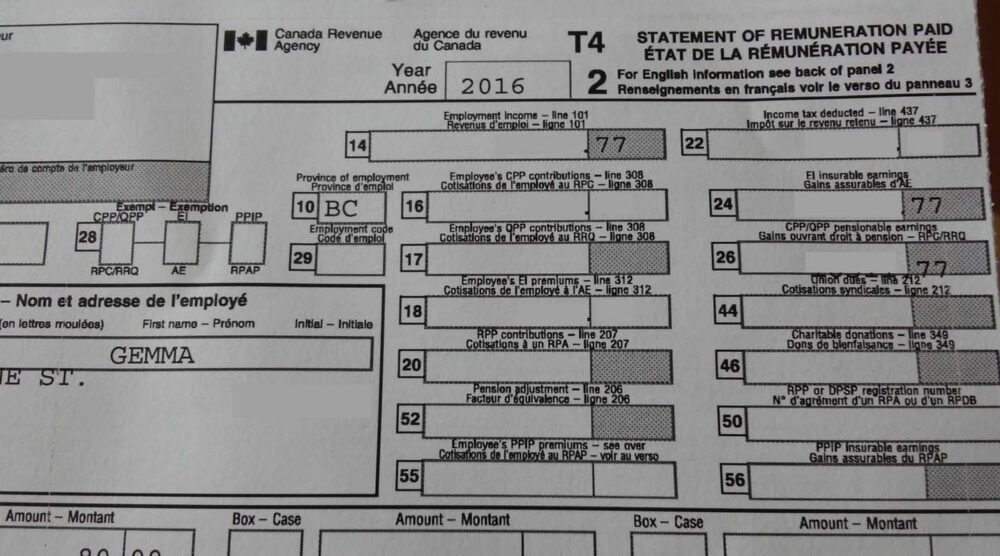

How To File A Tax Return On A Working Holiday In Canada 2021

How To File A Tax Return On A Working Holiday In Canada 2021

Form 5011 R 2020 Fill Out Sign Online And Download Fillable PDF

TD1 2013 Personal Tax Credits Return

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

Personal Tax Credits Return Canada - There are two types of tax credits available to you on a federal and provincial level refundable and non refundable Refundable tax credits will be given to you no