Personal Tax Relief On Electric Cars Uk Find out whether you or your employee need to pay tax or National Insurance for charging an electric car You can also check if your employee is eligible for tax relief

The new 2025 VED rules will impact hundreds of thousands of EV owners and their electric vehicle running costs As well as paying for road tax for the first time there will also be In this article we outline the key tax reliefs available to Limited Companies who are considering purchasing an Electric Vehicle EV New company car tax rates

Personal Tax Relief On Electric Cars Uk

Personal Tax Relief On Electric Cars Uk

https://bop.boilerhouse.co.uk/static/headers/1508851821.jpg

Personal Tax Relief 2021 L Co Accountants

https://landco.my/wp-content/uploads/2021/11/3-5.png

Mivo Link Tax Credits On Electric Cars Heat Pumps Will Help Low

https://oregoncapitalchronicle.com/wp-content/uploads/2022/09/DSC04259-scaled.jpg

Electric cars will no longer be exempt from vehicle excise duty from April 2025 the chancellor has said Announcing the change as part of his Autumn Statement Jeremy Hunt said the move was Capital Allowances If your business purchases a new and unused electric car you get full tax relief in the year of purchase Buy a 50 000 car save 9 500 in

From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s The cost of domestic electricity incurred charging the company car at the employee s home is in tax law indistinguishable from the other running and

Download Personal Tax Relief On Electric Cars Uk

More picture related to Personal Tax Relief On Electric Cars Uk

Auto Suppliers Bearish On Electric Cars Robot swarms In Warehouses

http://static5.businessinsider.com/image/593ab753c4adee28008b4a19-1190-625/transportation-and-logistics-briefing-auto-suppliers-bearish-on-electric-cars--robot-swarms-in-warehouses--target-looks-to-speed-up-deliveries.jpg

Pin On Electric Cars And Transport

https://i.pinimg.com/originals/3a/50/0e/3a500e39285b0cafb9b2535a1f331069.png

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Where an employee uses their own electric car for business mileage they can claim an Authorised Mileage Allowance and if the employer pays less than the published rate Unlike with a combustion engined car businesses can deduct the full cost of buying or leasing an electric vehicle from their pre tax profits resulting in lower tax bills

Electric cars are a taxable benefit which means employees have to pay Benefit in Kind BIK tax on electric company cars However electric cars currently benefit from a much There s a different way to work out what you can claim if the car qualifies for the 100 first year allowance for example if it s an electric car or a car with zero CO2 emissions

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://cnadvisory.my/wp-content/uploads/2023/03/personal-tax-relief-2022-scaled.jpg

List Of Personal Tax Relief And Incentives In Malaysia 2024

https://iqiglobal.com/blog/wp-content/uploads/2023/01/tax-relief.jpg

https://www.gov.uk/expenses-and-benefits-electric-company-cars

Find out whether you or your employee need to pay tax or National Insurance for charging an electric car You can also check if your employee is eligible for tax relief

https://www.rac.co.uk/drive/electric-cars/running/...

The new 2025 VED rules will impact hundreds of thousands of EV owners and their electric vehicle running costs As well as paying for road tax for the first time there will also be

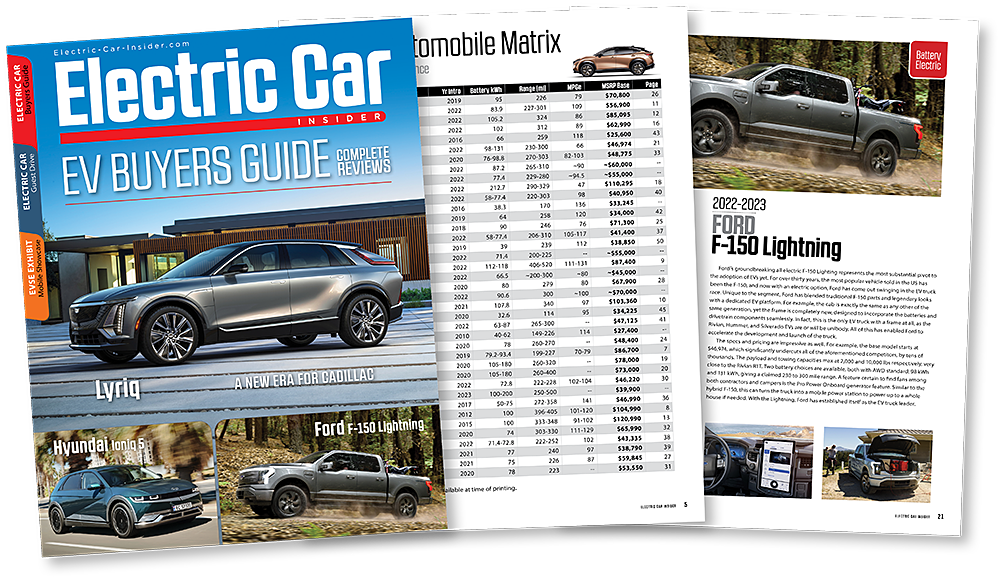

EV Buyers Guides

Company Tax Relief 2023 Malaysia Printable Forms Free Online

Malaysia Personal Income Tax Relief 2022

Personal Tax Relief 2022 L Co Accountants

PERSONAL INCOME TAX RELIEF 2022 MALAYSIA Haji Land Berhad

I Help Toyota Make A Real EV Commercial EV Auto Magazine

I Help Toyota Make A Real EV Commercial EV Auto Magazine

How To Claim Higher Rate Tax Relief On Pension Contributions

What Can I Claim On Tax 2023 Malaysia Sep 22 2022 Johor Bahru JB

)

BIK On Electric Cars BIK Explained For EV Company Car Drivers

Personal Tax Relief On Electric Cars Uk - Capital Allowances If your business purchases a new and unused electric car you get full tax relief in the year of purchase Buy a 50 000 car save 9 500 in