Petrol Allowance Tax Exemption Section 11 min read The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about

But when an employer has given a tax benefit on transport allowance or forgotten to give the tax benefit in Form 16 you can claim tax exemption by following Fuel allowance Flexible Benefit Plans allow organisations to include fuel costs in the salary structure of their employees Employees can claim a reimbursement of their

Petrol Allowance Tax Exemption Section

Petrol Allowance Tax Exemption Section

https://carajput.com/blog/wp-content/uploads/2020/10/Salary-allowances-1.png

Fuel Allowance Archives DocumentsHub Com

https://i1.wp.com/documentshub.com/wp-content/uploads/2015/12/Request-Application-for-Double-Duty-Allowance.png?w=1422&ssl=1

Car Allowance Exemption YouTube

https://i.ytimg.com/vi/GctBuLR_a1w/maxresdefault.jpg

Fuel allowance tax exemption how much is exempted The fuel allowance received by employees is subject to certain tax exemptions under section 10 The government has Benefit on free petrol petrol cards petrol bills up to RM6 000 It s important to note that the exemptions here do not apply if the employee in question is a director or

Find out the list of benefits available to a salaried person in India and save your tax legally What is Form EA Part 2 Defining the Perquisites Talenox 11 Comments Reading Time 4 minutes Editor s Note This article was first published in Jan 2020 and

Download Petrol Allowance Tax Exemption Section

More picture related to Petrol Allowance Tax Exemption Section

Fuel Allowance Form Michigan Free Download

https://www.formsbirds.com/formimg/fuel-allowance-form/1666/fuel-allowance-form-michigan-l3.png

How Do I Fill Out The 2019 W 4 Calculate Withholding Allowances Gusto

https://gusto.com/wp-content/uploads/2019/02/Screen-Shot-2019-07-18-at-11.00.43-AM.png

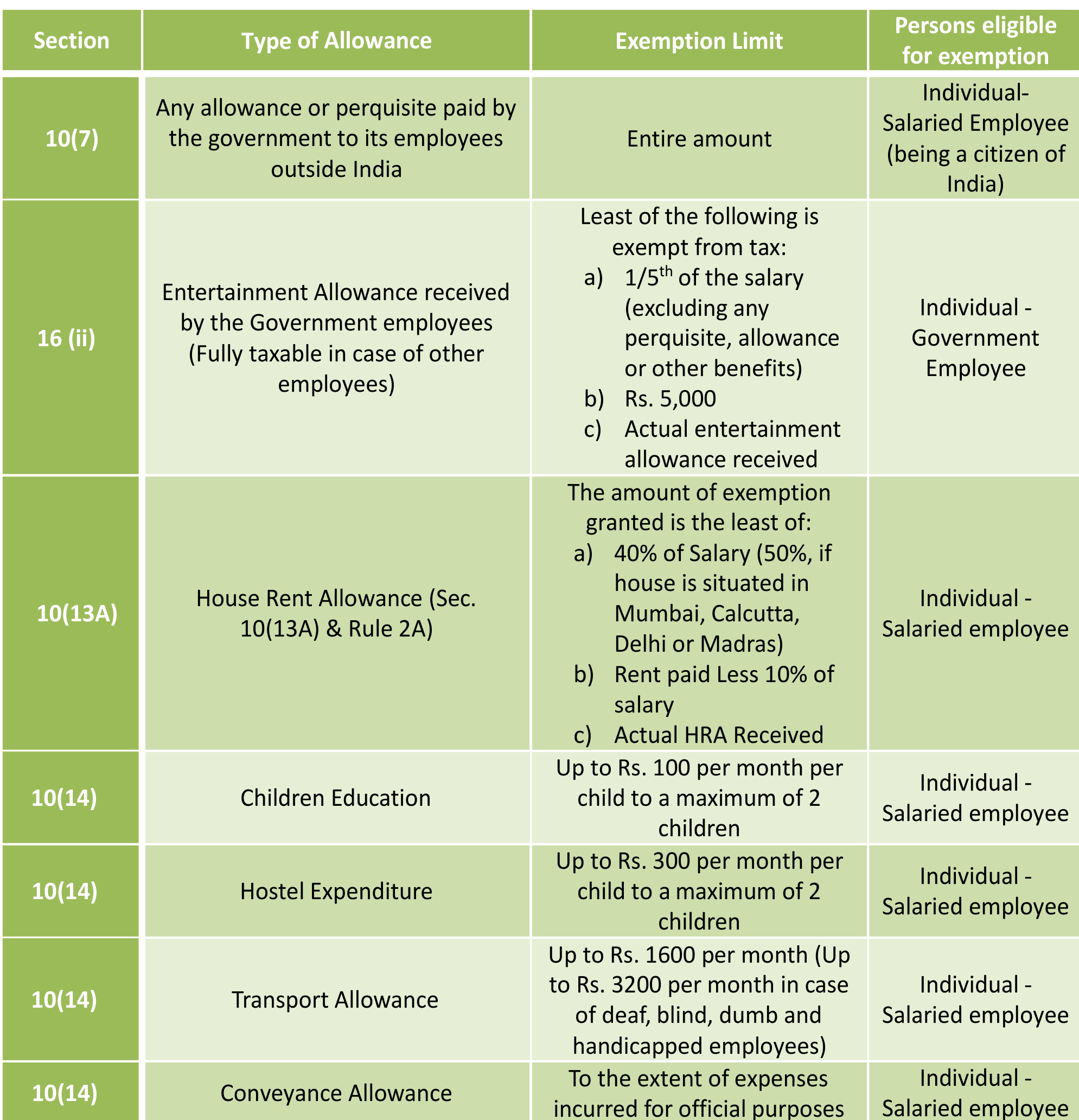

Exemptions Allowances And Deductions Under Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/EXEMPTIONS-ALLOWANCES-DEDUCTIONS-AVAILABLE-UNDER-THE-OLD-NEW-TAX-REGIME-1.jpg

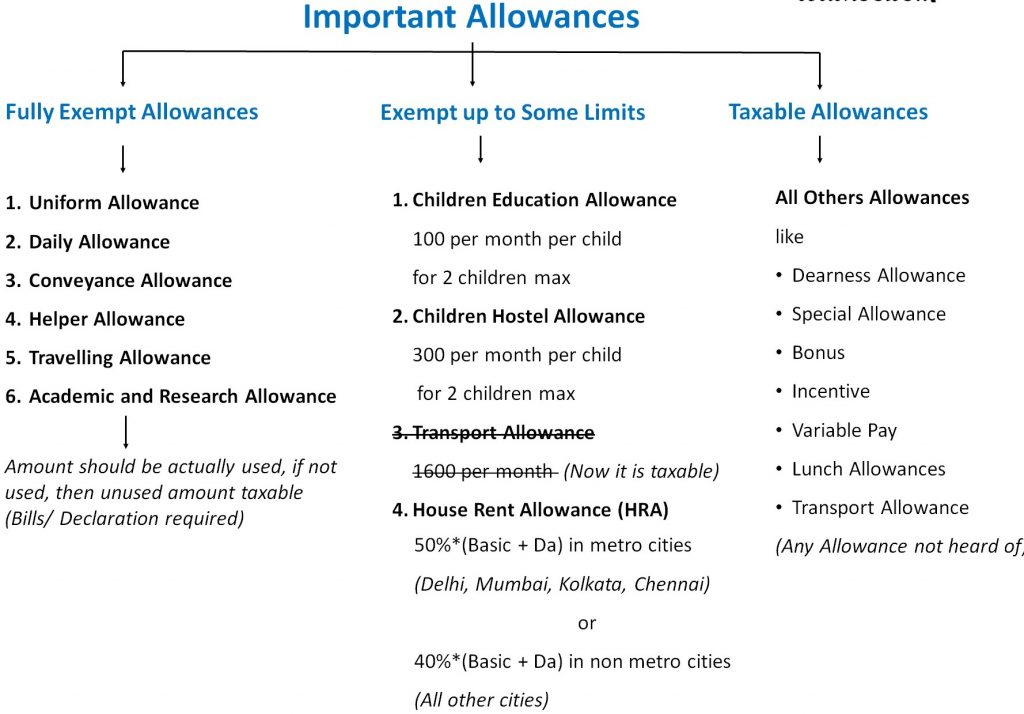

Petrol allowance also known as fuel allowance is a financial provision offered by employers to their employees to cover the cost of fuel expenses incurred EXEMPTION LIMIT PER YEAR 1 Petrol allowance travelling allowance or toll payment or any of its combination for official duties If the amount received exceeds

The benefit categorized as either fuel allowance car allowance petrol allowance or fuel allowance by corporate if availed by salaried for tax benefits can save 1 How much Petrol and Driver Reimbursement component is allowed under income tax can an company give 50 of salary as Petrol and Driver Reimbursement

Fuel Allowance Form Michigan Free Download

https://www.formsbirds.com/formimg/fuel-allowance-form/1666/fuel-allowance-form-michigan-l4.png

G LATAS 5 16 17 1 Corintios Romanos 2 Corintios

https://i.pinimg.com/originals/d0/be/7d/d0be7daf57a7e4c82a0cdba148a62e9a.jpg

https://cleartax.in/s/section-10-of-income-tax-act

11 min read The Government of India provides some exemptions in order to reduce your income tax burdens Section 10 of the Income tax Act 1961 talks about

https://cleartax.in/s/transport-allowance

But when an employer has given a tax benefit on transport allowance or forgotten to give the tax benefit in Form 16 you can claim tax exemption by following

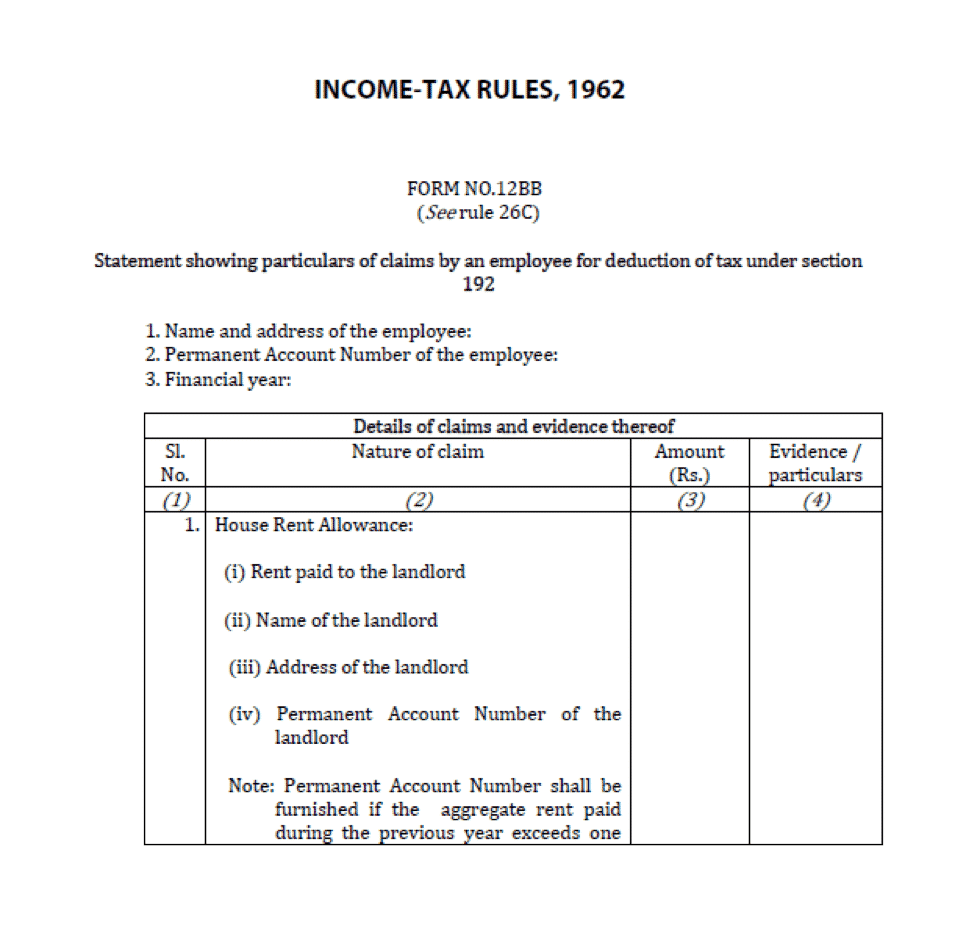

A Very Simple Guide To Form 12BB Download Format PDF

Fuel Allowance Form Michigan Free Download

You ll Pay R313 Tax Every Time You Fill Up With Petrol From Tomorrow

Salary Income And Tax Implications For FY 2020 21 AY 2021 22 TAXCONCEPT

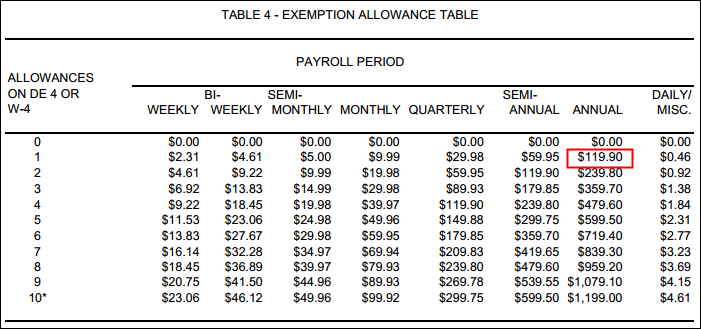

Exemptions Allowances Standard Withholding Table 2021 Federal

Deductions And Adjustments Worksheet For Federal Form W 4 Free Worksheets

Deductions And Adjustments Worksheet For Federal Form W 4 Free Worksheets

All About Allowances Income Tax Exemption CA Rajput Jain

Certificate Of TAX Exemption PAFPI

Rit 2022 2023 Acaedemic Calendar January 2022 Calendar

Petrol Allowance Tax Exemption Section - Benefit on free petrol petrol cards petrol bills up to RM6 000 It s important to note that the exemptions here do not apply if the employee in question is a director or