Phev Tax Credit Income Limit The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive

One credit is allowed per each new clean vehicle A taxpayer may make no more than two credit transfer elections per taxable year In the case of a joint income tax return All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Phev Tax Credit Income Limit

Phev Tax Credit Income Limit

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

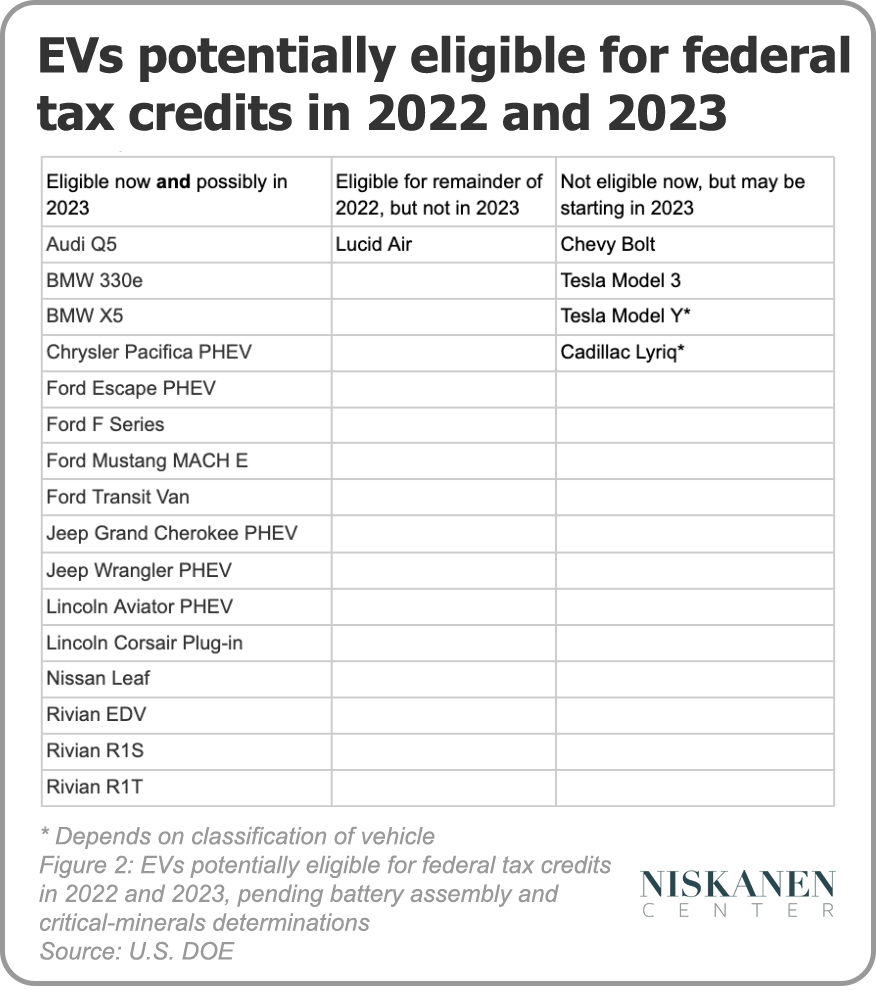

Federal EV Tax Credits Are About To Become Scarce Who Should Get Them

https://www.niskanencenter.org/wp-content/uploads/2022/10/Graph.png

The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

If you bought a new qualified clean vehicle in 2022 or before you may still be eligible for a clean vehicle tax credit but some restrictions apply For a full summary of those restrictions review this IRS guide All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity

Download Phev Tax Credit Income Limit

More picture related to Phev Tax Credit Income Limit

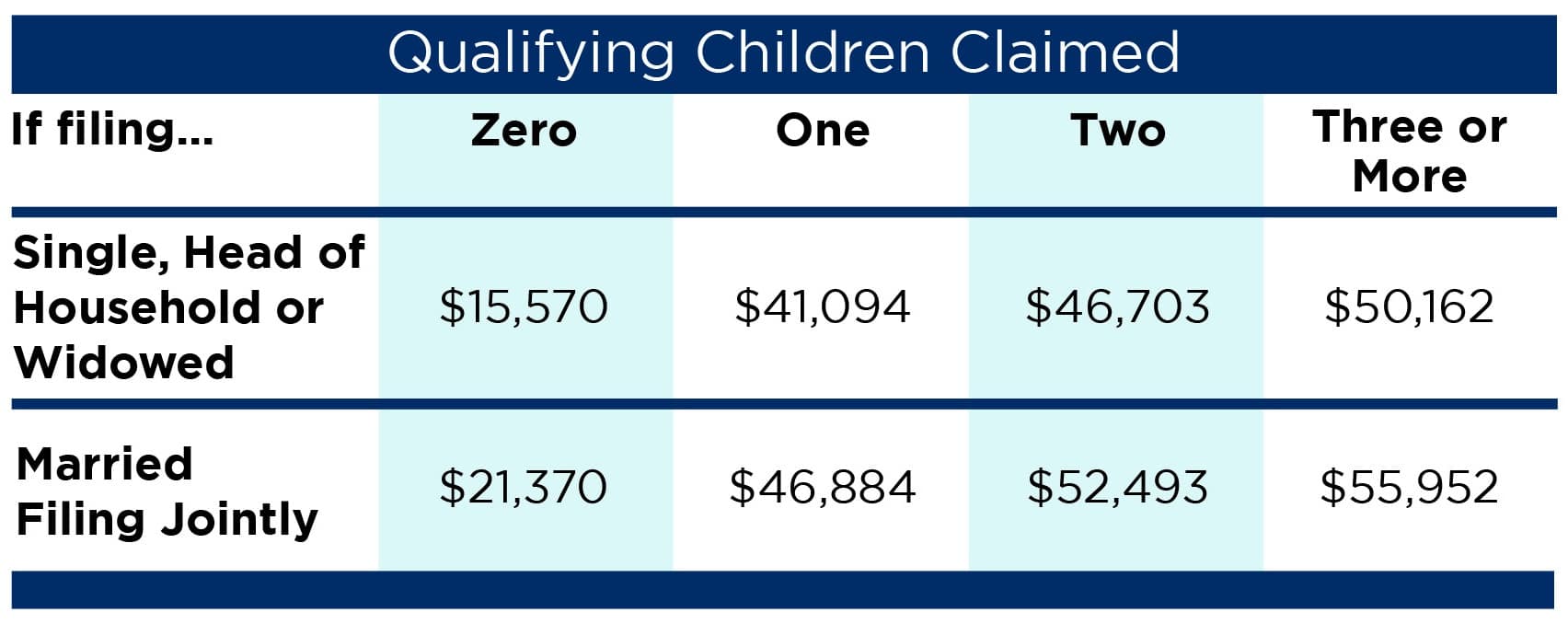

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

Child Tax Credit Income Limit 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2021/01/Child-Tax-Credit-Income-Limit.jpg

Earned Income Tax Credit For Households With One Child 2023 Center

https://www.cbpp.org/sites/default/files/2023-04/policybasics-eitc_rev4-28-23_f1.png

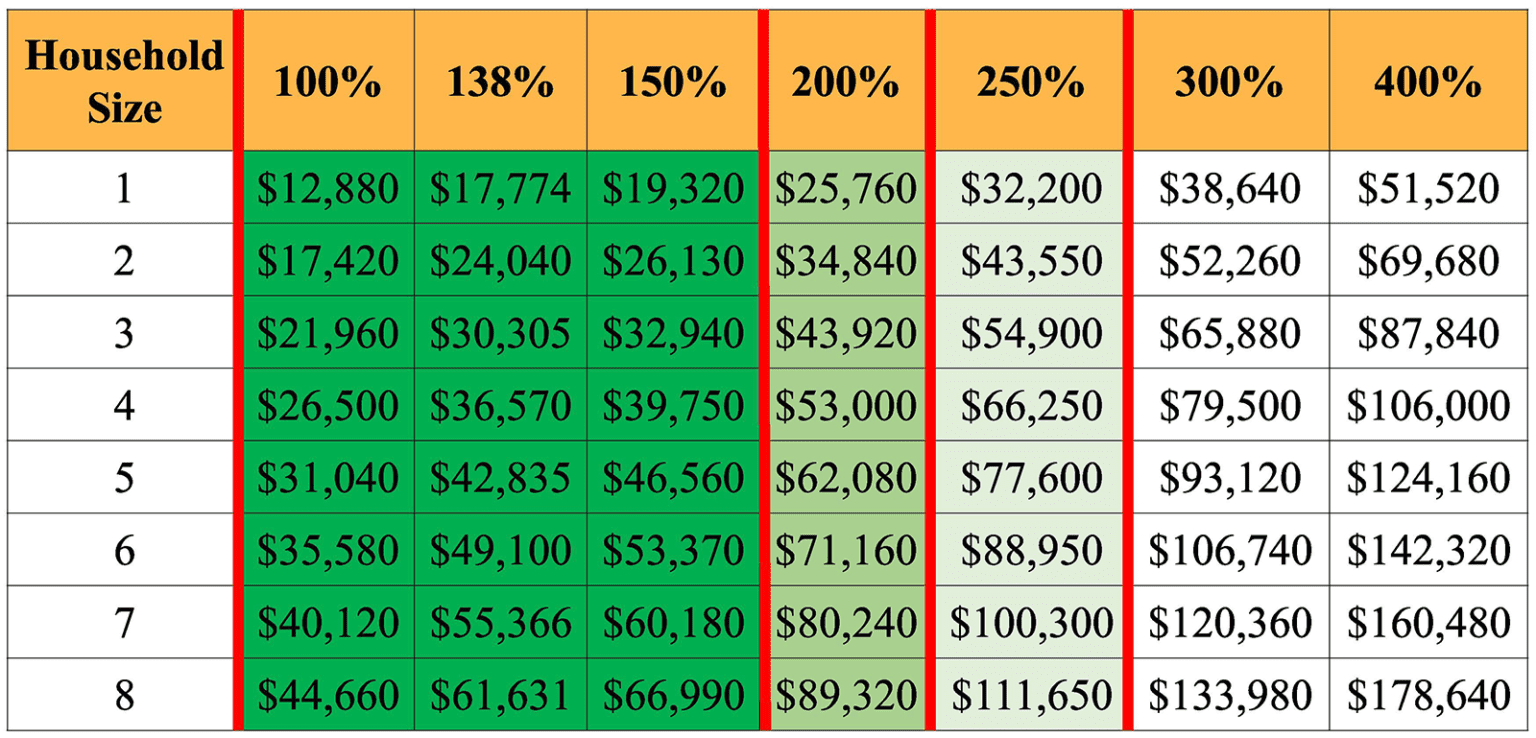

The Inflation Reduction Act IRA of 2022 made a tax credit of up to 7 500 available to qualifying purchasers of certain EVs But restrictions on buyer income and where the car components are There are also income caps though they re fairly generous starting at 150 000 for single filers and 300 000 for married couples filing jointly To claim the tax credit the buyer must

For 2024 the list of qualified vehicles for federal tax rebates only includes fully electric vehicles and a small selection of plug in hybrids If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The

EV Tax Credit 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2021/11/EV-Tax-Credit.jpg

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

https://img1.wsimg.com/isteam/ip/cdfbdeb1-9bb8-4d54-828b-6c8a27c8b1f0/image (1).png

https://www.irs.gov/newsroom/topic-b-frequently...

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive

https://www.irs.gov/newsroom/topic-a-frequently...

One credit is allowed per each new clean vehicle A taxpayer may make no more than two credit transfer elections per taxable year In the case of a joint income tax return

Where Could Interest And Tax Rates Be Headed Mercer Advisors

EV Tax Credit 2024 Credits Zrivo

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Tax Reduction Company Inc

FAQ WA Tax Credit

Phev federal Tax Credit

Phev federal Tax Credit

ACA Tax Credits To Help Pay Premiums White Insurance Agency

2023 Tax Brackets The Best Income To Live A Great Life

Earned Income Credit Limitation Tax Reform Changes Ohio CPA

Phev Tax Credit Income Limit - Comprehensive 2024 EV tax credit guide Learn about income limits eligible vehicles point of sale rebates and how to claim up to 7 500 on your tax return