Philadelphia Corporate Income Tax Return Instructions 2022 Verkko 2022 City of Philadelphia BUSINESS INCOME amp RECEIPTS TAX FOR BUSINESS CONDUCTED IN AND OUT OF PHILADELPHIA Entity Classification MUST select one Individual Sole Corporation Partnership Proprietor Business Name Estate Trust First Name MI Last Name Street Address Apt Suite City State Zip Postal Code 2022

Verkko Business Income amp Receipts Tax BIRT Due date April 15th for previous year s business returns Tax rate 1 415mills on gross receipts and 5 99 on taxable net income To complete online returns and payments for Verkko General information for 2022 Business Income amp Receipts Tax BIRT and Net Profits Tax NPT Tax regulations and forms are available at www phila gov revenue STOP If you have less than or equal to 100 000 in Philadelphia taxable gross receipts you are not required to file the BIRT return

Philadelphia Corporate Income Tax Return Instructions 2022

Philadelphia Corporate Income Tax Return Instructions 2022

https://i.pinimg.com/originals/16/3a/3f/163a3fd630928279add76e015be7ca00.png

List Of Tax Refund Calendar 2022 Ideas Blank November 2022 Calendar

https://i2.wp.com/www.thebalance.com/thmb/r9yZNfeqALaM7mQnJMp3woJh_18=/1170x1141/filters:no_upscale():max_bytes(150000):strip_icc()/tax-form-1040-line-5a-2020-3b8663a83ed14c3e8d94db10c19b7262.PNG

How To Fill Out Form 1040 For 2022 Taxes 2023 Money Instructor

https://i.ytimg.com/vi/dXjHkaNOFBo/maxresdefault.jpg

Verkko 11 tammik 2023 nbsp 0183 32 Business Income amp Receipts Tax BIRT Hotel Tax Liquor Tax Mechanical Amusement Tax Net Profits Tax Outdoor Advertising Tax Parking Tax Philadelphia Beverage Tax Sales Use amp Hotel Occupancy Tax Tobacco and Tobacco Related Products Tax Use amp Occupancy Tax Valet Parking Tax Vehicle Rental Tax Verkko 2022 Corporation Tax Forms Corptax 168k Example 168K Example Adjustment for Bonus Depreciation CT V PA Corporate Net Income Tax Fed State Payment Voucher DCT 64 Corporation Tax Bulletin Number 123 Subjectivity to Gross Receipts Taxes Article IX Mobile Telecommunications PA 8453 C 2022 PA

Verkko NEW FOR 2022 1 The RCT 101 PA Corporate Net Income Tax Report RCT 101I Inactive PA Corporate Net Income Tax Report and RCT 128C Report of Change in PA Corporate Net Income Tax Report have an updated look for 2022 tax year 2 Taxpayers now have the option to have their refund directly 500 000 or more of gross receipts Verkko Every individual partnership association limited liability company LLC and corporation engaged in a business profession or other activity for profit within the City of Philadelphia must le a Business Income amp Receipts Tax BIRT return This includes Those engaged in commercial or residential real estate rental activity

Download Philadelphia Corporate Income Tax Return Instructions 2022

More picture related to Philadelphia Corporate Income Tax Return Instructions 2022

TaxTips ca Business 2022 Corporate Income Tax Rates

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

How To Amend Tax Return After Filing Under S 131 Of The Income Tax Act

https://cdn1.npcdn.net/image/1650550678ec103e15ec4662f4b29af6214ee22dca.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/548/372/548372379/large.png

Verkko Tax requirements since individuals partnerships associations limited debt companies real partnerships engaged in for profit activity Business Income amp Receipts Tax BIRT Services City of Philadelphia 2022 PA Corporate Net Income Tax CT 1 Instructions REV 1200 Verkko 2022 BORN HJ return PDF Use to form to file your 2022 Business Sales amp Income Tax BIRT This form inclusive schedules H J January 11 2023

Verkko 25 tammik 2023 nbsp 0183 32 Recently though an ordinance signed by Philadelphia Mayor Jim Kenney in June 2022 adopts market based sourcing for sales of services and intangibles This change in sourcing methodology requires state authorizing legislation and will be effective for the tax year after the year the state legislation is enacted Verkko REV 413 F 2022 Instructions for Estimating PA Fiduciary Income Tax For Estates and Trusts Only REV 414 F 2022 Estates and Trusts Worksheet for PA Estimated Tax REV 998 Shareholder Tax Basis in PA S Corporation Stock Worksheet REV 999 Partner PA Outside Tax Basis in a Partnership Worksheet

How Many Uears Of Tax Teturs For Home Loan

https://www.manishanilgupta.com/public/assets/upload/blog/5f6af0338d718_Income Tax.jpeg

Corporate Income Tax Disputes Under The New UAE Federal Decree Law No

https://waselandwasel.com/wp-content/uploads/2023/01/j-benjamin-LSbb9vqAga8-unsplash.png

https://www.phila.gov/media/20231019114311/Business-In…

Verkko 2022 City of Philadelphia BUSINESS INCOME amp RECEIPTS TAX FOR BUSINESS CONDUCTED IN AND OUT OF PHILADELPHIA Entity Classification MUST select one Individual Sole Corporation Partnership Proprietor Business Name Estate Trust First Name MI Last Name Street Address Apt Suite City State Zip Postal Code 2022

https://www.phila.gov/.../business-income-receipts-tax-birt

Verkko Business Income amp Receipts Tax BIRT Due date April 15th for previous year s business returns Tax rate 1 415mills on gross receipts and 5 99 on taxable net income To complete online returns and payments for

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Many Uears Of Tax Teturs For Home Loan

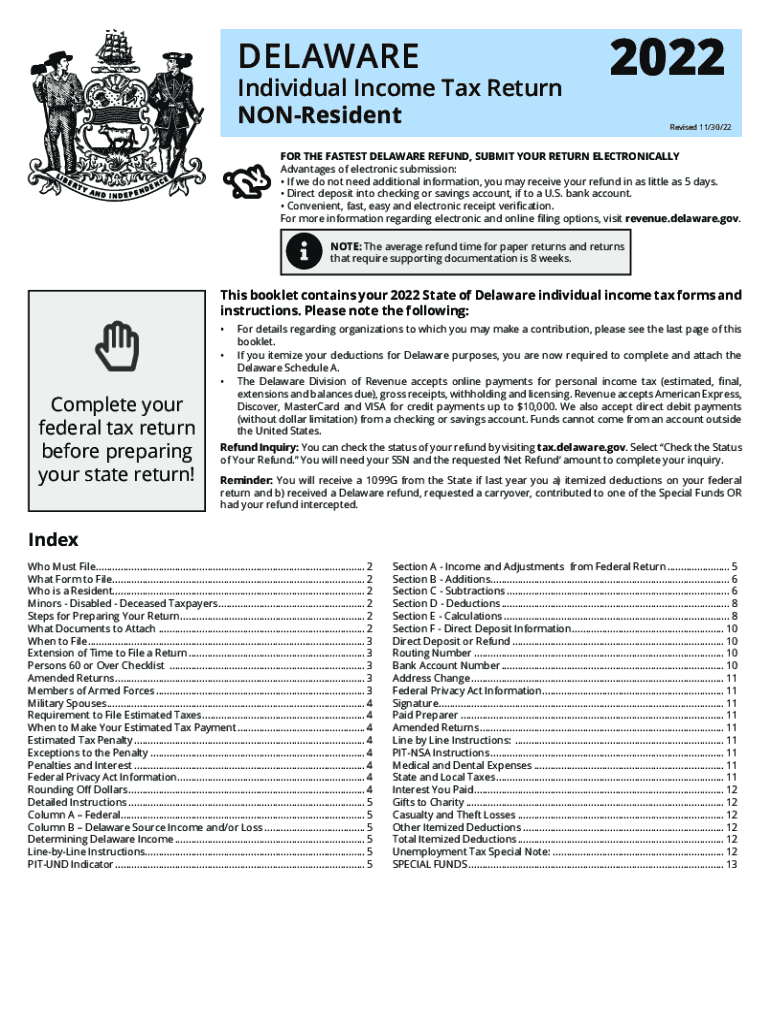

Delaware Taxes 2022 2024 Form Fill Out And Sign Printable PDF

Nice Audit Report Of Reliance 2019 International Accounting Standard 10

Connecticut 2023 State Income Tax Form And Instructions Printable

Is Corporate Income Tax Needed Eye Witness News

Is Corporate Income Tax Needed Eye Witness News

Here s When IRS Will Start Accepting Tax Returns In 2023 Al

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Salary Income Tax Return Service At Best Price In Bengaluru ID

Philadelphia Corporate Income Tax Return Instructions 2022 - Verkko Any individual corporation LLC partnership or association engaged in for profit activity within the city of Philadelphia must file a Business Income amp Receipts Tax BIRT return Any individual or entity maintaining a Commercial Activity License CAL even if not actively engaged in business must file a BIRT return