Philadelphia Income Tax Form 2022 Forms and instructions to use when filing City tax returns Forms include supplementary schedules and worksheets from 2009 to present

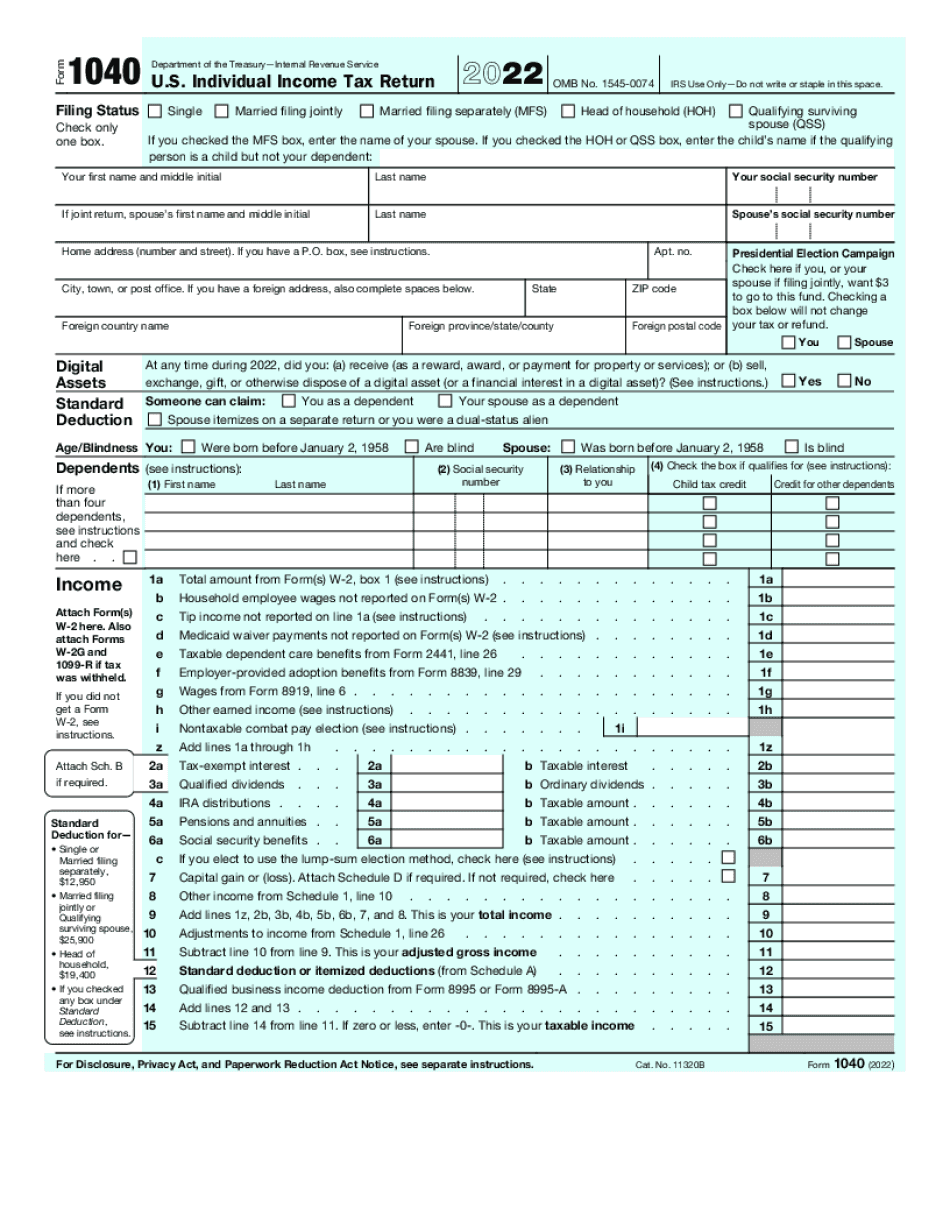

We re excited to announce that taxpayers can now print payment vouchers on the Philadelphia Tax Center It s free and the process is fast No username and password Your w 2 form showing city income tax withheld is not provided Credit for Taxes Paid to Philadelphia You may use any wage tax paid to Philadelphia as a credit toward your

Philadelphia Income Tax Form 2022

Philadelphia Income Tax Form 2022

https://www.signnow.com/preview/472/976/472976641/large.png

Tax Alert 2022 Company Income Tax Form Available For Submission

https://asterisk.cy/wp-content/uploads/2023/08/Asterisk-Corporate-Services-Income-Tax-Alert-2022-Income-Tax-Return-Submission.jpg

Form 1040a 2023 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/624/654/624654310/big.png

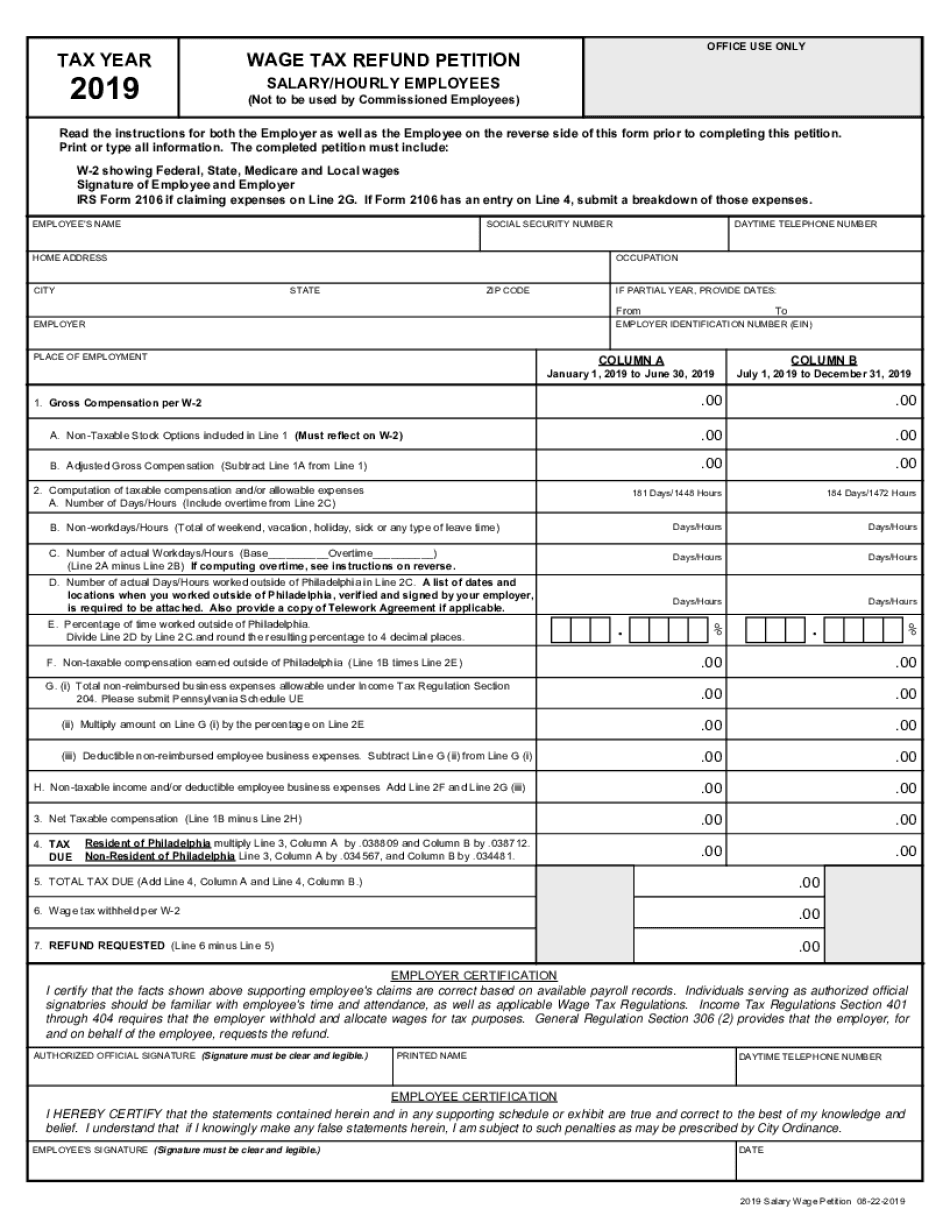

Employees who are nonresidents of Philadelphia and who are required to work at various times outside of Philadelphia within a calendar year may file for a wage The City of Philadelphia s Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly The first due date to file

From a part time employer or income from a business you will need to file a return and pay the local earned income tax required Use full months not fraction of month The first filing date in the new schedule is May 2 2022 However the City recommends you take three actions next week Visit the Philadelphia Tax Center and bookmark its web address https tax

Download Philadelphia Income Tax Form 2022

More picture related to Philadelphia Income Tax Form 2022

Do I Need To File A Philadelphia Income Tax Return By Dale S

https://miro.medium.com/v2/resize:fit:1070/1*7O4xZVdvY2dkVy-cHQOukw.jpeg

2021 PA Form PA 40 ES I Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/548/372/548372379/large.png

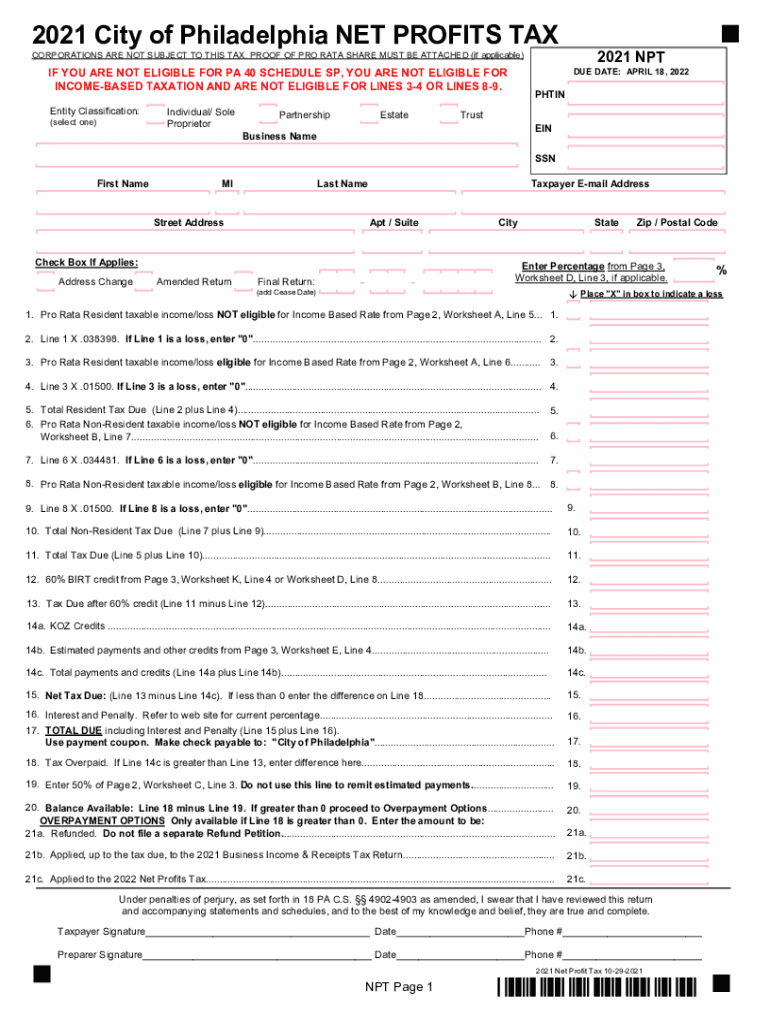

Philadelphia Net Profits Tax 2021 2024 Form Fill Out And Sign

https://www.signnow.com/preview/585/578/585578495/large.png

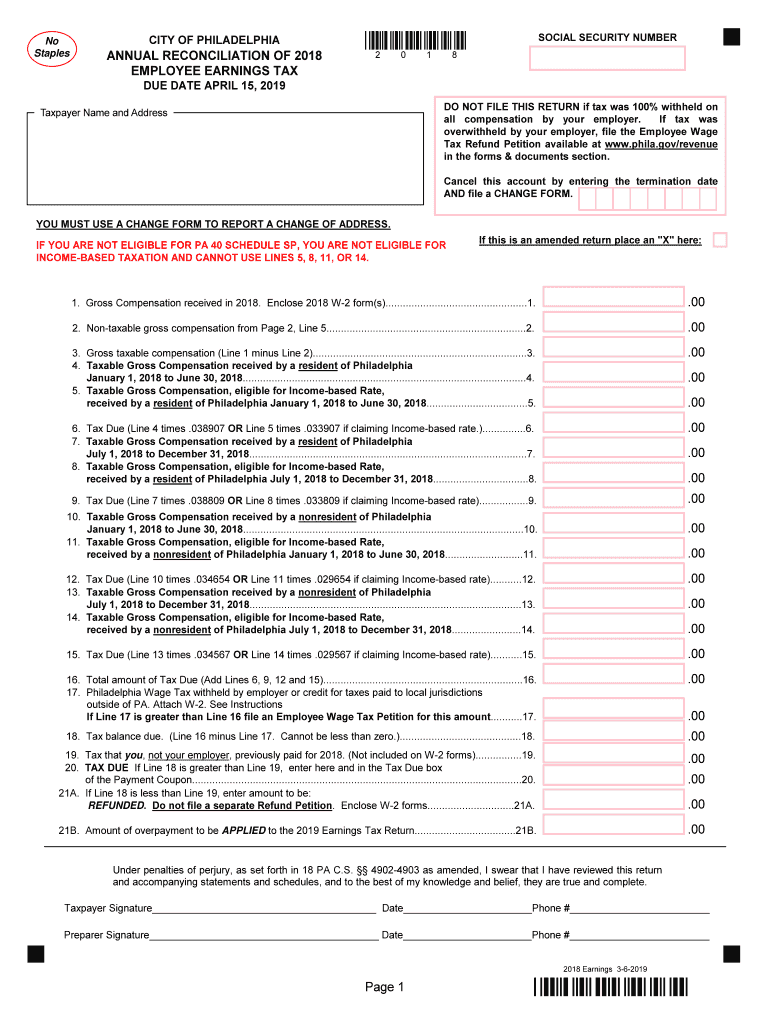

Use the Part Year Resident Schedule on reverse side of tax return form to calculate income and taxes owed for each taxing jurisdiction or to allocate income and tax The Philadelphia Employee Earnings Tax Return cannot be electronically filed The Employee Earnings Tax is a tax on salaries wages commissions and other

The free PA 40 electronic tax return can be filed via myPATH File your return or extension by April 15th Most common Pennsylvania Personal Income Tax The City of Philadelphia has announced reduced tax rates for its School Income Tax SIT Changes to the Wage and Earnings tax rates become effective July

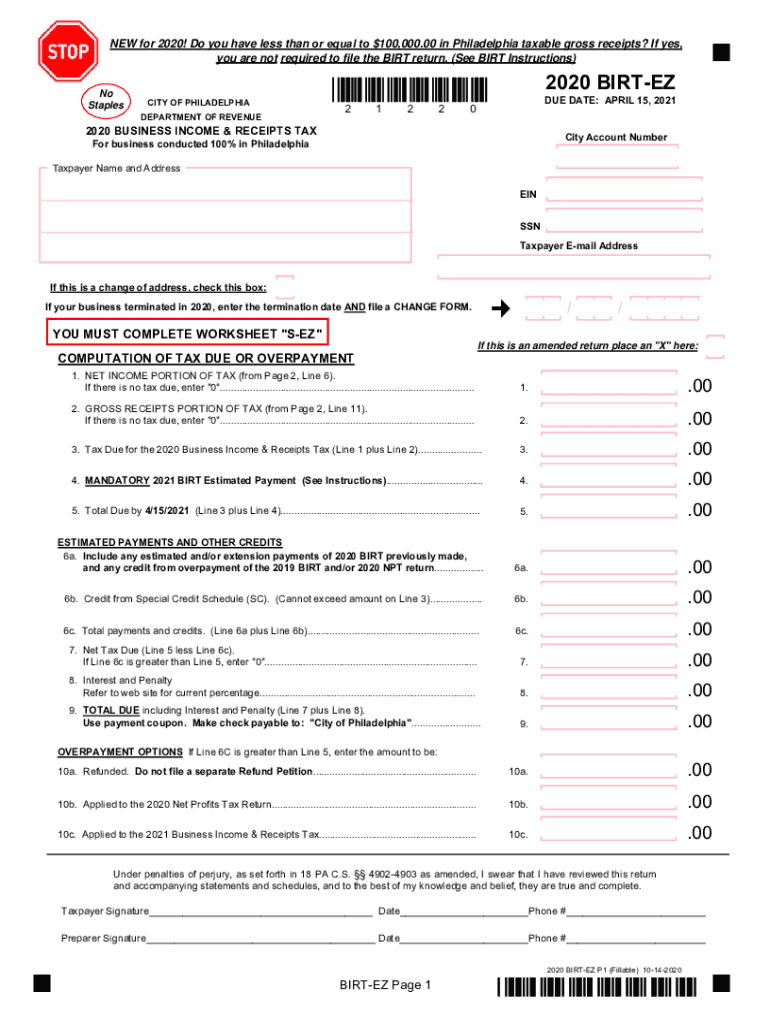

Philadelphia Birt Instructions 2022 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/544/791/544791055/large.png

City Of Philadelphia Wage Tax Refund 2019 2024 Form Fill Out And Sign

https://www.signnow.com/preview/490/705/490705456/big.png

https://www.phila.gov/.../taxes/tax-forms-instructions

Forms and instructions to use when filing City tax returns Forms include supplementary schedules and worksheets from 2009 to present

https://myemail.constantcontact.com/Print-payment...

We re excited to announce that taxpayers can now print payment vouchers on the Philadelphia Tax Center It s free and the process is fast No username and password

Income Tax Return Filing ITR For FY 2022 23 Important Tips Form 16

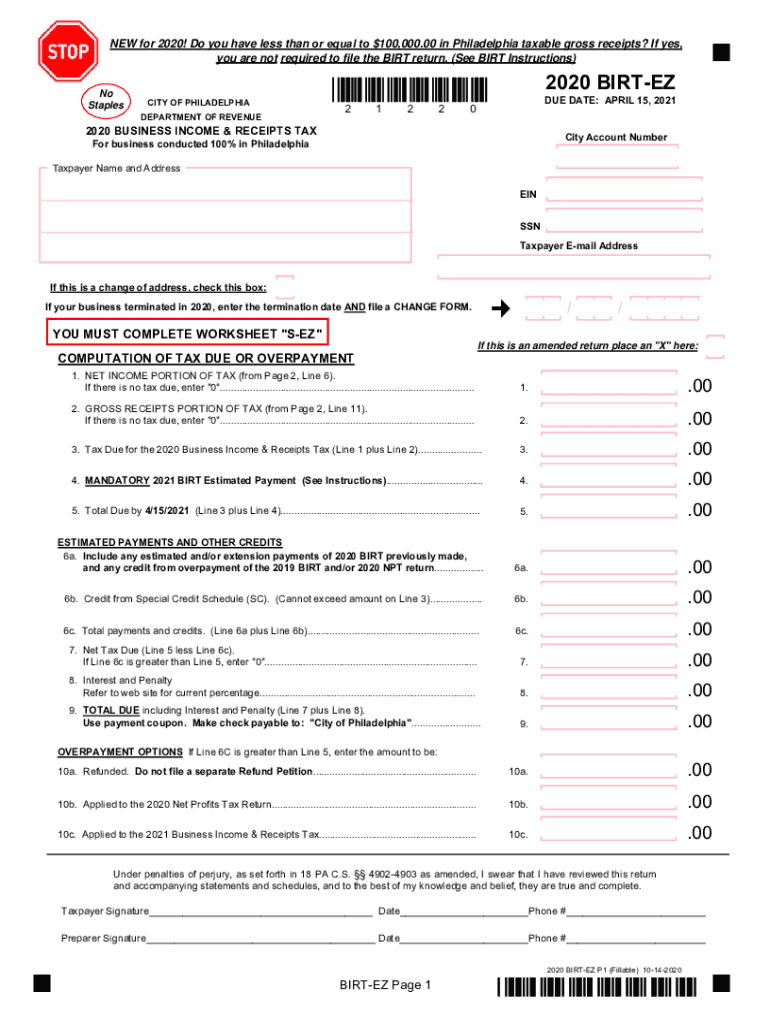

Philadelphia Birt Instructions 2022 Fill Out Sign Online DocHub

2023 Income Tax Form Printable Forms Free Online

Income Tax Form 2022

INTRODUCTION OF INCOME TAX FORM CP22 CP22A CP21 PBAG

Fillable Online 2022 BIRT EZ tax return pdf Philadelphia Fax Email

Fillable Online 2022 BIRT EZ tax return pdf Philadelphia Fax Email

Publication Details

PA DoR REV 1220 AS 2020 2022 Fill Out Tax Template Online US Legal

Federal Income Tax Forms 1040ez 2017 Universal Network Free Download

Philadelphia Income Tax Form 2022 - Payments can be made by cash check or money order and online through PSN on the city s website www newphilaoh The 2021 general income tax form